PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937343

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937343

Europe Collagen Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

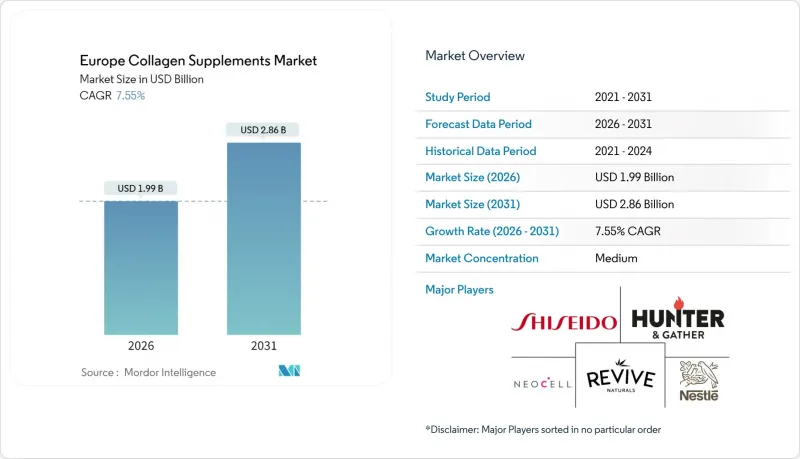

The Europe collagen supplement market was valued at USD 1.85 billion in 2025 and estimated to grow from USD 1.99 billion in 2026 to reach USD 2.86 billion by 2031, at a CAGR of 7.55% during the forecast period (2026-2031).

This market progression reflects fundamental shifts in consumer behavior and industry dynamics. The increasing elderly population across European countries, combined with a growing awareness of preventive healthcare measures, has created substantial market opportunities. Technological advancements have improved collagen bioavailability, making supplements more effective and appealing to consumers. The market benefits from evolving consumer preferences toward clean-label products, with customers actively seeking transparent ingredient lists and natural formulations. The rapid adoption of e-commerce platforms has transformed distribution channels, while consumers demonstrate a consistent willingness to invest in premium-quality collagen supplements. The European Food Safety Authority's regulatory framework provides essential quality assurance, building consumer trust and market stability. Manufacturers continue to innovate across various product formats, addressing specific consumer needs and preferences. The competitive landscape remains balanced, characterized by established global companies and innovative market entrants, all focusing on sustainable sourcing practices, user-friendly product formats, and scientifically validated claims to enhance their market presence.

Europe Collagen Supplements Market Trends and Insights

Growing Consumer Preference for Natural and Clean-Label Products

The European natural health ingredients market continues to expand significantly, driven by increasing consumer demand for transparent and natural supplement options . This transparency requirement extends beyond ingredient sourcing to production processes, where precision fermentation enables the development of animal-free collagen alternatives that address both ethical and safety requirements. Evonik's Vecollage Fortify L exemplifies this trend, offering a vegan collagen polypeptide that replicates human collagen type III while maintaining ethical sourcing standards and product purity. Research indicates that older Portuguese consumers demonstrate increased acceptance of clean-label products despite initial taste preferences, suggesting substantial market opportunities for reformulated collagen supplements. Marine collagen has emerged as a preferred option in the European market, offering natural clean-label profiles without religious or dietary restrictions, while providing enhanced bioavailability compared to land-based sources.

Aging Population Actively Seeking Solutions for Skin, Bone, and Joint Health

The European collagen supplements market is expanding due to the region's aging population demographic. With increasing life expectancy and a focus on healthy aging practices, the demand for collagen supplements has grown significantly, reflecting the emphasis on preventive healthcare among older adults. This demographic shift has created market opportunities as elderly consumers seek supplements for joint health, skin elasticity, and overall physical well-being. The market growth reflects the evolving healthcare preferences of Europe's senior population, who recognize the importance of nutritional supplements in maintaining their quality of life. Research supports collagen's effectiveness in addressing age-related concerns, particularly in improving skin hydration and elasticity. Market opportunities are prominent in countries with high elderly populations, as demographic forecasts indicate that 22 out of 27 EU countries will see a decrease in their working-age population (20-64 years) by 2050. Additionally, the population aged 85 and above is projected to double to 6% by 2050 and increase to nearly 8% by 2070, highlighting the growing demand for age-related healthcare products and supplements in Europe .

Complexities of Halal, Kosher, and Vegan Certifications for Supplements

The collagen supplement manufacturing industry faces substantial challenges in navigating complex certification requirements. Companies must ensure their ingredients and production processes comply with strict kosher certification standards rooted in religious laws, while simultaneously meeting halal requirements that govern animal sourcing and processing methods. Within the European Union, manufacturers encounter additional obstacles due to the regulatory fragmentation, where different member states maintain distinct certification requirements, effectively creating trade barriers and operational complexities. Marine-derived collagen has emerged as a practical solution for manufacturers, as it inherently satisfies both halal and kosher certification criteria without the religious constraints associated with pig or cattle-based sources. However, the industry's landscape is evolving with the introduction of precision fermentation technologies, exemplified by products such as Brenntag and Cambrium's NovaColl vegan collagen, which presents new certification challenges as regulatory bodies work to establish appropriate assessment frameworks for these innovative products.

Other drivers and restraints analyzed in the detailed report include:

- Increased Consumer Focus on Preventive Healthcare and Holistic Wellness

- Growing Preference for Beauty-from-Within Products

- Taste, Odor, and Texture Issues with Certain Collagen Formats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European supplement market demonstrates a clear consumer preference for powder formulations, which currently command a substantial 53.20% market share in 2025. This dominance stems from multiple factors, including manufacturing efficiency, lower production costs, and widespread consumer familiarity with powder-based products. The versatility of powder formats allows manufacturers to offer various serving sizes and blend options, making them particularly attractive for both consumers and producers in the European market landscape.

The drinks and shots segment has emerged as the most dynamic category, achieving a remarkable 9.68% CAGR through 2031. This growth reflects evolving consumer preferences toward ready-to-consume formats that offer improved nutrient absorption. A notable innovation in this space is Rohto Pharmaceutical's MOCOLA, launched in June 2025, which combines a 20ml collagen drink with vitamin tablets, following successful South Korean market trends. Traditional capsule formats continue to serve consumers who prefer conventional supplement delivery methods, while the gummy segment attracts younger demographics seeking more enjoyable consumption experiences. The addition of prebiotics to gelatin-based gummy formulations has notably enhanced their stability and shelf life, further strengthening their market position.

The Europe Collagen Supplements Market Report is Segmented by Form (Powder, Capsules, Gummies, and More), Source (Animal Based, and Marine Based), Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Stores and More), and Geography (United Kingdom, Germany, France, Italy, Spain, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shiseido Co. Ltd

- Nestle S.A.

- Everest NeoCell LLC

- Revive Naturals LLC

- Hunter & Gather Foods Ltd

- Bayer AG

- Golden Greens Organic Ltd

- Codeage LLC

- Amorepacific Corp.

- Hangzhou Nutrition Biotechnology Co. Ltd

- Aneva Nutraceuticals Ltd

- Rousselot (Darling Ingredients)

- PB Leiner (Tessenderlo Group)

- Sirio Europe

- Symrise AG

- Edible Health Ltd

- Pura Collagen Ltd

- Nitta Gelatin Inc.

- Tessenderlo Group

- On-Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer preference for natural and clean-label products

- 4.2.2 Aging population actively seeking solutions for skin, bone, and joint health

- 4.2.3 Increased consumer focus on preventive healthcare and holistic wellness

- 4.2.4 Growing preference for beauty-from-within products

- 4.2.5 Expansion of online retail and e-commerce making products more accessible

- 4.2.6 Advancements in technology and innovation enabling diverse supplement formats

- 4.3 Market Restraints

- 4.3.1 Complexities of halal, kosher, and vegan certifications for supplements

- 4.3.2 Taste, odor, and texture issues with certain collagen formats

- 4.3.3 High prices of premium collagen supplements

- 4.3.4 Difficulties maintaining consistent product quality and bioavailability

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Powder

- 5.1.2 Capsules

- 5.1.3 Gummies

- 5.1.4 Drinks and Shots

- 5.1.5 Others

- 5.2 By Source

- 5.2.1 Animal Based

- 5.2.2 Marine Based

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Pharmacies/Drug Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Specialty Stores

- 5.3.5 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 Italy

- 5.4.4 France

- 5.4.5 Spain

- 5.4.6 Netherlands

- 5.4.7 Poland

- 5.4.8 Belgium

- 5.4.9 Sweden

- 5.4.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Shiseido Co. Ltd

- 6.4.2 Nestle S.A.

- 6.4.3 Everest NeoCell LLC

- 6.4.4 Revive Naturals LLC

- 6.4.5 Hunter & Gather Foods Ltd

- 6.4.6 Bayer AG

- 6.4.7 Golden Greens Organic Ltd

- 6.4.8 Codeage LLC

- 6.4.9 Amorepacific Corp.

- 6.4.10 Hangzhou Nutrition Biotechnology Co. Ltd

- 6.4.11 Aneva Nutraceuticals Ltd

- 6.4.12 Rousselot (Darling Ingredients)

- 6.4.13 PB Leiner (Tessenderlo Group)

- 6.4.14 Sirio Europe

- 6.4.15 Symrise AG

- 6.4.16 Edible Health Ltd

- 6.4.17 Pura Collagen Ltd

- 6.4.18 Nitta Gelatin Inc.

- 6.4.19 Tessenderlo Group

- 6.4.20 On-Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK