PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937264

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937264

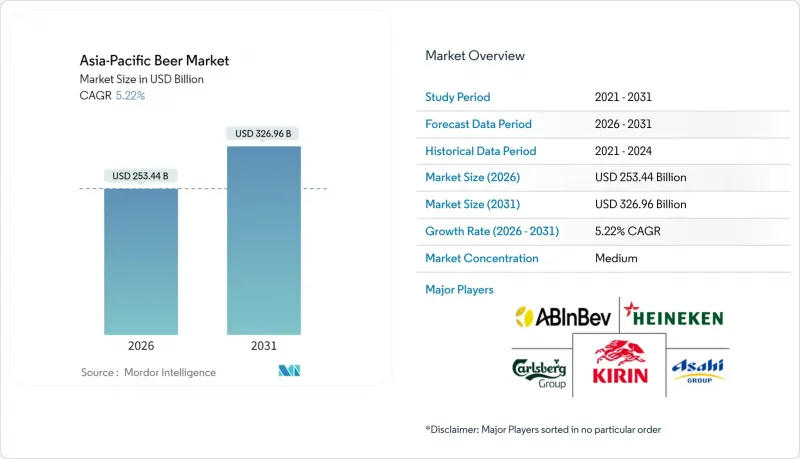

Asia-Pacific Beer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific beer market size in 2026 is estimated at USD 253.44 billion, growing from 2025 value of USD 240.87 billion with 2031 projections showing USD 326.96 billion, growing at 5.22% CAGR over 2026-2031.

This growth is driven by factors such as increasing disposable incomes, the recovery of the tourism industry, and the wider availability of premium, craft, and low-alcohol beer options. However, challenges like higher taxation and cultural restrictions in certain regions continue to limit the overall volume growth of the market. Leading beer manufacturers are expanding their product portfolios to include functional, gluten-free, and non-alcoholic beverages, while smaller craft breweries are focusing on local markets and introducing innovative products. In terms of product type, non-alcoholic beer innovations are helping brands position themselves in the premium segment. Within the category, the premium beer segment is growing despite economic challenges. Regarding packaging, the adoption of sustainable aluminum cans is increasing, and in distribution channels, on-trade sales are recovering faster than off-trade sales. The market is moderately concentrated, with key players like Anheuser-Busch InBev and Asahi Group Holdings collectively accounting for a significant share of the market's revenue.

Asia-Pacific Beer Market Trends and Insights

Growing number of breweries driving craft adoption

The Asia-Pacific beer market is growing steadily, driven by the increasing number of breweries focusing on craft beer, supported by regulatory changes and expanded production capacities. A significant development occurred on June 23, 2025, when India's Food Safety and Standards Authority (FSSAI) introduced new regulations recognizing categories such as nitro craft beer, ready-to-drink alcoholic beverages (with 0.5-15% alcohol by volume), mead, and country liquors. These new standards, which will take effect on January 1, 2026, aim to simplify labeling requirements, reduce compliance challenges, and create a clearer pathway for smaller brewers to enter the market. In May 2025, Carlsberg Group announced plans to strengthen its presence in India by building 2 to 3 new breweries, adding to its existing network of 7 facilities. This expansion reflects the growing demand for beer in the region and these regulatory changes and investments are expected to drive the growth of microbreweries in the Asia-Pacific beer market.

Tourism rebound lifting on-trade sales

The Asia-Pacific beer market is experiencing growth driven by the recovery of tourism, which is boosting on-trade sales in hotels, bars, and tourist destinations. As international travel increases, demand for beer in these locations is rising, and governments are adjusting alcohol policies to capitalize on the hospitality sector's revenue potential. For instance, Thailand has introduced extended service hours for alcohol in airports and hotels during Buddhist holidays as part of its Tourism Year 2025 campaign. According to the Pacific Asia Travel Association (PATA), international visitor arrivals (IVAs) to the Asia-Pacific region are expected to grow from an estimated 648.1 million in 2024 to 813.7 million by 2027, highlighting the long-term growth potential of tourism. Since hotels and bars typically generate higher per-capita alcohol spending compared to retail outlets, brewers are focusing on draught beer and premium packaging formats in tourist-heavy areas. This strategy is helping on-trade sales grow faster, further driving the market's expansion.

Stringent government regulations

Strict government regulations are creating significant obstacles for the Asia-Pacific beer market, affecting profitability, market entry, and overall growth potential. For example, in Vietnam, the National Assembly has approved a gradual increase in alcohol excise taxes, rising from 65% in 2024 to 90% by 2031. These higher taxes reduce profit margins for brewers and encourage the growth of informal or unregulated trade, which weakens the development of the formal market. The unpredictable nature of such regulatory changes makes it difficult for companies to plan long-term investments, particularly in building new breweries, as they face uncertainty regarding future costs and compliance requirements. Smaller and craft brewers are especially impacted, as they often lack the resources to manage high compliance costs and navigate complex licensing processes. This creates significant barriers to their growth, limits innovation, and slows the diversification of the market.

Other drivers and restraints analyzed in the detailed report include:

- Ingredient and alcohol-content innovation

- Sustainability and ethical brewing initiatives

- Religious and cultural constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lager continues to dominate the Asia-Pacific beer market, accounting for 45.68% of the market share in 2025. Its widespread appeal comes from its consistent taste, affordability, and familiarity, making it popular in both developed and developing markets. Strong distribution networks and well-known brands further support its leading position. Lager is available in various formats, such as bottles and cans, catering to different consumption needs. It serves as a reliable base for innovation, with brewers introducing new flavors and premium options without losing mainstream customers.

Non- and low-alcohol beers are the fastest-growing segment, with an expected CAGR of 7.92% through 2031. This growth is fueled by health-conscious urban consumers who prefer "mindful drinking" and want beverages that align with healthier lifestyles. Brewers are meeting this demand by improving de-alcoholization processes, offering unique flavors, and creating premium products to attract younger, trend-focused buyers. This segment helps brands expand their product range and tap into niche markets while addressing cultural and regulatory challenges around alcohol. Non- and low-alcohol beers also provide options for responsible drinking, making them increasingly relevant in the changing beer market.

Standard beer products led the Asia-Pacific market, holding 65.05% of the market share in 2025. Their popularity comes from being widely available in supermarkets, convenience stores, and bars, along with affordable pricing that appeals to a large number of consumers. These products are well-known for their consistent taste and strong brand recognition, which keeps customers loyal. Promotions, multi-pack deals, and availability in both cities and smaller towns help maintain their strong presence. This segment is a key revenue driver for major brewers, providing stable sales even during economic challenges.

Premium beer products are growing quickly, with an expected CAGR of 7.18% from 2026 to 2031. Increasing incomes and changing consumer tastes in countries like China, South Korea, and Thailand are boosting demand for better-quality ingredients, unique flavors, and imported brands. Even with rising costs, many consumers are willing to spend more for higher quality, exclusivity, and a sense of luxury, making premium beers a major contributor to market growth. Brewers are expanding their offerings, focusing on craft-style production, and promoting the origin of their products. This helps premium beers attract wealthier and experience-focused consumers while providing brewers with new revenue opportunities beyond standard products.

The Asia-Pacific Beer Market Report is Segmented by Product Type (Ale, Lager, and More), Category (Standard and Premium), Packaging Type (Bottles, Cans, and More), Distribution Channels (On-Trade and Off-Trade), and Geography (China, India, Japan, South Korea, Australia, Indonesia, Thailand, Vietnam, Philippines, Malaysia, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

List of Companies Covered in this Report:

- Anheuser-Busch InBev

- China Resources Holdings (CR Beer)

- Tsingtao Brewery

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company

- Heineken NV

- Carlsberg Group

- Beijing Enterprises Holdings Limited

- Chip Mong Group (Khmer Beverages)

- Sapporo Holdings Ltd.

- Thai Beverage

- Kingdom Breweries

- San Miguel Corporation

- Vattanac Group

- BrewDog plc

- Guangzhou Zhujiang Brewery Co., Ltd.

- Alive Brewing Co.

- Boon Rawd Brewery Co. Ltd.

- Suntory Holding Ltd.

- Constellation Brands Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing number of breweries leading to high prevalence of craft beer

- 4.2.2 Growing tourism and hospitality impact positive growth

- 4.2.3 Product innovation in terms of ingredient and alcohol content

- 4.2.4 Health conscious consumer accelerating demand for gluten free beer

- 4.2.5 Rising focus on sustainable and ethical beer production

- 4.2.6 Brewing industry's technological evolution

- 4.3 Market Restraints

- 4.3.1 Stringent government regulations

- 4.3.2 Health concerns and shifting consumer preferences

- 4.3.3 Raw material cost inflation and supply chain challenges impact beer production

- 4.3.4 Religious and cultural constraints affecting beer market growth

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE and VOLUME)

- 5.1 By Product Type

- 5.1.1 Ale

- 5.1.2 Lager

- 5.1.3 Non/Low-Alcohol Beer

- 5.1.4 Other Beer Types

- 5.2 By Category

- 5.2.1 Standard

- 5.2.2 Premium

- 5.3 By Packaging Type

- 5.3.1 Bottles

- 5.3.2 Cans

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Specialty/Liquor Stores

- 5.4.2.2 Other Off-Trade Channels

- 5.5 By Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Australia

- 5.5.6 Indonesia

- 5.5.7 Thailand

- 5.5.8 Vietnam

- 5.5.9 Philippines

- 5.5.10 Malaysia

- 5.5.11 Singapore

- 5.5.12 New Zealand

- 5.5.13 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Anheuser-Busch InBev

- 6.4.2 China Resources Holdings (CR Beer)

- 6.4.3 Tsingtao Brewery

- 6.4.4 Asahi Group Holdings, Ltd.

- 6.4.5 Kirin Holdings Company

- 6.4.6 Heineken NV

- 6.4.7 Carlsberg Group

- 6.4.8 Beijing Enterprises Holdings Limited

- 6.4.9 Chip Mong Group (Khmer Beverages)

- 6.4.10 Sapporo Holdings Ltd.

- 6.4.11 Thai Beverage

- 6.4.12 Kingdom Breweries

- 6.4.13 San Miguel Corporation

- 6.4.14 Vattanac Group

- 6.4.15 BrewDog plc

- 6.4.16 Guangzhou Zhujiang Brewery Co., Ltd.

- 6.4.17 Alive Brewing Co.

- 6.4.18 Boon Rawd Brewery Co. Ltd.

- 6.4.19 Suntory Holding Ltd.

- 6.4.20 Constellation Brands Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK