PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934824

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934824

Europe Home Energy Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

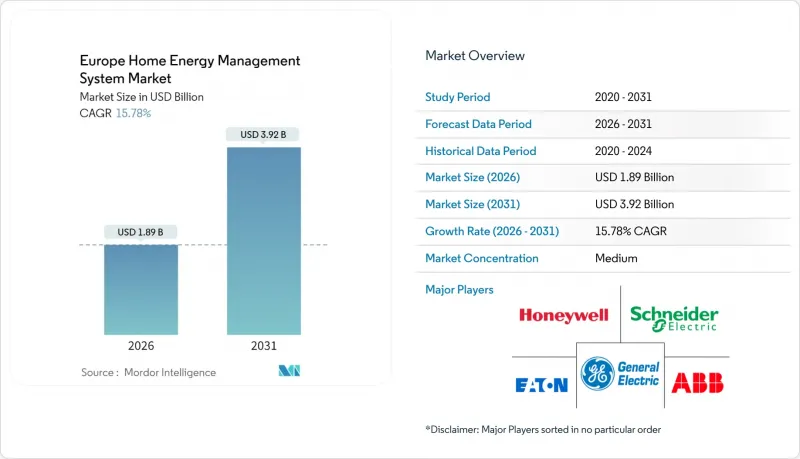

The Europe Home Energy Management System Market was valued at USD 1.63 billion in 2025 and estimated to grow from USD 1.89 billion in 2026 to reach USD 3.92 billion by 2031, at a CAGR of 15.78% during the forecast period (2026-2031).

Mandatory smart meter deployments under the EU Clean Energy Package intersect with sustained residential electricity price inflation and accelerated electrification of space heating and mobility, creating a fertile demand environment. Germany's regulatory mandate for smart meters in the 6,000-100,000 kWh consumption bracket starting 2025, Spain's fully rolled-out dynamic tariff framework, and the United Kingdom's scaled demand-flexibility programs together illustrate widespread policy alignment. Technology convergence around Matter-over-Thread and artificial-intelligence-enabled analytics lowers payback periods and simplifies device onboarding. Competitive strategies now favor ecosystem partnerships that integrate energy, HVAC, solar, battery, and electric-vehicle-charging controls behind unified user interfaces.

Europe Home Energy Management System Market Trends and Insights

Mandatory smart-meter roll-outs under EU Clean Energy Package

Revisions to Germany's Messstellenbetriebsgesetz in 2023 set interim smart-meter milestones of 20% by end-2025, moving toward 95% coverage by 2030. Grid operators require granular consumption data to coordinate flexible loads amid rising renewable penetration. One million units had been installed by September 2024, triple the pre-2023 pace. Variability across member-state standards, however, risks market fragmentation even as CEN-CENELEC develops minimum cybersecurity specifications.

Soaring household electricity prices post-energy crisis

Average European residential tariffs rested at EUR 28.72 per 100 kWh in late 2024, 35% above 2019 levels. German households faced EUR 39.43 per 100 kWh, buttressing investment cases for demand-side flexibility. Dynamic contracts enable 34% bill savings during high-renewable periods, yet household awareness stands at 27% despite upcoming mandatory tariff offerings.

High upfront hardware cost vs. traditional controls

Comprehensive HEMS installations average EUR 1,000, dwarfing EUR 50-100 thermostat alternatives, discouraging adoption in price-sensitive regions. Subscription models cut entry costs but accumulate EUR 10-20 monthly fees, raising lifetime expense concerns. Component shortages raised semiconductor costs 15-25% in 2024, stretching payback times to beyond three years for non-solar homes, even when savings reach EUR 400-500 annually for solar-equipped households.

Other drivers and restraints analyzed in the detailed report include:

- Residential electrification needing load orchestration

- Utility-led demand-response incentive programmes

- Fragmented device standards creating interoperability challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 54.45% of the home energy management system market in 2025, underscoring the impact of mandatory smart meter gateways and intelligent controllers. Utility cloud analytics are now diverging demand, and the services segment's 22.90% CAGR reflects rising appetite for subscription-based optimization. Services bundles offload maintenance requirements and shift capital expenditure into operating expenditure, attracting budget-constrained households. Edge-based processing remains critical for latency-sensitive functions such as voltage regulation and frequency response. Vendors integrate over-the-air firmware updates that prolong hardware lifespan, yet subscription tiers differentiate on analytics depth, demand-response participation, and peer-to-peer trading access.

Continued smart-meter mandates ensure hardware revenue resilience. Nevertheless, platform providers position recurring services as the primary revenue driver by 2031, bundling third-party device onboarding and insurer-linked safety diagnostics. Hardware-software convergence empowers real-time bidirectional communication, and Schneider Electric, ABB, and Legrand leverage their installed electrical backbones to cross-sell services. The home energy management system market size for services is projected to expand rapidly, supported by growing regulatory incentives for residential flexibility.

The Europe Home Energy Management System Market Report is Segmented by Component (Hardware, Software, and Services), Product Type (Lighting Controls, Self-Monitoring Systems and Services, Programmable Communicating Thermostats, Advanced Central Controllers, Intelligent HVAC Controller, and More), Technology (Z-Wave, Zigbee, Wi-Fi, Internet, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric

- Eaton Corporation

- ABB Group

- General Electric

- Honeywell International

- tado GmbH

- Netatmo

- Legrand Group

- EnergyHub

- Johnson Controls

- OVO Energy

- E.ON Group

- tado GmbH

- Sonnen GmbH

- Netatmo

- Hive (Home Serve)

- Devolo AG

- Legrand Group

- Thermondo

- Deutsche Telekom (Magenta SmartHome)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory smart-meter roll-outs under EU Clean Energy Package

- 4.2.2 Soaring household electricity prices post-energy crisis

- 4.2.3 Residential electrification (heat pumps and EV chargers) needing load orchestration

- 4.2.4 Utility-led demand-response incentive programmes

- 4.2.5 AI-enabled HEMS apps lowering payback to <3 yrs

- 4.2.6 Retail-energy "Flexibility Trading" revenue streams for prosumers (under-reported)

- 4.3 Market Restraints

- 4.3.1 High upfront hardware cost vs. traditional controls

- 4.3.2 Fragmented device standards (Zigbee, Thread, Matter, etc.)

- 4.3.3 Consumer cyber-privacy concerns on granular load data

- 4.3.4 Slow roll-out of dynamic tariffs in several EU states (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Product Type

- 5.2.1 Lighting Controls

- 5.2.2 Self-Monitoring Systems and Services

- 5.2.3 Programmable Communicating Thermostats

- 5.2.4 Advanced Central Controllers

- 5.2.5 Intelligent HVAC Controllers

- 5.3 By Technology

- 5.3.1 Zigbee

- 5.3.2 Wi-Fi

- 5.3.3 Internet

- 5.3.4 Z-Wave

- 5.3.5 Others

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Schneider Electric

- 6.4.2 Eaton Corporation

- 6.4.3 ABB Group

- 6.4.4 General Electric

- 6.4.5 Honeywell International

- 6.4.6 tado GmbH

- 6.4.7 Netatmo

- 6.4.8 Legrand Group

- 6.4.9 EnergyHub

- 6.4.10 Johnson Controls

- 6.4.11 OVO Energy

- 6.4.12 E.ON Group

- 6.4.13 tado GmbH

- 6.4.14 Sonnen GmbH

- 6.4.15 Netatmo

- 6.4.16 Hive (Home Serve)

- 6.4.17 Devolo AG

- 6.4.18 Legrand Group

- 6.4.19 Thermondo

- 6.4.20 Deutsche Telekom (Magenta SmartHome)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment