PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937307

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937307

US Vinyl Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

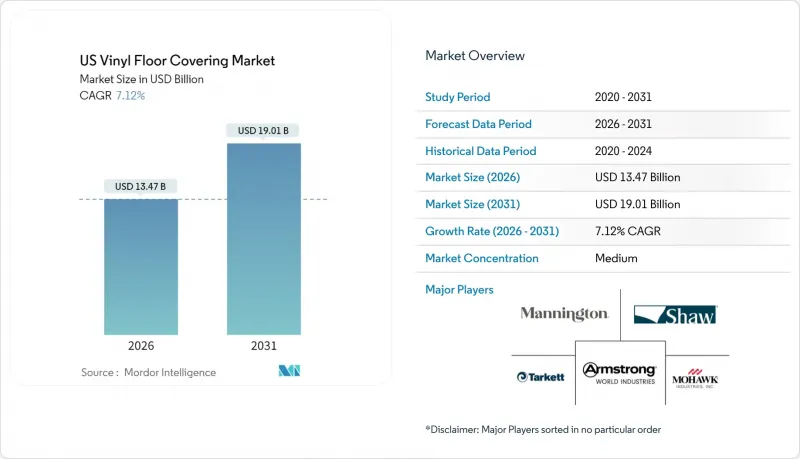

The US vinyl floor covering market is expected to grow from USD 12.57 billion in 2025 to USD 13.47 billion in 2026 and is forecast to reach USD 19.01 billion by 2031 at 7.12% CAGR over 2026-2031.

Strong Remodeling spending sustained multi-family completions, and rapid adoption of rigid-core technologies counterbalance input-cost volatility and regulatory scrutiny, keeping the US vinyl floor covering market on a firmly expansionary trajectory. Residential renovations continue to underpin volume, while commercial specification rebounds as offices, healthcare facilities, and hospitality venues prioritize infection control, acoustic comfort, and lower maintenance costs.

Domestic producers leverage tariffs on Chinese imports, boosting local capacity and shortening lead times, which further fortifies the competitive stance of the US vinyl floor covering market amid global supply disruptions. Resilience funding tied to federal hazard-mitigation programs, together with consumer demand for waterproof flooring, amplifies sales of Stone Plastic Composite (SPC) and Wood Plastic Composite (WPC) formats. Ongoing technological improvements in digital printing and click-lock systems enhance aesthetics, reduce installation time, and spur broader acceptance across both professional and do-it-yourself channels, ensuring that the US vinyl floor covering market remains responsive to evolving end-user expectations.

US Vinyl Floor Covering Market Trends and Insights

Accelerated Residential Remodeling Boom

The remodeling expenditure pool touched USD 509.0 billion in 2025, 1.22% higher than 2024, and outlays remain 50% above pre-pandemic benchmarks. Aging homes with a median age of 44 years sustain demand for floor upgrades that combine aesthetics and ease of installation. Vinyl formats satisfy budget-conscious homeowners by offering hardwood visuals at 40-60% lower installed cost while avoiding grout maintenance common to ceramic tiles. Rising property values enhance home-equity borrowing capacity, encouraging discretionary renovation spending that lifts the US vinyl floor covering market. Older householders, now the largest spenders on remodeling, gravitate toward low-maintenance surfaces, reinforcing this driver. Elevated participation of racially diverse households in renovation activity widens style preference ranges, adding tailwinds for SKU proliferation across big-box assortments. Continuous innovation in print fidelity and embossed-in-register textures helps vinyl maintain mindshare despite competing laminate launches, ensuring momentum through at least mid-decade.

Growing Adoption of Rigid-Core (SPC/WPC) Technologies

Rigid-core lines reached 63% penetration within Luxury Vinyl Tile, with SPC commanding incremental share because of a thinner profile and lower material cost. Dimensional stability lets builders specify vinyl in moisture-exposed basements, bathrooms, and high-traffic lobbies where sheet goods once dominated. Click-lock formats cut labor hours, meeting project schedules amid ongoing skilled-labor shortages. Mohawk's USD 900.0 million multi-year capex adds automated SPC lines that help the company defend its 19% leadership share. Shaw upgrades Calhoun facilities for WPC production, widening domestic capacity and lowering tariff exposure. Building-code wording on in-place water resistance, rather than topical spill testing, strengthens SPC's value proposition and funnels R&D toward higher-density limestone cores. Together, these forces guarantee rigid-core dominance in the US vinyl floor covering market well beyond 2030.

Increasing Regulatory Scrutiny on Phthalates & PFAS

EPA's draft DINP evaluation concludes unreasonable risk to children from vinyl flooring dust exposure, prompting public-comment rounds that signal future restrictions. Parallel PFAS designations under CERCLA widen liability exposure for manufacturers using fluorinated processing aids. Compliance drives R&D into PVC-free elastomers such as Shaw's EcoWorx Resilient, which met Cradle-to-Cradle Platinum criteria and captured the 2025 Edison Award. Re-formulation costs and potential product delistings compress gross margins, especially for small producers lacking scale to spread testing expense. Product-disclosure mandates in California and Washington increase labeling complexity, lengthening time-to-shelf for new lines. Retail buyers add supply-chain questionnaires that can delay award decisions, temporarily slowing project pipelines. Over time, investment in alternative chemistries may unlock premium pricing, but near-term drag persists on the US vinyl floor covering market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Multi-Family Housing Completions

- FEMA-Funded Resilient-Flooring Demand in Disaster-Prone States

- Volatile PVC Resin Prices Linked to Oil & Gas Swings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Luxury Vinyl Tile held 67.62% of US vinyl floor covering market share in 2025, and the segment is tracking an 8.64% CAGR to 2031, underscoring its status as both the largest and fastest-expanding product line. This dominance ensures that the US vinyl floor covering market size remains anchored in LVT performance metrics over the forecast horizon. SPC compositions reduce telegraphing over minor subfloor irregularities, widening retrofit use cases in rental units that cannot tolerate extended downtime. WPC remains popular in single-family living areas for its softer underfoot feel, absorbing footfall noise with cork or IXPE backers that enhance acoustic ratings. Sheet vinyl still claims pockets of medical and education interiors where welded seams support sterile cleaning regimes, though incremental shares migrate toward welded LVT planks as adhesive chemistries improve. Vinyl Composition Tile (VCT) defends industrial installations through low material cost yet rising maintenance favors migration to no-wax LVT that minimizes floor-care labor. Digital decor layers add complexity without meaningfully raising unit weight, enabling freight efficiency that protects landed cost even during fuel-price spikes.

Although product-mix evolution is pronounced, overall capacity additions proceed cautiously to avoid oversupply. Domestic mills stagger commissioning schedules, aligning runs with private-label planograms secured six months ahead. The strategy maintains healthy mill utilization, preserving price discipline in the US vinyl floor covering market. As suppliers synchronize decor palettes across rigid and flexible formats, retailers can bundle coordinated offerings, stimulating multi-room projects. Continuous-press technology imports from Europe promise deeper embossing registers that rival real wood, opening premium niches that lift average selling prices without detracting from value perceptions.

Interlocking planks represented 53.65% of shipments in 2025, validating consumer preference for adhesive-free methodologies that facilitate weekend projects. Glue-down tiles, while a smaller slice, are growing at 7.62% CAGR because healthcare, grocery, and office end-users demand permanence under heavy point loads. The US vinyl floor covering market size for glue-down formats equaled USD 4.41 billion in 2026, reflecting steady commercial pull. Self-adhesive sheets serve price-sensitive landlords who replace floors between tenants without hiring certified installers. Hybrid solutions combine tight-fit tongue-and-groove engagement with peel-film tackifiers at perimeter courses, mitigating lateral shear in rolling-load corridors.

Interlocking advances hinge on precision milling tolerances; SPC cores show minimal expansion, holding lock integrity across humidity swings common in U.S. climates. Retailers promote coordinating moldings that click into the same groove, reducing accessory SKU complexity. Commercial installers leverage adhesive rollers to back-butter interlocking planks in transition zones, ensuring long service life without losing speed advantages in field areas. Training modules from leading manufacturers certify installers in under two hours, a key selling point during labor-short conditions and a catalyst for wider adoption throughout the US vinyl floor covering market.

The US Vinyl Floor Covering Market Report is Segmented by Product Type (LVT, Luxury Vinyl Plank, and More), Installation Method (Self-Adhesive Vinyl Tiles, Glue-Down, and More), End User (Residential, Commercial), Construction Type (New Construction, Remodeling / Retrofit), Distribution Channel (B2C/Retail, B2B/Contractors), and Geography (Northeast, Midwest, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mohawk Industries

- Shaw Industries

- Armstrong Flooring

- Tarkett North America

- Mannington Mills

- Gerflor USA

- Karndean Designflooring

- The Dixie Group

- CFL Flooring

- Novalis Innovative Flooring

- Interface Inc.

- LG Hausys America

- Congoleum

- Roppe Corporation

- Forbo Flooring Systems

- Stonhard

- Parterre Flooring Systems

- Polyflor Ltd.

- Metroflor

- Halstead New England (LifeProof)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated residential remodeling boom

- 4.2.2 Growing adoption of rigid-core (SPC/WPC) technologies

- 4.2.3 Cost-competitiveness versus hardwood and ceramic tiles

- 4.2.4 Surge in multi-family housing completions

- 4.2.5 FEMA-funded resilient-flooring demand in disaster-prone states

- 4.2.6 Retailers' private-label expansion boosting SKU velocity

- 4.3 Market Restraints

- 4.3.1 Increasing regulatory scrutiny on phthalates and PFAS

- 4.3.2 Volatile PVC resin prices linked to oil and gas swings

- 4.3.3 Growing landfill fees pressuring end-of-life disposal

- 4.3.4 Tight domestic chlorine supply chain after Gulf-Coast outages

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.1.1.1 Stone Plastic Composite (SPC)

- 5.1.1.2 Wood Plastic Composite (WPC)

- 5.1.2 Luxury Vinyl Plank (LVP)

- 5.1.3 Sheet Vinyl

- 5.1.4 Others (Vinyl Composition Tile (VCT), Resilient Vinyl-Backed Rubber Hybrid)

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.2 By Installation Method

- 5.2.1 Self-Adhesive Vinyl Tiles

- 5.2.2 Glue-Down

- 5.2.3 Interlocking Vinyl Tiles

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality and Leisure

- 5.3.2.2 Retail and Shopping Centers

- 5.3.2.3 Healthcare Facilities

- 5.3.2.4 Education

- 5.3.2.5 Corporate Offices

- 5.3.2.6 Public and Government Buildings

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Remodeling/Retrofit

- 5.5 By Distribution Channel

- 5.5.1 B2C/Retail

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Flooring Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B/Contractors/Builders

- 5.5.1 B2C/Retail

- 5.6 By Geography

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 Southeast

- 5.6.4 Southwest

- 5.6.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mohawk Industries

- 6.4.2 Shaw Industries

- 6.4.3 Armstrong Flooring

- 6.4.4 Tarkett North America

- 6.4.5 Mannington Mills

- 6.4.6 Gerflor USA

- 6.4.7 Karndean Designflooring

- 6.4.8 The Dixie Group

- 6.4.9 CFL Flooring

- 6.4.10 Novalis Innovative Flooring

- 6.4.11 Interface Inc.

- 6.4.12 LG Hausys America

- 6.4.13 Congoleum

- 6.4.14 Roppe Corporation

- 6.4.15 Forbo Flooring Systems

- 6.4.16 Stonhard

- 6.4.17 Parterre Flooring Systems

- 6.4.18 Polyflor Ltd.

- 6.4.19 Metroflor

- 6.4.20 Halstead New England (LifeProof)

7 Market Opportunities and Future Outlook

- 7.1 Increasing focus on sustainability, circularity and take-back/recycling programs

- 7.2 Surging demand for realistic visuals, textures, and customization