PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937360

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937360

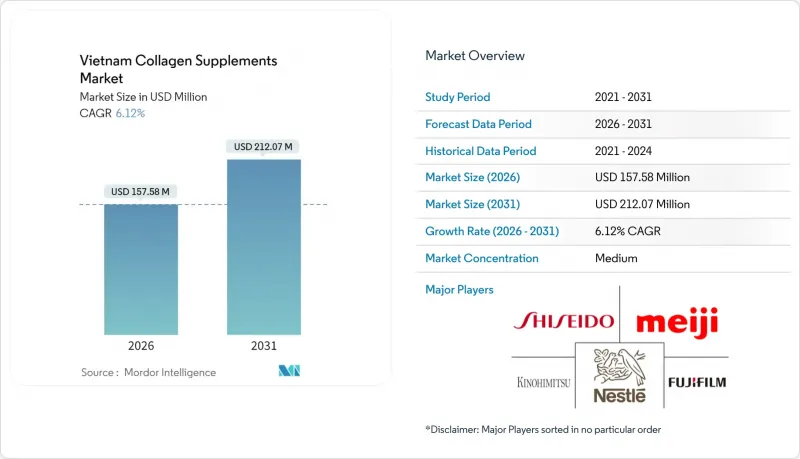

Vietnam Collagen Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam collagen supplements market size in 2026 is estimated at USD 157.58 million, growing from 2025 value of USD 148.49 million with 2031 projections showing USD 212.07 million, growing at 6.12% CAGR over 2026-2031.

Vietnam has established itself as a significant player in Southeast Asia's nutraceuticals industry, supported by increasing consumer health consciousness, improved household purchasing power, and widespread e-commerce adoption. Vietnamese consumers have evolved in their purchasing behavior, placing greater emphasis on product quality assurance and ingredient transparency rather than focusing solely on price points. The Ministry of Health's implementation of comprehensive regulatory measures in 2025, encompassing mandatory product testing protocols and enhanced e-commerce platform supervision, has created a market environment that particularly benefits established brands demonstrating robust regulatory compliance and quality control systems.

Vietnam Collagen Supplements Market Trends and Insights

Increasing awareness of collagen benefits for anti-aging and skin health

Vietnamese consumers are exhibiting a profound transformation in their purchasing patterns, demonstrating a clear preference for scientifically validated beauty supplements while progressively distancing themselves from traditional remedies. The strategic intersection of beauty-from-within trends and Vietnam's rapidly expanding middle-class demographic continues to generate robust market demand, particularly among urban female consumers aged 25-45 who demonstrate sophisticated preferences for evidence-based skincare solutions. The extensive reach of beauty influencers and healthcare professionals across diverse social media platforms has fundamentally reshaped consumer understanding and heightened awareness regarding collagen's comprehensive anti-aging benefits. This significant market evolution aligns naturally with Vietnam's deeply rooted cultural emphasis on skincare and appearance, where strategic investments in personal grooming simultaneously function as indicators of social status and represent thoughtful commitments to personal wellness and comprehensive self-care practices.

Popularity of multifunctional collagen supplements with added ingredients

Manufacturers are enhancing their product development strategies by formulating innovative collagen products that include complementary nutrients to address multiple health concerns. For instance, the partnership between Sac Ngoc Khang and Nitta Gelatin for Collagen Dipeptide incorporates Mitsubishi Corporation's Glutathione and AstaReal's Astaxanthin. This reflects the strong willingness of Vietnamese consumers to invest in premium-priced formulations that provide measurable benefits for skin health, joint function, and overall wellness. The market is witnessing a growing preference for products that cater to multiple health objectives, driven by the need to simplify daily supplement routines. Addressing this demand, Rohto Pharmaceutical launched MOCOLA, a collagen drink enriched with essential vitamins C, B6, and D. The existing regulatory framework supports such product innovations by streamlining approval processes for combination products that meet established safety standards.

Regulatory challenges and evolving compliance requirements

Vietnam's regulatory authorities are intensifying their oversight of the marketing and distribution of functional foods, with a focus on ensuring consumer safety and maintaining market integrity. This increased scrutiny has led to higher operational costs and created barriers to market entry. Foreign manufacturers face additional challenges, as they must regularly demonstrate compliance with Good Manufacturing Practices through ongoing verifications. The authorities' dedication to regulatory enforcement is evident in their detailed investigation into "Ngan Collagen" products. While ASEAN's harmonization initiatives suggest potential benefits from future standardization across the region, companies are currently allocating substantial resources to meet evolving compliance requirements. In March 2024, the FDA updated its submission protocols for collagen supplements and similar nutritional products, revising its New Dietary Ingredient Notification Procedures.

Other drivers and restraints analyzed in the detailed report include:

- Rapid growth of e-commerce and online retail channels

- Popularization of natural, clean-label, and sustainably sourced collagen

- Inconsistent quality standards among local and imported products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, powder formulations lead the market with a 43.10% share, reflecting their strong consumer appeal due to their versatility and perceived value. These formulations have gained popularity because they can be easily incorporated into beverages, smoothies, and various food preparations, allowing consumers to seamlessly integrate them into their daily routines. This adaptability has positioned powder formulations as a preferred choice for many, catering to diverse lifestyle needs and preferences.

The drinks and shots segment is projected to be the fastest-growing category, with a CAGR of 7.12% through 2031. This growth is attributed to rising consumer demand for convenience and the launch of innovative ready-to-consume products, such as Rohto's MOCOLA collagen drink, introduced in June 2025. Capsules remain in steady demand, catering to consumers who prefer traditional supplement formats. In contrast, gummies are experiencing notable growth, particularly among younger demographics, due to their appealing and enjoyable consumption experience, making them a prominent choice in this segment.

In 2025, animal-based collagen continues to dominate the market, accounting for 81.25% of the total share. This dominance highlights its strong consumer acceptance and well-established efficacy profiles. Bovine and marine sources remain the primary contributors to the supply chain, with marine collagen gaining increasing preference. Its superior absorption capabilities and reduced allergenicity make it a favored choice among consumers seeking effective and safer options. These factors reinforce the stronghold of animal-based collagen in the market landscape.

On the other hand, plant-based collagen alternatives are witnessing significant growth, with a compound annual growth rate (CAGR) of 6.92%. This surge is driven by rising consumer awareness around sustainability and the need to accommodate dietary restrictions. The industry's recognition of this growing potential is evident in initiatives like Evonik's partnership with Jland Biotech to develop vegan collagen. Such collaborations signal a strategic shift toward catering to the evolving preferences of environmentally conscious and health-focused consumers.

The Vietnam Collagen Supplement Market Report is Segmented by Form (Powder, Gummies, Capsules, and More), Source (Animal-Based, and Plant-Based), End-User (Men, and Women) and Distribution Channels (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Specialty Stores and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle SA

- Shiseido Co., Ltd.

- Meiji Holdings Co., Ltd.

- Fujifilm Holdings Corp.

- Kinohimitsu

- Zint Nutrition

- Applied Nutrition

- Heivy

- Nucos Cosmetics

- Nature's Way

- Blackmores Ltd.

- DHC Corporation

- Vital Proteins LLC

- Wellnex Life

- Youtheory (Nutrawise)

- Orihiro Co., Ltd.

- Swisse Wellness

- Sante Health Vietnam

- Thai Dương Pharma

- Vinh Wellness

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing awareness of collagen benefits for anti-aging and skin health

- 4.2.2 Popularity of multifunctional collagen supplements with added ingredients

- 4.2.3 Rapid growth of e-commerce and online retail channels

- 4.2.4 Popularization of natural, clean-label, and sustainably sourced collagen

- 4.2.5 Growing trend toward personalized nutrition and functional food integration

- 4.2.6 Demand for locally produced and trusted Vietnamese collagen products

- 4.3 Market Restraints

- 4.3.1 Regulatory challenges and evolving compliance requirements

- 4.3.2 Inconsistent quality standards among local and imported products

- 4.3.3 Religious or dietary restrictions affecting ingredient acceptance

- 4.3.4 Lack of extensive clinical trials or localized efficacy data

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Powder

- 5.1.2 Gummies

- 5.1.3 Capsules

- 5.1.4 Drinks and Shots

- 5.1.5 Others

- 5.2 By Source

- 5.2.1 Animal-Based

- 5.2.2 Plant-Based

- 5.3 By End-User

- 5.3.1 Men

- 5.3.2 Women

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Pharmacies/Drug Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Stores

- 5.4.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Shiseido Co., Ltd.

- 6.4.3 Meiji Holdings Co., Ltd.

- 6.4.4 Fujifilm Holdings Corp.

- 6.4.5 Kinohimitsu

- 6.4.6 Zint Nutrition

- 6.4.7 Applied Nutrition

- 6.4.8 Heivy

- 6.4.9 Nucos Cosmetics

- 6.4.10 Nature's Way

- 6.4.11 Blackmores Ltd.

- 6.4.12 DHC Corporation

- 6.4.13 Vital Proteins LLC

- 6.4.14 Wellnex Life

- 6.4.15 Youtheory (Nutrawise)

- 6.4.16 Orihiro Co., Ltd.

- 6.4.17 Swisse Wellness

- 6.4.18 Sante Health Vietnam

- 6.4.19 Thai Dương Pharma

- 6.4.20 Vinh Wellness

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK