PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934836

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934836

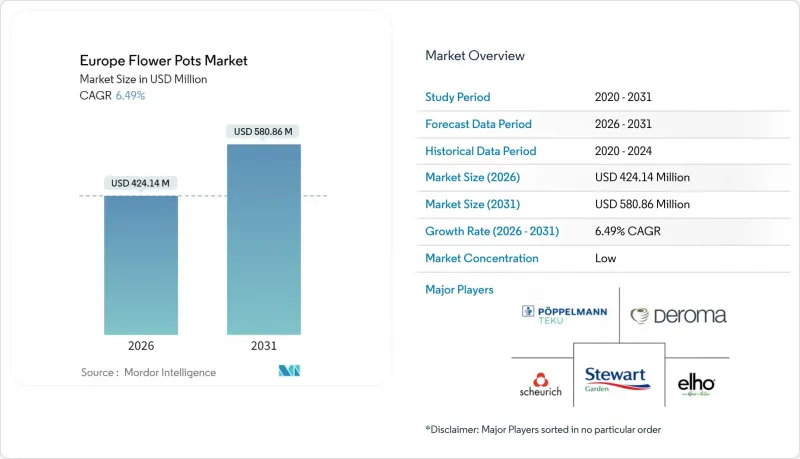

Europe Flower Pots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe flower pots market size in 2026 is estimated at USD 424.14 million, growing from 2025 value of USD 398.30 million with 2031 projections showing USD 580.86 million, growing at 6.49% CAGR over 2026-2031.

Demand resilience stems from a permanent shift toward home gardening, rapidly increasing preference for sustainable containers, and accelerated adoption of self-watering technologies that simplify plant care for busy urban dwellers. Regulatory pressure from the EU Packaging and Packaging Waste Regulation, effective February 2025, is pushing manufacturers to integrate at least 35% post-consumer recyclate in non-food packs, creating a materials innovation race. Public funding under the European Green Deal is channeling resources toward urban greening projects, opening institutional demand for large-format planters that meet circular-economy criteria. Supply-chain diversification away from Asia, together with sharp volatility in energy and polymer prices, is prompting regional production investments that should localize value capture and shorten lead times for European buyers.

Europe Flower Pots Market Trends and Insights

Sustainability Mandates Driving Shift to Biodegradable Pots

EU policy now requires every retail pack to be recyclable by 2030, forcing horticulture suppliers to overhaul materials strategies . German peat-reduction guidelines for hobby gardeners accelerate demand for sustainable substrates that pair neatly with compostable pots. Suppliers such as LECHUZA have introduced peat-free blends and bio-based containers that meet durability needs while reducing lifecycle emissions. Academic trials show coir and PLA pots can survive up to five years and safely biodegrade in soil, enriching it with organic matter. The resulting compliance pressure and consumer pull are opening opportunities for startups to launch specialty lines that bypass legacy plastic tooling.

Post-Pandemic Surge in Home-Gardening & Indoor Decor

Lockdowns sparked a widespread hobby boom, and survey data confirm indoor plant sales remain at least 15% above 2019 baseline in the region. Biophilic design trends encourage consumers to integrate greenery into living and workspaces for wellness benefits, buttressing premium indoor-planter demand. Gen Z shoppers prioritize ethical sourcing and unique aesthetics, rewarding brands that pair recycled inputs with modern styling. IoT-enabled pots that monitor moisture and push alerts to smartphones turn novice growers into confident plant owners, supporting repeat purchases and higher average selling prices. Remote-work permanence keeps home offices relevant, ensuring sustained container sales for desk-friendly foliage.

Volatile Polymer & Energy Prices Squeezing Margins

European resin spot prices swung more than 30% over twelve months, eroding budget visibility for pot molders. Gas-fired kilns contribute up to 40% of ceramic unit cost, exposing producers to geopolitical shocks and tariff disputes . Italian trade data show over 5,000 plastics firms flag price spikes as their top operating risk, compelling some to suspend production in winter peaks. Manufacturers mitigate volatility by hedging energy, renegotiating supply contracts, and exploring bio-based resins that decouple from fossil-fuel benchmarks. Price pressure is translating into selective list-price increases, though consumer resistance caps pass-through potential.

Other drivers and restraints analyzed in the detailed report include:

- EU Circular-Economy Funding for Recycled Plastic Capacity

- Growth of Omnichannel Garden Retail Chains

- Tightening PFAS & Micro-Plastic Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic maintained 48.10% of Europe flower pots market share in 2025 owing to entrenched supply chains, low pricing, and broad form-factor flexibility. Europe flower pots market size for biodegradable materials is forecast to expand at a 7.27% CAGR as coir, paper, and PLA formulations gain consumer trust for home composting applications. Ceramic and terracotta preserve premium niches where aesthetics and durability justify higher ticket prices for commercial landscapes and upscale households. Metal and bamboo serve specialized demand for modern designs or natural looks, although each faces durability or cost hurdles that limit mass adoption. Leading firms now market hybrid products-recycled-plastic outer shells with bio-based inner sleeves-that meet recyclability mandates without sacrificing strength.

Second-generation bioplastics can remain structurally sound for up to five years, providing functional parity with traditional resin pots while eventually decomposing into harmless biomass. EU funding programs cover pilot plants that upcycle agricultural waste into fillers, lowering cost gaps versus virgin PP. Ceramic players test 3D-printed slip casting to reduce kiln waste and customize shapes quickly, unlocking localized micro-factories closer to demand centers. Recyclate incorporation in mainstream plastic lines is rising, illustrated by Keter's 55% post-consumer content milestone that satisfies retailers' eco-scorecards. Competitive advantage in materials now hinges on lifecycle analysis credentials more than on absolute scale.

Outdoor planters generated 63.05% of Europe flower pots market size in 2025, supported by mature gardening cultures and municipal landscaping contracts. Indoor pots, however, are advancing at a 6.86% CAGR as remote workers curate biophilic home offices and living rooms. IoT-capable planters with moisture sensors command price premiums of 30-50% over basic plastic equivalents, making indoor the margin engine for producers. Hybrid balcony boxes that can transition from interior windowsills to exterior railings address space-constrained urban dwellers and extend seasonal usage. Retail merchandising now segments offerings by decor theme, Scandi minimalism, urban jungle, or cottagecore, reinforcing the emotional element in purchase decisions.

Commercial property landlords add statement greenery to lobbies for wellness certification points, creating bulk orders for oversized self-watering tubs that minimize maintenance labor. Research links indoor vegetation with cognitive performance gains, further institutionalizing plants in workplaces and schools. To address leakage risk, manufacturers employ double-wall constructions with integrated overflow reservoirs, reducing flooring damage claims. Outdoor buyers still value frost resistance and UV stability, so ceramic glazes and polypropylene stabilizers remain product-development focuses. Convergence is occurring as consumers demand visually harmonized pots for both patio and living room, pushing designers toward modular families that span sizes and materials.

The Europe Flower Pots Market Report is Segmented by Material (Plastic, Ceramic, Terracotta, Metal, Wood & Bamboo, Bio-Degradable), Usage Location (Outdoor, Indoor), End-User (Residential, Commercial), Distribution Channel (Garden Centres & DIY Stores, Supermarkets & Mass Merchandisers, Online Pure-Plays & Marketplaces, and Other), and Geography (Germany, and Other). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Scheurich GmbH & Co. KG

- elho B.V.

- Poppelmann (TEKU)

- Deroma Group

- Stewarts Garden Products Ltd.

- Prosperplast Sp. z o.o.

- Artevasi S.A.

- Yorkshire Flowerpots Ltd.

- Lechuza (Geobra Brandstatter)

- Tontarelli S.p.A.

- Euro3Plast S.p.A.

- Teraplast Group

- Graf GmbH (Garantia)

- Keter Group

- Harbo Horticulture A/S

- Kekkila-BVB

- Greemotion GmbH

- Blumfeldt (Chal-Tec GmbH)

- IRIS Ohyama Europe

- Plantpak (Petersfield)

- Verdemax S.p.A.

- Emsa GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainability mandates driving shift to biodegradable pots

- 4.2.2 Post-pandemic surge in home-gardening & indoor decor

- 4.2.3 EU circular-economy funding for recycled plastic capacity

- 4.2.4 Growth of omni-channel garden retail chains

- 4.2.5 Smart self-watering pot innovation clusters in NL & DE

- 4.2.6 Rapid urban greening targets under EU Green Deal

- 4.3 Market Restraints

- 4.3.1 Volatile polymer & energy prices squeezing margins

- 4.3.2 Tightening PFAS & micro-plastic regulations

- 4.3.3 Slow replacement cycles in institutional landscaping

- 4.3.4 Supply-chain risk from Asia ceramic capacity concentration

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Ceramic

- 5.1.3 Terracotta

- 5.1.4 Metal

- 5.1.5 Wood & Bamboo

- 5.1.6 Bio-degradable (Coir, Paper, PLA, etc.)

- 5.2 By Usage Location

- 5.2.1 Outdoor

- 5.2.2 Indoor

- 5.3 By End-user

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 Garden Centres & DIY Stores

- 5.4.2 Supermarkets & Mass Merchandisers

- 5.4.3 Online Pure-plays & Marketplaces

- 5.4.4 Direct-to-Consumer Brands

- 5.5 Geography - Europe

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Belgium

- 5.5.8 Nordics (Denmark, Sweden, Norway, Finland)

- 5.5.9 Rest of Europe (Poland, Czechia, etc.)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Scheurich GmbH & Co. KG

- 6.4.2 elho B.V.

- 6.4.3 Poppelmann (TEKU)

- 6.4.4 Deroma Group

- 6.4.5 Stewarts Garden Products Ltd.

- 6.4.6 Prosperplast Sp. z o.o.

- 6.4.7 Artevasi S.A.

- 6.4.8 Yorkshire Flowerpots Ltd.

- 6.4.9 Lechuza (Geobra Brandstatter)

- 6.4.10 Tontarelli S.p.A.

- 6.4.11 Euro3Plast S.p.A.

- 6.4.12 Teraplast Group

- 6.4.13 Graf GmbH (Garantia)

- 6.4.14 Keter Group

- 6.4.15 Harbo Horticulture A/S

- 6.4.16 Kekkila-BVB

- 6.4.17 Greemotion GmbH

- 6.4.18 Blumfeldt (Chal-Tec GmbH)

- 6.4.19 IRIS Ohyama Europe

- 6.4.20 Plantpak (Petersfield)

- 6.4.21 Verdemax S.p.A.

- 6.4.22 Emsa GmbH

7 Market Opportunities & Future Outlook

- 7.1 Transition to bio-based and compostable pots

- 7.2 Smart, self-watering and IoT-enabled planters

- 7.3 Urban-greening mega-projects funded by the EU Green Deal