PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937392

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937392

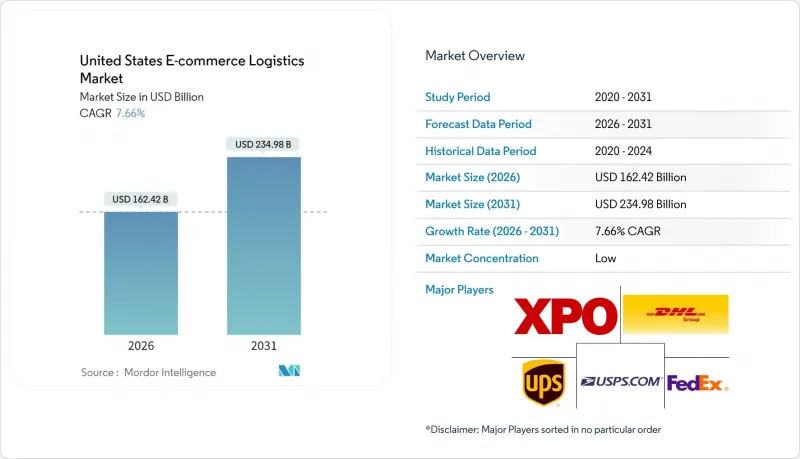

United States E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States E-commerce Logistics Market is expected to grow from USD 150.86 billion in 2025 to USD 162.42 billion in 2026 and is forecast to reach USD 234.98 billion by 2031 at 7.66% CAGR over 2026-2031.

Steady expansion reflects digital commerce's rise from a convenience option into the primary growth engine for logistics demand. Intensifying consumer expectations for instant delivery, a surge of lightweight parcel volumes, and widespread warehouse automation are together redefining cost structures and service models across the ecosystem. Regulatory shifts such as the end of the USD 800 de-minimis exemption for Chinese-origin goods are already prompting foreign sellers to hold inventory domestically, injecting fresh volume into fulfillment networks. Meanwhile, labor shortages, higher urban warehouse rents, and parcel-yield dilution from ultralight orders temper profit margins but accelerate innovation in robotics and data-driven route optimization.

United States E-commerce Logistics Market Trends and Insights

Dominance of B2C Parcel Volumes

Direct-to-consumer sales now outnumber business freight, forcing carriers to re-engineer networks built for pallets into systems tuned for millions of light parcels each day. High delivery density in metro corridors lets algorithms cluster stops, curbing route mileage and lifting driver productivity. Large players continue to automate sortation to meet traceability mandates and rising return flows, while smaller operators struggle with the administrative burden of consumer safety documentation. Scale, data integration, and reverse-logistics capability therefore confer durable competitive advantages.

Same-/Next-Day Delivery Expectations

Consumers consistently choose sellers promising shipment in 24 hours or less, letting retailers apply premium fees that offset the capital required for distributed inventory. Same-day viability hinges on high order density and advanced predictive analytics that stage popular SKUs inside urban micro-fulfillment nodes. Providers wield AI routing engines to combine multiple drops per run, slashing last-mile cost and protecting margins even when basket value dips. As coverage spreads to first-tier suburbs, delivery speed becomes a top-three brand selection criterion for online buyers.

Supply-Chain and Labor Disruptions

A shortage of around 330,000 truck drivers and warehouse turnover exceeding 40% keeps capacity tight and wages elevated. Strikes, extreme weather, or port congestion propagate swiftly through densely scheduled parcel networks, triggering surcharges and service deterioration. Automating repetitive tasks and cross-training crews provide partial risk mitigation, yet recruitment remains a structural challenge.

Other drivers and restraints analyzed in the detailed report include:

- Warehouse Automation and Robotics Adoption

- De-Minimis Reform Driving Chinese In-Market Stocking

- Escalating Urban Warehouse Rents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation maintained a 65.40% share of the United States e-commerce logistics market in 2025, underscoring the indispensable role of national parcel networks in covering 9.8 million km of public roads. Although warehousing and fulfillment are tracking a 6.12% CAGR the fastest among service categories linehaul and last-mile services carry the bulk of expenditure and growth visibility. Autonomous route optimization, electric-fleet rollouts, and API-integrated visibility platforms are lowering variable cost per package while shaving delivery windows to under 24 hours in most metro areas. Robust transportation activity also drives demand for in-line value-added services such as kitting and custom labeling, which fetch price premiums of 5-12%.

A growing share of shippers now demands multimodal solutions that reconcile cost, carbon, and speed targets within a single managed contract. As the United States e-commerce logistics market continues to absorb cross-border flows redirected into domestic stockholding, integrated service providers that couple warehousing capacity with controlled dedicated fleets own a defensible niche. Compliance with Department of Transportation safety standards and emerging state emissions rules is spurring telematics adoption and predictive maintenance scheduling, ensuring fleet uptime during surge events.

B2C fulfillment generated 72.30% of 2025 revenue; however, C2C marketplaces are on course for a 5.68% CAGR, reflecting the ascent of social-commerce channels and peer-to-peer resale apps. C2C consignments carry unique service needs, including identity verification, packaging guidance, and dispute resolution facilitation, prompting specialized 3PL solutions. End-to-end integrations with payment gateways and buyer-protection programs help shrink cycle times from seller listing to buyer delivery, improving marketplace liquidity.

Large direct-to-consumer brands are meanwhile deepening outsource partnerships to improve agility during new-product surges. Hybrid fulfillment models that pool C2C and B2C volume through shared micro-hubs deliver network density advantages. As a result, the United States e-commerce logistics market sees rising demand for flexible capacity contracts that ratchet space and labor commitments up or down on 24-hour notice.

The United States E-Commerce Logistics Market Report is Segmented by Service (Transportation, Warehousing & Fulfilment, and More), Business Model (B2C, B2B, C2C), Destination (Domestic, Cross-Border), Delivery Speed (Same-Day, Next-Day, Standard, Others), Product Category (Foods & Beverages, Personal & Household Care, Fashion & Lifestyle, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- United Parcel Service, Inc

- FedEx

- USPS

- XPO Logistics

- DHL

- DSV Solutions

- GEODIS

- Kuehne + Nagel

- C.H. Robinson

- CEVA Logistics

- Pitney Bowes

- OnTrac (formerly LaserShip)

- ShipBob

- ShipMonk

- Flexe

- Red Stag Fulfillment

- DSV Solutions

- Saddle Creek Logistics

- Rakuten Super Logistics

- Kenco Logistics Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Dominance of B2C parcel volumes

- 4.2.2 Same-/next-day delivery expectations

- 4.2.3 Warehouse automation and robotics adoption

- 4.2.4 De-minimis reform driving Chinese in-market stocking

- 4.2.5 Retail-media monetization of fulfilment data

- 4.2.6 Expansion of dark-store micro-fulfilment networks

- 4.3 Market Restraints

- 4.3.1 Supply-chain and labor disruptions

- 4.3.2 Escalating urban warehouse rents

- 4.3.3 Parcel-yield dilution from lightweight orders

- 4.3.4 AI-enabled returns fraud escalation

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Demand and Supply Analysis

- 4.8 Industry Attractiveness

- 4.8.1 Porter's Five Forces

- 4.8.2 Threat of New Entrants

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Bargaining Power of Suppliers

- 4.8.5 Threat of Substitutes

- 4.8.6 Competitive Rivalry

- 4.9 Reverse / Return Logistics Insights

- 4.10 Impact of Geo-Political Events on Supply Chain Shifts

5 Market Size and Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing and Fulfilment

- 5.1.3 Value-Added Services (Labelling, Packaging, Kitting)

- 5.1.1 Transportation

- 5.2 By Business Model

- 5.2.1 B2C

- 5.2.2 B2B

- 5.2.3 C2C

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 Cross-border (international)

- 5.4 By Delivery Speed

- 5.4.1 Same-day (less than 24 h)

- 5.4.2 Next-day (24-48 h)

- 5.4.3 Standard (3-5 days)

- 5.4.4 Others (more than 5 days)

- 5.5 By Product Category

- 5.5.1 Foods and Beverages

- 5.5.2 Personal and Household Care

- 5.5.3 Fashion and Lifestyle (accessories, apparel, footwear)

- 5.5.4 Furniture

- 5.5.5 Consumer Electronics and Household Appliances

- 5.5.6 Other Products

- 5.6 By U.S. Region

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 United Parcel Service, Inc

- 6.4.2 FedEx

- 6.4.3 USPS

- 6.4.4 XPO Logistics

- 6.4.5 DHL

- 6.4.6 DSV Solutions

- 6.4.7 GEODIS

- 6.4.8 Kuehne + Nagel

- 6.4.9 C.H. Robinson

- 6.4.10 CEVA Logistics

- 6.4.11 Pitney Bowes

- 6.4.12 OnTrac (formerly LaserShip)

- 6.4.13 ShipBob

- 6.4.14 ShipMonk

- 6.4.15 Flexe

- 6.4.16 Red Stag Fulfillment

- 6.4.17 DSV Solutions

- 6.4.18 Saddle Creek Logistics

- 6.4.19 Rakuten Super Logistics

- 6.4.20 Kenco Logistics Services

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment