PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939100

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939100

Asia Pacific Pharmaceutical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

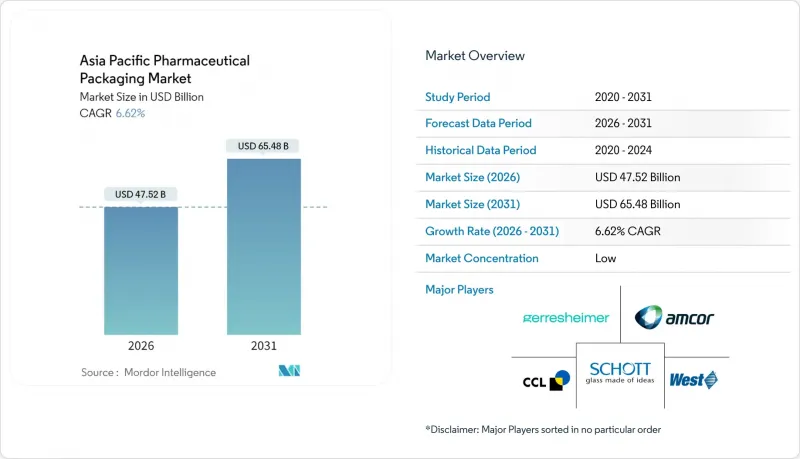

The Asia Pacific pharmaceutical packaging market was valued at USD 44.57 billion in 2025 and estimated to grow from USD 47.52 billion in 2026 to reach USD 65.48 billion by 2031, at a CAGR of 6.62% during the forecast period (2026-2031).

This steady climb reflects the region's transition from a low-cost production base into a global center for high-value biologics, complex fill-finish services, and serialization-ready packaging lines. Demand intensifies as China enforces e-code serialization and India scales its Drug Authentication and Verification Application, pushing every tier of the supply chain toward traceable, tamper-evident formats. Material innovation also quickens: converters move from commodity plastics toward cyclic olefins and bioplastics that withstand deep-cold logistics for cell-and-gene therapies. In parallel, pharmaceutical brand owners favor single-dose formats and integrated digital identifiers, locking the Asia Pacific pharmaceutical packaging market into a multi-year investment cycle focused on sustainability and compliance.

Asia Pacific Pharmaceutical Packaging Market Trends and Insights

Rising Biologics Pipeline Demanding High-Integrity Primary Packaging

Biologics represented 34% of SCHOTT Pharma's biopharmaceutical revenue in 2024, lifting total sales to USD 1.05 billion and signaling a structural pivot toward pre-sterilized borosilicate formats that minimize contamination risk.Stevanato Group echoed this trend, generating USD 1.21 billion in fiscal 2024 with 38% of revenue from ready-to-use vials and cartridges. The two firms, together with Gerresheimer, formed the Alliance for RTU in September 2024 to standardize ready-to-use container formats across the Asia Pacific pharmaceutical packaging market. Contract manufacturers now specify depyrogenated vials and pre-assembled closures at bid stage, compressing validation timelines for vaccine and monoclonal antibody launches. As biologics pipelines mature, high-value container demand expands beyond top-tier sites, encouraging regional glass makers to retrofit furnaces for tighter dimensional tolerances and visible-particle-free output.

Accelerated Fill-Finish Outsourcing to Asia Driving Contract Packaging Volumes

Lotus Pharmaceutical's FDA-, EMA- and PMDA-certified network earned a record first-half 2025 revenue, reinforcing India's ability to absorb complex fill-finish work relocated from Western plants. Singapore and South Korea compete on biologics expertise, while cost-efficient sterilization suites in China shorten lead times for seasonal vaccine production. The Asia Pacific pharmaceutical packaging market consequently records higher throughput for nested syringes, dual-chamber cartridges, and serialized secondary cartons. Technology transfer contracts increasingly bundle packaging qualification with drug-product manufacture, elevating local converters into solution partners rather than commodity suppliers. This momentum accelerates adoption of ISO -compliant clean-room infrastructure and creates a ripple effect on labelling, inspection, and aggregation services.

Volatile Resin and Alumina Prices Squeezing Converter Margins

Winpak's 2024 earnings call revealed a 9-13% quarter-over-quarter drop in nylon and aluminum foil prices after earlier spikes, underscoring the commodity whiplash confronting converters. Packaging producers devote treasury resources to hedging strategies and flexible pricing clauses, yet smaller firms lack the credit lines to buffer sudden surges. Inventory runs leaner, raising the risk of line stoppages when suppliers ration allocations. Uneven cost absorption places integrated multinationals at an advantage, tilting competitive balance within the Asia Pacific pharmaceutical packaging market toward scale players that negotiate annual raw-material contracts.

Other drivers and restraints analyzed in the detailed report include:

- Government Bulk-Procurement Schemes Favouring Cost-Efficient Blister Formats

- Serialization Regulations Boosting Track-and-Trace Packaging

- Stringent PVC Phase-Out Policies in Japan and South Korea

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic maintained a commanding 46.78% share of the Asia Pacific pharmaceutical packaging market in 2025 thanks to established extrusion and injection-molding capacity close to major drug-manufacturing clusters. Yet the segment's mid-single-digit growth contrasts with the 8.22% CAGR logged by advanced materials, underscoring a pivot toward cyclic olefins, bio-based polymers, and specialty glass that better withstand cryogenic storage and high-potency drugs. The Asia Pacific pharmaceutical packaging market size attributable to cyclic-olefin copolymers is projected to climb in double digits as biologics pipelines deepen and Annex 1 clean-room standards tighten.

Mitsui Chemicals' APEL(TM) demonstrates how cyclic-olefin innovation satisfies moisture-barrier demands while remaining compatible with gamma sterilization, enabling wider adoption in pre-filled syringe barrels. Glass producers also renovate furnaces for Type I borosilicate, aiming to capture injectable fill-finish growth without the delamination risks of legacy vials. On the sustainability front, film converters experiment with PLA-nanocellulose blends that promise compostability yet meet extractables limits required by pharmacopeias. Regional regulators support this shift by issuing guidance prioritizing recyclability and carbon-footprint disclosure, embedding environmental metrics into material-selection checklists.

The Asia Pacific Pharmaceutical Packaging Market Report is Segmented by Material (Plastic, Paper and Paperboard, Glass, Aluminum Foil, Other Advanced Materials), Type (Ampoules, Blister Packs, Plastic Bottles, Syringes, Vials, IV Fluids, Stick Packs, Pouches and Sachets, Caps and Closures), Drug Delivery Mode (Oral, Injectable, Pulmonary, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services Inc

- CCL Industries Inc

- NIPRO Corporation

- Wihuri Group

- Klockner Pentaplast Group

- Catalent Pharma Solutions Inc

- Berry Global Group Inc

- SGD Pharma

- AptarGroup Inc

- Stevanato Group

- Huhtamaki Oyj

- Daikyo Seiko Ltd

- Shandong Pharmaceutical Glass Co

- Tekni-Plex Inc

- Alpla Werke

- Chongqing Zhengchuan Glass

- Essel Propack Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Biologics Pipeline Demanding High-Integrity Primary Packaging

- 4.2.2 Accelerated Fill-Finish Outsourcing to Asia Driving Contract Packaging Volumes

- 4.2.3 Government Bulk-Procurement Schemes Favouring Cost-Efficient Blister Formats

- 4.2.4 Serialization Regulations (China E-Codes, India Dava) Boosting Track-and-Trace Packaging

- 4.2.5 Surge in Low-Dose, High-Potency OSD Drugs Spurring Adoption of High-Barrier PTP Foils (Under-Reported)

- 4.2.6 Growth of Temperature-Sensitive Cell-and-Gene Therapies Creating Demand for Cryo-Compatible Vials (Under-Reported)

- 4.3 Market Restraints

- 4.3.1 Volatile Resin and Alumina Prices Squeezing Converter Margins

- 4.3.2 Stringent PVC Phase-Out Policies In Japan and South Korea

- 4.3.3 Port Congestion and Cold-Chain Bottlenecks Slowing Export Shipments (Under-Reported)

- 4.3.4 Limited Regional Supply of Pharma-Grade Borosilicate Tubing (Under-Reported)

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Supplier

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industry Partnerships and Collaborations

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paper and Paperboard

- 5.1.3 Glass

- 5.1.4 Aluminum Foil

- 5.1.5 Other Materials (Bioplastics, Cyclic Olefins)

- 5.2 By Type

- 5.2.1 Ampoules

- 5.2.2 Blister Packs

- 5.2.3 Plastic Bottles

- 5.2.4 Syringes

- 5.2.5 Vials

- 5.2.6 IV Fluids

- 5.2.7 Stick Packs

- 5.2.8 Pouches and Sachets

- 5.2.9 Caps and Closures

- 5.3 By Drug Delivery Mode

- 5.3.1 Oral

- 5.3.2 Injectable

- 5.3.3 Pulmonary

- 5.3.4 Topical and Transdermal

- 5.3.5 Other Modes

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia

- 5.4.6 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amcor plc

- 6.4.2 Gerresheimer AG

- 6.4.3 Schott AG

- 6.4.4 West Pharmaceutical Services Inc

- 6.4.5 CCL Industries Inc

- 6.4.6 NIPRO Corporation

- 6.4.7 Wihuri Group

- 6.4.8 Klockner Pentaplast Group

- 6.4.9 Catalent Pharma Solutions Inc

- 6.4.10 Berry Global Group Inc

- 6.4.11 SGD Pharma

- 6.4.12 AptarGroup Inc

- 6.4.13 Stevanato Group

- 6.4.14 Huhtamaki Oyj

- 6.4.15 Daikyo Seiko Ltd

- 6.4.16 Shandong Pharmaceutical Glass Co

- 6.4.17 Tekni-Plex Inc

- 6.4.18 Alpla Werke

- 6.4.19 Chongqing Zhengchuan Glass

- 6.4.20 Essel Propack Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment