PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934811

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934811

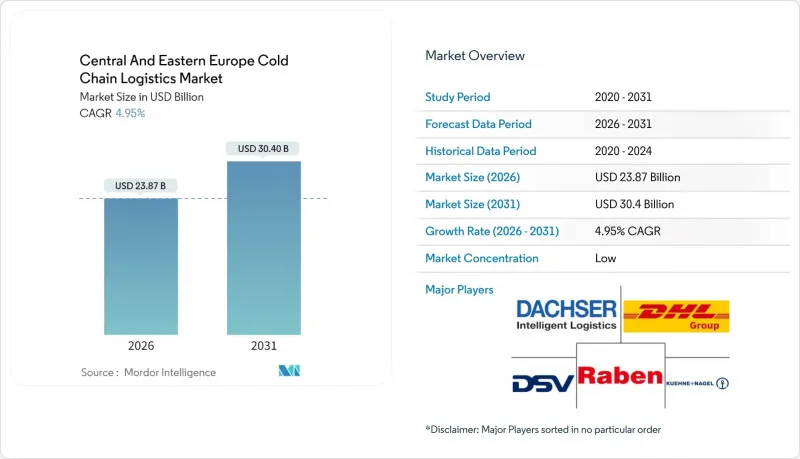

Central And Eastern Europe Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Central And Eastern Europe Cold Chain Logistics market is expected to grow from USD 22.74 billion in 2025 to USD 23.87 billion in 2026 and is forecast to reach USD 30.4 billion by 2031 at 4.95% CAGR over 2026-2031.

Heightened pharmaceutical manufacturing activity, rapid automation of temperature-controlled facilities, and strict EU food-safety frameworks are the primary growth catalysts. Operators are compressing operating costs by up to 40% through high-density automated storage systems while leveraging multimodal corridors financed by the Connecting Europe Facility to widen service reach. The region's strategic position for biologics production, coupled with booming e-grocery adoption, is spurring demand for end-to-end temperature integrity solutions that blend storage, transportation, and value-added services. At the same time, the ongoing F-gas phase-down and volatile energy market are reshaping refrigeration choices, nudging operators toward natural refrigerants and renewable power agreements to safeguard margins.

Central And Eastern Europe Cold Chain Logistics Market Trends and Insights

E-grocery Boom & Omni-channel Fulfillment Pressure

Surging online grocery adoption is transforming cold chain network design across the region. Romania's e-commerce value is forecast to exceed EUR 10 billion (USD 11.03 billion) in 2025 as more than half of consumers shift a portion of food purchases online. Retailers are responding with micro-fulfillment hubs that blend chilled, frozen, and ambient zones, allowing same-day dispatch in major cities. Rohlik Group's USD 170 million expansion program illustrates the scale of investment, deploying an AI-enabled fulfillment platform that optimizes routing and real-time inventory allocation. Such models shorten last-mile distances, cut spoilage, and raise demand for multi-temperature vehicles capable of fine-grained delivery windows. As a result, cold chain providers are partnering with omnichannel retailers to co-locate stock in high-density automated cubes that free scarce urban land and mitigate labor constraints.

Pharma / Biologics Volume Shift Toward CEE Hubs

Rising biologics and personalized-medicine production is drawing major logistics investments into Poland, Hungary, and the Czech Republic. UPS's 2025 completion of Frigo-Trans and BPL acquisitions boosted its cryogenic and 2-8 °C capacity across Europe, positioning the firm to handle high-value cell-therapy shipments from new regional plants. DHL Group followed suit by purchasing CRYOPDP, a specialist moving more than 600,000 temperature-sensitive consignments each year. With 80% of pharmaceutical products requiring strict temperature management, 3PLs are scaling validated packaging, redundant power systems, and GDP-compliant monitoring for route visibility. The multiplier effect cascades into demand for specialized air cargo containers, ultra-low warehouses, and rapid-clearance customs corridors, reinforcing the Central and Eastern Europe Cold Chain Logistics market's premium growth segment.

Volatile Energy Prices for Refrigeration

Energy remains the largest variable cost in cold storage, accounting for around one-fifth of electricity consumption in global logistics facilities electricity and gas markets have experienced sharp swings since 2022, constraining investment and eroding margins, particularly for financially leveraged operators. In response, players such as HOPI Logistics have rolled out photovoltaic arrays and waste-heat recovery to hedge tariff spikes, supported by EU co-financing. Expanded demand response schemes and corporate renewable PPAs are gaining traction to stabilize cost bases.

Other drivers and restraints analyzed in the detailed report include:

- EU Food-safety Compliance Tightening (HACCP, GDP)

- High-density Automated Frozen Warehouses Cut OPEX

- Surging F-gas Phase-down Refrigerant Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage delivered 50.32% of the Central and Eastern Europe Cold Chain Logistics market share in 2025, anchored by demand for compliant warehousing from both food and life-science shippers. Multi-level high-bay sites equipped with shuttle systems continue to attract capital as tenants favor long leases tied to GDP and HACCP accreditation. The Central and Eastern Europe Cold Chain Logistics market size attributable to value-added services is projected to climb 4.18% CAGR through 2031, as shippers outsource packaging, kitting, and vendor-managed inventory to reduce complexity.

Investment trends point to fully integrated nodes combining rail access and cross-dock operations that speed throughput for frozen and chilled commodities. Lineage's USD 223 million ColdPoint Logistics purchase added 62,000 pallet positions along a strategic meat-protein corridor, illustrating investor appetite for scale assets. Meanwhile, EU-funded TEN-T upgrades are boosting refrigerated transportation demand by shortening line-haul times and trimming spoilage risk. As operators bundle real-time monitoring with customs brokerage and regulatory filing, service integration becomes a decisive tender criterion, shifting competition away from rate-based bidding toward technology credentials.

The Central and Eastern Europe Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen), Application (Fruits & Vegetables, Meat & Poultry, Pharmaceuticals & Biologics, Others), and Geography (Poland, Romania, Czech Republic, Hungary, Slovakia, Rest of CEE). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Supply Chain

- DSV

- Raben Group

- Dachser SE

- Kuehne + Nagel

- Lineage Logistics

- NewCold

- Havi Logistics

- Frigo Logistics (PL)

- PLG Logistics & Warehousing

- Gartner KG

- Rohlig Logistics GmbH & Co. KG.

- Yusen Logistics (Part of NYK Line)

- Rhenus Logistics

- CEVA Logistics

- SEKO Logistics

- ARRA Group

- Fructus Transport

- AMS Freight & Logistic

- Arrowsped Sp. z o.o

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-grocery boom and omni-channel fulfilment pressure

- 4.2.2 Pharma/biologics volume shift toward CEE hubs

- 4.2.3 EU food-safety compliance tightening (HACCP, GDP)

- 4.2.4 High-density automated frozen warehouses cut OPEX

- 4.2.5 Rail-freight upgrades on TEN-T Baltic-Adriatic and Danube corridors

- 4.2.6 Supermarket private-label penetration driving vendor-managed inventory

- 4.3 Market Restraints

- 4.3.1 Volatile energy prices for refrigeration

- 4.3.2 Surging F-gas-phase-down refrigerant costs

- 4.3.3 Shortage of certified refrigeration technicians

- 4.3.4 Aged road fleet; slow adoption of zero-emission trucks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits and Vegetables

- 5.3.2 Meat and Poultry

- 5.3.3 Fish and Seafood

- 5.3.4 Dairy and Frozen Desserts

- 5.3.5 Bakery and Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals and Biologics

- 5.3.8 Vaccines and Clinical Trial Materials

- 5.3.9 Chemicals and Specialty Materials

- 5.3.10 Other Applications

- 5.4 By Country

- 5.4.1 Poland

- 5.4.2 Slovakia

- 5.4.3 Czech Republic

- 5.4.4 Hungary

- 5.4.5 Romania

- 5.4.6 Rest of CEE

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 DHL Supply Chain

- 6.4.2 DSV

- 6.4.3 Raben Group

- 6.4.4 Dachser SE

- 6.4.5 Kuehne + Nagel

- 6.4.6 Lineage Logistics

- 6.4.7 NewCold

- 6.4.8 Havi Logistics

- 6.4.9 Frigo Logistics (PL)

- 6.4.10 PLG Logistics & Warehousing

- 6.4.11 Gartner KG

- 6.4.12 Rohlig Logistics GmbH & Co. KG.

- 6.4.13 Yusen Logistics (Part of NYK Line)

- 6.4.14 Rhenus Logistics

- 6.4.15 CEVA Logistics

- 6.4.16 SEKO Logistics

- 6.4.17 ARRA Group

- 6.4.18 Fructus Transport

- 6.4.19 AMS Freight & Logistic

- 6.4.20 Arrowsped Sp. z o.o

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment