PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937281

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937281

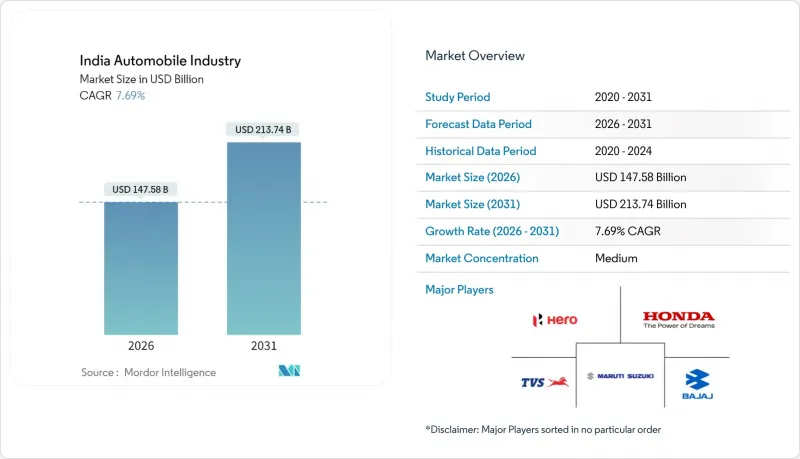

India Automobile Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India automobile market is expected to grow from USD 137.06 billion in 2025 to USD 147.58 billion in 2026 and is forecast to reach USD 213.74 billion by 2031 at 7.69% CAGR over 2026-2031.

Demand is buoyed by population-led consumption, rising household incomes, policy-backed electrification, and a manufacturing base that produced 28.43 million vehicles in FY 2024. Sustained output across two-wheelers, passenger cars, commercial vehicles, and three-wheelers keeps the sector resilient, while infrastructure programs such as Pradhan Mantri Gram Sadak Yojana widen geographic reach. Competitive dynamics remain intense, yet opportunities persist in electric models, subscription ownership, and corporate fleet decarbonization. Semiconductor self-reliance, rural road density, and digital retail are additional levers set to lift the India automobile market through the decade.

India Automobile Industry Trends and Insights

Rising Disposable Incomes and Rapid Urbanization

Income growth is enlarging the consumer base for the Indian automobile market, especially in Tier-2 and Tier-3 cities, where land availability and lower congestion make vehicle ownership attractive. Sixty-five percent of the population is under 35, aligning prime earning years with first-time purchases. Migration from rural districts stimulates dual demand, urban buyers seek mobility, while remittances finance upgrades back home. The spread of suburban employment hubs reduces dependence on mass transit and supports two-wheelers and compact cars. Subscription programs extend access by sidestepping hefty down payments, further deepening penetration.

Government EV and FAME-II Incentives

India's FAME (Faster Adoption and Manufacturing of Hybrid & Electric Vehicles) Scheme Phase-II, launched in 2019, comes with a hefty budget of INR 11,500 crore (USD 1.31 billion), set to span five years. This initiative aims to boost the sales of electric vehicles, covering e-2Ws, e-3Ws, and e-4Ws. . State add-ons in Tamil Nadu and Gujarat enhance regional differentials, while the planned FAME-III revision aims to broaden support into heavier segments. These incentives shorten payback periods, encouraging personal buyers and fleet operators to pivot toward zero-emission models.

Regulatory Changes, Safety Standards and GST Shifts

As India implements BS-VII norms and mandates safety gear, small assemblers grapple with costly powertrain upgrades and validations, squeezing their model margins. These upgrades require significant research and development investments and rigorous testing to meet compliance standards. Meanwhile, GST realignments on components introduce pricing uncertainties, impacting the overall cost structure for manufacturers. Adding to the challenge, varying state road-tax regimes complicate compliance, as manufacturers must navigate differing tax policies across regions. These factors lead to noticeable price hikes for consumers, potentially delaying their purchases and dampening immediate demand in the Indian automobile market. Additionally, the increased costs may push manufacturers to explore alternative strategies, such as the localization of components, to mitigate the financial burden.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of National Highway and Rural Road Network

- Subscription-Based Ownership and Leasing Models

- Global Semiconductor Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In the Indian auto market, two-wheelers reign supreme, commanding a significant 73.64% share. This dominance highlights the preference for two-wheelers among Indian consumers, driven by factors such as affordability, fuel efficiency, and ease of navigation in congested urban areas. Although smaller, passenger cars are posting the swiftest 8.84% CAGR on the back of SUV and crossover launches tuned to aspirational middle-class tastes. Scooter sales climbed 21% versus the motorcycle segment's 10% gain, highlighting urban preference for automatic transmissions and ease of use.

Growth momentum continues as electric two-wheelers enter mainstream price points and as financiers extend longer tenures to first-time buyers. Conversely, commercial vehicles hinge on infrastructure budgets and industrial output cycles but benefit from ongoing highway upgrades. Three-wheelers retain relevance for last-mile goods and passenger movement in Tier-2 centers. Regulatory emission upgrades funnel investments toward modular platforms, potentially elevating scale efficiencies for incumbents in the Indian automobile market.

Petrol engines retained 59.27% of the India automobile market share in 2025, buoyed by refinery capacity and lower purchase prices relative to diesel. Battery electric vehicles, though smaller in volume, are advancing at a 10.02% CAGR thanks to tax rebates, FAME-II subsidies and falling lithium-ion cell costs. Hybrids bridge range-anxiety gaps, offering efficiency gains without new-energy infrastructure dependence.

Policy commitments to domestic power generation and stricter fuel-economy norms will gradually shift OEM portfolios toward electrified drivetrains. LPG/CNG use expands in commercial fleets seeking operating-cost relief. Meanwhile, fuel-cell technology remains exploratory due to hydrogen supply gaps. Charging-network rollouts and battery-swapping pilots dictate adoption pace but indicators already point to accelerating consumer acceptance across segments in the India automobile market.

The India Automobile Market Report is Segmented by Vehicle Type (Two-Wheelers, Three-Wheelers and More), Fuel Type (Petrol/Gasoline, Diesel, LPG/CNG, and More), Sales Channel (OEM-Authorized Dealers and Online), Ownership Type (Personal Use and Commercial Use), and by Region (North India, South India, East India, West India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- TVS Motor Company

- Hero MotoCorp

- Honda Motorcycle

- Royal Enfield

- Bajaj Auto

- Suzuki Motorcycle India

- Maruti Suzuki India

- Tata Motors

- Hyundai Motor India

- Mahindra & Mahindra

- MG Motor India

- Volkswagen India

- Renault-Nissan Alliance

- Honda Cars India

- BYD India

- BMW Group India

- Mercedes-Benz India

- Kia India

- Ashok Leyland

- Eicher Motors (VE Commercial)

- Atul Auto

- Piaggio Vehicles

- Kinetic Green

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Incomes and Rapid Urbanization

- 4.2.2 Government EV and FAME-II Incentives

- 4.2.3 Expansion of National Highway and Rural Road Network

- 4.2.4 Subscription-Based Ownership and Leasing Models

- 4.2.5 Local Semiconductor Fabrication Investments

- 4.2.6 Corporate Fleet-Decarbonization Mandates

- 4.3 Market Restraints

- 4.3.1 Regulatory Changes, Safety Standards and GST Shifts

- 4.3.2 Global Semiconductor Supply-Chain Volatility

- 4.3.3 Urban Congestion-Driven Usage Restrictions

- 4.3.4 Rising Telematics-Linked Insurance Premiums

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD billion)

- 5.1 By Vehicle Type

- 5.1.1 Two-wheelers

- 5.1.2 Three-wheelers

- 5.1.3 Passenger Cars

- 5.1.4 Commercial Vehicles

- 5.2 By Fuel Type

- 5.2.1 Petrol / Gasoline

- 5.2.2 Diesel

- 5.2.3 LPG / CNG

- 5.2.4 Battery Electric Vehicles

- 5.2.5 Hybrid Electric Vehicles

- 5.2.6 Plug-in Hybrid Electric Vehicles

- 5.2.7 Fuel-Cell Electric Vehicles

- 5.3 By Sales Channel

- 5.3.1 OEM-Authorised Dealers

- 5.3.2 Online

- 5.4 By Ownership Type

- 5.4.1 Personal Use

- 5.4.2 Commercial Use

- 5.5 By Region

- 5.5.1 North India

- 5.5.2 South India

- 5.5.3 East India

- 5.5.4 West India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 TVS Motor Company

- 6.4.2 Hero MotoCorp

- 6.4.3 Honda Motorcycle

- 6.4.4 Royal Enfield

- 6.4.5 Bajaj Auto

- 6.4.6 Suzuki Motorcycle India

- 6.4.7 Maruti Suzuki India

- 6.4.8 Tata Motors

- 6.4.9 Hyundai Motor India

- 6.4.10 Mahindra & Mahindra

- 6.4.11 MG Motor India

- 6.4.12 Volkswagen India

- 6.4.13 Renault-Nissan Alliance

- 6.4.14 Honda Cars India

- 6.4.15 BYD India

- 6.4.16 BMW Group India

- 6.4.17 Mercedes-Benz India

- 6.4.18 Kia India

- 6.4.19 Ashok Leyland

- 6.4.20 Eicher Motors (VE Commercial)

- 6.4.21 Atul Auto

- 6.4.22 Piaggio Vehicles

- 6.4.23 Kinetic Green

7 Market Opportunities & Future Outlook