PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939092

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939092

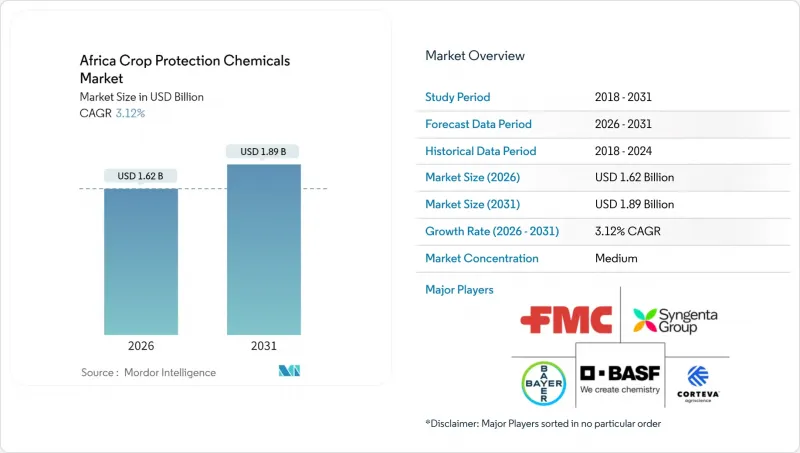

Africa Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Africa crop protection chemicals market is expected to grow from USD 1.57 billion in 2025 to USD 1.62 billion in 2026 and is forecast to reach USD 1.89 billion by 2031 at 3.12% CAGR over 2026-2031.

Current growth rests on mounting climate pressures that increase pest outbreaks, rising government input subsidies, improving mobile fintech access for smallholders, and steady commercialization of farming in Southern and Eastern corridors. Intensifying fall armyworm damage, supply-chain digitization, and biotechnology approvals are reshaping product mix toward premium, more selective actives. Meanwhile, fragmented national regulations and shipping cost volatility raise cost-to-serve, prompting suppliers to pursue regional manufacturing and partner-led distribution models. Competitive intensity remains moderate, leaving room for local specialists to tackle counterfeit mitigation, biologics integration, and last-mile advisory gaps.

Africa Crop Protection Chemicals Market Trends and Insights

Escalating pest pressure from climate-change-driven outbreaks

Climate variability is expanding pest ranges and reproductive cycles. Fall armyworm alone destroys up to 20 million metric tons of maize annually, equal to feeding 100 million people. Farmers respond with frequent foliar sprays and premium systemic insecticides. Desert locust resurgence in East Africa magnifies seasonal volatility. Limited biological control infrastructure elevates demand for selective chemistries that align with integrated pest management mandates. Temperature increases shorten life cycles, tightening spray windows and driving investments in predictive scouting tools and precision nozzles that minimize off-target drift.

Government subsidies for input intensification programs

Nigeria's Anchor Borrowers' Programme and Kenya's subsidized fertilizer initiatives bundle pesticides with seed and fertilizer, creating assured volumes for suppliers. Voucher and e-wallet payments lower credit risk, spur distributor expansion, and stimulate early-season stocking. Fiscal constraints and donor dependency create start-stop purchasing patterns, yet still inject sizable short-term demand spikes. Programs pairing subsidies with extension advice record higher repayment rates, reinforcing yield gains that justify repeat chemical purchases. Suppliers that pre-register products within government procurement lists secure preferential access to these large-volume channels.

Stringent regional bans on high-toxicity actives

Kenya's Agriculture and Food Authority seized Kenya Shilling (KES) 3.4 million (USD 26,000) of illegal agrochemicals in 2024. South Africa's regulator now requires expanded environmental assessments, lengthening new registration timelines by up to 18 months. The Economic Community of West African States pesticide harmonization draft plans to phase out over 30 active ingredients. Reformulation increases research costs and reduces portfolios, particularly for small molecules targeting niche pests. Transition gaps risk yield losses if low-toxicity alternatives are not readily available or affordable.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of herbicide-tolerant crop varieties

- Expansion of commercial farming clusters

- Proliferation of counterfeit pesticides

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, insecticides secured 39.50% of the Africa crop protection chemicals market share due to acute fall armyworm infestations that imperil maize and sorghum in West and East Africa. The Africa crop protection chemicals market size for insecticides is projected to rise steadily but cede relative share as genetically modified insect-resistant crops diffuse. Herbicides enjoy the fastest 3.55% CAGR through 2031, underpinned by commercial farms adopting reduced-tillage and herbicide-tolerant cultivars. Fungicides remain vital in export-oriented horticulture where maximum residue limit compliance dictates precise scheduling and premium actives. Niche segments such as nematicides gain traction in root and tuber production hotspots where yield losses from nematodes approach 12%.

Biotechnology triggers a nuanced shift rather than outright substitution. TELA maize approval cuts insecticide sprays by up to three rounds each season, yet fosters higher herbicide usage to protect more uniform stands. Suppliers respond with combo packs that integrate pre-emergence herbicides and biological seed coatings. Investment in digital scouting platforms enables threshold-based insecticide applications, aligning with stewardship guidelines. Ultimately, the portfolio mix evolves toward molecules with dual or multiple modes of action that delay resistance and comply with future regulatory standards.

The Africa Crop Protection Chemicals Market Report is Segmented by Function (Fungicide, Herbicide, Insecticide, and More), Application Mode (Chemigation, Foliar, Fumigation, and More), Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, Pulses and Oilseeds, and Turf and Ornamental), and Geography (South Africa, Rest of Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Syngenta Group

- Bayer AG

- Corteva Agriscience

- BASF SE

- FMC Corporation

- Sumitomo Chemical Co., Ltd.

- Nufarm Limited

- UPL Limited

- Wynca Group (Zhejiang Xinan Chemical Industrial Group Co., Ltd.)

- Koppert B.V.

- Andermatt Group AG

- Albaugh LLC

- Rotam Global AgroSciences Ltd.

- Bioceres Crop Solutions Corp.

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY and KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 South Africa

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Escalating pest pressure from climate-change-driven outbreaks

- 4.5.2 Government subsidies for input intensification programs

- 4.5.3 Rapid adoption of herbicide-tolerant crop varieties

- 4.5.4 Expansion of commercial farming clusters in Southern and Eastern Africa

- 4.5.5 EU-MRL revisions shifting exporters to premium actives

- 4.5.6 Mobile agro-input fintech platforms improving input access

- 4.6 Market Restraints

- 4.6.1 Stringent regional bans on high-toxicity actives

- 4.6.2 Accelerating pest and weed resistance

- 4.6.3 Proliferation of counterfeit pesticides

- 4.6.4 Red-Sea/Suez shipping volatility inflating import costs

5 MARKET SIZE AND GROWTH FORECASTS (VALUE and VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Country

- 5.4.1 South Africa

- 5.4.2 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Syngenta Group

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 BASF SE

- 6.4.5 FMC Corporation

- 6.4.6 Sumitomo Chemical Co., Ltd.

- 6.4.7 Nufarm Limited

- 6.4.8 UPL Limited

- 6.4.9 Wynca Group (Zhejiang Xinan Chemical Industrial Group Co., Ltd.)

- 6.4.10 Koppert B.V.

- 6.4.11 Andermatt Group AG

- 6.4.12 Albaugh LLC

- 6.4.13 Rotam Global AgroSciences Ltd.

- 6.4.14 Bioceres Crop Solutions Corp.

- 6.4.15 Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS