PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934854

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934854

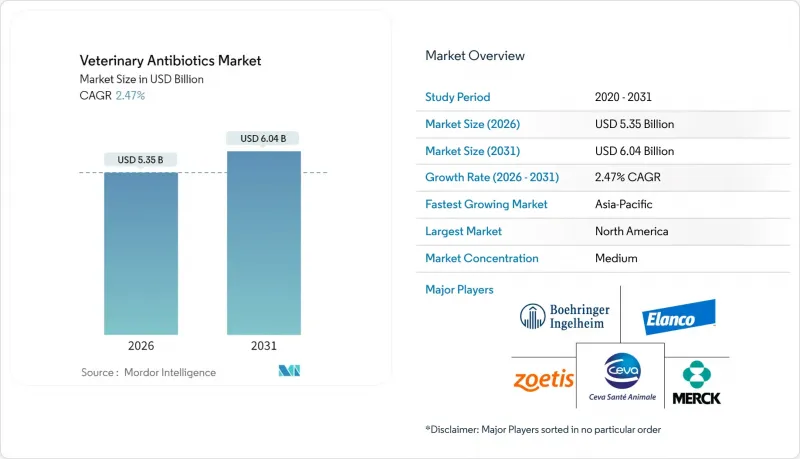

Veterinary Antibiotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The animal antibiotics market size in 2026 is estimated at USD 5.35 billion, growing from 2025 value of USD 5.22 billion with 2031 projections showing USD 6.04 billion, growing at 2.47% CAGR over 2026-2031.

This steady expansion signals how producers are balancing stricter antimicrobial-use policies with persistent disease threats across intensive livestock systems. Uptake of prescription-only rules in major economies has elevated veterinary oversight, while herd restocking in China and Brazil and growing pet numbers in North America are adding volume momentum. Demand for broad-spectrum agents such as tetracyclines remains solid because they cut diagnostic delays, even as farm operators trial "animal-only" classes to limit cross-resistance. Long-acting injectable technologies are gaining traction because they reduce handling stress and labor costs. Convergence of these trends keeps pricing disciplined yet sustains innovation, particularly in heat-stable formulations for tropical climates.

Global Veterinary Antibiotics Market Trends and Insights

Growing Pet & Livestock Ownership Rebound Post-COVID-19

Livestock restocking accelerated once pandemic-era supply shocks eased and meat demand surpassed pre-2020 benchmarks. China removed several disease-related import bans in early 2025, stimulating fresh herd investments and driving antibiotic protocols during animal acclimation. Companion-animal ownership also climbed, with an uptick in senior pets that need chronic infection management. Broad-spectrum products, therefore, see repeat usage in bovine respiratory prophylaxis and canine skin infections. The dual rebound sustains capacity utilization at manufacturing plants even as regulators tighten sales channels.

Intensifying Livestock-Disease Outbreaks In China & Brazil

Recurring cases of sheep pox, goat pox, foot-and-mouth, and poultry clostridial disorders have raised the baseline for therapeutic demand in Asia Pacific and South America. When outbreaks flare, producers intensify prophylactic regimes to secure downstream revenues. China's import restrictions ripple across global trade and inspire operators in unaffected countries to boost biosecurity, which includes broader antibiotic coverage. The poultry sector alone loses USD 6 billion annually to clostridial complications, underscoring the financial stakes that justify continued antibiotic reliance.

Escalating Antimicrobial-Resistance Regulations

Governments are tightening stewardship rules to curb resistance. India banned several drug classes in food animals from April 2025, while China's action plan already cut growth-promoter usage by nearly half between 2018 and 2020. The FDA now requires veterinary prescriptions for all medically important molecules. Compliance raises costs for smallholders and shrinks prophylactic volumes. Economists warn that resistance could wipe USD 575 billion from global GDP by 2050, intensifying political scrutiny.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward "Animal-Only" Antibiotic Classes

- Expansion Of Heat-Stable, Long-Acting Injectable Platforms

- Scarcity Of Rural Veterinarians & Skilled Farm Labor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cattle generated 39.10% of 2025 revenue, underpinning the animal antibiotics market through routine therapy for bovine respiratory disease complexes. Large feedlots rely on metaphylaxis to protect thousands of head during transport stress, sustaining steady oxytetracycline volumes. Aquaculture, though smaller, accelerates at a 6.61% CAGR as Vietnam, Indonesia, and China scale pond production. Antibiotic use intensity is higher in fish than in poultry because waterborne pathogens spread quickly, giving the animal antibiotics market an avenue for incremental tonnage.

Investment in shrimp and tilapia farming also stimulates diagnostic innovation. Operators monitor water quality and microbial counts, then apply narrow-spectrum agents when alerts trigger. Swine, poultry, and companion animals remain essential but slower-growing pillars. Swine respiratory and enteric infections still command significant penicillin and macrolide shipments. Ageing pets support small-volume, high-margin therapies sold through clinics. Varied disease ecologies across species ensure demand diversity, cushioning the animal antibiotics market against volatility in any one meat category.

The Veterinary Antibiotics Market is Segmented by Animal Type (Poultry, and More), Drug Class (Tetracyclines, and More), Delivery Form (Premixes, and More), Spectrum of Activity (Broad-Spectrum and More), End User (Food-Producing Animal Producers and More), Distribution Channel (Veterinary Hospitals and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.10% of global revenue in 2025, with sales anchored in the United States, where the FDA's Guidance 263 moved all medically significant molecules under prescription. The regulation raised clinic footfall and shifted distribution from farm stores to veterinary channels, shaping the animal antibiotics market. Zoetis, Merck Animal Health, and Elanco upgraded production footprints, and Merck's USD 895 million Kansas expansion underscores supply security themes. Growth to 2031 is modest but steady because advanced diagnostics and long-acting injectables offset tighter prophylactic rules.

Asia Pacific posts the fastest 5.42% CAGR to 2031, reflecting its status as the world's largest protein supplier. China alone consumed 32,776 tons of veterinary antimicrobials in 2020, and while its national plan trims usage, absolute demand stays high due to herd size. Vietnam reports 64% antibiotic use on fish farms, highlighting persistent reliance amid waterborne disease risk. Regulatory frameworks trail Western rigor, so producers prioritize cost and efficacy. Rising disposable incomes in Indonesia and Thailand expand meat consumption, which supports volumes even as stewardship messaging gains ground.

Europe remains a mature yet innovative arena. The bloc banned growth promoters in 2006, so sales focus on therapy and precision dosing. Companies invest in non-antibiotic alternatives but still rely on macrolides and beta-lactams for acute outbreaks. Latin America grows moderately; Brazil's poultry giants adopt surveillance platforms to curb resistance,e yet still require therapeutic packages during rainy-season flare-ups. The Middle East and Africa offer long-term upside once cold-chain and veterinary education gaps shrink, presenting frontier markets for heat-stable injectables.

- Zoetis

- Boehringer Ingelheim

- Merck Animal Health (MSD)

- Elanco

- Phibro Animal Health

- Virbac

- Ceva

- Dechra Pharmaceuticals

- Huvepharma

- Vetoquinol

- Norbrook

- Bimeda Holdings

- Hipra

- Chanelle Pharma

- KRKA d.d.

- Zydus Animal Health

- Ashish Life Science

- AdvaCare

- Ourofino Saude Animal

- Kyoritsu Seiyaku

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Pet & Livestock Ownership Rebound Post-COVID-19

- 4.2.2 Intensifying Livestock-Disease Outbreaks In China & Brazil

- 4.2.3 Shift Toward 'Animal-Only' Antibiotic Classes

- 4.2.4 Expansion Of Heat-Stable, Long-Acting Injectable Platforms

- 4.2.5 Genomic Surveillance Enabling Precision-Dose Stewardship

- 4.2.6 Aquaculture Boom In ASEAN Driving Off-Label Antibiotic Demand

- 4.3 Market Restraints

- 4.3.1 Escalating Antimicrobial-Resistance Regulations

- 4.3.2 Scarcity Of Rural Veterinarians & Skilled Farm Labour

- 4.3.3 Rapid Penetration Of Non-Antibiotic Growth Promoters

- 4.3.4 IPO-Funded Start-Ups Launching Phage Therapies That Displace Antibiotics

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Animal Type

- 5.1.1 Poultry

- 5.1.2 Swine

- 5.1.3 Cattle

- 5.1.4 Sheep & Goats

- 5.1.5 Companion Animals

- 5.1.6 Aquaculture

- 5.1.7 Other Livestock

- 5.2 By Drug Class

- 5.2.1 Tetracyclines

- 5.2.2 Penicillins

- 5.2.3 Sulfonamides

- 5.2.4 Macrolides

- 5.2.5 Aminoglycosides

- 5.2.6 Cephalosporins

- 5.2.7 Fluoroquinolones

- 5.2.8 Others (Lincosamides, Ionophores, Streptogramins)

- 5.3 By Delivery Form

- 5.3.1 Premixes

- 5.3.2 Oral Powders

- 5.3.3 Oral Solutions

- 5.3.4 Injections

- 5.3.5 Intramammary & Intra-uterine

- 5.3.6 Feed Additive Blends

- 5.4 By Spectrum of Activity

- 5.4.1 Broad-Spectrum

- 5.4.2 Narrow-Spectrum

- 5.5 By End User

- 5.5.1 Food-Producing Animal Producers

- 5.5.2 Companion Animal Owners

- 5.6 By Distribution Channel

- 5.6.1 Veterinary Hospitals & Clinics

- 5.6.2 Retail Pharmacies

- 5.6.3 Online Channels

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia

- 5.7.3.6 Rest of Asia Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Zoetis

- 6.3.2 Boehringer Ingelheim

- 6.3.3 Merck Animal Health (MSD)

- 6.3.4 Elanco Animal Health

- 6.3.5 Phibro Animal Health

- 6.3.6 Virbac

- 6.3.7 Ceva Sante Animale

- 6.3.8 Dechra Pharmaceuticals

- 6.3.9 Huvepharma

- 6.3.10 Vetoquinol

- 6.3.11 Norbrook

- 6.3.12 Bimeda Holdings

- 6.3.13 HIPRA

- 6.3.14 Chanelle Pharma

- 6.3.15 KRKA d.d.

- 6.3.16 Zydus Animal Health

- 6.3.17 Ashish Life Science

- 6.3.18 AdvaCare Pharma

- 6.3.19 Ourofino Saude Animal

- 6.3.20 Kyoritsu Seiyaku

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment