PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940691

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940691

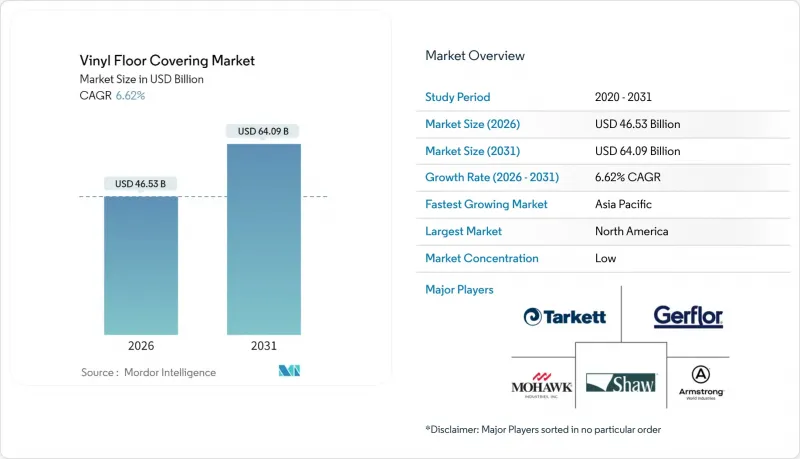

Vinyl Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The vinyl floor covering market is expected to grow from USD 43.64 billion in 2025 to USD 46.53 billion in 2026 and is forecast to reach USD 64.09 billion by 2031 at 6.62% CAGR over 2026-2031.

Current expansion is propelled by rigid-core technologies that displace engineered wood and laminate, a move that shields the vinyl floor covering market from construction volatility. Adoption accelerates as circular-economy mandates, low-maintenance attributes, and cost efficiencies converge in residential remodeling and commercial retrofits. Luxury Vinyl Tile (LVT) retains leadership, yet Luxury Vinyl Plank (LVP) outpaces peers on the back of stone plastic composite (SPC) and wood plastic composite (WPC) advances. Asia-Pacific's scale advantage, South America's growth momentum, and near-shoring efforts in North America together highlight the global re-allocation of capacity and demand vectors.

Global Vinyl Floor Covering Market Trends and Insights

Construction Rebound in Emerging Economies

Emerging market build-outs expand the vinyl floor covering market as governments prioritize cost-effective, durable solutions for rapid urbanization. India's Smart Cities Mission and Brazil's residential stimulus funnel resources into flooring upgrades that favor SPC and WPC formats for heavy traffic endurance. Manufacturers leverage Vietnam-based capacity to serve ASEAN and Latin American demand efficiently, capitalizing on competitive labor rates. Local distributors pair vinyl's quick installation with constrained construction schedules, accelerating project turnovers. Collectively, these factors raise baseline demand and underpin positive price discipline amid raw-material swings.

Shift Toward Resilient, Low-Maintenance Flooring

Facility managers in healthcare, education, and hospitality sectors elevate cleaning efficiency and infection control, expanding the vinyl floor covering market as an alternative to ceramic tile and wood . Vinyl's seamless surfaces reduce microbial harborage, while loose-lay systems facilitate rapid replacement during maintenance cycles. Producers integrate ultra-low VOC recipes and phthalate-free plasticizers, addressing stricter indoor-air-quality codes without sacrificing performance . Specifiers reward these advances with premium positioning, narrowing the perception gap between vinyl and high-end surfaces. The durability narrative translates into lower lifecycle costs that resonate with budget-sensitive institutions.

Volatility in PVC and Plasticizer Prices

PVC resin tracks energy and naphtha inputs, producing cost shocks that ripple through the vinyl floor covering market. Producers hedge partially with long-term contracts but remain exposed when Asian ethylene values spike . Smaller firms thin margins to preserve volume, limiting R&D budgets and capital investment. Global buyers negotiate shorter price-validity windows, complicating tender processes for large-scale projects. Forward integration into recycling streams aims to lower virgin PVC dependence but faces technical hurdles in multilayer LVT reclamation.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Rigid-Core Technologies (SPC/WPC)

- Surge in Residential Remodeling Activity

- Indoor-Air-Quality & VOC Emission Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Luxury Vinyl Tile commanded 74.12% of the 2025 vinyl floor covering market share as facility planners and homeowners gravitated toward its broad design palette and proven durability. The segment's entrenched position across healthcare, education, and hospitality installations provides stable baseline volume that anchors the overall vinyl floor covering market size. Luxury Vinyl Plank, meanwhile, is projected to grow at a 6.79% CAGR through 2031 as rigid-core technology elevates dimensional stability and wood-look authenticity. Advancements in embossed-in-register textures, matte finishes, and pressed bevels heighten aesthetic realism, enabling vinyl to contest engineered hardwood in premium remodels. Continuous upgrades in antimicrobial and scratch-resistant coatings further widen the performance gap with ceramic and laminate alternatives.

Over the forecast horizon, LVP's click-lock assemblies shorten installation cycles, a feature that appeals to professional contractors juggling labor constraints. Makers capitalize on digital printing to reduce pattern inventory, improving cash flow amid PVC price swings. LVT producers respond with thicker wear layers and integrated underlayment aimed at corporate offices and multifamily corridors, preserving share in heavy-traffic venues. Bio-attributed PVC formulas debut first in European LVT lines to satisfy eco-label procurement rules. Collectively, the product landscape is shifting from a budget-versus-premium dichotomy toward a spectrum defined by core technology, surface finish, and sustainability credentials.

Interlocking vinyl tiles held 56.20% of 2025 revenue, underscoring buyer preference for floating floors that accelerate project timelines and minimize adhesive odors in occupied spaces. Click-lock geometries have grown increasingly tolerant of subfloor irregularities, encouraging adoption in multifamily renovations and office fit-outs where speed outweighs permanence. Glue-down formats, although forecast to climb at a 7.02% CAGR to 2031, now target applications demanding maximum dimensional stability such as airports, grocery aisles, and industrial assembly lines. Enhanced polyurethane adhesives and high-friction backings reduce curl risk, extending lifecycle beyond ten-year maintenance windows.

Loose-lay innovations complement the interlocking segment by offering repositionable planks that facilitate rapid tenant turnovers in hospitality suites. Integrated acoustic pads mitigate floor-to-floor sound transfer without adding separate underlayment, an advantage in high-rise construction. Manufacturers invest in robotic milling to perfect tongue-and-groove tolerances, shrinking on-site waste and warranty claims. Adhesive-free systems also lower VOC emissions, helping projects qualify for LEED credits and propelling the vinyl floor covering market size within green-building programs. Overall, installation technology has emerged as a primary differentiator alongside visual design and raw-material chemistry.

The Vinyl Floor Covering Market is Segmented by Product Type ( Product Type, Luxury Vinyl Plank (LVP), and Other), Installation Method (Self-Adhesive Vinyl Tiles, Glue-Down, and Other), End-User (Residential and Commercial), Construction Type (New Construction and Remodeling / Retrofit), and Distribution Channel(B2C / Retail and B2B / Contractors / Builders ). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 36.20% of 2025 revenue, supported by near-shoring that mitigates UFLPA-related supply risk and shortens lead times for remodel projects. Domestic capacity expansions in Georgia and Tennessee reduce dependency on Asian imports, stabilizing inventory for big-box retailers and commercial contractors. Asia-Pacific, in contrast, is poised for an 7.90% CAGR through 2031 as urbanization and infrastructure programs fuel demand in China, India, and Southeast Asia. Vietnam's burgeoning production hub leverages cost advantages while serving both regional consumption and U.S. re-export flows.

Rising disposable incomes in South Korea and Australia shift consumer preference toward premium rigid-core planks, elevating average selling prices. India's Smart Cities and housing initiatives pivot directly to modern resilient flooring, bypassing legacy ceramic dominance. Trade agreements under RCEP streamline intra-Asia shipments, accelerating product turnover and market penetration. Meanwhile, Canada tightens VOC regulations, nudging buyers toward low-emission vinyl lines. Collectively, the geographic dynamics illustrate how supply-chain realignment and disparate growth drivers reshape the global vinyl floor covering market share distribution.

South America records underpinned by Brazil's Minha Casa Minha Vida housing push and Chilean education upgrades that target durable, hygienic surfaces. Currency stability and commodity exports shore up household renovation budgets, uplifting vinyl consumption. Argentine import restrictions lift prospects for local SPC factories, while Peru leans on North American imports to replenish quake-resilient reconstruction stock. Trade pacts under Mercosur simplify intra-regional shipments, fostering cross-border distributor consolidation. As confidence rebounds, commercial developers shift from granite to wood-look SPC to shorten build schedules and cut structural loads.

- Mohawk Industries

- Tarkett SA

- Shaw Industries Group

- Armstrong World Industries

- Gerflor Group

- Mannington Mills

- Interface Inc.

- Beaulieu International Group

- Forbo Holding AG

- LG Hausys

- Novalis Innovative Flooring

- Milliken & Company

- Raskin Industries

- Congoleum Corporation

- IVCT (IndoFloor Vinyl Composite Tile)

- Karndean Designflooring

- CFL Flooring

- Responsive Industries

- Polyflor Ltd

- ShawContract

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction rebound in emerging economies

- 4.2.2 Shift toward resilient, low-maintenance flooring

- 4.2.3 Rapid adoption of rigid-core technologies (SPC/WPC)

- 4.2.4 Surge in residential remodeling activity

- 4.2.5 Circular-economy take-back mandates for vinyl floors

- 4.2.6 Near-shoring of LVT production in North America & EU

- 4.3 Market Restraints

- 4.3.1 Volatility in PVC and plasticizer prices

- 4.3.2 Indoor-air-quality & VOC emission concerns

- 4.3.3 U.S.-China trade & UFLPA supply-chain disruptions

- 4.3.4 End-of-life recycling challenges for multilayer LVT

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.1.1.1 Stone Plastic Composite (SPC)

- 5.1.1.2 Wood Plastic Composite (WPC)

- 5.1.2 Luxury Vinyl Plank (LVP)

- 5.1.3 Sheet Vinyl

- 5.1.4 Others (VCT, Resilient Vinyl-Backed Rubber Hybrid)

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.2 By Installation Method

- 5.2.1 Self-Adhesive Vinyl Tiles

- 5.2.2 Glue-Down

- 5.2.3 Interlocking Vinyl Tiles

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality & Leisure

- 5.3.2.2 Retail & Shopping Centers

- 5.3.2.3 Healthcare Facilities

- 5.3.2.4 Education

- 5.3.2.5 Corporate Offices

- 5.3.2.6 Public & Government Buildings

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Remodeling / Retrofit

- 5.5 By Distribution Channel

- 5.5.1 B2C / Retail

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Flooring Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B / Contractors / Builders

- 5.5.1 B2C / Retail

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 South-East Asia

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East & Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East & Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mohawk Industries

- 6.4.2 Tarkett SA

- 6.4.3 Shaw Industries Group

- 6.4.4 Armstrong World Industries

- 6.4.5 Gerflor Group

- 6.4.6 Mannington Mills

- 6.4.7 Interface Inc.

- 6.4.8 Beaulieu International Group

- 6.4.9 Forbo Holding AG

- 6.4.10 LG Hausys

- 6.4.11 Novalis Innovative Flooring

- 6.4.12 Milliken & Company

- 6.4.13 Raskin Industries

- 6.4.14 Congoleum Corporation

- 6.4.15 IVCT (IndoFloor Vinyl Composite Tile)

- 6.4.16 Karndean Designflooring

- 6.4.17 CFL Flooring

- 6.4.18 Responsive Industries

- 6.4.19 Polyflor Ltd

- 6.4.20 ShawContract

7 Market Opportunities & Future Outlook

- 7.1 Eco-Friendly Vinyl: Recyclable, Low-VOC, and Sustainable Materials

- 7.2 Luxury Vinyl Tiles (LVT) Surging with Hyper-Realistic Textures

- 7.3 DIY-Friendly Click-Lock and Peel-and-Stick Innovations