PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937304

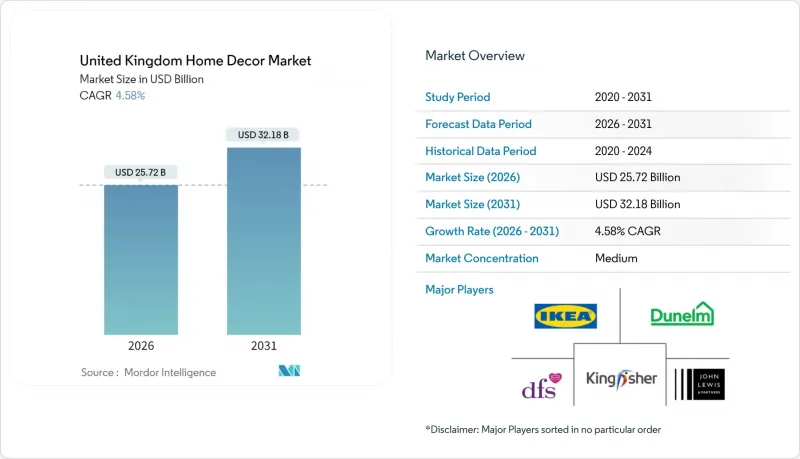

United Kingdom Home Decor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom home decor market size in 2026 is estimated at USD 25.72 billion, growing from 2025 value of USD 24.59 billion with 2031 projections showing USD 32.18 billion, growing at 4.58% CAGR over 2026-2031.

Expansion continues even while consumers face higher living costs because of hybrid work patterns, insulation incentives, and a growing preference for sustainable products keep renovation activity robust. Energy-efficiency upgrades under the Great British Insulation Scheme, coupled with stable home-ownership levels, are steering spending toward furniture, textiles, lighting, flooring, and accessories that improve both comfort and resale value. Retailers have redesigned supply chains to handle Red Sea shipping risks while still maintaining service levels, helping preserve shopper confidence despite longer global lead times. E-commerce penetration, already at 37% of sales for market leaders, continues to expand as AI search tools and mobile-first checkouts reduce friction for big-ticket purchases.

United Kingdom Home Decor Market Trends and Insights

Rising Disposable Income & Homeownership

Home-ownership stability and gradual wage growth have created an environment where households feel secure enough to resume discretionary decor projects deferred during pandemic uncertainty. Millennials entering prime purchasing ages prefer personalized interiors, resulting in per-square-foot spending that exceeds prior generations. Regional variations help premium brands thrive in southern England, while value lines find volume in northern cities where affordability remains paramount. Government programs supporting first-time buyers add incremental demand because new owners typically invest heavily in furniture and decoration during their first two years of occupancy. The wealth effect from rising property values in London, Manchester, and Birmingham further encourages spending on premium furnishings.

Growth of DIY & Hybrid-Work Refurbishments

Permanent hybrid work arrangements have reshaped room layouts, elevating demand for ergonomic desks, screens, and versatile storage that toggle between professional and leisure use. Remote-work tax relief increases disposable budgets for home office improvements, and retailers have seized the moment by offering virtual design advice and modular kits that simplify do-it-yourself assembly. Social media tutorials have deepened DIY sophistication, enabling consumers to tackle complex projects once left to contractors. Click-and-collect orders for small hardware and decor items grew 40% year-over-year as shoppers sought quick upgrades between virtual meetings. Retailers now schedule smaller but more frequent deliveries to align with this wave of micro-projects.

Raw-Material Cost Volatility

Timber, steel, and energy costs continue to fluctuate sharply, squeezing margins for firms unable to hedge effectively. Softwood lumber swung more than 40% in several quarters, while fabricated steel prices jumped 15.7% year-on-year by mid-2024. Rising energy tariffs have raised manufacturing overhead, raising the share of production costs tied to electricity and gas from 8-12% before 2022 to 15-20% today. Red Sea shipping disruption layered higher container charges onto Asian imports, complicating inventory planning. Smaller brands face capital constraints when stockpiling inputs, potentially accelerating consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce & Omnichannel Retail

- Demand for Sustainable Decor Materials

- Low-Cost Import Price Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Furniture delivered 31.12% of the United Kingdom home decor market share in 2025 because large pieces like sofas and beds anchor every room's utility and style. Hybrid work boosted sales of adjustable desks and ergonomic chairs as knowledge workers outfitted permanent offices within the home. Textiles such as bedding and curtains recorded brisk turnover because they allow inexpensive seasonal refreshes, while smart lighting extended beyond utility to mood-setting and video call aesthetics. Rug and flooring updates help divide open-plan layouts into functional zones, driving demand for luxury vinyl tile and engineered wood that offer durability with design flexibility. Accessories are projected to outpace all other categories at a 5.02% CAGR as shoppers embrace low-commitment items that align with fast-changing social trends.

Accessories thrive because they enable constant micro-upgrades without the financial strain of replacing core furniture. Multifunctional pieces that combine storage with decor resonate in micro-apartments, where Bonbon Compact Living and similar brands provide solutions built for constrained footprints. Subscription boxes introduce consumers to emerging designers while guaranteeing predictable revenue for suppliers, amplifying discovery beyond traditional showrooms. Limited-edition seasonal collections from mainstream retailers achieve margins 20-30% above evergreen lines by creating urgency-driven buying. Social-commerce ads on Instagram and Pinterest further catalyze accessory demand because impulse-friendly price points pair naturally with visual platforms.

The United Kingdom Home Decor Market Report is Segmented by Product Type (Furniture, Home Textiles, Decorative Lighting, and More), Distribution Channel (Homeware & Furniture Specialists, DIY Stores, Supermarkets, and More), Material (Wood, Metal, Glass, and More), and Geography (England, Scotland, Wales, Northern Ireland). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IKEA Ltd (UK)

- Dunelm Group plc

- DFS Furniture plc

- B&Q (Kingfisher plc)

- John Lewis & Partners

- Homebase Ltd

- Oak Furnitureland

- The Range

- Wayfair UK

- Habitat (Sainsbury's)

- Next plc (Home)

- Wickes Group plc

- Furniture Village

- Heal's

- Loaf

- ScS Group plc

- Sofology

- BoConcept UK

- LuxDeco

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - United Kingdom Home Decor Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rising disposable income & home-ownership

- 5.2.2 Growth of DIY & hybrid-work refurbishments

- 5.2.3 Expansion of e-commerce & omnichannel retail

- 5.2.4 Demand for sustainable decor materials

- 5.2.5 Micro-living driving multifunctional furniture

- 5.2.6 VAT incentives for energy-efficient upgrades

- 5.3 Market Restraints

- 5.3.1 Raw-material cost volatility

- 5.3.2 Low-cost import price pressure

- 5.3.3 Supply-chain lead-time disruptions

- 5.3.4 Growth in second-hand/circular channels

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Suppliers

- 5.5.3 Bargaining Power of Buyers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

- 5.6 Insights into the Latest Trends and Innovations in the Market

- 5.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

6 Market Size & Growth Forecasts (Value)

- 6.1 By Product Type

- 6.1.1 Furniture

- 6.1.2 Home Textiles (Bedding, Curtains)

- 6.1.3 Decorative Lighting

- 6.1.4 Flooring (Rugs, Carpets, Hard Flooring)

- 6.1.5 Wall Decor (Paint, Wallpaper, Art)

- 6.1.6 Home Accents & Accessories

- 6.2 By Distribution Channel

- 6.2.1 Homeware & Furniture Specialists

- 6.2.2 DIY / Home Improvement Stores

- 6.2.3 Supermarkets & Hypermarkets

- 6.2.4 Department & Variety Stores

- 6.2.5 Online Pure-Players

- 6.2.6 Direct-to-Consumer Brands

- 6.3 By Material

- 6.3.1 Wood

- 6.3.2 Metal

- 6.3.3 Glass

- 6.3.4 Plastic & Acrylic

- 6.3.5 Textiles & Fabrics

- 6.3.6 Sustainable / Recycled Materials

- 6.4 By Region

- 6.4.1 England

- 6.4.2 Scotland

- 6.4.3 Wales

- 6.4.4 Northern Ireland

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 IKEA Ltd (UK)

- 7.4.2 Dunelm Group plc

- 7.4.3 DFS Furniture plc

- 7.4.4 B&Q (Kingfisher plc)

- 7.4.5 John Lewis & Partners

- 7.4.6 Homebase Ltd

- 7.4.7 Oak Furnitureland

- 7.4.8 The Range

- 7.4.9 Wayfair UK

- 7.4.10 Habitat (Sainsbury's)

- 7.4.11 Next plc (Home)

- 7.4.12 Wickes Group plc

- 7.4.13 Furniture Village

- 7.4.14 Heal's

- 7.4.15 Loaf

- 7.4.16 ScS Group plc

- 7.4.17 Sofology

- 7.4.18 BoConcept UK

- 7.4.19 LuxDeco

8 Market Opportunities & Future Outlook

- 8.1 Circular & "Re-Made" Home Decor

- 8.2 Smart & Sensor-Rich Decor

- 8.3 Heritage-Meets-Contemporary Artisanal Lines