PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939048

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939048

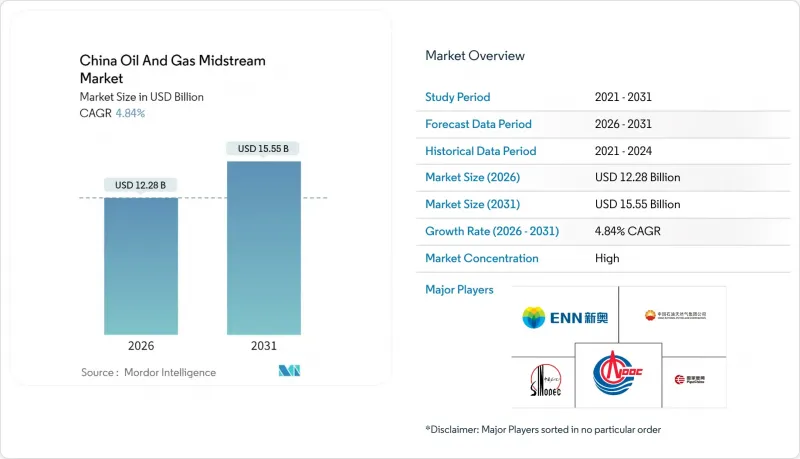

China Oil And Gas Midstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

China Oil And Gas Midstream Market market size in 2026 is estimated at USD 12.28 billion, growing from 2025 value of USD 11.71 billion with 2031 projections showing USD 15.55 billion, growing at 4.84% CAGR over 2026-2031.

The market growth is driven by Beijing's twin goals of energy security and carbon neutrality, which together prioritize infrastructure resilience, diversified supply routes, and measurable reductions in emissions. Surging natural gas demand from industrial and residential users, combined with steady domestic production, intensifies the need for additional transmission, import handling, and storage capacity. Policy-backed pipeline mileage expansion, accelerated LNG terminal commissioning, and mandatory strategic reserve targets create a sustained construction pipeline for contractors and equipment suppliers. Digitalization-especially AI-enabled monitoring-enhances asset utilization, reduces operating costs, and facilitates stricter environmental compliance, thereby further improving project economics.

China Oil And Gas Midstream Market Trends and Insights

Expansion of National Gas-Pipeline Mileage

China's 14th Five-Year Plan raises the transmission grid target to 120,000 km by 2025-a 25% jump over 2020-anchored by the West-to-East system. Redundant trunk lines mitigate the risk of single-point failure during geopolitical or technical disruptions and enhance cross-regional balancing. PipeChina's unified ownership accelerates interconnections, allowing flexible, bidirectional flows that lift utilization rates. The commissioning of the China-Russia East Route in 2024 diversified supply and reduced reliance on seaborne trade. Although cross-provincial land coordination is complex, centralized planning compresses build times once permits are clear. These projects present sizable opportunities for specialist contractors, high-specification pipe manufacturers, and digital monitoring solution providers.

Accelerated Build-out of LNG Regasification Terminals

Regas capacity hit 130 million tpa in 2024, with 40 million tpa under construction, positioning the country as the world's most active LNG-infrastructure builder. Smaller, distributed facilities mitigate supply bottlenecks that were revealed during the 2022 crisis, when large terminals faced congestion. Coastal governments are increasingly favoring FSRUs due to their rapid deployment speed, flexibility in capital expenditure, and reduced demand for onshore land. The 2024-commissioned Zhoushan III terminal reduced methane emissions by 15% through advanced vapor-recovery systems, setting a new domestic benchmark. Average 65% utilization leaves headroom for opportunistic spot cargo buying while serving strategic stockpiles. The segment thereby underpins import diversification and strengthens price-risk management.

Lengthy Environmental & Land-Use Permitting Process

Environmental reviews now last 18-36 months, with extra delays where routes cross ecologically sensitive zones. Land acquisition in the densely populated eastern provinces averages USD 50,000 per hectare, often triggering valuation disputes that prolong project timelines. As a result, planning-to-operation spans stretch 5-7 years, raising financing risk and slicing IRRs for developers. Digital one-stop portals unveiled in 2024 aim to condense review cycles, yet agency adoption is uneven. Investors now incorporate 12-18 month permitting buffers into their schedules, which inflates budgets and delays revenue generation.

Other drivers and restraints analyzed in the detailed report include:

- Coal-to-Gas Switching Mandates in Industrial & Residential Sectors

- AI-Driven Pipeline-Health Analytics Adoption

- Capex Escalation Amid Commodity-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Terminals accounted for an 8.16% CAGR growth between 2026 and 2031, outpacing pipelines, which retained a dominant 45.12% 2025 share of the China oil and gas midstream market size. FSRU rollouts shorten build cycles and limit shoreline disruption, enabling rapid response to demand shifts. Coastal governments are fast-tracking the development of smaller terminals to diversify landing points, thereby reducing congestion and regional price spikes. Pipelines still underpin system integrity, linking western resources and Russian imports with high-consumption eastern provinces. AI-enhanced monitoring reduced pipeline O&M costs by 15-20% and improved safety compliance, enhancing the platform's attractiveness for further capacity expansion. Storage facilities, although the smallest, gain policy momentum from the 20% strategic reserve mandate, shifting capital expenditures toward depleted field re-engineering and salt-cavern leaching. Collectively, blended infrastructure investments strike a balance between import flexibility and transmission reliability, thereby securing multi-path gas flow resilience.

The China Oil and Gas Midstream Market Report is Segmented by Infrastructure (Pipelines, Terminals, and Storage Facilities), Product Type (Crude Oil, Natural Gas, Refined Products, and LNG), and Service Type (Pipeline Construction, Pipeline Maintenance and Repair, Storage and Handling Services, and Transportation and Logistics). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China National Petroleum Corporation (CNPC)

- PipeChina (China Oil & Gas Pipeline Network Corp.)

- China Petroleum & Chemical Corporation (Sinopec Group)

- China National Offshore Oil Corporation (CNOOC)

- PetroChina Pipeline Company

- China Petroleum Pipeline Engineering Co. (CPP)

- Kunlun Energy

- ENN Natural Gas

- Towngas China

- China Gas Holdings

- Guanghui Energy

- Beijing Gas Group

- Shenzhen Gas Corp.

- Guangdong Dapeng LNG Company

- Tian Lun Gas Group

- Xinxing Ductile Iron Pipes Co.

- COSCO Shipping Energy Transportation

- Yantai LNG Co.

- Shanghai Gas Group

- Zhejiang Energy Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of national gas-pipeline mileage

- 4.2.2 Accelerated build-out of LNG regasification terminals

- 4.2.3 Coal-to-gas switching mandates in industrial & residential sectors

- 4.2.4 AI-driven pipeline-health analytics adoption

- 4.2.5 Boom in LNG-fueled heavy-duty trucking creating small-scale LNG demand

- 4.2.6 Strategic gas storage capacity mandates

- 4.3 Market Restraints

- 4.3.1 Lengthy environmental & land-use permitting process

- 4.3.2 Capex escalation amid commodity-price volatility

- 4.3.3 Shipping chokepoints inflating landed LNG costs

- 4.3.4 Coastal water-stress limits on new LNG terminals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Installed Pipeline Capacity Analysis

- 4.8 Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Infrastructure

- 5.1.1 Pipelines

- 5.1.2 Terminals

- 5.1.3 Storage Facilities (Underground and Above-ground)

- 5.2 By Product Type

- 5.2.1 Crude Oil

- 5.2.2 Natural Gas

- 5.2.3 Refined Products

- 5.2.4 LNG

- 5.3 By Service Type

- 5.3.1 Pipeline Construction

- 5.3.2 Pipeline Maintenance and Repair

- 5.3.3 Storage and Handling Services

- 5.3.4 Transportation and Logistics

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 China National Petroleum Corporation (CNPC)

- 6.4.2 PipeChina (China Oil & Gas Pipeline Network Corp.)

- 6.4.3 China Petroleum & Chemical Corporation (Sinopec Group)

- 6.4.4 China National Offshore Oil Corporation (CNOOC)

- 6.4.5 PetroChina Pipeline Company

- 6.4.6 China Petroleum Pipeline Engineering Co. (CPP)

- 6.4.7 Kunlun Energy

- 6.4.8 ENN Natural Gas

- 6.4.9 Towngas China

- 6.4.10 China Gas Holdings

- 6.4.11 Guanghui Energy

- 6.4.12 Beijing Gas Group

- 6.4.13 Shenzhen Gas Corp.

- 6.4.14 Guangdong Dapeng LNG Company

- 6.4.15 Tian Lun Gas Group

- 6.4.16 Xinxing Ductile Iron Pipes Co.

- 6.4.17 COSCO Shipping Energy Transportation

- 6.4.18 Yantai LNG Co.

- 6.4.19 Shanghai Gas Group

- 6.4.20 Zhejiang Energy Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment