PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937252

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937252

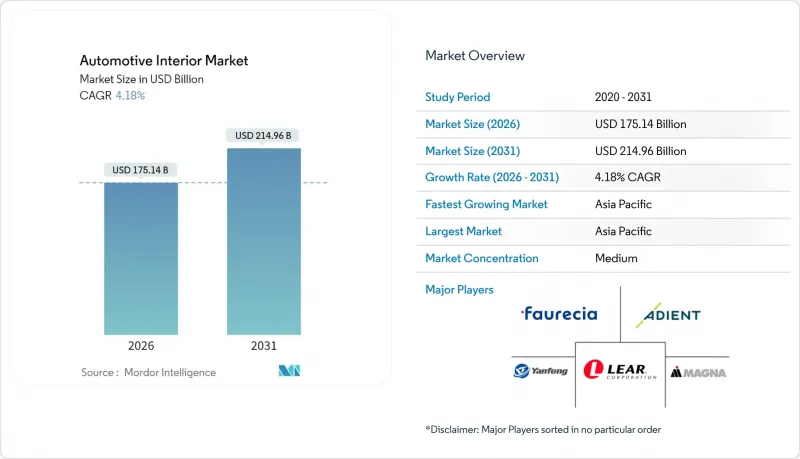

Automotive Interior - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Automotive Interior Market size in 2026 is estimated at USD 175.14 billion, growing from 2025 value of USD 168.11 billion with 2031 projections showing USD 214.96 billion, growing at 4.18% CAGR over 2026-2031.

This measured expansion conceals a more profound transformation as software-defined cockpits, biometric monitoring, and sustainable materials move from niche options to mainstream specifications. Automotive OEMs re-engineer cabin layouts around high-density displays and centralized compute units, while suppliers explore subscription revenue tied to over-the-air feature upgrades. Electric vehicle platforms add further content per car because silent cabins heighten the importance of premium surfaces, ambient lighting, and wellness features. The Asia-Pacific region already sets the pace for these upgrades, and its volume advantage encourages fast local iteration. Simultaneously, aftermarket demand stays resilient because fleet operators and retail owners keep refreshing worn trim with longer-life, digitally upgradable modules, dampening fears that shared mobility would erode replacement cycles.

Global Automotive Interior Market Trends and Insights

Shift Toward Software-Defined Vehicles & HD Displays

Software-centric design decouples cabin functions from fixed hardware and allows continuous upgrades through secure over-the-air patches. Continental now delivers cockpit domains that host three or more ultra-high-resolution displays driven by processors exceeding 1,000 DMIPS . Qualcomm's Snapdragon Digital Chassis powers numerous vehicle models and underscores how semiconductor players influence cabin electronics . Suppliers that blend electronics, software, and user-experience design monetize new features long after production, reshaping cost-plus contracts into recurring revenue frameworks. Predictive maintenance and usage-based insurance ride on the same data backbone, expanding the business case for interior sensor suites. Traditional component-only firms risk erosion unless they partner or acquire digital talent.

Rising Demand for Premium & Electric SUVs in China & ASEAN

Electric premium SUVs sold in China carry a one-fifth higher interior bill-of-materials than their ICE peers, mainly due to ambient lighting, multi-screen infotainment, and advanced monitoring. Companies like NIO and XPeng have normalized biometric sensing even in mid-range trims, prompting global suppliers to localize advanced modules in Changzhou, Wuhan, and Rayong. Thailand's fast-growing EV export base pulls seat, trim, and cockpit makers into Southeast Asia, lowering lead times for Japanese, Korean, and Western OEMs that assemble there. ASEAN's middle-income families increasingly weigh the in-cabin experience when buying a first SUV, so local Tier-1s invest in color, material, and finish studios close to Bangkok and Ho Chi Minh City. The high gross margins on premium interiors soften price sensitivity, letting suppliers recoup R&D more quickly. Localization further shields vendors from potential geopolitical tariffs on cross-border components.

Persistent Chipset Shortages in the Infotainment Domain

Lead times for automotive-grade processors still range from 26 to 52 weeks, hurting interior build schedules and forcing OEMs to prioritize safety controllers over infotainment head units. Tier-1s that adopt chip-agnostic architectures buffer some risk, yet smaller players lose allocation clout against consumer electronics giants. Margins narrow because suppliers stockpile semiconductors at peak spot prices, tying up working capital. In emerging markets, cost-sensitive OEMs downgrade cabin specs or postpone rollouts of multi-camera monitoring. The shortage accelerates vertical integration as Continental, ZF, and others add internal ASIC design to secure strategic components. Until new fabs in Arizona, Saxony, and Penang ramp, the constraint will continue to clip near-term upside for display-heavy interiors.

Other drivers and restraints analyzed in the detailed report include:

- Over-The-Air Upgradable Cockpit Architectures

- Lightweight Sustainable Materials Mandated by OEM Carbon Targets

- High Raw-Material Volatility for PU & Bio-Based Polymers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars sustained 66.13% of overall revenue in 2025, showing the segment's scale advantage in the automotive interior market. Electric passenger cars represent the fastest growing slice at a 4.21% CAGR as higher in-cabin technology density lifts basket value per unit. The automotive interior market size for electric cars benefits from wide, flat floors that free up storage modules, lounge-style seating, and panoramic display surfaces. Light commercial vehicles track parcel delivery expansion, but cabin upgrades stay utilitarian, so growth stems mainly from mandated driver monitoring rather than luxury trim. Medium and heavy trucks remain sensitive to downtime; therefore, suppliers pitch durable fabrics and antimicrobial surfaces to fleet buyers.

The electrification wave lets suppliers insert wellness functions such as active noise cancellation and air ionizers that were previously cost-prohibitive. Tesla sparked minimalist layouts, yet legacy OEMs show there is still an appetite for robust switchgear coupled with multi-screen clusters. New EU rules that require inward-facing cameras on heavy trucks generate incremental demand for occupant monitoring kits. Over time, cabin differentiation shifts from mechanical craftsmanship to software-driven personalization that updates throughout the vehicle's life, extending aftermarket potential even in commercial fleets.

Internal combustion vehicles still accounted for 72.47% revenue in 2025, anchoring volumes across the automotive interior market. Nonetheless, electric models grow 4.27% annually and dictate forward design language. Battery layouts remove transmission tunnels, so floor-mounted sensor pods and illuminated storage compartments gain prominence. The automotive interior market share for EV-specific components expands as low cabin noise raises occupant awareness of rattles and panel gaps, forcing tighter manufacturing tolerances. Hybrids serve as transition products and often bundle larger displays and premium fabrics to justify higher price tags despite modest pure-electric range.

EV architecture increases demand for real-time energy visualizations, prompting suppliers to reconfigure cluster graphics and center-stack UX to display charging data. Silence inside the cabin accentuates audio quality and encourages OEMs to specify higher wattage speakers and vibration-damping mats, further boosting content per car. Thermal management for battery longevity influences HVAC routing, giving suppliers experienced in dual-zone and tri-zone climate control a competitive edge.

The Automotive Interior Market Report is Segmented by Vehicle Type (Passenger Cars and More), Propulsion Type (Internal-Combustion Engine and Electric Vehicle), Component Type (Instrument Panels & Cockpit Modules and More), Material Type (Synthetic Leather, Genuine Leather, Fabrics & Textiles, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific delivered 37.43% of global revenue in 2025 and will post the fastest 4.31% CAGR through 2031. China's indigenous brands fit multi-screen cockpits and wellness seats even on compact SUVs, lifting average interior spend. Mainland volume plus regional free-trade zones entice Yanfeng, Magna, and FORVIA to localize R&D and build material labs close to OEM design centers. Thailand scales EV assembly for export to Australia and the Middle East, catalyzing new Tier-2 clusters that supply seat frames, trims, and screens. Japan and South Korea use advanced sensor algorithms for occupant monitoring, often licensing software globally. Rising disposable incomes across Indonesia and Vietnam elevate demand for comfort features, sustaining growth even if macroeconomics fluctuate.

North America stands as the second-largest revenue pool. The United States pushes driver-monitoring requirements through the expanding FMVSS docket, raising baseline sensor content. Pickup and SUV popularity inflates cabin surface area, which favors high-margin upholstery and infotainment upgrades. Canada's harsh winters boost heated steering wheel usage and seat usage, further enlarging vehicle content. Mexico's competitive labor costs and USMCA rules-of-origin keep interior manufacturing vibrant for regional and export volumes.

Europe maintains moderate growth backed by stringent green and safety mandates. The EU General Safety Regulation obliges all new cars to include passive driver monitoring from 2026, guaranteeing demand for inward-facing cameras. Germany's premium marques lead experimentation with high-resolution OLED clusters and recycled composites, while Eastern Europe offers cost-effective assembly for volume models. Regulatory focus on circularity pushes suppliers to adopt closed-loop material flows. Supply-chain rerouting post-Brexit opens share opportunities for continental producers who can supply UK plants without tariff risk.

- Adient plc

- Faurecia SE

- Lear Corporation

- Magna International Inc.

- Yanfeng Automotive Interiors

- Grupo Antolin

- Toyota Boshoku Corp.

- Hyundai Mobis Co.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Continental AG

- DENSO Corp.

- Valeo SA

- JVCKENWOOD Corp.

- Pioneer Corp.

- Visteon Corp.

- Grammer AG

- Haartz Corporation

- Huayu Automotive Systems (HASCO)

- Seoyon E-Hwa

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift Toward Software-Defined Vehicles & HD Displays

- 4.2.2 Rising Demand For Premium & Electric SUVs In China & Asean

- 4.2.3 Over-The-Air Upgradable Cockpit Architectures

- 4.2.4 Lightweight Sustainable Materials Mandated By OEM Carbon Targets

- 4.2.5 Adoption Of In-Cabin Health, Safety & Biometrics Regulations (GSR-EU, NCAP)

- 4.2.6 Solid-State Ambient Lighting As A Brand Differentiator

- 4.3 Market Restraints

- 4.3.1 Persistent Chipset Shortages In Infotainment Domain

- 4.3.2 Lower Refresh-Cycle In Shared-Mobility Fleets Squeezing Aftermarket

- 4.3.3 High Raw-Material Volatility For PU & Bio-Based Polymers

- 4.3.4 IP- & Standards-Fragmentation For HMI Software Stacks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium and Heavy Commercial Vehicles

- 5.2 By Propulsion Type

- 5.2.1 Internal-Combustion Engine (ICE)

- 5.2.2 Electric Vehicle (EV)

- 5.3 By Component Type

- 5.3.1 Instrument Panels & Cockpit Modules

- 5.3.2 Infotainment & Connected Displays

- 5.3.3 Seating Systems

- 5.3.4 Interior Lighting (Ambient, Functional)

- 5.3.5 Door & Body Trim Panels

- 5.3.6 HVAC & Thermal Comfort

- 5.3.7 Upholstery & Surface Materials

- 5.3.8 Driver / Occupant Monitoring Systems

- 5.3.9 Other Components

- 5.4 By Material Type

- 5.4.1 Synthetic Leather (PU, PVC)

- 5.4.2 Genuine Leather

- 5.4.3 Fabrics & Textiles

- 5.4.4 Plastics & Composites

- 5.4.5 Natural & Recycled Materials

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle-East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle-East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Adient plc

- 6.4.2 Faurecia SE

- 6.4.3 Lear Corporation

- 6.4.4 Magna International Inc.

- 6.4.5 Yanfeng Automotive Interiors

- 6.4.6 Grupo Antolin

- 6.4.7 Toyota Boshoku Corp.

- 6.4.8 Hyundai Mobis Co.

- 6.4.9 Panasonic Holdings Corp.

- 6.4.10 Robert Bosch GmbH

- 6.4.11 Continental AG

- 6.4.12 DENSO Corp.

- 6.4.13 Valeo SA

- 6.4.14 JVCKENWOOD Corp.

- 6.4.15 Pioneer Corp.

- 6.4.16 Visteon Corp.

- 6.4.17 Grammer AG

- 6.4.18 Haartz Corporation

- 6.4.19 Huayu Automotive Systems (HASCO)

- 6.4.20 Seoyon E-Hwa

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment