PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934818

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934818

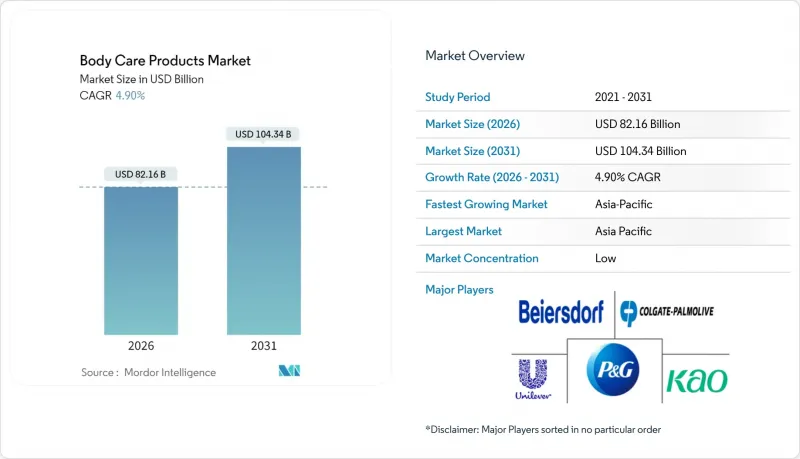

Body Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Body care products market size in 2026 is estimated at USD 82.16 billion, growing from 2025 value of USD 78.32 billion with 2031 projections showing USD 104.34 billion, growing at 4.9% CAGR over 2026-2031.

This market expansion indicates a substantial increase in the emphasis on personal hygiene, skin health, and wellness across developed and emerging economies. Consumer preferences have evolved from fundamental hygiene products toward sophisticated, multifunctional body care formulations that address multiple requirements, encompassing moisturization, exfoliation, anti-aging properties, skin brightening, and antimicrobial protection. The market advancement is attributed to enhanced awareness regarding grooming practices, increased disposable income levels, progressive urbanization, and the proliferation of beauty and wellness trends through social media and digital platforms. Through sustained investment in research and development initiatives, ingredient innovations, and strategic marketing approaches, the body care products market demonstrates continued progression toward global expansion, characterized by product diversification and premium offerings.

Global Body Care Products Market Trends and Insights

Rising awareness of personal hygiene and grooming practices

The global body care products market is primarily driven by increasing awareness of personal hygiene and grooming practices. The emphasis on hygiene has evolved from a public health necessity into a permanent behavioral change, leading to increased consumption of body care products across demographics. Consumers focus beyond basic cleansing, prioritizing skin health, antimicrobial protection, and comprehensive wellness routines that include moisturizers, specialty cleansers, and targeted treatments. The integration of self-care into daily wellness practices has increased demand for body care products that address both hygiene and overall health. Companies are developing products that combine cleansing efficacy with skin benefits. For instance, in September 2023, Unilever launched the Lifebuoy Multivitamins+ range, featuring an antibacterial formula in body wash and other formats, demonstrating the market's shift toward products that offer both cleansing and skin nourishment.

Increasing consumer preference for natural and organic products

The global body care products market is experiencing significant growth driven by increasing consumer demand for natural and organic products. Consumers are seeking safer alternatives due to growing awareness about the potential risks associated with synthetic chemicals, parabens, and artificial fragrances. This consumer shift stems from increased health consciousness, environmental awareness, and demand for transparency in ingredient sourcing. Companies offering plant-based formulations and ethical production practices are gaining consumer trust and loyalty. In January 2025, moha launched its Kesar Chandan Soap, featuring natural ingredients to meet this market demand. Such product launches demonstrate how innovations incorporating botanical ingredients and traditional wellness principles, along with transparent communication about natural ingredients, align with consumer preferences. This trend toward natural and organic body care products is expanding the market while creating opportunities for product differentiation and market positioning.

Regulatory compliance requirements impact market growth

Regulatory compliance requirements constrain the growth of the global body care products market. Governments and international bodies strengthen regulations governing product ingredients, labeling, marketing claims, and packaging standards in response to consumer safety and environmental concerns. Companies must navigate diverse national and regional regulations, including the European Union's Cosmetics Regulation (EC) No 1223/2009, the United States Food and Drug Administration (FDA) compliance for personal care products, and ingredient disclosure requirements in emerging economies. The cost and time required for regulatory approval particularly affect smaller and mid-sized brands with limited resources. Safety testing, documentation, and audits often delay product launches and restrict innovation, as companies must modify formulations and packaging to comply with local regulations.

Other drivers and restraints analyzed in the detailed report include:

- Advancement in product formulations and ingredients

- Expanding female workforce participation

- Rising concerns over counterfeit products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, soaps maintain their market leadership with a 32.45% share. This dominance stems from their affordability, simplicity, and established role in basic hygiene practices. Traditional bar soaps offer cost-effectiveness, making them accessible across demographic segments, especially in developing economies with high price sensitivity. Their availability in multipacks, extended shelf life, and minimal packaging support their practical daily use. Soaps have built consumer trust through generations of use and remain valued for effective germ and dirt removal. The segment continues to evolve through antibacterial variants and herbal formulations that offer value while maintaining efficacy.

Body washes and shower gels show the highest growth rate, with a projected CAGR of 5.86% through 2031. This growth reflects increased consumer preference for premium personal care products that enhance the bathing experience. These liquid formats provide improved sensory benefits through rich lathers, fragrances, and advanced formulations containing moisturizers, essential oils, and dermatological ingredients. Their growth is driven by changing lifestyles and increased skin health awareness, particularly among younger, urban consumers. The perceived hygiene advantages of body wash packaging and application methods support their increasing adoption across both developed and emerging markets.

The Body Care Products Market Report is Segmented by Product Type (Moisturizers, Powders, Body Wash, and More), Category (Conventional, and Organic), Distribution Channel (Supermarkets / Hypermarkets, Specialty Stores, Online Retail Stores, Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, Middle East, Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 37.21% of the global body care products market share in 2025 and exhibits the highest regional growth rate at 6.70% CAGR through 2031. The region's market leadership stems from its large population base, increasing disposable incomes, and strong cultural focus on personal care routines. China and India serve as key growth markets, driven by their expanding middle classes and increased adoption of premium products. Japan and South Korea remain innovation centers, particularly in skincare formulations and packaging technologies. While regulatory alignment across regional markets supports expansion, companies must adapt to local cultural preferences and price sensitivities.

North America maintains a strong market position through high per-capita consumption and consumer preference for premium products. The region's market strength builds on robust retail infrastructure, e-commerce penetration, and established regulatory frameworks. Growth rates remain moderate due to market maturity and changing demographics. Europe shows similar market characteristics, with increasing demand for organic and natural products driven by sustainability concerns. The European Union's strict ingredient and environmental regulations shape global product development, often setting international manufacturing standards.

South America, the Middle East, and Africa offer significant growth potential with varying levels of market development. Brazil dominates the Latin American market through its established beauty culture and expanding middle-class consumption. The Middle East shows strong growth due to its young population, rising female workforce participation, and cultural emphasis on personal care. African markets remain underserved, presenting long-term expansion opportunities for companies investing in distribution networks and locally adapted products. Regional climate variations influence product formulation and packaging requirements across all markets.

- Beiersdorf AG

- The Procter & Gamble Company

- Unilever PLC

- Colgate-Palmolive Company

- Kao Corporation

- L'Oreal S.A.

- Natura & Co

- Oriflame Cosmetics Global SA

- The Estee Lauder Companies Inc.

- Shiseido Co. Ltd.

- Johnson & Johnson Services Inc.

- Coty Inc.

- Henkel AG & Co. KGaA

- Bath & Body Works Inc.

- L'Occitane International SA

- The Body Shop International Ltd.

- Kose Corp.

- Clarins Group

- Mary Kay Inc.

- Amorepacific Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising awareness of personal hygiene and grooming practices

- 4.2.2 Increasing consumer preference for natural and organic products

- 4.2.3 Advancement in product formulations and ingredients

- 4.2.4 Expanding female workforce participation

- 4.2.5 Impact of social media on beauty trends and consumer choices

- 4.2.6 Growth in digital retail and e-commerce adoption

- 4.3 Market Restraints

- 4.3.1 Regulatory compliance requirements impact market growth

- 4.3.2 Rising concerns over counterfeit products

- 4.3.3 Volatile pricing and availability of botanical raw materials

- 4.3.4 Influence of cultural and religious factors

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Moisturizers

- 5.1.2 Powders

- 5.1.3 Body Wash and Shower Gels

- 5.1.4 Soaps

- 5.1.5 Others

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets / Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channel

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Beiersdorf AG

- 6.4.2 The Procter & Gamble Company

- 6.4.3 Unilever PLC

- 6.4.4 Colgate-Palmolive Company

- 6.4.5 Kao Corporation

- 6.4.6 L'Oreal S.A.

- 6.4.7 Natura & Co

- 6.4.8 Oriflame Cosmetics Global SA

- 6.4.9 The Estee Lauder Companies Inc.

- 6.4.10 Shiseido Co. Ltd.

- 6.4.11 Johnson & Johnson Services Inc.

- 6.4.12 Coty Inc.

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 Bath & Body Works Inc.

- 6.4.15 L'Occitane International SA

- 6.4.16 The Body Shop International Ltd.

- 6.4.17 Kose Corp.

- 6.4.18 Clarins Group

- 6.4.19 Mary Kay Inc.

- 6.4.20 Amorepacific Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK