PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934860

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934860

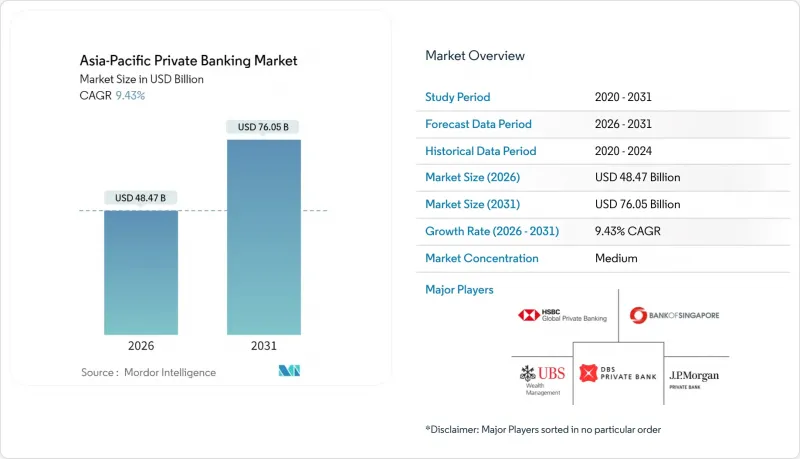

Asia-Pacific Private Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific private banking market size in 2026 is estimated at USD 48.47 billion, growing from 2025 value of USD 44.3 billion with 2031 projections showing USD 76.05 billion, growing at 9.43% CAGR over 2026-2031.

Rapid HNWI creation, surging inter-generational transfers, and sovereign-wealth diversification mandates collectively reinforce the region's status as the fastest-growing global hub. Regulatory alignment among Singapore, Hong Kong, and emerging corridors in India and Southeast Asia lowers friction and broadens cross-border opportunity sets. Intensified technology investment, especially in AI-powered portfolio tools and ESG analytics, has become a primary competitive differentiator. Meanwhile, escalating AML and CRS compliance costs prompt operating-model redesigns as institutions balance growth ambitions with rising regulatory overhead.

Asia-Pacific Private Banking Market Trends and Insights

Rapid Growth of HNWI & UHNW Population

India's 12.2% annual millionaire expansion and China's absolute scale make demographic momentum the core catalyst for the Asia-Pacific private banking market. Entrepreneurial wealth from technology, manufacturing, and services demands sophisticated discretionary mandates that accelerate fee pools. Younger clients insist on digital-first interaction and ESG-aligned strategies, raising the bar for platform capabilities. Structures such as Singapore's Variable Capital Company and Hong Kong's Open-ended Fund Company lower fund-launch frictions and attract cross-border capital. Private banks that integrate legal, tax, and investment expertise capture outsized wallet share in the Asia-Pacific private banking market.

Inter-generational Wealth Transfer Wave

Roughly USD 2.4 trillion is slated to change hands this decade, reshaping service demand across the Asia-Pacific private banking industry. Cohorts tilt toward impact investing, venture capital, and liquid alternatives, forcing portfolio redesign. Concurrent policy changes, Australia's superannuation tweaks, and Japan's larger NISA allowances expand accumulation vehicles that need professional advice. Singapore's single-family-office count climbed 40% in 2024, illustrating ownership shifts toward direct control. Advisory teams fluent in governance, philanthropy, and digital assets stand to win new mandates within the Asia-Pacific private banking market.

Escalating AML / CRS Compliance Costs

Leading private banks now allocate 8-12% of their revenue to compliance, putting a strain on their operating leverage. The complexity intensifies with multi-jurisdiction clients, especially since rule harmonization is still a work in progress. Smaller firms, without the advantage of scale, face these challenges more acutely, driving a wave of consolidation in the sector. Onboarding takes a hit as enhanced due diligence for politically exposed persons can stretch the process by weeks, diminishing the overall client experience. While RegTech adoption offers a solution, it comes with a hefty upfront capital requirement in the Asia-Pacific private banking arena.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Family Offices in Hong Kong & Singapore

- Demand for Alternative & Sustainable Assets

- Shortage & Rising Cost of Experienced Relationship Managers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Asset management contributed 72.15% of the Asia-Pacific private banking market size in 2025, underscoring the pivot toward discretionary mandates and alternative allocation models. Rapid client sophistication and supportive regulation fuel a 12.42% CAGR that keeps this segment at the center of strategic planning. Trust services outpace peers within the broader suite as succession and tax dynamics intensify cross-border structuring needs. Insurance solutions maintain a stable niche through private-placement life products that blend protection and estate-planning benefits. Platforms bundling these services reinforce client stickiness by satisfying multi-dimensional advice requirements.

The convergence of technology and investment management strengthens competitive moats in the Asia-Pacific private banking market. AI-driven optimization personalizes risk-return profiles while boosting operational leverage. ESG analytics embedded in core systems align portfolios with mandatory disclosures in hub jurisdictions. Modular tech stacks shorten product-development cycles, allowing quick responses to shifting investor sentiment. Institutions scaling such capabilities command valuation premiums during consolidation waves.

The Asia-Pacific Private Banking Market Report is Segmented by Type (Asset Management, Insurance Services, Trust Services, Tax Consulting, Real-Estate Consulting), Application (Personal, Enterprise), and Geography (China, India, Japan, South Korea, Australia, Southeast Asia, Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- UBS Global Wealth Management

- HSBC Global Private Banking

- J.P. Morgan Private Bank

- DBS Private Bank

- Bank of Singapore

- Julius Baer

- Goldman Sachs PWM

- Morgan Stanley PWM

- Citi Private Bank

- Standard Chartered Private Bank

- BNP Paribas WM

- LGT Private Banking

- Lombard Odier

- UOB Private Bank

- ICBC Private Banking

- China Merchants Bank PB

- Credit Suisse (integrated into UBS)

- Barclays Private Bank APAC

- ANZ Private Bank

- OCBC Private Bank

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth Of HNWI & UHNW Population

- 4.2.2 Inter-Generational Wealth Transfer Wave

- 4.2.3 Expansion Of Family Offices In HK & SG

- 4.2.4 Demand For Alternative & Sustainable Assets

- 4.2.5 Cross-Border Wealth Passporting Programs

- 4.2.6 Ai-Enabled Hybrid Advisory Productivity Gains

- 4.3 Market Restraints

- 4.3.1 Escalating AML / CRS Compliance Costs

- 4.3.2 Shortage & Rising Cost of Experienced Rms

- 4.3.3 Geopolitical-Driven Asset Relocation From Hubs

- 4.3.4 Wealthtech Fee Compression on Entry Segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Bn)

- 5.1 By Type

- 5.1.1 Asset Management

- 5.1.2 Insurance Services

- 5.1.3 Trust Services

- 5.1.4 Tax Consulting

- 5.1.5 Real-Estate Consulting

- 5.2 By Application

- 5.2.1 Personal

- 5.2.2 Enterprise

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Australia

- 5.3.6 Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, and Philippines)

- 5.3.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 UBS Global Wealth Management

- 6.4.2 HSBC Global Private Banking

- 6.4.3 J.P. Morgan Private Bank

- 6.4.4 DBS Private Bank

- 6.4.5 Bank of Singapore

- 6.4.6 Julius Baer

- 6.4.7 Goldman Sachs PWM

- 6.4.8 Morgan Stanley PWM

- 6.4.9 Citi Private Bank

- 6.4.10 Standard Chartered Private Bank

- 6.4.11 BNP Paribas WM

- 6.4.12 LGT Private Banking

- 6.4.13 Lombard Odier

- 6.4.14 UOB Private Bank

- 6.4.15 ICBC Private Banking

- 6.4.16 China Merchants Bank PB

- 6.4.17 Credit Suisse (integrated into UBS)

- 6.4.18 Barclays Private Bank APAC

- 6.4.19 ANZ Private Bank

- 6.4.20 OCBC Private Bank

7 Market Opportunities & Future Outlook