PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939133

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939133

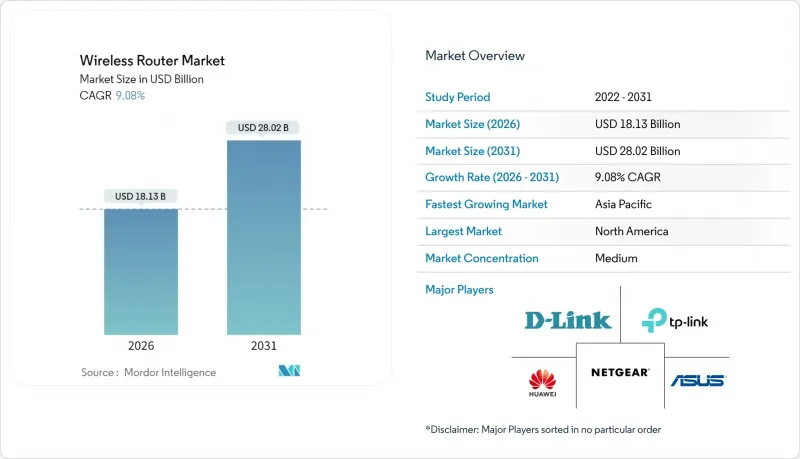

Wireless Router - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Wireless router market size in 2026 is estimated at USD 18.13 billion, growing from 2025 value of USD 16.62 billion with 2031 projections showing USD 28.02 billion, growing at 9.08% CAGR over 2026-2031.

Growth springs from surging enterprise digitalization, rising residential bandwidth needs, and rapid commercialization of Wi-Fi 7. Device shipments for Wi-Fi 7 totaled 269 million units in 2024 and are projected to exceed 2.1 billion by 2028, underscoring pent-up demand for multi-gigabit performance. A parallel boom in 6 GHz Wi-Fi hardware-807.5 million units shipped in 2024-confirms strong ecosystem readiness as 63 nations free portions of the 6 GHz band for unlicensed use. Mesh systems, higher-bandwidth tri-band designs, and ISP-managed CPE bundles are expanding total addressable demand, while fixed-wireless access and semiconductor supply constraints create pockets of volatility. Vendors now race to add AI-powered management and network-as-a-service features to preserve pricing power and mitigate intensifying price competition from low-cost Chinese suppliers.

Global Wireless Router Market Trends and Insights

Growing Internet Traffic and Connected Devices

More than 21.1 billion Wi-Fi devices are active worldwide, and another 4.1 billion are expected to ship in 2024, saturating legacy networks and prompting upgrades to multi-gigabit routers. Roughly one-fifth of residential broadband users now exceed 1 TB of monthly data, stressing quality-of-service thresholds. IoT growth in smart factories, smart cities, and autonomous mobility deepens the need for low-latency throughput that Wi-Fi 7's 320 MHz channels can deliver. Enterprises face device-density headaches when Wi-Fi 6 access points hit practical limits, forcing investment in next-generation radios. The result is an accelerated refresh cycle favoring vendors with Wi-Fi 7 portfolios.

Enterprise Digitalization Driving Bandwidth Demand

Forty-five percent of enterprises already trial both Wi-Fi 6 and private 5G in parallel, highlighting a preference for converged wireless fabrics. Manufacturing plants adopt Wi-Fi 7 to run AI-enabled robotics, sub-millisecond supervisory control, and machine-vision analytics. Quarterly router orders tied to AI infrastructure surpassed USD 350 million among leading suppliers in 2025. Subscription-based network-as-a-service models lower capex barriers, allowing faster rollouts. In short, bandwidth-hungry applications and flexible financing coalesce to push the wireless router market forward.

Network-Security Complexity and Skill Shortages

A 3.8 Tbps DDoS attack exploiting the ASUS router CVE-2024-3080 illustrated the sector's exposure to firmware vulnerabilities. Meanwhile, telecom operators report a 33% shortfall in qualified network engineers, particularly for emerging Wi-Fi 7 security and WPA3 configurations. Enterprises face higher deployment costs due to specialist consulting needs, stretching project lead times. Small firms often default to lax settings, heightening breach risks and limiting the adoption of premium routers with advanced threat detection.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Wi-Fi 6/6E and Wi-Fi 7

- Mesh Wi-Fi as a Managed Service by ISPs

- Mobile/5G Broadband Substitution Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standalone routers retained a 43.62% share in 2025, yet the mesh category is on track for an 11.74% CAGR through 2031 as users seek wall-to-wall coverage and self-optimizing performance. The wireless router market size tied to mesh deployments is forecast to expand in tandem with multi-gigabit fiber rollouts. ISP adoption of cloud-managed platforms such as Aginet and eero for Service Providers reinforces growth momentum. In contrast, mobile hotspot routers gain renewed relevance by embedding 5G radios, while industrial models address harsh-environment requirements.

Mesh vendors now bake in AI algorithms, Wi-Fi 7 multi-link operation, and 320 MHz backhaul channels to sustain premium pricing. Standalone designs increasingly target gamers, featuring tri-band radios and latency-shaping engines. Industrial routers leverage SD-WAN overlays to connect remote assets securely. Collectively, these sub-segments illustrate how innovation niches defend margin even as entry-level hardware commoditizes.

Wi-Fi 5 still commands 41.55% share thanks to mass-market affordability, but Wi-Fi 7 shipments are set for a 24.74% CAGR that will reshape the wireless router market. Enterprise demand for 6-15 Gbps real-world throughput pushes early adoption, and the wireless router market size linked to Wi-Fi 7 could surpass Wi-Fi 6 by the decade's end. Certification has eased multi-vendor interoperability concerns, although higher power requirements necessitate PoE switch upgrades.

Wi-Fi 6 remains a bridge technology, offering OFDMA efficiency to budget-constrained buyers. Legacy Wi-Fi 4 devices persist in niche IoT settings where cost and power trump speed. In advanced regions, procurement roadmaps now include phased Wi-Fi 7 rollouts paired with edge-compute investments, ensuring future-proof capacity without forklift overhauls.

The Wireless Router Market Report is Segmented by Product Type (Standalone Routers, Mesh Wi-Fi Systems, and More), Wi-Fi Standard (802. 11n, 802. 11ac, 802. 11ax, 802. 11be), Frequency Band (Single-Band, Dual-Band, Tri-/Quad-Band), End-User Industry (Residential, Enterprise), Distribution Channel (Online Retailers, Offline), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 33.55% of global revenue in 2025, buoyed by 5G rollouts, smart-city programs, and ongoing manufacturing digitization. National initiatives in Singapore and South Korea anchor demand for Wi-Fi 7 backbone connectivity, while Chinese vendors navigate overseas regulatory headwinds tied to security scrutiny. Hyperscale data-center expansion throughout the region further bolsters enterprise orders for high-throughput routers.

North America remains pivotal, thanks to aggressive fiber builds and sizable BEAD funding that directs equipment to underserved rural zones. Fixed-wireless access surpassed 12 million subscribers in 2024, simultaneously pressuring and complementing router sales via hybrid cellular-Wi-Fi gateways. Enterprises already account for 2% of Wi-Fi 7 AP shipments, a figure expected to quintuple by 2025.

Europe posts steady gains behind multi-gigabit fiber and phased 6 GHz clearance. France leads Wi-Fi 7 adoption, showcasing how premium CPE differentiates broadband tiers. Germany and the U.K. prioritize Industry 4.0 and secure networking, driving demand for tri-band routers with WPA3 and AI-powered threat analytics. Regulatory nuances post-Brexit still complicate certification timetables, nudging vendors toward localized logistics strategies.

South America registers the fastest trajectory at 10.47% CAGR on the back of fiber-to-the-home expansion and rural-connectivity subsidies. Brazil spearheads rollouts, while regional currency volatility forces creative pricing models. Emerging markets in the Middle East and Africa are leveraging smart-city ambitions to pilot Wi-Fi 7 in hospitality, education, and public-sector environments, laying groundwork for long-term demand.

- TP-Link Technologies Co., Ltd.

- NETGEAR, Inc.

- ASUSTeK Computer Inc.

- D-Link Corporation

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Ubiquiti Inc.

- CommScope Holding Company, Inc. (ARRIS)

- Amazon.com, Inc. (eero)

- Google LLC (Nest Wi-Fi)

- Belkin International, Inc. (Linksys)

- Xiaomi Corporation

- Buffalo Americas, Inc.

- Zyxel Communications Corp.

- MikroTik SIA

- TOTOLINK (CJSC Est.)

- Edimax Technology Co., Ltd.

- Amped Wireless (A division of NexGen Connected LLC)

- Mercury-PC Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing internet traffic and connected devices

- 4.2.2 Enterprise digitalization driving bandwidth demand

- 4.2.3 Rapid adoption of Wi-Fi 6/6E and forthcoming Wi-Fi 7

- 4.2.4 Mesh-Wi-Fi as a managed service by ISPs (under-the-radar)

- 4.2.5 Government-funded rural broadband CPE roll-outs (under-the-radar)

- 4.2.6 Emerging Wi-Fi sensing applications for ambient intelligence (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Network-security complexity and skill shortages

- 4.3.2 Mobile/5G broadband substitution risk

- 4.3.3 Semiconductor supply-chain volatility (under-the-radar)

- 4.3.4 Uneven global release of 6 GHz spectrum (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Standalone Routers

- 5.1.2 Mesh Wi-Fi Systems

- 5.1.3 Mobile Hotspot Routers

- 5.1.4 Industrial/Rugged Routers

- 5.2 By Wi-Fi Standard

- 5.2.1 802.11n (Wi-Fi 4)

- 5.2.2 802.11ac (Wi-Fi 5)

- 5.2.3 802.11ax (Wi-Fi 6)

- 5.2.4 802.11be (Wi-Fi 7)

- 5.3 By Frequency Band

- 5.3.1 Single-Band

- 5.3.2 Dual-Band

- 5.3.3 Tri-/Quad-Band

- 5.4 By End-user Industry

- 5.4.1 Residential

- 5.4.2 Enterprise

- 5.4.3 BFSI

- 5.4.4 Education

- 5.4.5 Healthcare

- 5.4.6 Media and Entertainment

- 5.4.7 Retail

- 5.4.8 Government and Public Sector

- 5.4.9 Other Enterprises

- 5.5 By Distribution Channel

- 5.5.1 Online Retailers

- 5.5.2 Offline (CE Stores, Hypermarkets)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves (M&A, Partnerships, Launches)

- 6.3 Market Share Analysis (Top-15, 2024)

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 TP-Link Technologies Co., Ltd.

- 6.4.2 NETGEAR, Inc.

- 6.4.3 ASUSTeK Computer Inc.

- 6.4.4 D-Link Corporation

- 6.4.5 Huawei Technologies Co., Ltd.

- 6.4.6 Cisco Systems, Inc.

- 6.4.7 Ubiquiti Inc.

- 6.4.8 CommScope Holding Company, Inc. (ARRIS)

- 6.4.9 Amazon.com, Inc. (eero)

- 6.4.10 Google LLC (Nest Wi-Fi)

- 6.4.11 Belkin International, Inc. (Linksys)

- 6.4.12 Xiaomi Corporation

- 6.4.13 Buffalo Americas, Inc.

- 6.4.14 Zyxel Communications Corp.

- 6.4.15 MikroTik SIA

- 6.4.16 TOTOLINK (CJSC Est.)

- 6.4.17 Edimax Technology Co., Ltd.

- 6.4.18 Amped Wireless (A division of NexGen Connected LLC)

- 6.4.19 Mercury-PC Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment