PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939011

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939011

Beryllium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

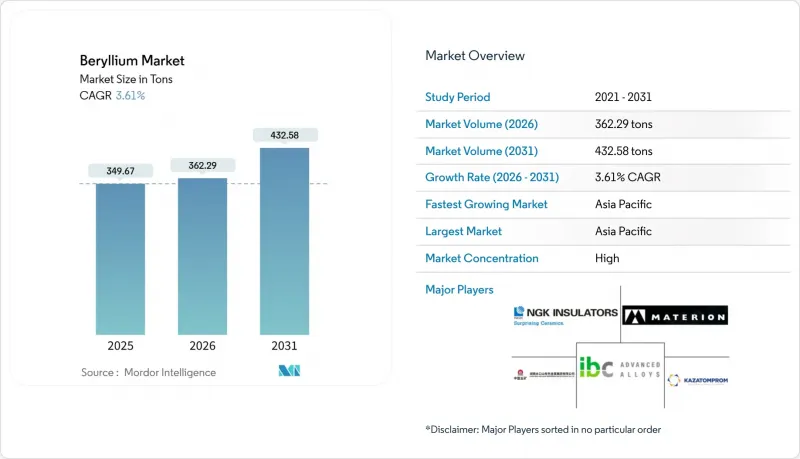

The Beryllium Market was valued at 337.26 tons in 2025 and estimated to grow from 349.67 tons in 2026 to reach 418.86 tons by 2031, at a CAGR of 3.68% during the forecast period (2026-2031).

Robust growth stems from the metal's unmatched stiffness-to-weight ratio, superior thermal conductivity, and neutron transparency that position it as a linchpin material across defense, aerospace, electronics, and nascent clean-energy systems. Rising 5G infrastructure roll-outs, reusable launch vehicle programs, and advanced power-electronics platforms elevate demand, while tightening occupational-exposure rules and supply-chain concentration in Kazakhstan and China create cost and security pressures. Strategic integration efforts by U.S. producers strengthen domestic resilience even as Asia-Pacific leads consumption. Competitive differentiation centers on alloy innovation, powder-metallurgy processing, and rapid-prototyping capability that deliver lighter, more durable components for high-value applications.

Global Beryllium Market Trends and Insights

Rising Adoption of Be-Cu Alloys in 5G And mm-wave Base-Station RF Filters

Global 5G roll-outs drive unprecedented volumes of high-frequency RF connectors that mandate copper-beryllium for its simultaneous electrical, mechanical, and corrosion-resistant performance. Each mmWave base station uses more Be-Cu per node than 4G equipment, multiplying overall consumption. Continuous processing improvements now yield ultra-thin precision strip essential for 24 GHz-plus systems. Because 5G infrastructure is classified as critical national infrastructure, security-of-supply considerations amplify strategic interest in the beryllium market. Asia-Pacific remains the demand epicenter, yet North American and European operators maintain stringent specifications that favor high-purity alloys.

Growing Requirement for Lightweight, High-Stiffness Structures in Reusable Launch Vehicles

The shift from expendable to reusable launch systems hinges on materials that survive repeated thermal and vibrational extremes without mass penalties. Beryllium's specific stiffness is six times that of steel at one-quarter the weight, enabling lighter optical benches, sensor mounts, and structural panels. Beryllium-aluminum composites such as AlBeMet and Beralcast deliver dimensional stability across temperature swings, validated by the performance of the James Webb Space Telescope mirror segments. As commercial launch providers target hundreds of sorties per year, demand for durable beryllium components scales in tandem.

Stringent Occupational-Exposure Limits and Rising Compliance Costs

OSHA cut permissible exposure thresholds from 2 µg/m3 to 0.2 µg/m3, obligating producers to install enhanced ventilation, isolation, and medical-surveillance systems that elevate unit costs. Europe applies comparable restrictions under REACH authorization, further tightening the regulatory envelope. Smaller processors struggle to absorb these expenses, accelerating industry consolidation and raising entry barriers that constrain overall supply expansion.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Demand for Thermal-Management Materials in Advanced EV Power Electronics

- Defense Modernization Programs Boosting Satellite, Missile-Seeker and Optical-Sensor Volumes

- Volatility of Beryllium Concentrate Supply from Kazakhstan and China

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alloys captured 72.86% of the beryllium market share in 2025 and are projected to expand at a 3.95% CAGR through 2031, confirming their central role in high-performance platforms. Within this category, copper-beryllium alloys dominate telecommunications connectors, while aluminum-beryllium metal-matrix composites unlock weight savings in aerospace structures. Because alloy formulations can be tuned for strength, conductivity, or thermal properties, producers devote significant research and development budgets to new compositions that address emerging design constraints.

Pure metal continues to serve nuclear reflectors and space-optics segments where alloying would impair neutron or thermal performance. Beryllium-oxide ceramics fill niche but critical positions in high-density power modules that require extreme thermal conductivity. Powder-metallurgy advances and hot-isostatic-pressing routes enable intricate geometries unprecedented a decade ago, underscoring how alloy progress propels overall beryllium market momentum.

The Beryllium Report is Segmented by Product Type (Alloys, Metals, Ceramics, and Other Product Types), End-User Industry (Industrial Components, Automotive, Healthcare, Aerospace and Defense, Oil and Gas and Other Energy, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific generated 37.62% of 2025 volume and is forecast to log a 4.08% CAGR through 2031 as China spearheads electronics production and 5G base-station deployment. Domestic processors integrate upstream concentrate and downstream alloying, sustaining a largely closed supply loop that buffers local consumers from international volatility. Japan and South Korea contribute sizeable volumes through automotive electrification and high-precision semiconductor tooling, while India's expanding space program lifts regional aerospace demand.

North America anchors supply-chain resilience with the world's only fully integrated mine-to-mill operation at Materion's Utah-Ohio complex. Mature aerospace and defense sectors ensure stable base load consumption, and the Inflation Reduction Act incentives bolster domestic EV battery and power-electronics manufacturing that rely on Be-O substrates. Canada and Mexico add incremental growth via aerospace assembly and emerging EV export hubs.

Europe balances stringent occupational regulations with robust application demand. The continent's accelerated EV adoption and renewable-energy build-out intensify requirements for high-performance thermal-management materials, favoring beryllium alloys and ceramics. NGK Berylco France pioneers lower-carbon processing routes aligned with EU sustainability goals. While Middle East-Africa and South America remain smaller markets, new processing ventures such as BerylTech Rwanda illustrate early steps toward geographic diversification.

- American Beryllia Inc.

- American Elements

- Belmont Metals

- Hunan Shuikoushan Nonferrous Metals Group Co., Ltd.

- IBC Advanced Alloys

- JSC Ulba Metallurgical Plant (JSC NAC Kazatomprom)

- Materion Corporation

- NGK INSULATORS, LTD.

- Rockland Resources Ltd.

- Texas Mineral Resources Corp.

- Tropag Oscar H. Ritter Nachf GmBH

- Xiamen Beryllium Copper Technologies Co. , Ltd.

- Xinjiang Xinxin Mining Industry Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Be-Cu Alloys in 5G and mm-wave Base-Station RF Filters

- 4.2.2 Growing Requirement for Lightweight, High-Stiffness Structures in Reusable Launch Vehicles

- 4.2.3 Escalating Demand for Thermal Management Materials in Advanced EV Power Electronics

- 4.2.4 Defense Modernization Programs Boosting Satellite, Missile-Seeker and Optical Sensor Volumes

- 4.2.5 Emerging Need for Neutron-Transparent Be Reflectors in Small Modular Reactors (SMRs)

- 4.3 Market Restraints

- 4.3.1 Stringent Occupational?Exposure Limits and Rising Compliance Costs

- 4.3.2 Volatility of Beryllium Concentrate Supply from Kazakhstan and China

- 4.3.3 Accelerating Research and Development on Aluminum and Titanium Metal-Matrix Composites as Substitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Alloys

- 5.1.2 Metals

- 5.1.3 Ceramics

- 5.1.4 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Industrial Components

- 5.2.2 Automotive

- 5.2.3 Healthcare

- 5.2.4 Aerospace and Defense

- 5.2.5 Oil and Gas and Other Energy

- 5.2.6 Electronics and Telecommunication

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 American Beryllia Inc.

- 6.4.2 American Elements

- 6.4.3 Belmont Metals

- 6.4.4 Hunan Shuikoushan Nonferrous Metals Group Co., Ltd.

- 6.4.5 IBC Advanced Alloys

- 6.4.6 JSC Ulba Metallurgical Plant (JSC NAC Kazatomprom)

- 6.4.7 Materion Corporation

- 6.4.8 NGK INSULATORS, LTD.

- 6.4.9 Rockland Resources Ltd.

- 6.4.10 Texas Mineral Resources Corp.

- 6.4.11 Tropag Oscar H. Ritter Nachf GmBH

- 6.4.12 Xiamen Beryllium Copper Technologies Co. , Ltd.

- 6.4.13 Xinjiang Xinxin Mining Industry Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment