PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934821

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934821

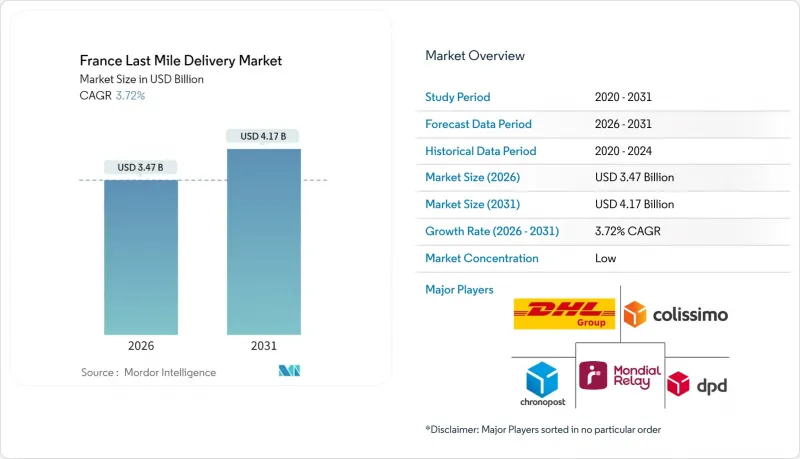

France Last Mile Delivery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The France Last Mile Delivery market is expected to grow from USD 3.35 billion in 2025 to USD 3.47 billion in 2026 and is forecast to reach USD 4.17 billion by 2031 at 3.72% CAGR over 2026-2031.

Demand scales with e-commerce volume growth, the densification of parcel-locker networks, and government incentives that accelerate fleet electrification. Competitive intensity has risen as global integrators, regional parcel specialists, and digital platforms jostle for route density and locker access, forcing operators to adjust tariffs in response to low-value cross-border parcels. Urban congestion, courier shortages, and scarce micro-hub real estate temper growth, yet investment in dark-store partnerships and temperature-controlled logistics continues to open premium service niches. Profitability now hinges on automated sortation, pickup-drop-off (PUDO) diversification, and zero-emission vehicle deployment, each delivering incremental cost and access advantages in heavily regulated urban cores.

France Last Mile Delivery Market Trends and Insights

Explosion in e-commerce order volume

La Poste's Colissimo processed millions of parcels in 2024. Higher order density fuels network expansion, evidenced by Geopost's capital spend on automated sorters and depots in 2024. Yet profitability diverges: lightweight shipments from platforms such as Shein and Temu carry wafer-thin yields even as they lift headline volumes. Operators counter margin pressure by upselling tracked, scheduled, or carbon-neutral options that command premium fees.

Expansion of parcel locker & PUDO infrastructure

La Poste hosts 128,000 pickup points and lockers-the densest network in Europe, cutting failed-delivery costs and lifting customer satisfaction scores. InPost-owned Mondial Relay raised its automated locker count to 7,000 by 2025 while pruning low-traffic retail agents. Nearly 30% of Mondial Relay's 62.3 million Q3-2024 parcels flowed through lockers, signaling shopper preference for flexible, contactless retrieval. For carriers, locker density collapses last-mile unit cost by consolidating multiple drop-offs into a single location, improving driver productivity and shrinking carbon intensity.

Urban traffic & parking constraints

Paris ranks among Europe's top three congestion hot spots, pushing average urban route speed below 13 km/h and inflating driver hours per stop. Municipal curb fees and reduced delivery windows squeeze capacity, forcing split-shift scheduling that raises labor requirements. Developers respond with urban consolidation centers like SEGRO's Les Gobelins, a 1,600-m2 hub fifteen minutes from central Paris. Such micro-hubs shave 1.3 km off average last-leg distance, yet the limited availability of industrial-zoned plots curtails widespread replication.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for zero-emission delivery fleets

- Growth of urban dark stores & nano-fulfillment

- Courier labor shortages & wage inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standard Delivery captured 42.55% of the France last mile delivery market share in 2025 by leveraging established postal depots, long-haul line-hauls, and cost-efficient batch sorting. The segment supplies predictable workloads that optimize hub-and-spoke infrastructure, sustaining favorable drop-density economics across suburban and rural routes. Volume leadership persists even as consumers upgrade to faster tiers for mission-critical items. Same-day services, advancing at a 3.78% CAGR, ride urban shopper expectations for immediacy and retailer promises of "order-by-1 pm-receive-today." Operators bundle premium fees with carbon-neutral badges to preserve margin. Express Delivery holds steady as a business account staple for time-definite B2B shipments, filling the gap between economy and same-day.

Growth differentials hint at a bifurcated future where convenience-led SKUs flow through rapid-cycle channels, while bulkier, lower-value items continue in economy lanes. Retailers increasingly offer hybrid cart checkout, letting shoppers split baskets between same-day perishables and slower, free-shipping lines. That elasticity underpins incremental revenue while preventing network overload. For carriers, orchestrating multi-speed promises within a single route remains the primary optimization frontier, demanding dynamic dispatching and real-time capacity visibility.

The France Last Mile Delivery Market Report is Segmented by Service (Standard Delivery, Same-Day, and Express Delivery), Business Model (Business-To-Business (B2B), Business-To-Consumer (B2C), and Customer-To-Consumer (C2C)), End-User Industry (E-Commerce Retail, Fashion & Lifestyle, Beauty, and More), Region (Hauts-De-France, Nouvelle-Aquitaine, Occitanie, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Colissimo (La Poste Group)

- Chronopost

- DPD

- Mondial Relay (InPost)

- DHL Express

- FedEx

- UPS

- GLS

- Colis Prive

- Cubyn

- Geodis

- DSV

- Yusen Logistics

- GOFO

- Relais Colis

- Rhenus Logistics

- My Delivery France

- AIT Worldwide Logistics

- CEVA Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion in e-commerce order volume

- 4.2.2 Expansion of parcel locker & PUDO infrastructure

- 4.2.3 Government incentives for zero-emission delivery fleets

- 4.2.4 Growth of urban dark stores & nano-fulfilment

- 4.2.5 Social commerce boosts micro-shipment frequency

- 4.2.6 Municipal mandates for urban consolidation centres

- 4.3 Market Restraints

- 4.3.1 Urban traffic & parking constraints

- 4.3.2 Courier labour shortages & wage inflation

- 4.3.3 Scarcity of urban micro-hub real estate

- 4.3.4 Public resistance & drone-regulation hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers/Consumers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Standard Delivery

- 5.1.2 Same-day

- 5.1.3 Express Delivery

- 5.2 By Business Model

- 5.2.1 Business-to-Business (B2B)

- 5.2.2 Business-to-Consumer (B2C)

- 5.2.3 Customer-to-Consumer (C2C)

- 5.3 By End-user Industry

- 5.3.1 E-commerce Retail

- 5.3.2 Fashion & Lifestyle

- 5.3.3 Beauty, Wellness & Personal Care

- 5.3.4 Home & Furniture

- 5.3.5 Consumer Electronics & Appliances

- 5.3.6 Healthcare & Medical Supplies

- 5.3.7 Others

- 5.4 By French Region

- 5.4.1 Ile-de-France

- 5.4.2 Auvergne-Rhone-Alpes

- 5.4.3 Provence-Alpes-Cote d'Azur

- 5.4.4 Hauts-de-France

- 5.4.5 Nouvelle-Aquitaine

- 5.4.6 Occitanie

- 5.4.7 Grand Est

- 5.4.8 Brittany

- 5.4.9 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Colissimo (La Poste Group)

- 6.4.2 Chronopost

- 6.4.3 DPD

- 6.4.4 Mondial Relay (InPost)

- 6.4.5 DHL Express

- 6.4.6 FedEx

- 6.4.7 UPS

- 6.4.8 GLS

- 6.4.9 Colis Prive

- 6.4.10 Cubyn

- 6.4.11 Geodis

- 6.4.12 DSV

- 6.4.13 Yusen Logistics

- 6.4.14 GOFO

- 6.4.15 Relais Colis

- 6.4.16 Rhenus Logistics

- 6.4.17 My Delivery France

- 6.4.18 AIT Worldwide Logistics

- 6.4.19 CEVA Logistics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment