PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939043

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939043

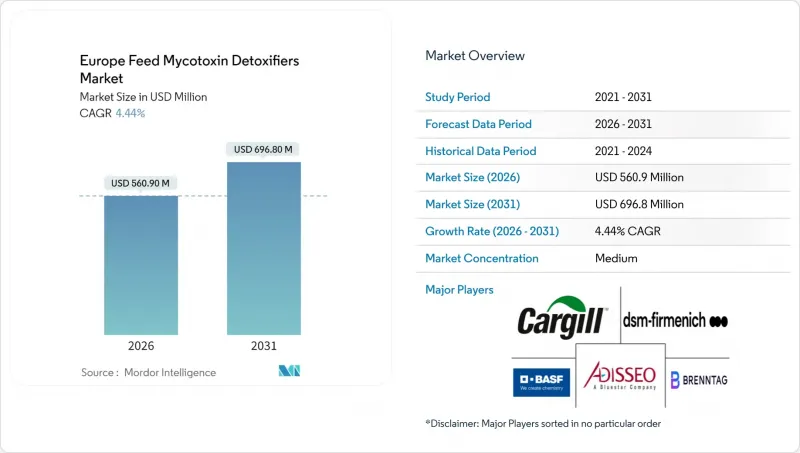

Europe Feed Mycotoxin Detoxifiers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Feed Mycotoxin Detoxifiers market size in 2026 is estimated at USD 560.9 million, growing from 2025 value of USD 537 million with 2031 projections showing USD 696.8 million, growing at 4.44% CAGR over 2026-2031.

Robust demand stems from rising multi-toxin loads in European grain supplies, stricter feed-safety rules that mandate validated detoxification processes, and sustained livestock intensification across poultry and swine sectors. Climate variability, especially the warmer and wetter post-harvest window, heightens Fusarium and Aspergillus growth, prompting feed manufacturers to adopt broader-spectrum solutions that blend binders with enzymatic biotransformers. Premium pricing for multi-modal products is further supported by the push for antibiotic-free meat, which elevates the need for non-antibiotic feed safety tools. Meanwhile, precision livestock farming's data-driven dosing capabilities help producers justify higher-value detoxifiers by aligning inclusion rates with real-time contamination risk.

Europe Feed Mycotoxin Detoxifiers Market Trends and Insights

Rising Incidence of Mycotoxin Contamination in European Grain Supply

Climate volatility has lengthened periods of elevated humidity and temperature during grain storage, allowing Fusarium, Aspergillus, and Penicillium species to proliferate across the supply chain. DSM-Firmenich's 2024 survey found deoxynivalenol in 85% of Central European feed samples, while Southern regions record parallel spikes in aflatoxin and fumonisin. Romanian surveillance shows 58% of feed samples now contain all six major toxin groups simultaneously, a steep escalation from past single-toxin profiles. The shift toward co-occurrence scenarios forces formulators to adopt detoxifiers that function across broad toxin spectra. As grain imports from Eastern Europe rise, so does cross-regional contamination risk, amplifying demand growth. These conditions underpin the Europe Feed Mycotoxin Detoxifiers market's steady expansion as buyers prioritize validated, multi-toxin solutions.

Strict EU Regulations on Feed Safety and Allowable Mycotoxin Levels

The European Food Safety Authority's January 2024 guidance sets rigorous efficacy and safety benchmarks for every detoxification technology EFSA. Commission Regulation EU 2023/2782 standardizes sampling protocols, elevating compliance costs and filtering out under-validated products. Acute reference doses for T-2 and HT-2 toxins now stand at 0.3 µg/kg body weight with a chronic tolerable intake of 0.02 µg/kg per day. These thresholds are among the world's strictest, pushing feed mills to favor suppliers with certified dossiers and peer-reviewed proof of toxin degradation. Because biotransformers provide enzymatic breakdown rather than temporary sequestration, they align closely with regulatory preferences, helping the sub-segment outpace traditional binders in value growth. Companies able to navigate the regulatory maze gain pricing power and brand loyalty throughout the region.

Volatility in Raw Material Prices Inflating Cost of Premium Toxin Binders

Bentonite and sepiolite prices fluctuate with diesel, explosives, and compliance fees, often moving 15-20% in a single quarter. European miners face mounting environmental scrutiny, driving permit delays that constrict supply. Enzymatic detoxifiers rely on fermentation substrates whose costs track energy and commodity price swings. Because detoxifiers typically represent 0.5-1.5% of a feed mill's input costs, any sudden surge becomes highly visible to procurement managers, prompting them to reduce inclusion rates or shift toward cheaper, less effective clay blends. This price sensitivity injects short-term volatility into what is otherwise a structurally growing market.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Intensive Livestock Production, Especially Poultry

- Increasing Adoption of Precision Livestock Farming Enabling Targeted Use of Detoxifiers

- Competition from Alternative Feed Safety Technologies Such as UV Grain Treatment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Binders retained 65.92% of the Europe Feed Mycotoxin Detoxifiers market share in 2025, underpinned by long-standing acceptance and cost efficiency at inclusion rates near 0.15% of feed weight. The biotransformers are expanding at a 4.47% CAGR as feed mills seek irreversible toxin degradation rather than temporary sequestration. The Europe Feed Mycotoxin Detoxifiers market size for biotransformers is projected to rise from USD 183.1 million in 2025 to USD 238 million by 2031, reflecting heightened regulatory favor for measurable detoxification.

Biotransformer growth is propelled by enzymes targeting zearalenone, fumonisin, and ochratoxin; Aeromicrobium-derived catalysts show notable in-vitro efficacy. Premium pricing is justified by consistent performance under co-occurrence scenarios where clay effectiveness wanes. Suppliers that pair enzymes with low-dose binders in a single premix capture cross-over demand while easing formulation complexity for mills. Because the top five players hold under a significant share of total revenue, newcomers with patented enzymes still find space for disruptive entry.

The Europe Feed Mycotoxin Detoxifiers Report is Segmented by Sub Additive (Binders and Biotransformers), by Animal (Aquaculture, Poultry, Ruminants, Swine, and More), and by Geography (France, Germany, Italy, Netherlands, Russia, Spain, Turkey, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Adisseo

- BASF

- Brenntag SE

- Cargill, Incorporated.

- Centafarm SRL

- DSM Firmenich

- Impextraco NV

- Kemin Industries

- Marubeni Corporation

- Nutreco N.V. (SHV Holdings)

- EW Nutrition

- Royal Agrifirm Group

- Olmix Group

- Novus International, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY AND KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions and Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Turkey

- 4.3.8 United Kingdom

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Rising incidence of mycotoxin contamination in European grain supply

- 4.5.2 Strict EU regulations on feed safety and allowable mycotoxin levels

- 4.5.3 Growth in intensive livestock production, especially poultry

- 4.5.4 Increasing adoption of precision livestock farming enabling targeted use of detoxifiers

- 4.5.5 Emergence of multi-mycotoxin binder-biotransformation blends with lower inclusion rates

- 4.5.6 Demand for antibiotic-free meat pushing integrators toward non-antibiotic feed safety solutions

- 4.6 Market Restraints

- 4.6.1 Volatility in raw material prices inflating cost of premium toxin binders

- 4.6.2 Limited efficacy data under commercial farm conditions leading to buyer skepticism

- 4.6.3 Competition from alternative feed safety technologies such as UV grain treatment

- 4.6.4 Supply-chain disruptions in specialty clay minerals due to tightening mining regulations

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Sub Additive

- 5.1.1 Binders

- 5.1.2 Biotransformers

- 5.2 By Animal

- 5.2.1 Aquaculture

- 5.2.1.1 Fish

- 5.2.1.2 Shrimp

- 5.2.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 Broiler

- 5.2.2.2 Layer

- 5.2.2.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 Beef Cattle

- 5.2.3.2 Dairy Cattle

- 5.2.3.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 By Geography

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Turkey

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Landscape

- 6.5 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.5.1 Adisseo

- 6.5.2 BASF

- 6.5.3 Brenntag SE

- 6.5.4 Cargill, Incorporated.

- 6.5.5 Centafarm SRL

- 6.5.6 DSM Firmenich

- 6.5.7 Impextraco NV

- 6.5.8 Kemin Industries

- 6.5.9 Marubeni Corporation

- 6.5.10 Nutreco N.V. (SHV Holdings)

- 6.5.11 EW Nutrition

- 6.5.12 Royal Agrifirm Group

- 6.5.13 Olmix Group

- 6.5.14 Novus International, Inc.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS