PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938981

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938981

Malaysia Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

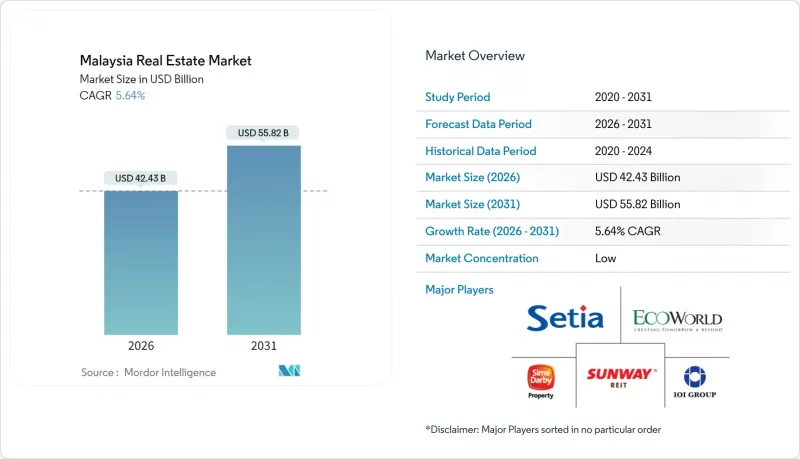

The Malaysia real estate market was valued at USD 40.16 billion in 2025 and estimated to grow from USD 42.43 billion in 2026 to reach USD 55.82 billion by 2031, at a CAGR of 5.64% during the forecast period (2026-2031).

Sustained government spending on rail, highway, and port infrastructure is redirecting housing and commercial demand toward newly connected corridors. Semiconductor capital expenditure, led by a USD 7 billion Intel plant, is translating into steady absorption of industrial parks and high-spec logistics hubs. Residential sentiment shows signs of revival after pandemic-era softness, supported by policy incentives for first-time buyers and the ongoing shift toward larger landed homes. At the same time, foreign direct investment in AI data centers and renewable-energy projects is broadening commercial asset demand. Developers with early land positions near transit nodes, port hinterlands, and cross-border gateways are best placed to ride the next growth wave of the Malaysia real estate market.

Malaysia Real Estate Market Trends and Insights

Infrastructure investments opening new property corridors

Infrastructure development is driving significant changes in Malaysia's property market. With a budget of USD 11.16 billion, the MRT3 Circle Line is set to add 51 kilometers and 31 stations, establishing an orbital route around Kuala Lumpur. In tandem with this rail expansion, Westports is investing USD 8.8 billion to boost Port Klang's capacity to 27 million TEUs, spurring a surge in warehouse demand along the Klang logistics belt. Meanwhile, the Pan Borneo Highway and East Coast Rail Link are enhancing connectivity along the east-west axis, reaching into secondary states. This has led to proactive landbank acquisitions, anticipating a rise in valuations. Developers, seizing the opportunity, are strategically planning township launches near interchange hubs slated to open from 2027. This newfound accessibility is poised to drive capital appreciation in Malaysia's real estate market, especially in the suburbs now gaining prominence.

Urban growth in Klang Valley, Penang, and Johor sustaining residential demand

Urbanization is driving significant changes in Malaysia's real estate market, particularly in Klang Valley, Penang, and Johor. As urbanization intensifies, economic activities are increasingly aligning with mass-transit corridors in Klang Valley, Penang, and Johor. The MRT2 line, linking satellite townships to Kuala Lumpur's primary job zones, has notably elevated property values in Bandar Sri Damansara and Kepong due to reduced commute times. In Penang, Batu Kawan township introduced 704 landed units priced at USD 209,000 each, capitalizing on the influx of new semiconductor factories. Johor's landscape is shaped by the Johor-Singapore Special Economic Zone, with projects like the USD 582 million Bukit Chagar, designed for cross-border commuters. This trend underscores a growing preference for developments that seamlessly integrate residential, retail, and logistics components. Real estate agents highlight that properties within a 500-meter radius of transit stations can command resale premiums of up to 30%. Such trends indicate a pronounced shift towards transit-oriented housing as the dominant investment focus in Malaysia's real estate landscape.

Oversupply challenges in high-rise segments

The high-rise segment in Malaysia's real estate market is grappling with significant oversupply challenges. As of Q3 2023, unsold inventory in Malaysia's real estate market stood at 25,311 units, valued at USD 3.87 billion. Notably, Kuala Lumpur accounted for 3,111 units, representing 19.07% of the total overhang. The issue arises from a pricing mismatch: developers have primarily focused on units priced above USD 111,000, while actual demand is concentrated in the USD 67,000 to USD 111,000 range. Adding to the problem, banks have restricted end-financing for speculative projects, leading to slower sales and higher marketing expenses. In response to changing post-pandemic preferences, some firms are shifting back to landed formats, launching 3,127 units in Q1 2024. However, until the clearance rate improves, the oversupply is expected to continue weighing on capital gains in Malaysia's real estate market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial and logistics expansion supporting land absorption

- Foreign investment avenues enhancing market participation

- Household income constraints moderating absorption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sales properties controlled 59.45% of the Malaysia real estate market in 2025, mirroring the nation's home-ownership ethos. Transaction volume hit 311,211 units worth USD 36.21 billion that year, validating the segment's scale. Supported by fixed-rate mortgages and stamp-duty waivers for first homes, primary launches continue to record robust bookings. Developers such as Sime Darby Property have sold over 2,700 units valued at USD 578 million since 2023 through digital booking systems.

Rental stock, although smaller, is charting a 6.32% CAGR to 2031, the fastest rate in the Malaysia real estate market. Younger professionals favor flexibility and are clustering around MRT and LRT stations where transit-linked apartments allow car-free living. Coworking operators located in these nodes estimate that reduced commute times save tenants 7,000 hours annually. Johor's proximity to Singapore further propels rental yields, with serviced apartments like Gen Rise (GDV USD 125 million) aimed at cross-border workers achieving pre-leasing success.

The Malaysia Real Estate Market Report is Segmented by Business Model (Sales and Rental), by Property Type (Residential and Commercial), by End-User (Individuals/Households, Corporates & SMEs and Others), and by Key Cities (Kuala Lumpur, Penang, Johor Bahru, Petaling Jaya and the Rest of Malaysia). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sime Darby Property Berhad

- SP Setia Berhad

- Sunway Berhad (Property Division)

- Eco World Development Group Berhad

- IOI Properties Group Berhad

- UEM Sunrise Berhad

- Mah Sing Group Berhad

- Gamuda Land

- Tropicana Corporation Berhad

- LBS Bina Group Berhad

- GuocoLand (Malaysia) Berhad

- Eastern & Oriental Berhad

- Matrix Concepts Holdings Berhad

- TA Global Berhad

- MK Land Holdings Berhad

- Country Garden Malaysia

- IJM Land Berhad

- Kuala Lumpur Kepong Berhad (Property)

- YTL Land & Development Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Capital-Market Penetration & REIT Presence

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Insights into Real Estate Tech and Startups Active in the Real Estate Segment

- 4.8 Insights into Existing and Upcoming Projects

- 4.9 Market Drivers

- 4.9.1 Urban growth in Klang Valley, Penang, and Johor sustaining residential and mixed-use demand

- 4.9.2 Infrastructure investments (MRT/LRT, highways, cross-border links) opening new corridors

- 4.9.3 Industrial and logistics expansion (E&E, nearshoring) supporting land and warehousing take-up

- 4.9.4 Foreign ownership avenues and REIT market supporting investment participation

- 4.9.5 Shift toward sustainable, transit-oriented, and smart developments improving asset appeal

- 4.10 Market Restraints

- 4.10.1 Oversupply and unsold inventory in select high-rise submarkets weighing on prices

- 4.10.2 Policy shifts (e.g., foreign buyer thresholds/MM2H changes) creating investor uncertainty

- 4.10.3 Household income constraints and selective bank lending moderating absorption

- 4.11 Value / Supply-Chain Analysis

- 4.11.1 Overview

- 4.11.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.11.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.11.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.11.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.11.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.11.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers/Occupiers

- 4.12.3 Bargaining Power of Suppliers (Developers/Builders)

- 4.12.4 Threat of Substitutes

- 4.12.5 Competitive Rivalry Intensity

5 Real Estate Market Size & Growth Forecasts (Value USD billion)

- 5.1 By Business Model

- 5.1.1 Sales

- 5.1.2 Rental

6 Real Estate Market (Sales Model) Size & Growth Forecasts (Value USD billion)

- 6.1 By Property Type

- 6.1.1 Residential

- 6.1.1.1 Apartments & Condominiums

- 6.1.1.2 Villas & Landed Houses

- 6.1.2 Commercial

- 6.1.2.1 Office

- 6.1.2.2 Retail

- 6.1.2.3 Logistics

- 6.1.2.4 Others (industrial real estate, hospitality real estate, etc.)

- 6.1.1 Residential

- 6.2 By End-user

- 6.2.1 Individuals / Households

- 6.2.2 Corporates & SMEs

- 6.2.3 Others

- 6.3 By Key Cities

- 6.3.1 Kuala Lumpur

- 6.3.2 Penang (George Town)

- 6.3.3 Johor Bahru

- 6.3.4 Petaling Jaya

- 6.3.5 Rest of Malaysia

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 7.3.1 Sime Darby Property Berhad

- 7.3.2 SP Setia Berhad

- 7.3.3 Sunway Berhad (Property Division)

- 7.3.4 Eco World Development Group Berhad

- 7.3.5 IOI Properties Group Berhad

- 7.3.6 UEM Sunrise Berhad

- 7.3.7 Mah Sing Group Berhad

- 7.3.8 Gamuda Land

- 7.3.9 Tropicana Corporation Berhad

- 7.3.10 LBS Bina Group Berhad

- 7.3.11 GuocoLand (Malaysia) Berhad

- 7.3.12 Eastern & Oriental Berhad

- 7.3.13 Matrix Concepts Holdings Berhad

- 7.3.14 TA Global Berhad

- 7.3.15 MK Land Holdings Berhad

- 7.3.16 Country Garden Malaysia

- 7.3.17 IJM Land Berhad

- 7.3.18 Kuala Lumpur Kepong Berhad (Property)

- 7.3.19 YTL Land & Development Berhad

8 Market Opportunities & Future Outlook