PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937412

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937412

United States Barbeque Grill - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

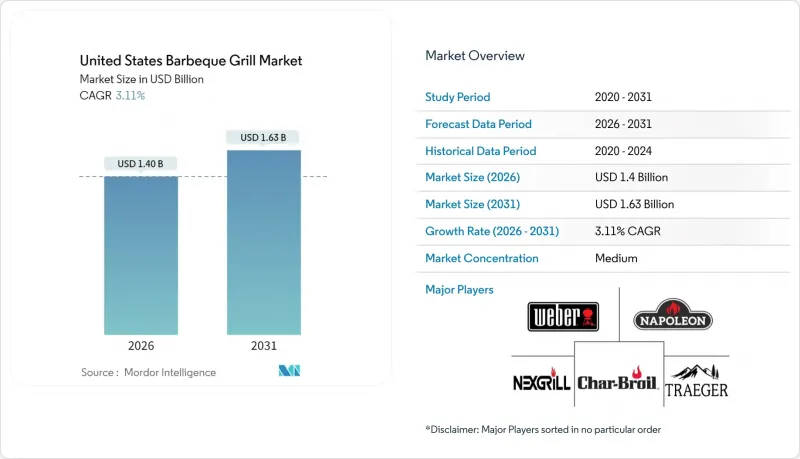

The United States barbeque grill market was valued at USD 1.36 billion in 2025 and estimated to grow from USD 1.40 billion in 2026 to reach USD 1.63 billion by 2031, at a CAGR of 3.11% during the forecast period (2026-2031).

A maturing replacement cycle, ongoing home-improvement spending, and premium grill introductions keep demand on a steady rather than explosive track. Sustained growth in owner-occupied housing-up 8.4% to 82.9 million units between 2019 and 2023-continues to enlarge the addressable pool of households able to install permanent outdoor cooking stations. Convenient gas models hold the broadest appeal, yet the fastest gains emerge in electric and smart lines as urban fire codes restrict open flames and tech-savvy households seek precision cooking. Regulatory incentives for cleaner-burning fuels, along with real-estate developers adding communal grilling areas, broaden commercial use cases. Aluminum price volatility and tightening particulate-emission rules temper the outlook but do not derail the long-term trajectory of the United States barbeque grill market.

United States Barbeque Grill Market Trends and Insights

Rise in outdoor cooking culture & longer grilling seasons

Expanding grilling seasons and a shift toward year-round backyard entertainment propel sustained demand beyond traditional summer peaks. Median U.S. home values rose 21.7% to USD 303,400 between 2019 and 2023, stimulating investments in outdoor living amenities. Weber's consumer research indicates 85% of grill owners plan to maintain or increase grilling frequency post-pandemic, suggesting behavioral permanence rather than temporary adoption. The Southeast benefits most from mild climates that encourage frequent grill use, keeping replacement cycles brisk. Social platforms normalize grilling as an entertainment ritual, widening adoption among younger households. This cultural mainstreaming underpins resilience in the United States barbeque grill market even during economic slowdowns.

Premiumization & higher disposable incomes

Lower mortgage-payment burdens-down to 17.5% of income in 2023-free cash for high-end appliances. Weber's 2024 SUMMIT smart gas grill carries a USD 3,899 ticket and illustrates how IoT features command premiums. Traeger's consumables share climbed to 19.7% of 2024 revenue, signaling a profitable aftermarket model. Investment-grade materials, multi-fuel versatility, and connected controls justify price escalations without sacrificing volume. These attributes help widen margins and sustain value growth in the United States barbeque grill industry. The trend toward "investment-grade" outdoor cooking equipment mirrors broader consumer appliance premiumization, where functionality convergence drives differentiation through premium materials and advanced features. This dynamic supports margin expansion for manufacturers capable of delivering genuine innovation rather than cosmetic upgrades.

Stringent open-fire / particulate regulations

Growing environmental consciousness and health awareness create headwinds for traditional charcoal grilling, particularly in urban markets where air quality concerns drive regulatory restrictions and consumer behavior changes. California's clean-air standards and multiple city-level fire codes restrict charcoal and open-flame devices within 10 feet of combustible structures, limiting traditional grill placement. Similar ordinances spread to dense metros nationwide, curbing charcoal demand in apartments and condominiums. Manufacturers pivot toward gas and electric lines that comply with emission rules, yet adoption costs and flavor trade-offs slow full conversion. Persistent regulatory tightening subtracts 0.6 percentage points from forecast CAGR but simultaneously nurtures electric-grill expansion within the United States barbeque grill market.

Other drivers and restraints analyzed in the detailed report include:

- Surging demand for smart/connected grills

- Growth of communal outdoor-kitchen amenities in multi-family housing

- Volatility in steel & aluminum prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gas units held 47.92% of United States barbeque grill market share in 2025 as homeowners favored quick start-up and temperature control. Charcoal retained cultural cachet but ceded ground in multi-family settings subject to NFPA clearances. Electric alternatives rose fastest at a 3.76% CAGR, powered by urban fire-code compliance and eco-conscious buyers. Pellet grills, though niche, drew premium enthusiasts with smoke-plus-sear capability exemplified by Weber's SEARWOOD launch. State propane incentives in Texas and Pennsylvania add modest tailwinds for gas, yet they do not offset the electric acceleration redefining category dynamics within the United States barbeque grill market.

In future cycles, gas will likely remain the baseline choice for suburban households enjoying ample yard space, while electric penetration climbs in condos and cities where emission rules tighten further. Charcoal brands respond with cleaner-burn briquettes and hybrid systems that aim to preserve authentic flavor without violating particulate thresholds. Pellet innovation should sustain double-digit gains among hobbyists seeking wood-smoke profiles with digital control. Combined, these trends diversify the fuel mix and contribute to a stable United States barbeque grill market size over the forecast horizon.

Freestanding models accounted for 41.62% of the United States barbeque grill market size in 2025, anchored by suburban backyards that value capacity and side-shelf prep areas. Portable formats, including tabletop and foldable grills, are expanding at a 3.97% CAGR thanks to tailgating, camping, and shrinking urban patios. Built-in designs cater to luxury outdoor kitchens and track closely with home-renovation outlays, creating a high-ticket but cyclical niche. Disposable grills confront mounting environmental pushbacks, curbing their contribution. Manufacturers now offer modular ecosystems that start with a compact cart and scale up through add-on islands, capturing lifetime value across consumer life stages in the United States barbeque grill market.

The portability wave also intersects with the experience economy; consumers seek devices they can transport to parks yet store easily in tight apartments. Brands improve fuel efficiency and heat retention to maximize cooking space within small footprints. For built-ins, premium stainless-steel and Wi-Fi controls differentiate offerings in competitive luxury neighborhoods. This bifurcation between mobility and permanence encourages segmented marketing strategies and shields revenues from localized economic swings.

The United States Barbeque Grill Market Report is Segmented by Fuel Type (Gas, Charcoal, Electric, Pellet, Hybrid/Alternative, Infrared), Product Design (Built-In, Freestanding, Portable/Table-top, Disposable/Single-use), Technology (Conventional, Smart/Connected), End-User (Residential, Commercial), Distribution Channel (B2B/Direct, B2C/Retail), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Weber Inc.

- Traeger Inc.

- Char-Broil LLC

- Nexgrill Industries

- Napoleon (Wolf Steel)

- Broil King

- Blackstone Products

- Dyna-Glo

- Coleman Company

- PK Grills

- Cuisinart (Conair)

- Camp Chef

- Green Mountain Grills

- Masterbuilt

- George Foreman Grills

- Pit Boss (Dansons)

- Kenmore

- Lynx Grills

- Blaze Grills

- Kalamazoo Outdoor Gourmet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Outdoor Cooking Culture & Longer Grilling Seasons

- 4.2.2 Premiumization & Higher Disposable Incomes

- 4.2.3 Surging Demand For Smart/Connected Grills

- 4.2.4 Growth Of Communal Outdoor-Kitchen Amenities In Multi-Family Housing

- 4.2.5 Influencer-Driven At-Home Cooking Content Boost

- 4.2.6 State-Level Tax Incentives For Propane/Natural-Gas Appliances

- 4.3 Market Restraints

- 4.3.1 Health & Environmental Concerns Over Charcoal Smoke

- 4.3.2 Volatility In Steel & Aluminum Prices

- 4.3.3 Urban Fire-Safety Rules Limiting Live-Fire Grills

- 4.3.4 Electronic-Component Shortages For Smart Grills

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Insights into the Latest Trends and Innovations in the Market

- 4.8 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.9 Insights on Regulatory Framework and Energy-Efficiency Standards for BBQ Grill in Key European Countries

5 Market Size & Growth Forecasts

- 5.1 By Fuel Type

- 5.1.1 Gas Grills

- 5.1.2 Charcoal Grills

- 5.1.3 Electric Grills

- 5.1.4 Pellet Grills

- 5.1.5 Hybrid/Alternative Fuel

- 5.1.6 Infrared

- 5.2 By Product Design

- 5.2.1 Built-In

- 5.2.2 Freestanding

- 5.2.3 Portable / Table-top

- 5.2.4 Disposable / Single-use

- 5.3 By Technology

- 5.3.1 Conventional

- 5.3.2 Smart/Connected

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.5 By Distribution Channel

- 5.5.1 B2B/Direct from the Manufacturers

- 5.5.2 B2C/Retail

- 5.5.2.1 Specialty Stores

- 5.5.2.2 Home Centers & DIY Stores

- 5.5.2.3 Mass Merchandisers

- 5.5.2.4 Online

- 5.5.2.5 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 Southeast

- 5.6.4 Southwest

- 5.6.5 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Weber Inc.

- 6.4.2 Traeger Inc.

- 6.4.3 Char-Broil LLC

- 6.4.4 Nexgrill Industries

- 6.4.5 Napoleon (Wolf Steel)

- 6.4.6 Broil King

- 6.4.7 Blackstone Products

- 6.4.8 Dyna-Glo

- 6.4.9 Coleman Company

- 6.4.10 PK Grills

- 6.4.11 Cuisinart (Conair)

- 6.4.12 Camp Chef

- 6.4.13 Green Mountain Grills

- 6.4.14 Masterbuilt

- 6.4.15 George Foreman Grills

- 6.4.16 Pit Boss (Dansons)

- 6.4.17 Kenmore

- 6.4.18 Lynx Grills

- 6.4.19 Blaze Grills

- 6.4.20 Kalamazoo Outdoor Gourmet

7 Market Opportunities & Future Outlook

- 7.1 Expansion Of Smart-Grill Subscription Ecosystems

- 7.2 Eco-Friendly Biomass & Electric Grill Formats For Urban Dwellers