PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937251

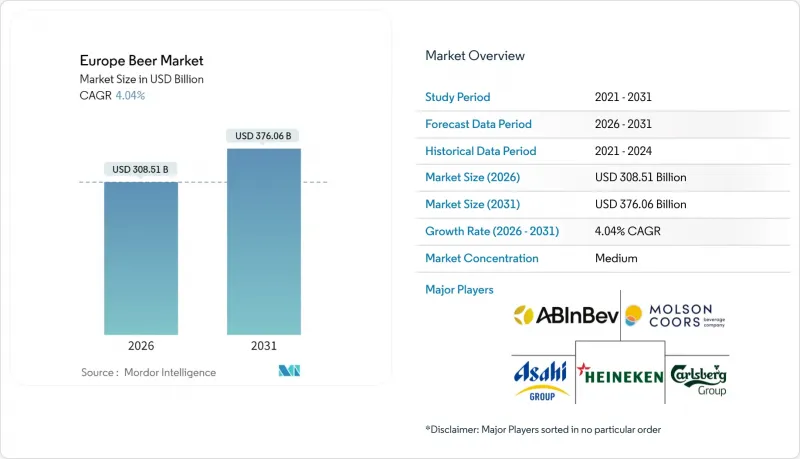

Europe Beer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European beer market size is projected to grow substantially, increasing from USD 308.51 billion in 2026 to USD 376.06 billion by 2031, at a CAGR of 4.04%.

In terms of market volume, the market is expected to grow from 36.81 billion liters in 2026 to 41.43 billion liters by 2031, at a CAGR of 2.39% during the forecast period (2026-2031). Brewers are increasingly focusing on premium products, which cater to evolving consumer preferences for higher-quality beverages. Additionally, there is a significant expansion in low- and no-alcohol beer offerings, aligning with the growing demand for healthier and more lifestyle-oriented options. Furthermore, the adoption of recyclable packaging is gaining traction, reflecting both environmental concerns and regulatory pressures. These trends collectively contribute to higher average selling prices, even as overall beer volumes stabilize.

Europe Beer Market Trends and Insights

Craft Beer Renaissance

France, now home to the EU's largest network of 2,500 independent brewers, showcases the paradox of the European craft beer renaissance. Despite this burgeoning presence, craft segments account for only 5-10% of total market volume, as Brewers of Europe highlights. This suggests that while craft brewing may not dominate in market share, its influence is palpable, exerting premiumization pressures on mainstream brands. Data from The Brewers of Europe revealed that in 2024, Germany had 836 microbreweries. Moreover, the sector grapples with consolidation pressures. Rising production costs, 44% hikes in barley malt and 20% in aluminum cans, are prompting brewery closures and market exits. Major brewing groups, once keen on craft acquisitions, are now pivoting, channeling resources into their flagship international brands. This craft renaissance has birthed a divided market: while successful artisanal producers champion premiumization, many others face extinction, inadvertently bolstering large-scale producers who seamlessly integrate craft-inspired innovations without the associated complexities.

Innovative Product and Flavor Formats

Brewers are moving beyond traditional beer categories, using flavor diversification to meet changing consumer tastes and support premium pricing. In France, artisanal beers are projected to capture a 27% market share by 2025, and brewers are adopting innovative techniques like accelerated fermentation to boost production efficiency. Sustainability is also a key focus, highlighted by 1664 Blonde's commitment to 100% sustainable malt by 2026. This initiative, involving 120 farmers and spanning 2,765 hectares, ensures digital traceability from barley to bottle. Technology is playing a pivotal role, allowing breweries to experiment with flavors while ensuring consistent quality. Automated systems now process 230-235 cans per minute, offering greater flexibility in recipe management. While the flavored beer segment has seen a 14% growth in Europe, overall volumes have declined, underscoring the need for brewers to balance novelty with consumer acceptance. The challenge remains: how to scale these innovative formats without losing cost competitiveness to established products.

Increasing Competition from Other Alcoholic Beverages

Ready-to-Drink (RTD) beverages are emerging as formidable competitors in the beverage market. Their mainstream acceptance was notably highlighted at ProWein 2024, where RTDs were extensively showcased. This growing popularity exerts competitive pressure, especially in traditional wine regions. Here, consumers are increasingly gravitating towards convenience-oriented products that deliver diverse flavors without the complexities of brewing. The challenge posed by RTDs isn't limited to merely substituting traditional beverages. They are also vying for prime distribution channels. Retailers, in pursuit of higher margins, are giving these RTDs premium shelf space and heightened marketing attention, often at the expense of traditional beer categories. Meanwhile, spirits and wine producers, capitalizing on their established brand recognition and robust distribution networks, are strategically positioning themselves to tap into beer consumption moments. This is particularly evident among younger consumers, who are showing diminished brand loyalty and a greater propensity to experiment across various beverage categories. As the lines between traditional beverage categories continue to blur, the competitive landscape grows more intricate. This evolution compels beer producers to pivot towards innovation and strategic positioning to safeguard their market share, moving away from a reliance on historical consumption trends.

Other drivers and restraints analyzed in the detailed report include:

- Low-Alcohol/Non-Alcoholic Expansion

- Advancements in Brewing Technology

- Raw Material Volatility and Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Lager holds a dominant 78.76% market share, but Ale segments are outpacing with a robust 5.66% CAGR projected through 2031. This shift underscores a changing consumer palate, leaning towards intricate flavors and craft-inspired brews. As the market matures, there's a noticeable transition: consumers once driven by Lager's volume are now gravitating towards Ales, valuing unique taste profiles and willing to pay a premium. Meanwhile, the Non/Low-Alcohol Beer category is surging, riding the wave of heightened health consciousness and regulatory nudges towards lower-alcohol options. Specialty and seasonal variants, grouped under Other Beer Types, may hold a smaller volume share, but their premium pricing indicates a savvy niche positioning.

Established beer categories are being reshaped by innovative segments, resonating more with today's consumer values and lifestyles. The European craft beer scene is booming, with Germany and the UK at the forefront, while France, Spain, and Italy are catching up, showing a growing appetite for craft varieties. Thanks to technological strides, Ale brewers can now produce at scale without sacrificing the artisanal touch that sets them apart from mainstream Lagers. This landscape suggests that while diversifying portfolios is crucial, brewers must also hone their core competencies. The burgeoning Ale market demands distinct production skills and marketing strategies, diverging from traditional Lager methods.

Despite the Standard category commanding an 85.65% share in 2025, premium segments are projected to grow at a 4.72% CAGR through 2031. This trend underscores the industry's shift towards premiumization, emphasizing value extraction over sheer volume. The disparity in category performance highlights consumers' readiness to pay more for perceived quality, authentic brand narratives, and enriched experiences. For premium positioning to thrive, brands must consistently deliver quality, craft compelling narratives, and forge partnerships with distribution channels that elevate their luxury status through curated retail environments and top-notch service.

While the Standard category remains resilient, driven by price-sensitive consumers valuing accessibility, its declining growth rates hint at a potential erosion. This shift could be fueled by improving economic conditions and a more discerning consumer base. The push towards premiumization is evident, with brands like Birra Moretti successfully repositioning themselves. Once a niche Italian import, Birra Moretti has ascended to UK market leadership, thanks to its Mediterranean authenticity messaging and unwavering quality. Distribution strategies are now honing in on premium channels, targeting specialty retailers, upscale hospitality venues, and direct-to-consumer platforms, all aimed at bolstering margins. The evolving dynamics hint at a long-term market tilt towards premiumization. Yet, the Standard segments continue to play a pivotal role, ensuring volume maintenance and safeguarding market share amidst competitive challenges.

The European Beer Market is Segmented by Product Type (Ale, Lager, Non/Low-Alcohol Beer, and More), by Category (Standard and Premium), by Packaging Type (Bottles, Cans, and More), by Distribution Channel (On-Trade and Off-Trade (Specialty/Liquor Stores and More)), and by Geography (Europe). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

List of Companies Covered in this Report:

- Anheuser-Busch InBev

- Heineken N.V.

- Carlsberg Group

- Molson Coors Beverage Company

- Asahi Group Holdings

- Diageo plc

- Bitburger Brauerei

- Radeberger Gruppe

- Krombacher Brauerei

- Veltins Brauerei

- Paulaner Brauerei

- Oettinger Brauerei

- Royal Unibrew

- Mahou San Miguel

- Hijos de Rivera (Estrella Galicia)

- Damm S.A. (Estrella Damm)

- BrewDog plc

- C&C Group plc (Tennent's)

- Beavertown Brewery

- Efes Breweries International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Craft Beer Renaissance

- 4.2.2 Innovative Product and Flavor Formats

- 4.2.3 Low-Alcohol/Non-Alcoholic Expansion

- 4.2.4 Advancements in Brewing Technology

- 4.2.5 Sustainable Brewing and Supply Chains

- 4.2.6 Sophisticated Branding and Storytelling

- 4.3 Market Restraints

- 4.3.1 Increasing Competition from Other Alcoholic Beverages

- 4.3.2 Raw Material Volatility and Availability

- 4.3.3 Environmental Regulations and Sustainability Pressures

- 4.3.4 Increasing Regulations Against Alcohol

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Ale

- 5.1.2 Lager

- 5.1.3 Non/Low-Alcohol Beer

- 5.1.4 Other Beer Types

- 5.2 By Category

- 5.2.1 Standard

- 5.2.2 Premium

- 5.3 By Packaging Type

- 5.3.1 Bottles

- 5.3.2 Cans

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Others Off Trade Channels

- 5.5 By Geography

- 5.5.1 Europe

- 5.5.1.1 United Kingdom

- 5.5.1.2 Germany

- 5.5.1.3 France

- 5.5.1.4 Italy

- 5.5.1.5 Spain

- 5.5.1.6 Russia

- 5.5.1.7 Sweden

- 5.5.1.8 Belgium

- 5.5.1.9 Poland

- 5.5.1.10 Netherlands

- 5.5.1.11 Rest of Europe

- 5.5.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anheuser-Busch InBev

- 6.4.2 Heineken N.V.

- 6.4.3 Carlsberg Group

- 6.4.4 Molson Coors Beverage Company

- 6.4.5 Asahi Group Holdings

- 6.4.6 Diageo plc

- 6.4.7 Bitburger Brauerei

- 6.4.8 Radeberger Gruppe

- 6.4.9 Krombacher Brauerei

- 6.4.10 Veltins Brauerei

- 6.4.11 Paulaner Brauerei

- 6.4.12 Oettinger Brauerei

- 6.4.13 Royal Unibrew

- 6.4.14 Mahou San Miguel

- 6.4.15 Hijos de Rivera (Estrella Galicia)

- 6.4.16 Damm S.A. (Estrella Damm)

- 6.4.17 BrewDog plc

- 6.4.18 C&C Group plc (Tennent's)

- 6.4.19 Beavertown Brewery

- 6.4.20 Efes Breweries International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK