PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937292

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937292

Textile Home Decor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

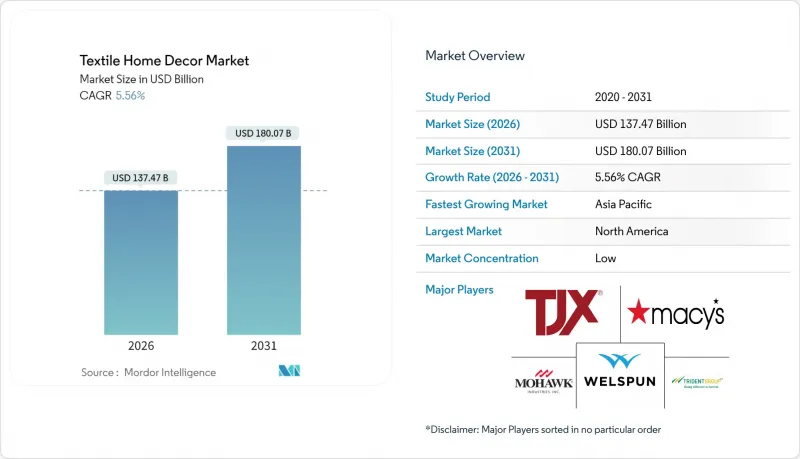

The textile home decor market was valued at USD 130.23 billion in 2025 and estimated to grow from USD 137.47 billion in 2026 to reach USD 180.07 billion by 2031, at a CAGR of 5.56% during the forecast period (2026-2031).

Sustained consumer interest in sustainable materials, the rollout of digitally enabled customization, and broad-based e-commerce penetration underpin this expansion. Rising disposable incomes in emerging economies reinforce premiumization, while hospitality renovation cycles lift commercial volumes. Competitive positioning now rests on vertical integration, traceable supply chains, and fast design refreshes that keep pace with social-media-driven style diffusion. At the same time, circular-economy mandates in Europe and North America heighten compliance costs, prompting investments in recycling infrastructure and design-for-disassembly practices.

Global Textile Home Decor Market Trends and Insights

Rising Disposable Income & Renovation Spend

Higher household purchasing power across Asia-Pacific, the Middle East, and Latin America is redirecting discretionary budgets toward aesthetic upgrades, lifting the premium textile home decor market demand. Growing middle classes are replacing single-purpose linens with differentiated product tiers that emphasize thread-count, organic certifications, and bespoke design. Renovation cycles are shortening as urban homeowners treat interiors as expressions of identity, leading to frequent replacement of visible soft furnishings. Small ticket sizes relative to furniture enable impulse upgrades, amplifying unit volumes and value per household. Brands able to link sustainability claims with aspirational design are capturing loyalty among affluent millennials who equate eco-friendly choices with social status.

E-commerce Expansion & Omnichannel Retail

Online marketplaces remove geographic barriers, letting niche labels scale globally without costly store rollouts, thereby enlarging the total textile home decor market opportunity. Augmented-reality visualization tools integrated into shopping apps help buyers gauge colors and patterns in real rooms, reducing returns and raising conversion rates. Hybrid models such as buy-online-pick-up-in-store preserve tactile verification while retaining digital convenience, particularly for high-touch items like plush throws and rugs. Data-rich direct-to-consumer relationships feed AI demand-forecast engines that align just-in-time printing with micro-trends, slashing inventory risk. Omnichannel ecosystems also give manufacturers leverage over retailers, accelerating margin-accretive B2B2C partnerships.

Raw-Material Price Volatility

Cotton and synthetic-fiber markets remain exposed to weather swings, energy prices, and logistics shocks, forcing frequent repricing that strains brand-retailer contracts. Manufacturers with upstream integration or advanced hedging instruments better cushion margins, while smaller mills face cash-flow stress when input costs rise faster than selling prices. The premium attached to certified organic and recycled feedstocks intensifies margin compression during commodity spikes. Consequently, many brands are engineering blends that maintain hand feel and sustainability perception while reducing exposure to any single fiber price. Longer term, bio-based alternatives with stable agricultural supply chains may mitigate volatility and support predictable cost curves.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Push for Natural Fibers & Circularity

- Hospitality Construction Boom

- Low-Cost Import Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bed linen retained a 33.78% textile home decor market share in 2025, underscoring its status as an essential replenishment item with short replacement cycles linked to hygiene and fashion refreshes. Higher thread counts, moisture-wicking weaves, and organic certifications command double-digit price uplifts, reflecting consumers' willingness to invest in nightly comfort. Bath towels follow similar logic, benefiting from hospitality reopening that swells institutional orders. Kitchen and dining linens grow steadily as at-home entertaining remains popular in urban centers where dining-out costs climbed in 2025.

Rugs and carpets, forecast to lead category growth at 5.74% CAGR, capture lifestyle upgrades that treat flooring as a canvas for self-expression rather than merely a functional covering. Innovations in digital print and tuft-on-demand allow photorealistic designs and personalized dimensions without prohibitive minimums. Smart rugs embedded with pressure sensors for fall detection or occupancy monitoring are emerging niche propositions that broaden use cases beyond aesthetics. Meanwhile, curtains and drapes confront architectural minimalism, favoring expansive glazing; however, smart-home integration revives interest through voice-controlled light and thermal regulation systems.

Natural fibers accounted for 42.08% of 2025 revenue as eco-conscious shoppers gravitated toward breathable, biodegradable fabrics and organically farmed cotton. Hemp and lyocell enjoy double-digit volume lifts owing to distinctive textures and sustainability halos, while bamboo viscose maintains momentum in bath and bedding for its softness and antimicrobial claims. Producers highlight water-saving and farmer-welfare certifications to secure shelf space at premium retailers.

Blended constructions are projected to post the fastest 5.69% CAGR, balancing the tactile appeal of natural yarns with the durability and wrinkle resistance of synthetics. Cotton-polyester mixes extend product life and simplify care, appealing to dual-income households seeking convenience. Recycled PET fibers are incorporated into decorative pillows and throws, bolstering circularity credentials without compromising color vibrancy or price access. Continued R&D into bio-based polyester and chemical recycling promises blends that reconcile performance with closed-loop ambitions.

The Global Textile Home Decor Market Report is Segmented by Product Type (Bed Linen and Bed Spread, Bath Linen, Curtains & Drapes, and More), Material (Natural Fibres, Synthetic Fibres, Blended), End User (Residential, Commercial), Distribution Channel (B2B/Direct From Manufacturers, B2C/Retail), and Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 31.88% of global revenue in 2025, supported by high homeownership, frequent renovation, and a strong preference for premium products with advanced wellness features like temperature regulation and hypoallergenic finishes. The United States consumers exhibit low price elasticity at the upper end, enabling brands to pass through cost increases tied to organic certifications. Canada tracks similar trends yet shows heightened interest in locally sourced linen as the government promotes domestic manufacturing resilience.

Asia-Pacific is projected to deliver the fastest 6.05% CAGR through 2031 as rising urban incomes and nuclear-family formation in China, India, Indonesia, and Vietnam expand addressable households. Government schemes supporting affordable housing accelerate first-time buying, triggering demand for starter decor packages. At the same time, regional manufacturing prowess shortens supply chains, letting domestic brands offer trendy designs at accessible prices, reinforcing volume growth.

Europe remains pivotal for sustainability leadership; circular-economy legislation compels product redesign for recyclability, nudging exporters worldwide to comply with EU standards to maintain market access. Premiumization persists, with Scandinavian and Italian design aesthetics commanding global influence and higher average unit values. Meanwhile, the Middle East and Africa advance from a low base; mega-tourism projects in Saudi Arabia's Red Sea corridor and the United Arab Emirates' post-Expo development spearhead hospitality textile procurement, boosting regional demand.

- Welspun India Ltd.

- Trident Group

- Inter IKEA Systems B.V.

- Indo Count Industries

- Sunvim Group Co., Ltd

- Marimekko Corporation

- TJX Companies Inc.

- Macy's Inc.

- Croscill Home Fashions

- Mohawk Industries

- Ralph Lauren Corp.

- Tempur Sealy International

- Brooklinen

- American Textile Company

- Loftex China

- Bombay Dyeing

- Luolai Home Textile

- Springs Global

- Frette

- Shaw Industries Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising disposable income & renovation spend

- 4.2.2 E-commerce expansion & omnichannel retail

- 4.2.3 Sustainability push for natural fibres & circularity

- 4.2.4 Hospitality construction boom

- 4.2.5 AI-enabled digital textile printing & on-demand decor

- 4.2.6 EU circular-economy regulations for home textiles

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Low-cost import competition

- 4.3.3 Energy-transition cost spikes across supply chain

- 4.3.4 Certification-compliance burden for SMEs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Bed Linen and Bed Spread

- 5.1.2 Bath Linen

- 5.1.3 Curtains & Drapes

- 5.1.4 Rugs & Carpets

- 5.1.5 Kitchen and Dining Linen

- 5.1.6 Wall Textiles & Others

- 5.2 By Material

- 5.2.1 Natural Fibres

- 5.2.2 Synthetic Fibres

- 5.2.3 Blended

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2B/Direct from the Manufacturers

- 5.4.2 B2C/Retail

- 5.4.2.1 Home-Improvement & DIY Stores

- 5.4.2.2 Specialty Flooring Stores (includes exclusive brand outlets)

- 5.4.2.3 Furniture & Furnishing Stores

- 5.4.2.4 Online

- 5.4.2.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South-East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Welspun India Ltd.

- 6.4.2 Trident Group

- 6.4.3 Inter IKEA Systems B.V.

- 6.4.4 Indo Count Industries

- 6.4.5 Sunvim Group Co., Ltd

- 6.4.6 Marimekko Corporation

- 6.4.7 TJX Companies Inc.

- 6.4.8 Macy's Inc.

- 6.4.9 Croscill Home Fashions

- 6.4.10 Mohawk Industries

- 6.4.11 Ralph Lauren Corp.

- 6.4.12 Tempur Sealy International

- 6.4.13 Brooklinen

- 6.4.14 American Textile Company

- 6.4.15 Loftex China

- 6.4.16 Bombay Dyeing

- 6.4.17 Luolai Home Textile

- 6.4.18 Springs Global

- 6.4.19 Frette

- 6.4.20 Shaw Industries Group

7 Market Opportunities & Future Outlook

- 7.1 Luxury Bedding Driving Premiumization in Urban Markets

- 7.2 E-Commerce Platforms Accelerating Direct-to-Consumer Growth

- 7.3 Hospitality Expansion Fueling Commercial Textile Demand