PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937395

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937395

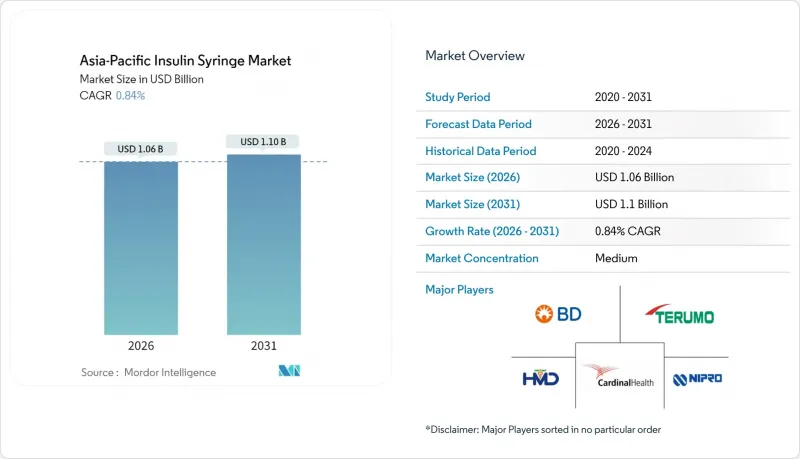

Asia-Pacific Insulin Syringe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific insulin syringes market size in 2026 is estimated at USD 1.06 billion, growing from 2025 value of USD 1.05 billion with 2031 projections showing USD 1.10 billion, growing at 0.84% CAGR over 2026-2031.

Rising diabetes prevalence, expanded reimbursement for pen-averse patients, CGM-guided basal-bolus protocols and safety-engineered innovations underpin demand, while pen-device cannibalization, single-use-plastic legislation and flat pricing temper overall growth. Competitive intensity remains moderate as Becton Dickinson, Novo Nordisk and Terumo defend share against cost-competitive regional players focused on low-dead-space and needlestick-prevention features. Digital pharmacies proliferate across tier-2 and tier-3 cities, mitigating stock-outs and enabling direct-to-patient fulfillment at lower logistics cost. Environmental mandates accelerate R&D into recyclable or biodegradable resin blends, adding compliance costs but fostering premium positioning for eco-conscious brands.

Asia-Pacific Insulin Syringe Market Trends and Insights

Growing Diabetes Prevalence & Insulin-Dependent Patients

Type 1 incidence reached 4.9 cases per 100,000 in India during 2025, while obesity-linked Type 2 keeps rising, sustaining syringe demand even as pens gain favor. Aging cohorts in Japan and Australia require multiple daily injections, and emerging economies expand coverage for newly diagnosed populations, prolonging relevance of traditional syringes. Precision dosing for mixed insulin regimens makes 0.3 mL and 0.5 mL volumes indispensable. Providers favor syringes for complex titration where disposable pens lack fine-scale graduations. Long-term demand thus persists despite low headline growth.

National Reimbursement Expansion for Pen-Averse Patients

China's NVBP cut median insulin prices 42.08%, lowering affordability thresholds from 1.63 to 0.68 days' wage and broadening access to conventional syringes for cost-sensitive users. India and Japan replicate centralized tenders, channeling savings toward pediatric and geriatric cohorts needing flexible dosing. Programs especially benefit gestational diabetes cases requiring temporary therapy. Policy momentum through 2027 supports the Asia-Pacific insulin syringes market by cushioning out-of-pocket costs in low-income groups. Spillover to ASEAN through regional trade pacts amplifies volume upside.

Pen-Device Cannibalization of Syringe Volumes

Domestic Indian makers captured 25% of national insulin revenue by pushing affordable pens that grew 13% YoY in 2025, signaling permanent share shift away from syringes. Japanese endocrinologists now recommend pens as first-line due to dosing accuracy and lower social stigma, suppressing hospital reorder frequencies for 30G syringes. As GLP-1 injectables eclipse human insulin, pen-optimized cartridges gain regulatory and marketing support, further cannibalizing legacy volumes across urban APAC by late decade.

Other drivers and restraints analyzed in the detailed report include:

- Sharp Increase in CGM-Guided Basal-Bolus Therapy Scripts

- Surge in Low-Dead-Space Safety Syringes for Hospitals

- Environmental Legislation on Single-Use Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 0.5 mL format held 45.67% of Asia-Pacific insulin syringes market share in 2025, reflecting versatility for adult basal-bolus regimens. Asia-Pacific insulin syringes market size for 0.5 mL units is projected to edge from USD 484 million in 2026 to USD 491 million by 2031, growing 0.28% annually. Meanwhile 0.3 mL demand grows 1.22% CAGR, underpinned by gestational and pediatric dosing needs.

Manufacturers invest in tighter tolerance molding and siliconized stoppers to maintain +-1 IU accuracy at lower volumes, a critical requirement for neonatal clinics in India and Thailand. Educational outreach via maternity hospitals normalizes smaller barrels, supporting penetration even in cost-sensitive provinces. Although 1 mL syringes remain necessary for insulin-resistant Type 2 cases, their share plateaus amid pen substitution. Specialty "others" formats serve diluted insulin research and retain niche relevance.

The 30G segment commanded 38.35% market share in 2025 and contributes USD 407 million to Asia-Pacific insulin syringes market size, yet 31G & above variants are forecast to climb 1.39% CAGR to 2031. Consumer surveys link thinner needles with 12% higher adherence at 12-month follow-up in Korea.

Investment in micro-taper grinding and electropolishing delivers 15% lower penetration force, matching pen-needle comfort benchmarks. Supply chains shift to higher gauge stainless wire, tightening demand for 28G-29G lines primarily used for viscous insulin analogs. As thinner gauges gain regulatory clearance for sub-cutaneous integrity, hospitals transition bulk contracts to reduce patient refusals and accelerate discharge throughput.

The Asia-Pacific Insulin Syringes Market Report is Segmented by Product Type (0. 3 ML, 0. 5 ML, 1 ML, and Others), Needle Gauge (28G, 29G, and More), Diabetes Type (Type 1, Type 2, and Gestational), End User (Hospitals & Clinics, Home Healthcare, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (China, India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beckton Dickinson

- Novo Nordisk

- Terumo

- Nipro

- Owen Mumford

- Hindustan Syringes & Medical Devices Ltd (HMD)

- Retractable Technologies

- Ultimed

- Allison Medical Inc.

- Smiths Medical (Tr-K Smiths Group)

- Ypsomed

- B. Braun

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing diabetes prevalence & insulin-dependent patients

- 4.2.2 National reimbursement expansion for pen-averse patients

- 4.2.3 Sharp increase in CGM-guided basal-bolus therapy scripts

- 4.2.4 Surge in low-dead-space safety syringes for hospitals

- 4.2.5 Local contract sterilisation capacity build-out

- 4.2.6 Generational shift to thinner-gauge, pain-reduction designs

- 4.3 Market Restraints

- 4.3.1 Pen-device cannibalisation of syringe volumes

- 4.3.2 Frequent stock-outs in tier-3 city pharmacies

- 4.3.3 Environmental legislation on single-use plastics

- 4.3.4 Patent cliff on BD "Micro-Fine+" design lowering ASPs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Product Type

- 5.1.1 0.3 mL

- 5.1.2 0.5 mL

- 5.1.3 1 mL

- 5.1.4 Other Product Types

- 5.2 By Needle Gauge

- 5.2.1 28G

- 5.2.2 29G

- 5.2.3 30G

- 5.2.4 31G & Above

- 5.3 By Diabetes Type

- 5.3.1 Type 1 Diabetes

- 5.3.2 Type 2 Diabetes

- 5.3.3 Gestational Diabetes

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Home Healthcare

- 5.4.3 Ambulatory Surgical Centres

- 5.4.4 Other End Users

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 Asia-Pacific

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Australia

- 5.6.6 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company (BD)

- 6.3.2 Novo Nordisk A/S

- 6.3.3 Terumo Corporation

- 6.3.4 Nipro Corporation

- 6.3.5 Owen Mumford Ltd

- 6.3.6 Hindustan Syringes & Medical Devices Ltd (HMD)

- 6.3.7 Retractable Technologies Inc.

- 6.3.8 UltiMed Inc.

- 6.3.9 Allison Medical Inc.

- 6.3.10 Smiths Medical (Tr-K Smiths Group)

- 6.3.11 Ypsomed Holding AG

- 6.3.12 B. Braun Melsungen AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment