PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934891

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934891

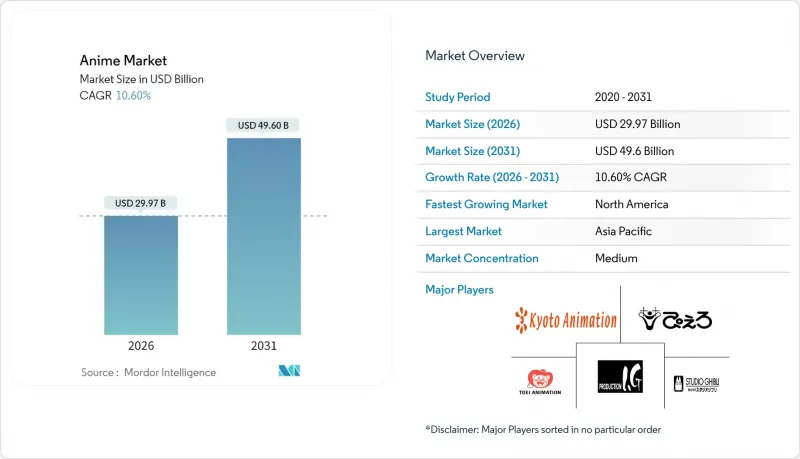

Anime - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The anime market is expected to grow from USD 27.1 billion in 2025 to USD 29.97 billion in 2026 and is forecast to reach USD 49.6 billion by 2031 at 10.6% CAGR over 2026-2031.

Scale expansion is underpinned by four reinforcing dynamics: surging global demand for Japanese intellectual property, rising investments from streaming platforms that shorten release windows, accelerated adoption of production automation tools, and an adult-skewing consumer base that spends more per title. Competitive positioning is shifting as overseas revenues overtake domestic earnings, prompting studios to strengthen localization and co-production capabilities. At the same time, chronic labor shortages have spurred experiments with generative artificial intelligence, compressed production cycles, and strategic alliances that link content libraries with direct-to-consumer channels. These forces collectively widen monetization avenues across merchandise, live events, gaming tie-ins, and financial services, even as they expose structural cost pressures in the core production ecosystem.

Global Anime Market Trends and Insights

Growing Popularity of Anime Content

Mainstream accepts anime as a must-carry programming for global streamers rather than a niche genre. Netflix captured 38% of 2023 subscription revenue linked to anime viewers, confirming the format's draw for large-scale platforms. Surveys show that 60% of fans also identify as active gamers, creating data-rich profiles that facilitate multi-channel upselling. In North America, adult collectors drove USD 1.5 billion in toy spending during Q1 2024, reflecting the willingness of older audiences to pay premium prices for licensed merchandise. Film releases such as "Hatsune Miku: Colorful Stage! The Movie" secured USD 2.77 million in its US opening weekend, outperforming the Japanese debut and signaling broad theatrical appeal. Financial services providers have even issued anime-themed credit cards that deliver higher profit margins than standard offerings, illustrating how cultural affinity translates into ancillary revenue streams.

Growing Popularity of Streaming Platforms

Internet distribution has rewritten the revenue architecture of the anime market. Crunchyroll's participation in production committees expanded from 21 titles in 2019-2021 to 62 titles in 2022-2023, equal to about one-fifth of late-night series output. Direct equity stakes grant platforms subscription income plus backend royalties, improving payback cycles versus pure licensing deals. Sony deepened this model by launching HAYATE Inc. in March 2025, integrating Aniplex production skills with Crunchyroll's global storefront. Domestic streaming revenue in Japan climbed more than 50% to roughly JPY 250 billion (USD 1.63 billion) in 2023, proof that on-demand access can revive even mature markets. Algorithms that balance advertising and subscription tiers now optimize title discovery and lower churn, further elevating lifetime value.

High Production Costs (Soaring Labor Costs)

Production budgets have climbed two-to-three-fold in the past decade, yet average key-frame pay hovers near JPY 1,300 (USD 9.1) per hour. Half the workforce logs more than 225 hours monthly, well above Japan's national average of 163.5 hours. Tight margins push subcontractors to accept razor-thin profit rates, fostering burnout and schedule slips. The Japanese government has begun evaluating data to propose minimum-wage reforms, but any mandated increase could pressure already fragile studio finances. Investment in AI offers relief but requires capital many boutiques' houses lack, perpetuating a two-tier production ecosystem.

Other drivers and restraints analyzed in the detailed report include:

- Adult Consumer Spending Power

- Artificial Intelligence in Production Workflows

- Talent Retention Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Internet distribution generated the fastest 21.2% CAGR between 2026 and 2031, overtaking traditional broadcasting as the prime growth engine for the anime market. Streaming payouts climbed in parallel with subscriber bases, while simultaneous global premieres curtailed piracy and preserved price integrity. Merchandising retained leadership with a 20.45% anime market share in 2025, thanks to a deep backlog of evergreen intellectual property and the spending power of adult collectors. Secondary streams such as live entertainment and gaming crossovers monetize fan engagement beyond viewing hours. The anime market size attributed to merchandising stood at roughly one-fifth of aggregate revenue in 2025 and is forecast to expand in mid-single digits as premium collectibles offset slowing toy volumes.

Traditional TV and movie windows face secular audience migration, but high-budget theatrical releases still anchor franchise lifecycles and lift peripheral sales. Physical video continues to recede as collectors shift to ultra-high-definition editions with value-added features. Music revenues benefit from digital platforms that bundle themed songs into curated playlists, improving discoverability. Pachinko remains domestically significant yet shows limited international headroom, while live events gain resilience through virtual concert formats that scale globally at low incremental cost. Studio strategies now bundle multi-format rights to secure multipliers across these revenue silos, tightening feedback loops between popularity and profitability.

The Anime Market Report is Segmented by Type (TV, Movie, Video, and More), Genre (Action and Adventure, Isekai, Horror, and More), Target Demographic (Young Adults (18-29), Kids (0-12), and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific commanded 48.72% of 2025 revenue, anchored by Japan's production hub and China's swelling consumer base. However, profit margins face compression as regional studios grapple with wage inflation and fierce bidding for veteran animators. Government export programs anticipate Japanese IP shipments hitting JPY 4.7 trillion (USD 30.4 billion) by 2025, with a longer-range goal of JPY 20 trillion (USD 130 billion) by 2033. Domestic streaming growth remains robust, signaling untapped runway despite the region's maturity.

North America delivered the fastest 13.7% CAGR, rising from USD 1.6 billion in 2018 to USD 4.0 billion in 2024. Superior licensing terms and high average revenue per user elevate profitability. Toho Animation reported a 91% surge in fiscal 2024 revenue to JPY 46.3 billion (USD 299 million), with overseas sales up 78%, underscoring North America's strategic weight in slate planning. Physical merchandise distribution contends with potential tariff shifts, yet digital sales and simulcast strategies insulate core earnings.

Europe's anime market is smaller but expanding as language-specific dubbing workflows quicken and local events proliferate. Latin America and the Middle East and Africa register early-stage adoption; Saudi Arabia's Manga Productions co-develops culturally tailored series in partnership with Japanese studios. Rising broadband penetration and youthful demographics suggest durable upside, prompting studios to pre-position content libraries ahead of demand curves.

- Kyoto Animation

- Pierrot

- Production I.G

- Toei Animation

- Studio Ghibli

- Crunchyroll (Sony Pictures)

- Madhouse

- P.A. Works

- VIZ Media

- Bandai Namco Filmworks

- Aniplex of America

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing popularity of anime content

- 4.2.2 Growing popularity of streaming platforms

- 4.2.3 Adult consumer spending power

- 4.2.4 Artificial intelligence in production workflows

- 4.2.5 Localization of intellectual property

- 4.2.6 Cross-platform IP monetization (gaming, live events)

- 4.3 Market Restraints

- 4.3.1 High production costs (soaring labor costs)

- 4.3.2 Talent retention challenges

- 4.3.3 Profit distribution imbalance

- 4.3.4 Intellectual property fragmentation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 TV

- 5.1.2 Movie

- 5.1.3 Video

- 5.1.4 Internet Distribution

- 5.1.5 Merchandising

- 5.1.6 Music

- 5.1.7 Pachinko

- 5.1.8 Live Entertainment

- 5.2 By Genre

- 5.2.1 Action & Adventure

- 5.2.2 Isekai

- 5.2.3 Horror

- 5.2.4 Others

- 5.3 By Target Demographic

- 5.3.1 Young Adults (18-29)

- 5.3.2 Kids (0-12)

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kyoto Animation

- 6.4.2 Pierrot

- 6.4.3 Production I.G

- 6.4.4 Toei Animation

- 6.4.5 Studio Ghibli

- 6.4.6 Crunchyroll (Sony Pictures)

- 6.4.7 Madhouse

- 6.4.8 P.A. Works

- 6.4.9 VIZ Media

- 6.4.10 Bandai Namco Filmworks

- 6.4.11 Aniplex of America

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment