PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939059

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939059

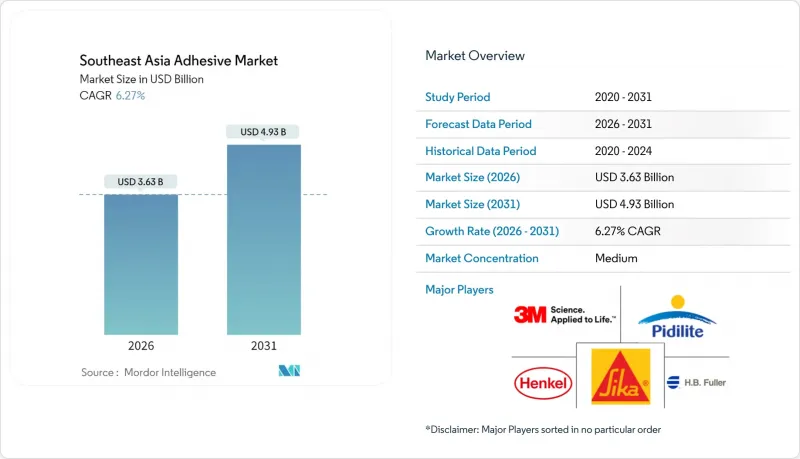

Southeast Asia Adhesive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Southeast Asia Adhesive Market size in 2026 is estimated at USD 3.63 billion, growing from 2025 value of USD 3.42 billion with 2031 projections showing USD 4.93 billion, growing at 6.27% CAGR over 2026-2031.

Rising construction outlays in Indonesia and Vietnam, accelerating EV-battery investments in Thailand and Indonesia, and the shift toward low-VOC waterborne chemistries collectively underpin this momentum. Foreign direct investment in electronics, footwear, and medical disposables manufacturing expands the regional customer base and stimulates the downstream localization of resin and formulation assets. Regulatory frameworks, such as Vietnam's Law on Chemicals (65/2025/QH15) and Singapore's NEA VOC limits, are redefining technology choices, steering demand toward water-borne, reactive, and UV-cured systems that align with circular economy goals. Price volatility in petrochemical feedstocks creates short-term margin pressure; however, producers with secured supply contracts or vertical integration can protect their earnings and invest in capacity expansions, such as Sika's Bekasi line doubling. Adhesive suppliers that combine localized production, compliant chemistries, and application training are best placed to capture new orders from infrastructure, packaging, and EV supply-chain projects.

Southeast Asia Adhesive Market Trends and Insights

Infrastructure-Led Construction Boom in Indonesia and Vietnam

Significant government budgets in Indonesia and Vietnam channel record volumes of cement, steel, and engineered panels into megaprojects such as the Ho Chi Minh City Ring Road 3. Adhesives replace mechanical fasteners in tile setting, insulation, curtain wall, and modular precast elements, shortening on-site labor and improving airtightness. Contractors prefer water-borne acrylic and reactive polyurethane grades that comply with ASEAN Green Building VOC caps of 50 g/L. Prefabrication plants situated near Jakarta and Ho Chi Minh City utilize two-component epoxies that cure in humid tropical climates without the need for ovens, allowing for a 24-hour turnaround of facade modules.

E-Commerce-Driven Surge in Flexible and Sustainable Packaging

Online retail across Southeast Asia requires corrugate mailers, pouches, and easy-peel labels that rely on hot-melt and water-borne adhesives. Pressure-sensitive products, such as Avery Dennison's CleanFlake, enhance PET recycling rates by detaching cleanly during wash cycles, enabling brand owners to meet recycling targets under the ASEAN Circular Economy framework. Corrugate converters running Henkel Technomelt Supra 115 seal up to 120 cartons per minute, saving energy required by solvent types. Consumer willingness to pay a premium for eco-friendly packaging elevates margins for converters that certify bio-based or solvent-free lines. These trends collectively widen the addressable pool for sustainable grades within the Southeast Asia adhesive market.

Stringent VOC and Hazardous-Chemical Regulations

Mid-sized producers are now required to invest significantly per product line for reformulation, safety testing, and re-registration, all in response to new VOC threshold compliance mandates. Singapore's mandatory emissions reporting adds annual administrative expenses, prompting some SMEs to outsource production or exit high-compliance segments. Water-borne systems solve VOC challenges but extend drying cycles, increasing production time unless dehumidification is installed, a barrier for cost-sensitive workshops. Harmonization under APEC facilitates cross-border trade, but varying phase-in periods create temporary arbitrage, complicating supply chain planning.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Hygiene and Medical Disposables Manufacturing

- Regulatory Push Toward Low-VOC Water-Borne and Reactive Systems

- Volatile Petrochemical Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane achieved a 6.57% CAGR, the fastest among resins, as EV batteries and solvent-free footwear lines specify single-sided PU adhesives that eliminate VOC emissions. Acrylic stayed dominant with a 31.18% share owing to its balanced cost and performance in flexible packaging laminates and tile-setting mortars. Epoxy addressed structural niches, such as battery-pack assembly. SikaPower-4720 reaches a tensile strength of 25 MPa while curing at room temperature. Silicone volumes in medical devices increased, supported by Wacker's new Asian capacity that meets ISO 10993 standards.

Intensifying sustainability pressure drives the development of bio-based polyurethanes derived from castor oil, while BASF's butyl-acrylate supply agreement highlights feedstock security priorities. Polyurethane's bonding of aluminum-to-carbon-fiber joints satisfies OEM lightweighting goals, enabling reduction in vehicle mass, thereby further expanding its role in the Southeast Asia adhesive market.

The Southeast Asia Adhesive Market Report is Segmented by Resin (Polyurethane, Epoxy, Acrylic, Silicone, Cyanoacrylate, and More), Technology (Water-Borne, Solvent-Borne, Reactive, Hot-Melt, and UV Cured), End-User Industry (Aerospace, Automotive, and More), and Geography (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, and Rest of South-East Asia). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- ADB Sealant Co., Ltd

- Arkema

- Ashland

- Avery Dennison Corporation

- Beardow Adams

- Dow

- DuPont

- Dymax Corporation

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers

- Jowat SE

- Mapei S.p.A

- Permabond LLC

- Pidilite Industries Ltd.

- Shin-Etsu Chemical Co., Ltd

- Sika AG

- Soudal NV

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure-led construction boom in Indonesia and Vietnam

- 4.2.2 E-commerce-driven surge in flexible and sustainable packaging

- 4.2.3 Expansion of hygiene and medical disposables manufacturing

- 4.2.4 Regulatory push toward low-VOC water-borne and reactive systems

- 4.2.5 EV-battery manufacturing investments in Thailand and Indonesia

- 4.3 Market Restraints

- 4.3.1 Stringent VOC and hazardous-chemical regulations

- 4.3.2 Volatile petrochemical feedstock prices

- 4.3.3 Shortage of skilled applicators for advanced chemistries

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Silicone

- 5.1.5 Cyanoacrylate

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Reactive

- 5.2.4 Hot-Melt

- 5.2.5 UV Cured

- 5.3 By End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Building and Construction

- 5.3.4 Footwear and Leather

- 5.3.5 Healthcare

- 5.3.6 Packaging

- 5.3.7 Woodworking and Joinery

- 5.3.8 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Philippines

- 5.4.4 Singapore

- 5.4.5 Thailand

- 5.4.6 Vietnam

- 5.4.7 Rest of South-East Asia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 ADB Sealant Co., Ltd

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 Avery Dennison Corporation

- 6.4.6 Beardow Adams

- 6.4.7 Dow

- 6.4.8 DuPont

- 6.4.9 Dymax Corporation

- 6.4.10 Franklin International

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Huntsman International LLC

- 6.4.14 ITW Performance Polymers

- 6.4.15 Jowat SE

- 6.4.16 Mapei S.p.A

- 6.4.17 Permabond LLC

- 6.4.18 Pidilite Industries Ltd.

- 6.4.19 Shin-Etsu Chemical Co., Ltd

- 6.4.20 Sika AG

- 6.4.21 Soudal NV

- 6.4.22 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment