PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937358

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937358

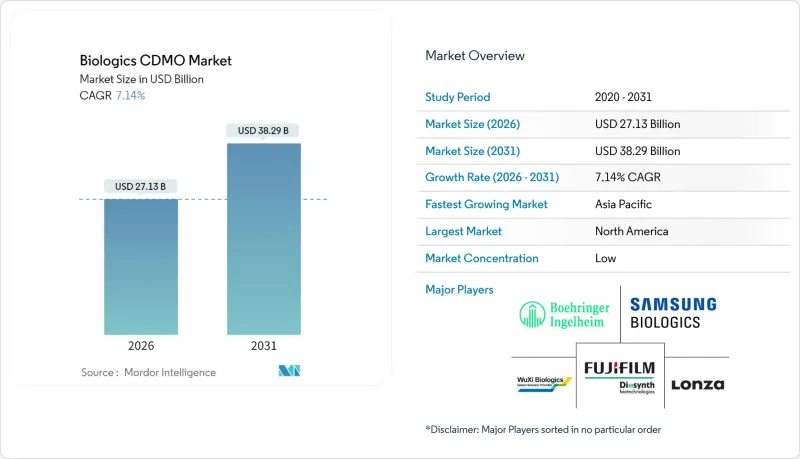

Biologics CDMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The biologics CDMO market was valued at USD 25.32 billion in 2025 and estimated to grow from USD 27.13 billion in 2026 to reach USD 38.29 billion by 2031, at a CAGR of 7.14% during the forecast period (2026-2031).

Robust demand for outsourced capacity, rising complexity of next-generation therapeutics, and mounting capital requirements for in-house facilities continue to steer sponsors toward specialized partners. Uptake of continuous manufacturing and single-use technologies is lifting operational agility, while full-service providers are broadening analytical, regulatory, and fill-finish offerings to capture a larger share of the biologics CDMO market. Expansionary moves-such as Samsung Biologics' 2024 achievement of full utilization across 362,000 L of bioreactors and Lonza's USD 1.2 billion acquisition of Genentech's Vacaville plant-signal tightening global capacity and intensifying competition. Regional dynamics add another growth layer: North America leads on revenue, but Asia-Pacific is posting the fastest gains thanks to pro-manufacturing policy incentives in China, South Korea, and India.

Global Biologics CDMO Market Trends and Insights

Aging population and chronic-disease pipeline expansion

Rising life expectancy is sharply increasing the prevalence of oncology, autoimmune, and metabolic disorders, driving long-run demand for advanced biologics. The global population aged 60+ will double to 2.1 billion by 2050, putting consistent pressure on healthcare systems and triggering accelerated therapeutic innovation. Novo Nordisk's USD 4.1 billion US fill-finish project highlights sponsor moves to ensure secure supply for high-volume injectables that serve older cohorts. CDMO alliances allow innovators to compress launch timelines and mitigate capital exposure, reinforcing steady growth of the biologics CDMO market.

Capital-intensive biologics innovation driving outsourcing

State-of-the-art antibody-drug conjugate or multispecific antibody plants can cost in excess of USD 1 billion. Such outlays strain sponsor balance sheets, encouraging transfer of manufacturing risk to partners offering GMP-compliant capacity at scale. Samsung Biologics secured USD 13 billion in long-term production contracts with 16 of the top 20 pharma firms by providing turnkey capability without client capex. Ongoing material cost inflation, especially for single-use equipment, further tilts economic logic toward outsourcing.

Evolving global GMP and comparability requirements

New FDA guidance on batch uniformity and updated EU legislation are escalating validation and documentation workloads, requiring CDMOs to devote 12-15% of revenue to quality assurance, well above traditional pharma norms. Heightened scrutiny around biosimilar comparability can prolong project timelines, tempering near-term momentum of the biologics CDMO market.

Other drivers and restraints analyzed in the detailed report include:

- SME biotech preference for asset-light CDMO partnerships

- Continuous bioprocessing accelerates flexible capacity

- Persistent capacity bottlenecks lengthen lead-times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fill-finish and packaging services captured 34.96% biologics CDMO market share in 2025, underlining the sterility and regulatory stakes of final drug-product preparation. Growth is reinforced by big-ticket investments such as Lonza's CHF 500 million Swiss facility. Parallel demand for robust release testing is accelerating analytical and QC uptake, which is projected to post a 12.24% CAGR through 2031.

Integrated developers increasingly bundle process development, GMP production, analytical, and regulatory support to minimize hand-offs. Eurofins BioPharma's network of 45 GMP labs exemplifies the trend toward geographically diversified, full-scope testing that shortens release cycles. This integrative model embeds stickier relationships and positions suppliers to harvest incremental share of the biologics CDMO market.

Mammalian platforms generated 61.68% of biologics CDMO market size in 2025, reflecting their necessity for monoclonal antibodies and other glycosylation-dependent drugs. Samsung's scale-up to 784,000 L underscores continued investment in high-titer CHO production.

Microbial systems are advancing on an 8.22% CAGR tailwind owing to simplified process trains and cost advantages. Thermo Fisher's single-use fermentors reduce contamination risk and shorten turnovers, broadening microbial applicability to peptide and oligonucleotide therapeutics. The resulting flexibility attracts emerging sponsors seeking economical early-stage production.

The Biologics CDMO Market Report is Segmented by Service Type (Process Development, GMP Manufacturing, and More), Type (Mammalian, Microbial), Product Type (Biologics [Monoclonal Antibodies, Recombinant Proteins, and More], Biosimilars), Scale (Pre-Clinical and Clinical, Commercial), End-User (Small/Mid-size Biotech, Large Pharma), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with 34.12% of 2025 revenue, propelled by dense innovation ecosystems and regulatory support for advanced manufacturing. FDA guidance on continuous processing and expedited review pathways fosters early adoption curves that benefit local CDMOs. Large-scale investments such as Novo Nordisk's USD 4.1 billion North Carolina plant reinforce the region's installed base.

Europe offers a sophisticated framework dominated by Germany, the United Kingdom, and Switzerland. Lonza's CHF 500 million fill-finish hub in Stein exemplifies the continent's specialized, high-margin focus. Updated EMA biologics guidelines simplify technology transfers and sustain steady inflows of both domestic and trans-Atlantic work. Emerging projects such as Biosynth's German bioconjugation expansion underscore persistent demand for niche expertise.

Asia-Pacific is the growth engine, set to post a 10.48% CAGR through 2031 on the back of aggressive capacity builds and public-sector incentives. Samsung Biologics' expansion to 784,000 L and SK pharmteco's USD 260 million Sejong project typify South Korea's strategy to become a global biologics powerhouse. China's streamlined NMPA approval procedures and India's infrastructure grants are equally pivotal in channeling sponsor projects into the region.

- Lonza Group

- Samsung Biologics

- WuXi Biologics

- Boehringer Ingelheim BioXcellence

- Catalent

- Fujifilm Diosynth Biotechnologies

- AGC Biologics

- Thermo Fisher Scientific (Patheon)

- AbbVie Contract Manufacturing

- Rentschler Biopharma

- Celonic

- Binex

- Sandoz

- Parexel

- ICON plc

- Recipharm - Arranta Bio

- Toyobo

- Emergent BioSolutions CDMO

- Porton Biologics

- Just-Evotec Biologics

- Grifols Contract Manufacturing

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population and chronic-disease pipeline expansion

- 4.2.2 Capital-intensive biologics innovation driving outsourcing

- 4.2.3 SME biotech preference for asset-light CDMO partnerships

- 4.2.4 Continuous bioprocessing accelerates flexible capacity

- 4.2.5 Single-use technologies compress CAPEX and timelines

- 4.2.6 Cell and gene therapy manufacturing spill-over to biologics CDMOs

- 4.3 Market Restraints

- 4.3.1 Evolving global GMP and comparability requirements

- 4.3.2 Persistent capacity bottlenecks lengthen lead-times

- 4.3.3 Captive facility expansion by big pharma reduces outsourcing

- 4.3.4 Resin and single-use component supply fragility

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Process Development

- 5.1.2 GMP Manufacturing

- 5.1.3 Fill-Finish and Packaging

- 5.1.4 Analytical and QC Services

- 5.1.5 Other Service Type

- 5.2 By Type

- 5.2.1 Mammalian

- 5.2.2 Microbial

- 5.3 By Product Type

- 5.3.1 Biologics

- 5.3.1.1 Monoclonal Antibodies

- 5.3.1.2 Recombinant Proteins

- 5.3.1.3 Vaccines

- 5.3.1.4 Antisense / Molecular Therapy

- 5.3.1.5 Other Biologics

- 5.3.2 Biosimilars

- 5.3.1 Biologics

- 5.4 By Scale

- 5.4.1 Pre-clinical and Clinical

- 5.4.2 Commercial

- 5.5 By End-user

- 5.5.1 Small / Mid-size Biotech

- 5.5.2 Large Pharma

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Lonza Group

- 6.4.2 Samsung Biologics

- 6.4.3 WuXi Biologics

- 6.4.4 Boehringer Ingelheim BioXcellence

- 6.4.5 Catalent

- 6.4.6 Fujifilm Diosynth Biotechnologies

- 6.4.7 AGC Biologics

- 6.4.8 Thermo Fisher Scientific (Patheon)

- 6.4.9 AbbVie Contract Manufacturing

- 6.4.10 Rentschler Biopharma

- 6.4.11 Celonic

- 6.4.12 Binex

- 6.4.13 Sandoz

- 6.4.14 Parexel

- 6.4.15 ICON plc

- 6.4.16 Recipharm - Arranta Bio

- 6.4.17 Toyobo

- 6.4.18 Emergent BioSolutions CDMO

- 6.4.19 Porton Biologics

- 6.4.20 Just-Evotec Biologics

- 6.4.21 Grifols Contract Manufacturing

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK