PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939579

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939579

Vietnam Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

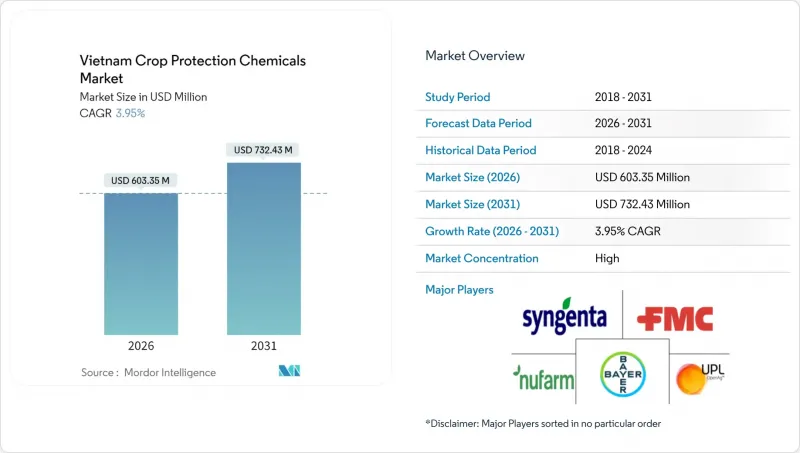

The Vietnam crop protection chemicals market is expected to grow from USD 580.42 million in 2025 to USD 603.35 million in 2026 and is forecast to reach USD 732.43 million by 2031 at 3.95% CAGR over 2026-2031.

Mounting export opportunities, fast-modernizing farms, and climate-induced pest loads combine to propel demand for both conventional and low-residue formulations. A nationwide pivot toward integrated pest management that blends synthetic and biological solutions is encouraging established brands to widen portfolios while domestic players scale generic lines. In parallel, digital contract-farming platforms streamline last-mile delivery, improving product traceability and locking farmers into branded input packages that underpin the Vietnam crop protection chemicals market. Government subsidy programs for rice-export compliance, specialty fruit orchard expansion, and herbicide-tolerant grain seed adoption collectively enlarge addressable acres, while counterfeit trade, residue-limit tightening, and rural labor scarcity temper the growth curve.

Vietnam Crop Protection Chemicals Market Trends and Insights

Government Incentives for Rice-Export Quality Compliance

Vietnam's agricultural export strategy fundamentally reshapes crop protection demand through quality-linked financial incentives that reward farmers for meeting international standards. The Ministry of Agriculture and Rural Development's Circular 01/2024/TT-BNNPTNT establishes direct subsidies for farmers adopting certified crop protection protocols, with premium payments reaching 15% above market rates for rice meeting EU organic residue standards. Export quality compliance requirements drive adoption of integrated pest management protocols that combine biological and chemical solutions, expanding market opportunities for companies offering comprehensive product portfolios rather than single-active ingredient solutions.

Rapid Expansion of Specialty Fruit Export Orchards

Specialty fruit cultivation emerges as a high-value driver transforming Vietnam's agricultural landscape, with dragon fruit exports alone reaching USD 2.8 billion in 2024, representing 23% growth from previous year levels. Orchard expansion in the Central Highlands and southern provinces creates demand for specialized fungicides and insecticides tailored to tropical fruit production, where single pest outbreaks can destroy entire seasonal harvests worth millions of dollars. Premium fruit export markets in China, Japan, and South Korea enforce strict maximum residue limits that require sophisticated application timing and product selection, driving farmers toward higher-priced, low-residue formulations. The shift from subsistence farming to commercial orchard management introduces professional crop protection practices that favor established international brands over local generic products.

Escalating Counterfeit Pesticide Trade

Counterfeit pesticide infiltration undermines legitimate market growth by offering substandard products at prices 30-50% below authentic formulations, creating unfair competition that pressures profit margins across the industry. Border provinces with China and Cambodia experience particularly acute counterfeit penetration, where cross-border smuggling networks exploit regulatory gaps and limited enforcement resources. Counterfeit products often contain incorrect active ingredient concentrations or banned substances, leading to crop failures that damage farmer confidence in chemical crop protection methods. The proliferation of fake products forces legitimate manufacturers to invest heavily in anti-counterfeiting measures and farmer education programs, reducing resources available for product development and market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Herbicide-Tolerant Hybrid Rice and Corn Seeds

- Growth of Contract-Farming Platforms Driving Input Packages

- Stringent Residue Limits from European Union/United States Buyers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fungicides captured 37.80% of the 2025 value as perennial humidity in paddies breeds blast, sheath blight, and brown spot. The Vietnam crop protection chemicals market size for fungicides remains anchored by triazoles and strobilurins, yet demand migrates toward low-residue SDHI blends that win export approvals. Molluscicides, propelled by golden apple snail incursions into 15 new provinces, headline growth at 6.48% CAGR. Farmers increasingly integrate metaldehyde alternatives with biological baits to satisfy residue audits while preserving efficacy.

Nematicides represent a smaller but growing segment, particularly in vegetable production areas where root-knot nematode pressure intensifies under climate change conditions. The functional mix reflects Vietnam's crop portfolio emphasis on rice and specialty crops that require intensive disease and pest management to meet export quality standards. Minor segments, namely nematicides for vegetable zones, enjoy niche expansion as root-knot outbreaks rise. Advances in mode-of-action rotation and resistance-management labeling bolster prospects for premium multi-active packs. International suppliers dominate patented fungicide and insecticide niches, while local firms thrive in single-active herbicide generics.

The Vietnam Crop Protection Chemicals Market Report is Segmented by Function (Fungicide, Herbicide, Insecticide, Molluscicide, and More), Application Mode (Chemigation, Foliar, Fumigation, Seed Treatment, and More), and Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, Pulses and Oilseeds, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Syngenta Group

- UPL Limited

- Wynca Group (Wynca Chemicals)

- Sumitomo Chemical Co.

- Albaugh LLC

- Loc Troi Group

- Hailir Group

- Nippon Soda Co., Ltd.

- Vietnam National Chemical Group - Vinachem

- Takeda Pharmaceutical Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Government incentives for rice-export quality compliance

- 4.5.2 Rapid expansion of specialty fruit export orchards

- 4.5.3 Adoption of herbicide-tolerant hybrid rice and corn seeds

- 4.5.4 Growth of contract-farming platforms driving input packages

- 4.5.5 Climate-change-driven pest pressure in Mekong Delta

- 4.5.6 Digitally enabled last-mile agro-dealer networks

- 4.6 Market Restraints

- 4.6.1 Escalating counterfeit pesticide trade

- 4.6.2 Stringent residue limits from European Union/United States buyers

- 4.6.3 Rising labor migration shrinking farm labor pool

- 4.6.4 Increasing consumer preference for organic produce

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Nufarm Ltd

- 6.4.6 Syngenta Group

- 6.4.7 UPL Limited

- 6.4.8 Wynca Group (Wynca Chemicals)

- 6.4.9 Sumitomo Chemical Co.

- 6.4.10 Albaugh LLC

- 6.4.11 Loc Troi Group

- 6.4.12 Hailir Group

- 6.4.13 Nippon Soda Co., Ltd.

- 6.4.14 Vietnam National Chemical Group - Vinachem

- 6.4.15 Takeda Pharmaceutical Co.

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS