PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937364

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937364

Spain Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

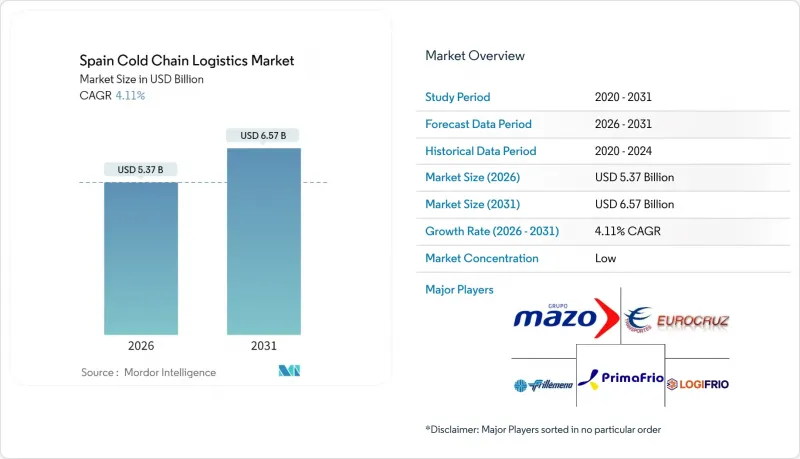

The Spain Cold Chain Logistics Market was valued at USD 5.16 billion in 2025 and estimated to grow from USD 5.37 billion in 2026 to reach USD 6.57 billion by 2031, at a CAGR of 4.11% during the forecast period (2026-2031).

Rising agrifood exports, highway and port upgrades, and the accelerating shift toward temperature-sensitive e-commerce deliveries underpin a stable demand outlook for warehousing, transport, and value-added services. International logistics groups continue acquiring regional operators to secure strategic locations and multi-temperature capacity, while local firms invest in automation to curb labor and energy costs. Policy support for rail freight, clean refrigeration technologies, and renewable energy adoption is widening modal choices and lowering emissions across the Spain cold chain logistics market. Growth opportunities remain strongest in pharmaceutical distribution, AI-enabled urban micro-fulfillment, and intermodal corridors linking Spanish production zones with Northern Europe and North Africa.

Spain Cold Chain Logistics Market Trends and Insights

E-commerce boom in fresh grocery delivery

Online food sales are growing at double-digit rates as consumers demand same-day delivery of chilled and frozen items, compelling retailers to build micro-fulfillment hubs and invest in automated storage that reduces spoilage and labor requirements. Automated distribution systems such as Cimcorp's installation for Mercadona now move fresh produce from field to store within a single day, demonstrating the efficiency gains that modern robotics bring to the Spain cold chain logistics market. Urban operators leverage AI-based demand forecasting to optimize route planning and shrink energy consumption, creating premium service niches that command higher margins. The EUR 300 million (USD 331.09 million) Amazon facility in Asturias exemplifies how large retailers are embedding robotics into temperature-controlled fulfillment to meet customer expectations . These investments stimulate third-party logistics providers to expand multi-temperature cross-docks near population centers and embed parcel-sized cool lockers inside dense city zones.

Rising pharma and vaccine cold-chain needs

Spain's biopharmaceutical sector is scaling both domestic manufacturing and re-export activity, elevating demand for GDP-certified warehousing, validated packaging, and track-and-trace technology. DHL's pledge to inject EUR 2 billion (USD 2.20 billion) into health logistics by 2030 includes Spanish hubs with controlled zones ranging from -80 °C deep-freeze to +15 °C CRT, enabling safe movement of advanced therapies. IoT sensors that deliver real-time temperature alerts are becoming standard across line-haul and last-mile operations, satisfying stricter health authority audits. The public immunization program in Catalonia alone processes vaccine volumes 21 times larger than two decades earlier, underscoring the sector's structural expansion. Higher service complexity and regulatory scrutiny allow providers to price premium solutions and reinforce long-term contracts in the Spain cold chain logistics market.

High energy and real-estate costs for cold storage

Wholesale electricity volatility has elevated operating costs for blast freezers and multi-temperature warehouses, prompting operators to retrofit variable-speed drives, high-efficiency compressors, and rooftop solar arrays. New F-Gas rules that phase down high-GWP refrigerants force supermarkets and 3PLs to invest in natural refrigerant systems, raising upfront capex. Prime land scarcity near Madrid and Barcelona pushes lease prices upward, compelling operators to build taller, fully automated facilities that maximize cubic capacity. Spain's grid-scale battery storage roadmap promises future relief, yet current policy clarity on energy cost pass-through remains limited, constraining expansion plans.

Other drivers and restraints analyzed in the detailed report include:

- Export-oriented horticulture and seafood growth

- EU Fit-for-55 rail intermodal transition

- Rural infrastructure gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refrigerated storage generated 41.35% of the Spain cold chain logistics market size in 2025 as exporters, grocers, and pharmaceutical firms sought buffer capacity against supply chain shocks. Automated high-bay freezers such as the Toledo site of Carnicas Chamberi handle more than 1,800 pallets at -18°C while cutting power use and labor expense. Public warehouses gain appeal by offering pooled assets and flexible slotting, whereas large processors build private facilities that integrate product-specific temperature zones. Value-added services, covering repacking, labeling, kitting, and cross-docking, are growing at a 3.84% CAGR, reflecting customer willingness to outsource non-core tasks and tighten turnaround times. Transportation services retain steady demand thanks to Spain's 15,825 km motorway network, yet margin pressure encourages adoption of LNG, electric, and rail-compatible reefers to align with emission goals. The Spain cold chain logistics market benefits from ATP treaty enforcement, which standardizes vehicle insulation and refrigeration equipment across the roughly 300,000-unit national fleet.

The Spain Cold Chain Logistics Market Report is Segmented by Service Type (Refrigerated Storage, Refrigerated Transportation, Value-Added Services), Temperature Type (Chilled, Frozen, Ambient, Deep-Frozen), Application (Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Dairy, and More), and Geography (Andalusia, Valencia Region, Madrid & Central Spain, Others). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Grupo Mazo

- Eurocruz

- Primafrio

- Frillemena SA

- Logifrio

- STEF

- Lineage Logistics

- DHL

- Transportes Corredor

- Frimercat

- Ferro-Montajes Albacete SCL de Balazote

- Asgasa Servicios Frigorificos

- ID Logistics

- Frigorifics Gelada SL

- CubeCold

- Frigorificos SOLY

- Frigorificos Sanchidrian

- Antonio Marco

- Vitotrans

- Autransa SL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom in fresh grocery delivery

- 4.2.2 Rising pharma and vaccine cold-chain needs

- 4.2.3 Export-oriented horticulture and seafood growth

- 4.2.4 EU "Fit-for-55" shift to rail intermodal cold-chain

- 4.2.5 AI-enabled micro-fulfilment cuts last-mile spoilage

- 4.2.6 Climate-driven south-to-north reverse logistics

- 4.3 Market Restraints

- 4.3.1 High energy and real-estate costs for cold storage

- 4.3.2 Rural infrastructure gaps

- 4.3.3 Shortage of certified refrigeration technicians

- 4.3.4 Water-scarcity rules for ammonia/CO? plants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Impact of Emission Standards on Cold-Chain

- 4.9 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Refrigerated Storage

- 5.1.1.1 Public Warehousing

- 5.1.1.2 Private Warehousing

- 5.1.2 Refrigerated Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Sea

- 5.1.2.4 Air

- 5.1.3 Value-Added Services

- 5.1.1 Refrigerated Storage

- 5.2 By Temperature Type

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0 °C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Application

- 5.3.1 Fruits and Vegetables

- 5.3.2 Meat and Poultry

- 5.3.3 Fish and Seafood

- 5.3.4 Dairy and Frozen Desserts

- 5.3.5 Bakery and Confectionery

- 5.3.6 Ready-to-Eat Meals

- 5.3.7 Pharmaceuticals and Biologics

- 5.3.8 Vaccines and Clinical Trial Materials

- 5.3.9 Chemicals and Specialty Materials

- 5.3.10 Other Perishables

- 5.4 By Region

- 5.4.1 Andalusia

- 5.4.2 Catalonia

- 5.4.3 Valencia Region

- 5.4.4 Madrid and Central Spain

- 5.4.5 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Grupo Mazo

- 6.4.2 Eurocruz

- 6.4.3 Primafrio

- 6.4.4 Frillemena SA

- 6.4.5 Logifrio

- 6.4.6 STEF

- 6.4.7 Lineage Logistics

- 6.4.8 DHL

- 6.4.9 Transportes Corredor

- 6.4.10 Frimercat

- 6.4.11 Ferro-Montajes Albacete SCL de Balazote

- 6.4.12 Asgasa Servicios Frigorificos

- 6.4.13 ID Logistics

- 6.4.14 Frigorifics Gelada SL

- 6.4.15 CubeCold

- 6.4.16 Frigorificos SOLY

- 6.4.17 Frigorificos Sanchidrian

- 6.4.18 Antonio Marco

- 6.4.19 Vitotrans

- 6.4.20 Autransa SL

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment