PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934845

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934845

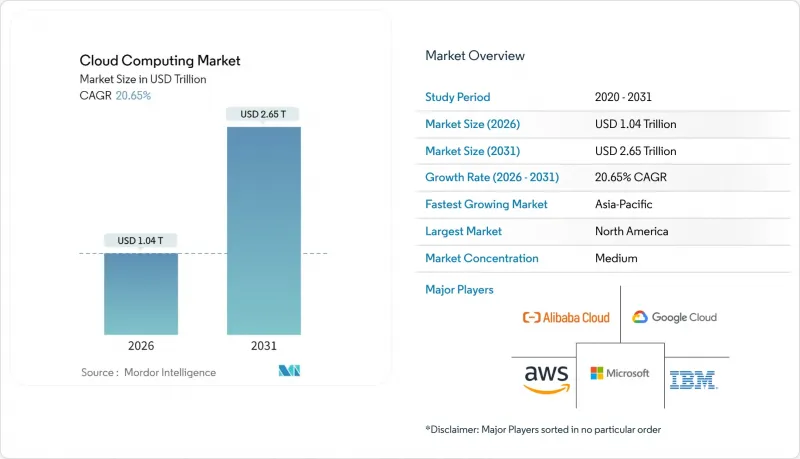

Cloud Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Cloud Computing market is expected to grow from USD 0.86 trillion in 2025 to USD 1.04 trillion in 2026 and is forecast to reach USD 2.65 trillion by 2031 at 20.65% CAGR over 2026-2031.

The surge is tied to AI-first digital-transformation agendas, enterprise migration of core applications to Software-as-a-Service (SaaS) platforms, expanding sovereign-cloud rules in Europe and the Gulf, and the rollout of sub-10 millisecond edge-cloud zones that underpin extended-reality (XR) and autonomous-operations use cases. Hyperscale providers are therefore racing to enlarge GPU-rich data-center footprints, while industry-specific cloud blueprints simplify compliance for health, finance, and the public sector. At the same time, hybrid-cloud strategies gain prominence as enterprises seek workload portability and cost discipline. Intensifying competition among providers is pushing multi-cloud interoperability to the forefront, positioning open ecosystems over lock-in as a new source of value creation.

Global Cloud Computing Market Trends and Insights

Explosive SaaS adoption in core enterprise software

Cloud migrations now encompass mission-critical enterprise-resource-planning, customer-relationship-management, and finance systems rather than only productivity workloads, a shift that is increasingly shaping the broader Cloud Computing Market. Delta Air Lines finalized a USD 500 million overhaul of its digital core in 2024, using SaaS to enable AI-driven personalization and punctuality improvements. The pivot delivers continuous feature updates and embedded analytics, unlocking real-time decision-making that on-premises software cannot match. Regulated sectors benefit from standardized compliance controls baked into SaaS stacks, accelerating audits and lowering operational overhead. Organizations delaying migration risk capability gaps and slower product cycles compared with SaaS-first peers

Proliferation of Gen-AI workloads demanding elastic compute

Large-language-model training requires thousands of high-bandwidth GPUs operating in parallel, dwarfing previous enterprise-workload footprints. Oracle reserved USD 40 billion worth of Nvidia processors for a Texas site supporting OpenAI in 2025. Such scale drives radical shifts in data-center power, cooling, and network fabric design. Providers are re-architecting around AI-optimized silicon, direct-liquid cooling, and high-speed interconnects to satisfy growing demand. Customers gravitate toward vendors able to guarantee capacity and favorable economics for bursty AI experiments and production inference.

Data-localization laws fragmenting global footprints

Jurisdiction-specific residency rules compel providers to duplicate infrastructure and create discrete logical environments, adding cost and operational complexity. Multinationals face overlapping obligations on storage, processing, and personnel access, often forcing architectural redesigns and higher service prices.

Other drivers and restraints analyzed in the detailed report include:

- Industry-specific cloud platforms (compliance-ready blueprints)

- Sovereign-cloud mandates in EU and GCC

- Run-rate cost overruns vs on-prem TCO

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform-as-a-Service is forecast to compound at 22.85% from 2026-2031, the quickest pace among service models. SaaS retained a commanding 52.87% of 2025 revenue, while Infrastructure-as-a-Service remains the elastic foundation underneath. The PaaS wave is fueled by container orchestration, serverless runtimes, and low-code tools that compress release cycles from months to weeks. Amazon earmarked USD 150 billion for AI-centric data centers catering to those PaaS workloads. As providers enrich platforms with built-in security and AI services, developers gain more freedom to focus on user value rather than plumbing.

In the cloud computing market, PaaS vendors increasingly differentiate through industry frameworks and integrated MLOps. These capabilities shorten deployment of advanced analytics, raise code quality, and reduce developer toil. The combination positions PaaS as a strategic lever for digital products, underpinning rapid experimentation and continuous delivery.

Although private clouds captured 46.62% revenue in 2025, hybrid clouds are expanding at 22.24% CAGR. The model preserves data closeness for sensitive workloads while bursting to public capacity for testing, analytics, and disaster recovery. The cloud computing market size for hybrid deployments is set to rise sharply as firms standardize Kubernetes control planes across on-premises cores and outsourced capacity.

Oracle's cross-cloud pact with AWS eliminates data-egress fees and permits Oracle Database to run seamlessly on either provider. Interoperability curbs vendor-lock fears and lets customers optimize on performance or price. Consequently, the hybrid strategy is viewed as a safety valve for compliance and a springboard for modernization without risky forklift migrations.

Cloud Computing Market is Segmented by Service Model (IaaS, Paas, Saas). Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), End User Vertical (IT and Telecom, BFSI, Manufacturing, and More), Organization Size (Large Enterprises, Small and Mid-Sized Enterprises (SMEs)) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 24.18% of 2025 revenue thanks to an early lead in cloud adoption and dense clusters of digital-native enterprises. Investment continues: Amazon is channeling USD 30 billion into Pennsylvania and North Carolina campuses, while Microsoft plans USD 80 billion in fiscal-year 2025 capacity. Growth in the region now pivots around AI workloads that demand proximity to talent and research hubs. Canada and Mexico open incremental opportunities as firms spread workloads for redundancy and cost optimization.

Europe balances aggressive digital-transformation targets with stringent data-sovereignty rules, shaping the region's trajectory within the Cloud Computing Market. Organizations favor hybrid architectures that keep sensitive data local yet leverage global clouds for development and analytics. Providers such as OVHcloud emphasize European data residency as a unique selling point. Geopolitical shifts post-Brexit compel UK businesses to navigate evolving cross-border data agreements, further reinforcing hybrid adoption.

Asia-Pacific is the engine of future expansion, with a projected 21.65% CAGR. Infrastructure projects scale rapidly: Sify will invest USD 5 billion in Indian AI-focused data centers. Domestic champions such as Alibaba Cloud and Tencent Cloud dominate China, while international providers target Japan, South Korea, India, and fast-growing ASEAN states. Governments back cloud-first policies and smart-city programs, accelerating demand for scalable platforms.

- Amazon (AWS)

- Microsoft

- Google Cloud

- Alibaba Cloud

- IBM

- Oracle

- Salesforce

- SAP SE

- Adobe

- Tencent Cloud

- Huawei Cloud

- Rackspace

- VMware

- Snowflake

- Workday

- ServiceNow

- DigitalOcean

- OVHcloud

- Linode

- Nutanix

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive SaaS adoption in core enterprise software

- 4.2.2 Proliferation of Gen-AI workloads demanding elastic compute

- 4.2.3 Industry-specific cloud platforms (compliance-ready blueprints)

- 4.2.4 Sovereign-cloud mandates in EU and GCC

- 4.2.5 Rise of less than 10 ms edge-cloud zones for XR and autonomous ops

- 4.2.6 Green-cloud buying criteria tied to Scope-3 targets

- 4.3 Market Restraints

- 4.3.1 Data-localisation laws fragmenting global footprints

- 4.3.2 Run-rate cost overruns vs on-prem TCO

- 4.3.3 Advanced chip export controls limiting GPU supply

- 4.3.4 Scarcity of low-carbon power for hyperscale DCs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Model

- 5.1.1 IaaS

- 5.1.2 PaaS

- 5.1.3 SaaS

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By End-user Vertical

- 5.3.1 IT and Telecom

- 5.3.2 BFSI

- 5.3.3 Manufacturing

- 5.3.4 Retail and Consumer Goods

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Others

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-Sized Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.2.5 Egypt

- 5.5.5.2.6 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon (AWS)

- 6.4.2 Microsoft

- 6.4.3 Google Cloud

- 6.4.4 Alibaba Cloud

- 6.4.5 IBM

- 6.4.6 Oracle

- 6.4.7 Salesforce

- 6.4.8 SAP SE

- 6.4.9 Adobe

- 6.4.10 Tencent Cloud

- 6.4.11 Huawei Cloud

- 6.4.12 Rackspace

- 6.4.13 VMware

- 6.4.14 Snowflake

- 6.4.15 Workday

- 6.4.16 ServiceNow

- 6.4.17 DigitalOcean

- 6.4.18 OVHcloud

- 6.4.19 Linode

- 6.4.20 Nutanix

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment