PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937407

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937407

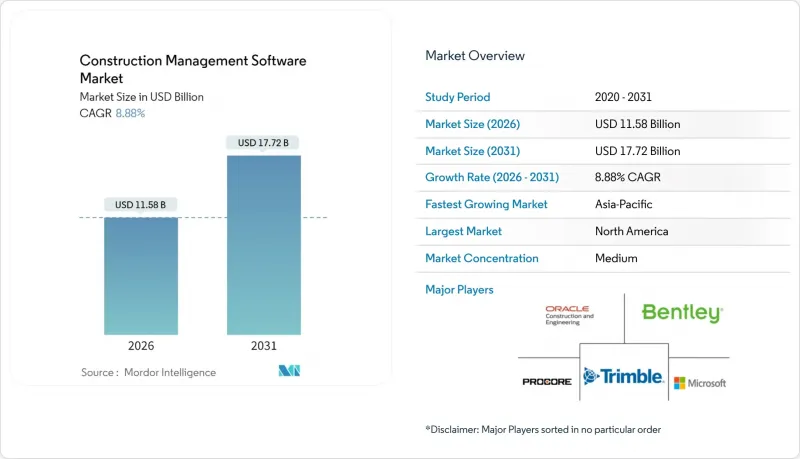

Construction Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The construction management software market is expected to grow from USD 10.64 billion in 2025 to USD 11.58 billion in 2026 and is forecast to reach USD 17.72 billion by 2031 at 8.88% CAGR over 2026-2031.

Firms are shifting capital toward integrated, cloud-based platforms to counter labor shortages, margin pressure, and rising project complexity. Remote work habits that emerged during the pandemic continue to be influential, making real-time collaboration tools indispensable. Vendors offering subscription pricing and robust cybersecurity controls are gaining ground as Department of Defense requirements become more stringent. Meanwhile, artificial-intelligence modules that automate scheduling and cost forecasting continue to attract both contractors and public owners, driving sustained demand across regions.

Global Construction Management Software Market Trends and Insights

Cloud-First Digital-Transformation Budgets Expanding Post-COVID

Construction firms redirected capital toward cloud solutions once pandemic disruptions highlighted the value of remote access. CMiC reports that cloud platforms improved schedule visibility and sped decision-making for dispersed teams. Mid-market contractors, traditionally dependent on assorted point tools, now favor unified suites that reduce data duplication. Subscription pricing reduces upfront costs, while automated updates maintain system security without requiring an in-house IT staff. As a result, the construction management software market is experiencing a steady shift away from on-premises hosting toward scalable public cloud environments.

Digital-Twin Adoption for Risk-Free Pre-Construction Simulation

Digital twins enable contractors to test build sequences virtually and identify clashes before fieldwork begins. A 2024 study in the Buildings Journal confirms that digital-twin models streamline constructability reviews and later support predictive maintenance during operations. Leighton Asia employed this approach during the Hong Kong airport expansion, integrating real-time sensor data to minimize rework and streamline documentation tasks. Although data management and cybersecurity remain obstacles, the method's contribution to risk mitigation is compelling enough to sustain long-term adoption-especially on complex transportation and energy projects.

Contractor Margin Pressures Delaying IT Capital Expenditure

Inflation and interest-rate volatility continue to squeeze profit margins, prompting some firms to postpone software purchases. Construction Business Owner's 2025 outlook notes that high financing costs persist in the multifamily segment despite GDP recovery, discouraging discretionary IT spending. Smaller trade contractors find large-scale implementations to be risky, even when subscription plans are available. Nonetheless, the spread of consumption-based pricing and the tangible savings from cloud deployment are narrowing this adoption gap.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled Progress Analytics Cutting Re-Work Costs

- Government "Construction-Tech" Tax Incentives Driving Adoption

- Data-Silo & Interoperability Issues Among Legacy Point Solutions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment held a 62.35% market share of the construction management software market in 2025, with revenue driven by the need for access to project data from anywhere. The segment is advancing at a 12.08% CAGR, outpacing on-premises alternatives and reinforcing the view that remote collaboration has become permanent. Contractors cite lower maintenance costs and automatic security updates as decisive advantages in vendor evaluations, particularly in North America, where Cybersecurity Maturity Model Certification requirements now apply to federal jobs.

On-premises solutions continue in highly regulated defense and utility projects that require on-site data control. Even so, most large enterprises are piloting hybrid architectures whereby core financial data remains local, but daily field documentation resides in the cloud. Trimble's January 2025 tiered subscription bundles illustrate how vendors nudge customers along the migration path by linking hardware leasing with cloud-service entitlements.

Project Management & Scheduling delivered 38.05% of the construction management software market size in 2025, supported by universal demand for Gantt charts, cost tracking, and RFIs. AI-Driven Progress Analytics, the fastest-growing application, is on a 14.12% CAGR trajectory through 2031. Early adopters report double-digit reductions in rework-related expenses after deploying image-recognition engines that benchmark field status against BIM models.

Cost Accounting and Estimation tools remain integral for bid accuracy, while mobile-first Field Service modules gain traction among specialty trades. Safety and Quality applications are resurging because insurers offer premium discounts when digital safety audits are in place. Vendors increasingly bundle these modules under one interface; Trimble's "LiveCount" auto-symbol detection in 2024 extended AI to structural detailing and further blurred historic application boundaries.

Construction Management Software Market Report is Segmented by Deployment (On-Premises, and Cloud), Application (Project Management and Scheduling, and More), End-User (General Contractors, Owners and Developers and More), Project Size (Small (< USD 50 M), Mid-Size (USD 50 M- 500 M), and More), and Geography (North America, Europe, South America, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 32.10% of the construction management software market revenue in 2025, reflecting mature digital infrastructures and favorable tax incentives, such as Section 179 deductions. Federal funding packages for highways and energy upgrades specify digital delivery requirements, further cementing the use of platforms. The U.S. Department of Transportation's grant program is accelerating the adoption of technology among state agencies that previously relied on spreadsheets.

Europe registers steady growth as carbon-reduction mandates spur the uptake of BIM modules. The region's stringent privacy laws have led to a preference for hybrid deployments, but large contractors still prioritize cloud systems for cross-border collaboration. Corporate sustainability reporting rules that take effect in 2025 will likely encourage even hesitant builders to adopt data-rich software that captures embodied-carbon metrics.

The Asia-Pacific region is the fastest-growing territory, with a 10.98% CAGR. Governments in Australia, Singapore, and Japan subsidize training for digital construction tools, while rising urbanization intensifies competition among contractors to deliver projects on time and on budget. Saudi Arabia's NEOM and Qatar's rail expansions showcase the Middle East's appetite for advanced project controls. Nemetschek and Nesma Infrastructure agreed in 2024 to promote open-platform standards in the Gulf, foreshadowing broader regional momentum.

- Oracle Corporation (Construction & Engineering GBU)

- Bentley Systems Incorporated

- Procore Technologies Inc.

- Microsoft Corporation

- Trimble Inc.

- Autodesk Inc.

- Constellation Software Inc.

- Intuit Inc.

- Nemetschek SE

- Roper Technologies Inc. (Viewpoint)

- Jonas Software USA LLC (Jonas Construction)

- Buildertrend Solutions Inc.

- CMiC Inc.

- The Sage Group plc (Sage CRE)

- STACK Construction Technologies Inc.

- CoConstruct LLC

- Fieldwire Ltd. (Hilti Group)

- e-Builder Inc. (Trimble)

- PlanGrid Inc. (Autodesk)

- Bluebeam Inc. (Nemetschek)

- Aconex Limited (Oracle)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first digital-transformation budgets expanding post-COVID

- 4.2.2 Digital-twin adoption for risk-free pre-construction simulation

- 4.2.3 AI-enabled progress analytics cutting re-work costs

- 4.2.4 Government "construction-tech" tax incentives (US 179 + EU CCUS)

- 4.2.5 Skilled-labour scarcity forcing productivity software uptake

- 4.2.6 Sustainability and embodied-carbon mandates driving BIM modules

- 4.3 Market Restraints

- 4.3.1 Contractor margin pressures delaying IT cap-ex

- 4.3.2 Data-silo and interoperability issues among legacy point solutions

- 4.3.3 Cyber-security and data-sovereignty concerns on multi-tenant clouds

- 4.3.4 Low digital readiness of small & micro-contractors (< 20 staff)

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premises

- 5.1.2 Cloud

- 5.2 By Application

- 5.2.1 Project Management and Scheduling

- 5.2.2 Cost Accounting and Estimation

- 5.2.3 Field Service and Site Operations

- 5.2.4 Safety, Quality and Reporting

- 5.2.5 Design/BIM Integration

- 5.3 By End-User

- 5.3.1 General Contractors

- 5.3.2 Owners and Developers

- 5.3.3 Architects and Engineers

- 5.3.4 Sub-contractors and Specialty Trades

- 5.3.5 Government and Infrastructure Agencies

- 5.4 By Project Size

- 5.4.1 Small (< USD 50 M)

- 5.4.2 Mid-size (USD 50 M-500 M)

- 5.4.3 Large (> USD 500 M)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation (Construction & Engineering GBU)

- 6.4.2 Bentley Systems Incorporated

- 6.4.3 Procore Technologies Inc.

- 6.4.4 Microsoft Corporation

- 6.4.5 Trimble Inc.

- 6.4.6 Autodesk Inc.

- 6.4.7 Constellation Software Inc.

- 6.4.8 Intuit Inc.

- 6.4.9 Nemetschek SE

- 6.4.10 Roper Technologies Inc. (Viewpoint)

- 6.4.11 Jonas Software USA LLC (Jonas Construction)

- 6.4.12 Buildertrend Solutions Inc.

- 6.4.13 CMiC Inc.

- 6.4.14 The Sage Group plc (Sage CRE)

- 6.4.15 STACK Construction Technologies Inc.

- 6.4.16 CoConstruct LLC

- 6.4.17 Fieldwire Ltd. (Hilti Group)

- 6.4.18 e-Builder Inc. (Trimble)

- 6.4.19 PlanGrid Inc. (Autodesk)

- 6.4.20 Bluebeam Inc. (Nemetschek)

- 6.4.21 Aconex Limited (Oracle)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment