PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934882

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934882

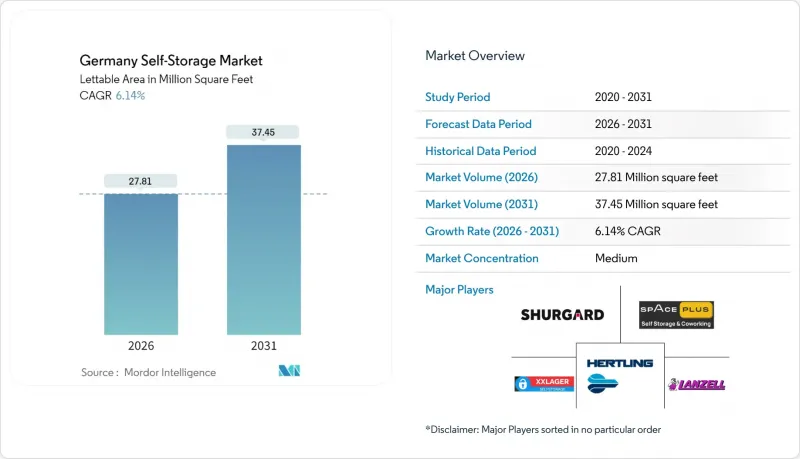

Germany Self-Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Germany Self-Storage market is expected to grow from 26.2 million sq.ft in 2025 to 27.81 million sq.ft in 2026 and is forecast to reach 37.45 million sq.ft by 2031 at 6.14% CAGR over 2026-2031.

Urban housing shortages, resilient e-commerce growth and sustained institutional capital flows keep demand elevated even as Germany's wider construction activity contracts. Operators favor asset-light leased facilities to mitigate construction cost inflation that hit 118.9 index points in 2024. PropTech adoption, including smart-lock, automated billing and AI security, cuts operating costs by up to 20% and unlocks 24/7 access, strengthening the competitive position of unmanned formats. Climate-controlled capacity grows fastest because SMEs seek reliable storage for temperature-sensitive inventory while insurance discounts encourage households to protect valuables in secure facilities. Consolidation intensifies as Shurgard, MyPlace and other well-capitalized players pursue acquisitions amid EUR 9.7 billion in non-performing commercial real-estate loans, creating a pipeline of distressed assets.

Germany Self-Storage Market Trends and Insights

Urbanisation and Shrinking Average Dwelling Size

Housing permits fell 24% year over year in 2024 and apartment vacancies hit record lows in Berlin, forcing households into smaller homes, tightening personal space and fueling demand for external units. Single-person households and delayed ownership among millennials intensify storage requirements, while building-material costs that climbed to 119.9 index points in 2024 discourage new residential supply. Municipal densification policies cap floor-space ratios, making vertical living unavoidable and prompting residents to rent nearby storage lockers. Long-term demographic pressure keeps demand durable even if construction volumes stabilize. Operators located within 5 kilometers of dense residential districts report occupancy above 90%, confirming the correlation between shrinking living space and take-up rates.

Growth in E-commerce and SME Inventory Needs

German online retail will grow 3% in 2025 versus 2% for total retail, extending a multiyear outperformance that enlarges flexible storage demand. SMEs use 50- to 150-sq ft climate-controlled rooms as micro-fulfillment nodes to manage seasonal peaks, returns and cross-border shipments within the EU. For merchants, month-to-month leases avoid long warehouse contracts amid uncertain sales volatility. Logistics parks ringing Hamburg and Cologne see blended occupancy of 92% as businesses seek proximity to parcel hubs. Rent premiums of 15-20% for climate-controlled units illustrate a willingness to pay for temperature safety and insurance compliance. This reinforces why the Germany self-storage market keeps aligning product design with omnichannel retail needs.

Restrictive Zoning and Land-Use Permits

Multi-layered permitting regimes lengthen development cycles, often exceeding 24 months in Berlin and Hamburg. Compliance with separate federal and state building codes adds technical complexity. Environmental reviews and noise assessments further protract approvals. Developers incur holding costs that raise breakeven rents, sometimes stalling projects where achievable rates cannot cover higher capitalized costs. Variability in municipal interpretations also adds uncertainty, discouraging conversion of vacant retail or industrial properties into storage despite latent demand.

Other drivers and restraints analyzed in the detailed report include:

- Higher Residential Mobility Among Students and Professionals

- Surge in Home Renovations Amid Ageing Housing Stock

- Escalating Urban Land and Construction Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal accounts generated 73.96% of Germany self-storage market share in 2025 as households relied heavily on external space amid shrinking apartments. The segment occupies 19.37 million sq ft within the Germany self-storage market size and is expected to reach 26.4 million sq ft by 2031, growing 5.29% annually. Single-person households, delayed homeownership and higher urban rents keep day-to-day occupancy high. Personal contracts average 56 sq ft, underpinning steady cash flow for operators.

Business users account for a smaller base but contribute a 7.74% CAGR, climbing from 6.83 million sq ft in 2025 to an estimated 10.7 million sq ft by 2031. SMEs leverage climate-controlled rooms to manage peak inventory and returns. Professional service firms archive documents off-site as offices downsize under hybrid-work models. Sirius Real Estate's Smartspace platform illustrates the commercial pivot, generating EUR 8.7 million annualized storage rent at 70% occupancy.

Small and medium rooms under 40 sq ft held 47.35% of Germany self-storage market share in 2025, equating to 12.41 million sq ft of lettable area within the Germany self-storage market size. Students, expatriates and urban renters choose these units for seasonal items and personal effects. Average stay lasts 7.4 months, moderately longer than European peers.

Large units above 100 sq ft recorded the fastest trajectory at 6.86% CAGR as businesses and home renovators require roomier space for inventory, equipment and furniture. The segment should reach 10.1 million sq ft by 2031, narrowing the share gap. Operators have introduced drive-up access and loading docks to attract commercial tenants, enhancing revenue per occupied square foot by up to 18% compared with mid-sized rooms.

The Germany Self-Storage Market Report is Segmented by End-User (Personal and Business), Storage Size (Small and Medium Units Less Than 40 Sq Ft, Large Units Above 40 Sq Ft, and More), Storage Type (Climate-Controlled and Non-Climate-Controlled), Ownership Pattern (Owned and Leased). The Market Forecasts are Provided in Terms of Volume (Units).

List of Companies Covered in this Report:

- Shurgard Self-Storage SA

- SelfStorage Dein Lagerraum GmbH (MyPlace Self-Storage)

- Space Plus Store GmbH

- Rousselet Groupe SA (HOMEBOX)

- Pickens Selfstorage GmbH

- Lagerbox Holding GmbH and Co. KG

- 1BOX Deutschland GmbH

- Storebox Holding GmbH

- ZeitLager GmbH

- XXLAGER Selfstorage GmbH

- BOXIE24 Deutschland GmbH

- Hertling GmbH and Co. KG

- Lanzell Spezialtransporte GmbH

- Klassik Umzuge GmbH

- KingBox Self-Storage GmbH

- CityBox24 GmbH

- CubeStorage Deutschland GmbH

- Jojo-Lagerhaus GmbH

- Easy-Selfstorage GmbH

- Container Self-Storage AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanisation and shrinking average dwelling size

- 4.2.2 Growth in e-commerce and SME inventory needs

- 4.2.3 Higher residential mobility among students and professionals

- 4.2.4 Surge in home renovations amid ageing housing stock

- 4.2.5 Insurance discounts for off-site storage of high-value goods

- 4.2.6 PropTech-enabled unmanned facility operations

- 4.3 Market Restraints

- 4.3.1 Restrictive zoning and land-use permits

- 4.3.2 Escalating urban land and construction costs

- 4.3.3 Rising energy tariffs squeezing climate-controlled margins

- 4.3.4 Local "Not-In-My-Back-Yard" opposition to new sites

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment Analysis

- 4.10 PESTEL Analysis

- 4.11 Key Considerations of Consumers while selecting a Self-Storage Facility

5 MARKET DYNAMICS IN GERMANY

- 5.1 Analysis of Occupancy Rates

- 5.2 Average Rental Trends

- 5.2.1 Pre-Covid and Post-Covid Market Implications

- 5.3 Profitability Analysis

- 5.3.1 Pre-Covid and Post-Covid Market Implications

- 5.4 Average Facility Size

6 MARKET SIZE AND GROWTH FORECASTS (UNITS)

- 6.1 By End-User

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Storage Size

- 6.2.1 Small and Medium Units (less than 40 sq ft)

- 6.2.2 Large Units (above 40 sq ft)

- 6.2.3 Others (Lockers/Double-Stacked)

- 6.3 By Storage Type

- 6.3.1 Climate-Controlled

- 6.3.2 Non-Climate-Controlled

- 6.4 By Ownership Pattern

- 6.4.1 Owned

- 6.4.2 Leased

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 Shurgard Self-Storage SA

- 7.4.2 SelfStorage Dein Lagerraum GmbH (MyPlace Self-Storage)

- 7.4.3 Space Plus Store GmbH

- 7.4.4 Rousselet Groupe SA (HOMEBOX)

- 7.4.5 Pickens Selfstorage GmbH

- 7.4.6 Lagerbox Holding GmbH and Co. KG

- 7.4.7 1BOX Deutschland GmbH

- 7.4.8 Storebox Holding GmbH

- 7.4.9 ZeitLager GmbH

- 7.4.10 XXLAGER Selfstorage GmbH

- 7.4.11 BOXIE24 Deutschland GmbH

- 7.4.12 Hertling GmbH and Co. KG

- 7.4.13 Lanzell Spezialtransporte GmbH

- 7.4.14 Klassik Umzuge GmbH

- 7.4.15 KingBox Self-Storage GmbH

- 7.4.16 CityBox24 GmbH

- 7.4.17 CubeStorage Deutschland GmbH

- 7.4.18 Jojo-Lagerhaus GmbH

- 7.4.19 Easy-Selfstorage GmbH

- 7.4.20 Container Self-Storage AG

8 MARKET SHARE OF KEY SELF-STORAGE OPERATORS

9 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 9.1 White-space and Unmet-Need Assessment