PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934884

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934884

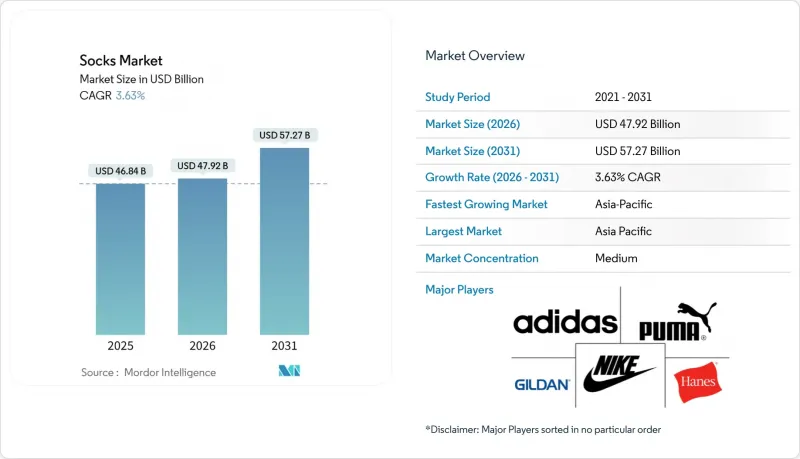

Socks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The socks market size is expected to grow from USD 46.84 billion in 2025 to USD 47.92 billion in 2026 and is forecast to reach USD 57.27 billion by 2031 at 3.63% CAGR over 2026-2031.

Rising disposable incomes, the widespread adoption of athleisure, and growing interest in performance fabrics continue to drive demand, even as the market matures. Technical advancements, such as moisture-wicking yarns, antimicrobial treatments, and seamless knitting, enable brands to maintain price premiums and differentiate themselves from private-label offerings. At the same time, sustainability requirements are influencing sourcing strategies, with circular business models, recycled synthetic materials, and organic cotton gaining significant traction. The Asia-Pacific region leads growth trends, supported by increasing urbanization and the expansion of organized retail. Additionally, omnichannel investments by supermarkets and hypermarkets are enhancing market reach. Competitive intensity remains high due to low entry barriers, widespread counterfeit activity, and the absence of a dominant global player in terms of revenue.

Global Socks Market Trends and Insights

Growing popularity of athleisure trends blending sportswear with casual fashion

Athleisure has evolved from a fitness-focused category into a mainstream wardrobe choice for work-from-home professionals, urban commuters, and weekend social activities. This trend has increased demand for socks that combine technical performance with aesthetic versatility, allowing consumers to transition seamlessly from the gym to the office without changing footwear. In response, brands are introducing hybrid designs featuring arch support, cushioned soles, and moisture management, paired with patterns and colors suitable for casual office settings. This development blurs the line between athletic and fashion socks. The shift is particularly evident among millennials and Generation Z, who prioritize comfort and functionality over traditional formal dress codes. Additionally, this demographic demonstrates a greater willingness to pay premiums for brands that reflect their values, such as sustainability and social responsibility. This creates opportunities for direct-to-consumer brands that focus on transparent sourcing and charitable initiatives. The athleisure trend is projected to contribute to the forecasted compound annual growth rate, with its impact expected to be most significant in the medium term as product offerings adapt to these blended use cases.

Increasing health and fitness awareness boosting demand for performance socks

Health consciousness has led to a sustained increase in participation in activities such as running, cycling, yoga, and gym-based training. This shift has driven consistent demand for socks designed to manage moisture, reduce friction, and prevent blisters. The World Health Organization's (WHO) 2025 Global Physical Activity Report highlights that an increasing number of adults in high-income countries now meet recommended exercise guidelines, marking a notable rise compared to previous years. Similarly, middle-income nations in Asia are experiencing significant growth in fitness club memberships and organized sports leagues . This behavioral shift is driving the adoption of activity-specific sock designs optimized for trail running, court sports, and endurance cycling, replacing generic hosiery options. Technical innovation in performance socks has advanced rapidly to meet this demand. Nike's 2025 annual report revealed that its hosiery division invested substantial resources in developing proprietary yarn blends incorporating phase-change materials to regulate foot temperature during high-intensity workouts. This feature has become a standard offering across its elite running sock range. These advancements are not limited to premium products, as mass-market brands are also adopting moisture-wicking technologies to offer entry-level performance socks at more affordable price points. This trend is expanding the market and encouraging active consumers to upgrade their sock collections, further driving growth in the athletic sock segment.

Fluctuations in raw material quality affecting consistency

Cotton quality is influenced by factors such as growing region, harvest timing, and processing methods, leading to variations in fiber length, strength, and color. These inconsistencies complicate manufacturing processes and affect brand consistency. According to the United States Department of Agriculture's 2025 Cotton Quality Report, adverse weather conditions in key growing regions reduced the share of premium-grade cotton, forcing mills to blend lower-grade fibers or use synthetic substitutes to maintain production schedules . Similarly, polyester quality is affected by feedstock purity and extrusion parameters, with recycled polyester showing greater variability than virgin resin due to contamination from mixed plastic waste streams. Brands without strong quality-control protocols face increased defect rates, higher customer returns, and warranty claims, which negatively impact profit margins and brand reputation. The challenges of maintaining quality consistency are further exacerbated by global supply chains. For instance, a single sock design may involve cotton from India, elastane from China, polyester from Indonesia, dyeing in Bangladesh, and final assembly in Vietnam, creating multiple points where quality may deteriorate. The International Textile Manufacturers Federation's 2025 survey revealed that many apparel brands experienced quality-related production delays in the previous year. This increase was attributed to fragmented sourcing and insufficient supplier audits.

Other drivers and restraints analyzed in the detailed report include:

- Technological advancements in moisture-wicking fabrics

- Growth in sustainable materials such as organic cotton and recycled fibers

- Proliferation of low-cost, unorganized, and counterfeit products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Casual and fashion socks accounted for 63.99% of the 2025 volume, reflecting their adaptability across work, social, and leisure settings. However, athletic socks are projected to grow at an annual rate of 4.15% through 2031, marking the fastest growth within this segment. Athletic socks increasingly incorporate features such as compression zones, seamless toe closures, and targeted cushioning, which help reduce injury risks and enhance comfort during high-impact activities. These features support higher price points and contribute to margin growth for brands.

Casual and fashion socks benefit from trend-driven consumer behavior, with seasonal wardrobe updates influenced by color palettes, patterns, and collaborations with designers and influencers. For example, Nike's 2025 launch of the Elite Cushioned Crew sock, made with a proprietary yarn blend of merino wool and recycled nylon, highlights the innovation trajectory in athletic socks. Despite a higher retail price, the product achieved strong first-quarter sales. While casual socks are growing at a slower pace, they remain critical for brands targeting everyday replenishment purchases. Additionally, casual socks experience lower return rates due to simpler fit requirements. The International Organization for Standardization (ISO) 105 color-fastness standards impact both segments by ensuring that dyes resist fading after repeated washing. Consumers increasingly verify this quality through online reviews.

Men accounted for 58.02% of 2025 consumption, driven by higher average purchase quantities and greater participation in organized sports and fitness activities. However, the kids and children segment is projected to grow at an annual rate of 4.43% through 2031, marking the fastest growth among end-user categories. Parental investment in youth athletic gear has increased as concerns over childhood obesity and sedentary lifestyles encourage enrollment in activities such as soccer leagues, basketball camps, and martial arts programs. This has created demand for socks designed to fit smaller feet while offering performance features comparable to adult products.

Women represent a significant and expanding segment, with brands focusing on designs that address anatomical differences in foot shape and arch height, as well as preferences for colors and patterns that differ from traditional athletic styles. In 2024, Adidas expanded its kids' sock line to include sizes for toddlers through teenagers, incorporating moisture-wicking polyester and reinforced heels to endure abrasion from playground and court surfaces. This expansion contributed to a 14% year-over-year growth in its youth hosiery category.

The Socks Market Report is Segmented by Product Type (Athletic Socks and Casual and Fashion Socks), End User (Men, Women, and Kids/Children), Fabric Material (Cotton, Polyester, and Others), Category (Mass and Premium), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region accounted for 33.32% of the projected 2025 revenue, making it the leading segment globally. This dominance is attributed to urbanization, rising disposable incomes, and the growing middle-class populations in countries such as China, India, Indonesia, and Vietnam. China's textile and apparel market, the largest in the world, benefits from both domestic consumption and export manufacturing. Local brands like Li Ning and Anta are increasing their market share through technical innovation and patriotic branding that resonates with younger consumers. In India, the socks market is expanding as organized retail grows and e-commerce platforms such as Flipkart and Amazon India provide branded hosiery at competitive prices, reaching tier-two and tier-three cities where traditional distribution remains underdeveloped. Japan and South Korea also contribute significantly, with high per-capita consumption of premium and technical socks driven by mature fitness cultures and a preference for quality over quantity.

North America and Europe, while growing at a slower pace, remain important markets due to high average selling prices, strong brand loyalty, and early adoption of sustainability and technical innovations. The United States market is highly competitive, with athletic giants, heritage hosiery brands, and direct-to-consumer entrants vying for market share. Distribution in the United States spans mass merchants, specialty chains, and online platforms. In Europe, consumers prioritize sustainability and regulatory compliance. The European Union's proposed Digital Product Passport requires brands to disclose fiber origins, manufacturing locations, and carbon footprints, benefiting established players with strong supply-chain traceability.

Other regions, including South America and the Middle East and Africa, are smaller but rapidly developing markets. Brazil, Argentina, Saudi Arabia, the United Arab Emirates, and South Africa lead consumption in their respective regions. Brazil's textile industry, traditionally focused on domestic production, is increasingly integrating into global supply chains and attracting foreign direct investment to expand manufacturing capacity. In contrast, Argentina's economic volatility results in cyclical demand patterns, favoring value-oriented brands.

- Nike Inc.

- Adidas AG

- Hanesbrands Inc.

- Puma SE

- Gildan Activewear Inc.

- VF Corporation

- Under Armour Inc.

- Skechers U.S.A. Inc.

- Falke KGaA

- Jockey International Inc.

- Renfro Brands LLC

- Stance Inc.

- Wigwam Mills Inc.

- Injinji Inc.

- Pantherella Int'l Group Ltd

- Happy Socks AB

- Bombas

- Darn Tough Vermont

- Balega (Implus)

- Feetures Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing popularity of athleisure trends blending sportswear with casual fashion

- 4.2.2 Increasing health and fitness awareness boosting demand for performance socks

- 4.2.3 Technological advancements in moisture-wicking fabrics

- 4.2.4 Growth in sustainable materials such as organic cotton and recycled fibers

- 4.2.5 Demand for personalized and custom-designed socks

- 4.2.6 Shift toward eco-friendly production practices like bamboo fibers

- 4.3 Market Restraints

- 4.3.1 Fluctuations in raw material quality affecting consistency

- 4.3.2 Proliferation of low-cost, unorganized, and counterfeit products

- 4.3.3 Challenges in scaling eco-friendly materials due to sourcing limit

- 4.3.4 Rapidly changing consumer preferences shortening product life cycle

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Athletic Socks

- 5.1.2 Casual and Fashion Socks

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Kids/Children

- 5.3 By Fabric Material

- 5.3.1 Cotton

- 5.3.2 Polyester

- 5.3.3 Others

- 5.4 By Category

- 5.4.1 Mass

- 5.4.2 Premium

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Specialty Stores

- 5.5.3 Online Retail Stores

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nike Inc.

- 6.4.2 Adidas AG

- 6.4.3 Hanesbrands Inc.

- 6.4.4 Puma SE

- 6.4.5 Gildan Activewear Inc.

- 6.4.6 VF Corporation

- 6.4.7 Under Armour Inc.

- 6.4.8 Skechers U.S.A. Inc.

- 6.4.9 Falke KGaA

- 6.4.10 Jockey International Inc.

- 6.4.11 Renfro Brands LLC

- 6.4.12 Stance Inc.

- 6.4.13 Wigwam Mills Inc.

- 6.4.14 Injinji Inc.

- 6.4.15 Pantherella Int'l Group Ltd

- 6.4.16 Happy Socks AB

- 6.4.17 Bombas

- 6.4.18 Darn Tough Vermont

- 6.4.19 Balega (Implus)

- 6.4.20 Feetures Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK