PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934908

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934908

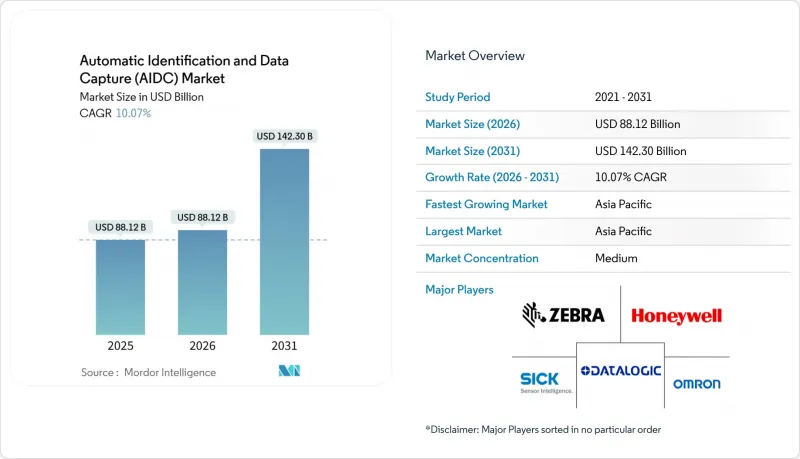

Automatic Identification And Data Capture (AIDC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Automatic Identification And Data Capture (AIDC) market size in 2026 is estimated at USD 88.12 billion, growing from 2025 value of USD 80.05 billion with 2031 projections showing USD 142.3 billion, growing at 10.07% CAGR over 2026-2031.

The projected 62.7% cumulative expansion reflects structural digitization across manufacturing, retail, and healthcare, where automated identification has become mission-critical to throughput, compliance, and error elimination. Labor-scarcity, increasing regulatory specificity, and proven ROI for real-time visibility collectively shape a demand environment in which the Automatic Identification And Data Capture (AIDC) market is viewed as infrastructure rather than discretionary spend biometricupdate.com. Heightened adoption of 2D codes, passive UHF-RFID, and national e-ID programs widens the opportunity set for solution providers able to integrate devices, middleware, and cloud analytics within cohesive ecosystems.

Global Automatic Identification And Data Capture (AIDC) Market Trends and Insights

Accelerated Migration to 2D/QR Codes in Omnichannel Retail

Global retailers are transitioning to 2D/QR codes in preparation for the GS1 Sunrise 2027 deadline, embedding expiry dates, lot numbers, and marketing links inside a single dense symbol. Early adopters report lower food waste and smoother omnichannel experiences because richer data supports automated markdowns and dynamic customer engagement. Investment returns manifest through fewer manual interventions, higher scan accuracy at point-of-sale, and emerging interactive marketing formats that leverage consumer smartphones. Hardware vendors gain incremental unit sales as retailers replace legacy 1D scanners with imagers capable of decoding stacked symbologies, while software providers capture upgrade fees tied to POS firmware refreshes.

Surge in UHF-RFID Adoption for Item-Level Inventory

Walmart's 2024 mandate for item-level RFID tags catalyzed broad retail adoption, pushing suppliers to embed inlays that retail chains read at dock, stockroom, and shelf. Cost per passive tag has fallen below USD 0.04, enabling mainstream categories such as apparel and home goods to justify real-time inventory visibility. Deployments deliver up to 25% accuracy improvement and materially reduce out-of-stock events . Continuous reads also power loss-prevention analytics, making RFID a dual lever for margin expansion and shrink mitigation.

Inter-System Data-Format Incompatibility Across Legacy ERPs

Enterprises with 1990s-era ERP stacks struggle to ingest RFID and image data natively, often funding middleware layers that inflate project cost by up to 40%. The Automatic Identification And Data Capture (AIDC) market therefore faces elongated sales cycles because budgets must include integration, testing, and migration. In multi-site networks, disparate schema multiply complexity, generating data silos that erode promised ROI. Vendors mitigate risk by offering pre-built connectors and consulting engagements, yet the barrier remains meaningful for brown-field rollouts.

Other drivers and restraints analyzed in the detailed report include:

- Government E-ID & Digital Health-Card Roll-outs

- Labor-Scarcity-Led Warehouse Automation

- High Initial CAPEX for Vision-Based AIDC in Brown-Field Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware dominated 62.50% of 2025 turnover due to foundational equipment refresh across retail and healthcare. Yet pricing compression, standardization, and supply-chain contingencies squeeze margins, accelerating the pivot toward higher-margin consulting and support contracts. Vendors bundling hardware-as-a-service maintain volume while shifting mix. Consequently, Automatic Identification And Data Capture (AIDC) market competitive advantage tilts toward providers mastering hybrid revenue models that unite capital equipment with recurring service matrices.

The services layer contributed 11.64% CAGR, outpacing hardware because enterprises increasingly award outcome-based contracts covering integration, maintenance, and cloud analytics. Many tier-1 retailers migrate from capex procurement to managed services that ensure uptime for scanners, printers, and RFID portals. Services players differentiate through domain expertise in edge-to-cloud orchestration, cybersecurity hardening, and multi-site rollouts, while hardware OEMs acquire systems integrators to secure lifecycle revenue.

Barcodes retained 46.20% revenue share as ubiquitous checkout and compliance identifiers underpin omnichannel operations. The Automatic Identification And Data Capture (AIDC) market size tied to barcode printers, imagers, and labels continues to expand modestly alongside retail floor space growth. However, passive UHF-RFID expands at 12.05% CAGR, reflecting item-level mandates that unlock simultaneous multi-item scans and real-time inventory verification. ROI stems from shrink reduction and fulfillment accuracy, prompting fashion, sports equipment, and consumer electronics categories to convert.

Passive RFID's cost curve decline and middleware maturity support hybrid deployments where RFID bridges upstream supply-chain workflows while barcodes remain consumer-facing on the shelf. Active RFID preserves niche roles in high-value asset monitoring, particularly aerospace and healthcare equipment. OCR systems incorporating AI extract alphanumeric data in logistics and manufacturing, widening addressable scenarios where labels are absent or damaged.

The Automatic Identification and Data Capture (AIDC) Market Report is Segmented by Offering (Hardware, Software, Services), Product (Barcodes, RFID, Smart Cards, and More), Media Type (Labels, Tags, Cards), End-User Industry (Manufacturing, Retail and E-Commerce, and More), and by Geography (North America, South America, Europe, Asia Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.00% of revenue in 2025 as early adopters institutionalized item-level RFID and digital patient safety. Walmart's mandate created a robust supplier ecosystem of inlay converters, printer-encoders, and middleware integrators. Meanwhile, the United States prioritizes biometric border control, reinforcing multi-technology adoption. Automatic Identification And Data Capture (AIDC) market participants capitalize on replacement cycles and advanced warehouse automation in Canada and Mexico that link cross-border supply chains.

Asia Pacific posts 11.44% CAGR, the fastest globally, fueled by manufacturing automation and national identity projects. China, the world's largest RFID tag producer, exports scale efficiencies that compress global tag pricing. South Korea, Japan, and India implement e-ID programs integrating biometrics, driving smart-card and sensor demand. E-commerce giants accelerate warehouse robotization, further expanding Automatic Identification And Data Capture (AIDC) market deployments.

Europe sustains steady growth through regulatory compliance. EU Medical Device Regulation mandates standardized UDI labeling, while the Digital Identity Framework Regulation sets a foundation for citizen wallets. France and Switzerland progress toward integrated identity-health solutions, reinforcing biometrics and smart-card volume. Automatic Identification And Data Capture (AIDC) market players align offerings with stringent data-protection norms, ensuring adoption remains compliant yet innovative.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Datalogic S.p.A.

- SICK AG

- Cognex Corporation

- Omron Corporation

- Toshiba Tec Corporation

- SATO Holdings Corporation

- Newland AIDC

- Bluebird Inc.

- Impinj Inc.

- Alien Technology LLC

- Avery Dennison Corporation

- Axicon Auto ID Ltd.

- Opticon Sensors Europe B.V.

- Zebex Industries Inc.

- Brady Corporation

- Thales Group (Gemalto)

- NEC Corporation

- HID Global Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated migration to 2D/QR codes in omnichannel retail

- 4.2.2 Surge in UHF-RFID adoption for item-level inventory

- 4.2.3 Government e-ID and digital health-card roll-outs

- 4.2.4 Labor-scarcity-led warehouse automation

- 4.2.5 Real-time cold-chain tracking mandates

- 4.2.6 Contactless biometric gates in travel-security corridors

- 4.3 Market Restraints

- 4.3.1 Inter-system data-format incompatibility across legacy ERPs

- 4.3.2 High initial CAPEX for vision-based AIDC in brown-field plants

- 4.3.3 Counterfeit low-cost barcode scanners from grey markets

- 4.3.4 Privacy pushback on biometric data storage

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.5.1 ISO/IEC 19762 expansion; EU MDR UDI deadline 2027

- 4.6 Technological Outlook

- 4.7 Investment Trend Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.1.1 Fixed Readers/Scanners

- 5.1.1.2 Mobile Computers and Handhelds

- 5.1.1.3 Printers/Encoders

- 5.1.2 Software

- 5.1.3 Services

- 5.1.3.1 Integration and Consulting

- 5.1.3.2 Maintenance and Support

- 5.1.1 Hardware

- 5.2 By Product

- 5.2.1 Barcodes

- 5.2.1.1 1D

- 5.2.1.2 2D/QR

- 5.2.2 RFID

- 5.2.2.1 Passive (LF, HF, UHF)

- 5.2.2.2 Active

- 5.2.3 Smart Cards

- 5.2.3.1 Contact

- 5.2.3.2 Contactless

- 5.2.4 Biometric Systems

- 5.2.4.1 Fingerprint

- 5.2.4.2 Facial/Iris

- 5.2.5 Optical Character Recognition (OCR)

- 5.2.6 Other Products

- 5.2.6.1 Magnetic Stripe, NFC, BLE Tags

- 5.2.1 Barcodes

- 5.3 By Media Type

- 5.3.1 Labels

- 5.3.2 Tags

- 5.3.3 Cards

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.2 Retail and E-commerce

- 5.4.3 Transportation and Logistics

- 5.4.4 Healthcare and Pharma

- 5.4.5 BFSI

- 5.4.6 Hospitality

- 5.4.7 Government and Public Sector

- 5.4.8 Energy and Utilities

- 5.4.9 Others

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Zebra Technologies Corporation

- 6.4.2 Honeywell International Inc.

- 6.4.3 Datalogic S.p.A.

- 6.4.4 SICK AG

- 6.4.5 Cognex Corporation

- 6.4.6 Omron Corporation

- 6.4.7 Toshiba Tec Corporation

- 6.4.8 SATO Holdings Corporation

- 6.4.9 Newland AIDC

- 6.4.10 Bluebird Inc.

- 6.4.11 Impinj Inc.

- 6.4.12 Alien Technology LLC

- 6.4.13 Avery Dennison Corporation

- 6.4.14 Axicon Auto ID Ltd.

- 6.4.15 Opticon Sensors Europe B.V.

- 6.4.16 Zebex Industries Inc.

- 6.4.17 Brady Corporation

- 6.4.18 Thales Group (Gemalto)

- 6.4.19 NEC Corporation

- 6.4.20 HID Global Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment