PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939119

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939119

China Water Treatment Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

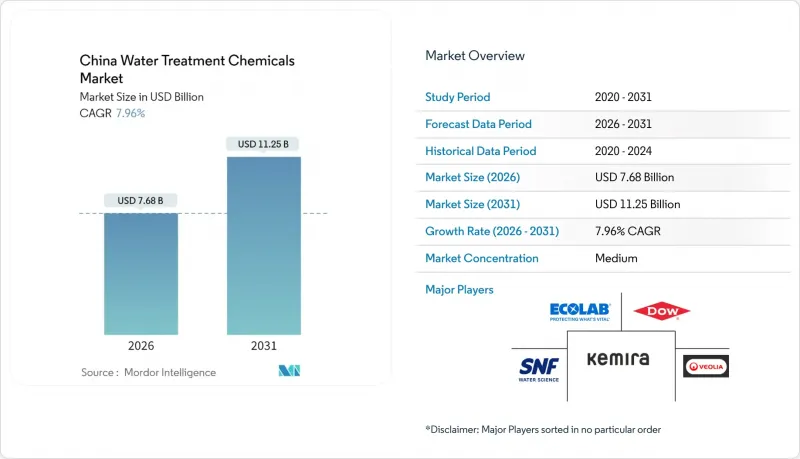

China Water Treatment Chemicals market size in 2026 is estimated at USD 7.68 billion, growing from 2025 value of USD 7.11 billion with 2031 projections showing USD 11.25 billion, growing at 7.96% CAGR over 2026-2031.

Robust funding for water infrastructure, strict GB 8978-2020 discharge limits, and zero-liquid-discharge (ZLD) directives in lithium-battery hubs are reinforcing demand for coagulants, flocculants, and advanced oxidation agents across municipal and industrial sites. Cooling system retrofits at hyperscale data centers and closed-loop upgrades at new coal and nuclear plants are widening the addressable base for corrosion inhibitors, scale preventers, and biocides. Green treatment chemistries that enable resource recovery under circular-economy mandates are evolving from niche to mainstream, while real-time dosing platforms are trimming chemical consumption yet expanding value-added service revenue. Competitive intensity remains moderate: multinationals leverage formulation know-how, whereas regional specialists exploit cost advantages and local market familiarity to serve fragmented end-user needs.

China Water Treatment Chemicals Market Trends and Insights

Rapid Capacity Additions in Coal and Nuclear Power Plants

New thermal and nuclear units impose higher water-quality standards, compelling operators to deploy sophisticated boiler-water conditioning packages and flue-gas desulfurization additives. In 2024, China commissioned 47.4 GW of new coal capacity, with each gigawatt consuming 3,000-5,000 tons of treatment chemicals annually. Ultra-pure systems at coastal reactors now rely on mixed-bed ion-exchange resins and low-fouling antiscalants to meet zero-emission goals. Closed-loop cooling retrofits curb freshwater draw but heighten the need for long-life corrosion inhibitors and microbiological controls. Procurement teams increasingly seek bundled chemical-and-service contracts that guarantee performance and mitigate price volatility over the life of the plant. Suppliers that demonstrate expertise in high-TDS brine crystallization and onsite technical support are increasingly shortlisted for multiyear frameworks.

Stricter Industrial Wastewater Discharge Standards (GB 8978-2020)

GB 8978-2020 reduced chemical-oxygen-demand limits to 50 mg/L and added 21 heavy metals plus 60 organics, forcing industrial parks to adopt advanced oxidation, membrane, and targeted coagulant regimens. Compliance costs run CNY 21-29 per ton of wastewater, with chemicals representing one-third of outlays. Phased rollout through 2027 assures steady demand, yet inconsistent regional enforcement fragments product specifications. Suppliers offering modular chemical portfolios that can be rapidly re-tuned to local discharge permits gain a competitive edge. Centralized treatment facilities unlock bulk-procurement efficiencies, prompting strategic alliances between chemical formulators and park operators.

Tight Limits on Chlorinated Organics (Class V Water)

Class V water rules cap total organic halogens at 0.5 mg/L, restricting chlorine-based biocides historically favored for cost and efficacy. Facilities near fragile ecosystems are shifting to ozone, UV, or peracetic acid regimes that lack residual kill but meet discharge permits. Transition raises operating costs by 20-30% and shortens the shelf life of on-site chemical stocks. Technology providers capable of marrying alternative disinfectants with real-time monitoring systems are offsetting efficacy gaps through data-driven control.

Other drivers and restraints analyzed in the detailed report include:

- Municipal WWTP Upgrades Under the 14th Five-Year Plan

- ZLD Mandates in Lithium-Battery Manufacturing Hubs

- Raw-Material Price Volatility Amid Eco-Inspections

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coagulants and flocculants represented 23.15% of the China water treatment chemicals market share in 2025, a position secured through indispensable use in primary clarification and nutrient removal. Aluminum-based formulations dominate municipal lines for low-turbidity raw water, whereas iron-based variants capture phosphorus in industrial run-off. The China water treatment chemicals market size attributable to coagulants is projected to expand at an 8.55% CAGR, spurred by tighter effluent criteria and microplastic abatement initiatives.

High-charge PAC grades reduce sludge volume, curbing downstream disposal costs and encouraging upgrades in aging plants. Polyacrylamide copolymers customized for high-salinity matrices now command premium pricing in oil-and-gas water flooding and mining tailings. Suppliers coupling laboratory jar-testing with on-site performance validation raise switching barriers and secure multi-cycle replenishment contracts.

The China Water Treatment Chemicals Report is Segmented by Product Type (Coagulants and Flocculants, Defoamer and Defoaming Agent, Corrosion and Scale Inhibitors, Biocides and Disinfectants, and More), Application (Boiler Water Treatment, Cooling Water Treatment, Membrane Treatment, and More), End-User Industry (Commercial and Institutional, Power Generation, Chemical Manufacturing, Mining and Mineral Processing, and More).

List of Companies Covered in this Report:

- Dow

- Ecolab

- Jiyuan Qingyuan Water Treatment Co., Ltd.

- Kemira

- Kemira

- Kurita Water Industries Ltd

- Shandong Taihe Technologies Co., Ltd.

- Shandong ThFine Chemical Co., Ltd.

- Shandong Xintai Water Treatment Technology Co., Ltd.

- SNF

- Veolia

- Yinhaijie Environmental Protection Technology (Beijing) Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid capacity additions in coal and nuclear power plants

- 4.2.2 Stricter industrial wastewater discharge standards (GB 8978-2020)

- 4.2.3 Municipal WWTP upgrades under the 14th Five-Year Plan

- 4.2.4 ZLD mandates in lithium-battery manufacturing hubs

- 4.2.5 Surge in hyperscale data-centre cooling demand

- 4.3 Market Restraints

- 4.3.1 Tight limits on chlorinated organics (Class V water)

- 4.3.2 Raw-material price volatility amid eco-inspections

- 4.3.3 Carbon-pricing costs for chemical-intensive plants

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Coagulants and Flocculants

- 5.1.2 Defoamer and Defoaming Agent

- 5.1.3 Corrosion and Scale Inhibitors

- 5.1.4 Biocides and Disinfectants

- 5.1.5 pH Adjuster and Softener

- 5.1.6 Other Product Types

- 5.2 By Application

- 5.2.1 Boiler Water Treatment

- 5.2.2 Cooling Water Treatment

- 5.2.3 Membrane Treatment

- 5.2.4 Green Water Treatment

- 5.2.5 Raw/Potable Water Preparation

- 5.2.6 Wastewater Treatment

- 5.3 By End-user Industry

- 5.3.1 Commercial and Institutional

- 5.3.2 Power Generation

- 5.3.3 Chemical Manufacturing

- 5.3.4 Mining and Mineral Processing

- 5.3.5 Municipal

- 5.3.6 Other End-user Industries

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dow

- 6.4.2 Ecolab

- 6.4.3 Jiyuan Qingyuan Water Treatment Co., Ltd.

- 6.4.4 Kemira

- 6.4.5 Kemira

- 6.4.6 Kurita Water Industries Ltd

- 6.4.7 Shandong Taihe Technologies Co., Ltd.

- 6.4.8 Shandong ThFine Chemical Co., Ltd.

- 6.4.9 Shandong Xintai Water Treatment Technology Co., Ltd.

- 6.4.10 SNF

- 6.4.11 Veolia

- 6.4.12 Yinhaijie Environmental Protection Technology (Beijing) Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment