PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939145

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939145

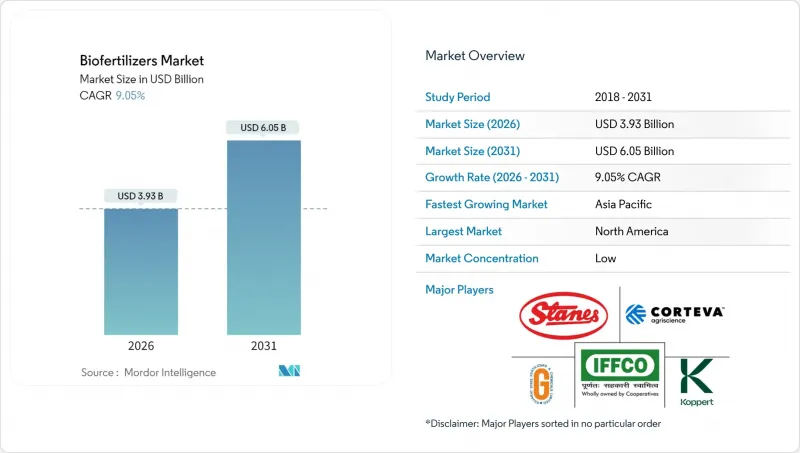

Biofertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The biofertilizers market is expected to grow from USD 3.60 billion in 2025 to USD 3.93 billion in 2026 and is forecast to reach USD 6.05 billion by 2031 at 9.05% CAGR over 2026-2031.

Strong momentum in sustainable farming, stricter environmental rules, and premium pricing for certified organic produce reinforce demand. North America leads current revenue with a 36.2% biofertilizers market share in 2024, reflecting mature organic certification systems and government cost-share programs. Asia-Pacific sets the pace on the growth front, propelled by national subsidy schemes in India and China and by large areas transitioning from synthetic to biological inputs. Across all regions, carbon-credit monetization, precision application tools, and bundled microbial consortia are widening profit pools for suppliers and growers alike. Consolidation among agricultural-input majors and local specialists further accelerates technology diffusion while reshaping competitive boundaries.

Global Biofertilizers Market Trends and Insights

Consumer Shift Toward Organic Food Drives Premium Market Expansion

Organic food sales reached USD 134 billion in 2024, posting 15.2% year-over-year growth, and certified produce commands 20-40% price premiums . Retailers now require verified biological input records for shelf space, prompting growers to embrace biofertilizers market solutions for compliance. Europe posts the highest per-capita organic consumption, reinforcing steady demand in Germany and the Netherlands. Brand owners outside traditional organic niches are adopting biological inputs to satisfy public sustainability pledges, thereby enlarging addressable hectares. These convergence dynamics elevate revenue visibility for suppliers and strengthen long-term expansion prospects for the biofertilizers market.

Government Subsidies Create Favorable Adoption Economics

The United States Department of Agriculture (USDA) earmarked USD 300 million in 2024 under the Environmental Quality Incentives Program to reimburse up to 75% of qualifying biofertilizer costs . India's Ministry of Chemicals and Fertilizers launched an INR 41 billion (USD 500 million) promotion scheme the same year. The European Union (EU) allocates EUR 8.1 billion (USD 8.7 billion) annually through eco-schemes that reward verified biological inputs . Brazil, under its National Program for Biological Inputs, offers tax holidays on microbial manufacturing equipment. These incentives narrow payback periods for growers and catalyze double-digit growth in the biofertilizers market.

Cold-Chain Infrastructure Limitations Constrain Market Access

Biofertilizers must remain between 2 °C and 8 °C, yet viability drops 15-30% monthly at ambient temperatures. Forty percent of developing nations lack adequate cold storage, raising distribution costs by up to four times. Logistics hurdles weaken retail availability and deter small distributors from stocking live microbial products. Freeze-dry and encapsulation methods extend shelf life to almost two years but raise production costs 35-50%. Until the existing cold-chain infrastructure gaps are effectively addressed, this challenge will continue to impede the growth potential of the biofertilizers market.

Other drivers and restraints analyzed in the detailed report include:

- Environmental Regulations Accelerate Synthetic Input Substitution

- Certified Organic Acreage Expansion Sustains Demand

- Performance Inconsistency Across Agricultural Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mycorrhiza products held 35.74% of the biofertilizers market share in 2025. Arbuscular mycorrhizal fungi deliver 20-35% higher phosphorus uptake across corn, soybean, and vegetable plots. Rhizobium formulations lead future expansion at 10.25% CAGR from 2026 to 2031 due to nitrogen fixation that trims synthetic needs by up to 60 kg per hectare. Growing interest in dual-organism blends, validated by the Environmental Protection Agency (EPA) in its rising approvals roster, drives incremental value. Multi-strain research strengthens crop resilience and broadens acreage, reinforcing CAGR forecasts and pulling fresh capital into this slice of the biofertilizers market.

Sustained investment in fermentation technology, coupled with precision carrier materials, is boosting shelf stability and field consistency. Suppliers that integrate agronomy advisory with product supply are earning loyalty among large growers and cooperatives. Granular application data guides next-generation R&D, encouraging custom inoculant packages that match soil profiles. These advances increase average selling prices and deepen the competitive moat around the biofertilizers market size for mycorrhiza and related consortia products.

The Biofertilizers Market Report is Segmented by Form (Azospirillum, Azotobacter, Mycorrhiza, Phosphate Solubilizing Bacteria, Rhizobium, and More), by Crop Type (Cash Crops, Horticultural Crops, and More), and by Geography (Africa, Asia-Pacific, Europe, Middle East, North America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America held a 35.62% share of the biofertilizers market in 2025, with the United States accounting for a significant portion to meet regional demand. Federal incentives, mature cold chains, and robust extension services underpin sustained volume growth. Canada follows with prairie-focused adoption in canola and wheat, while Mexico leverages organic certification for export-oriented horticulture. High research intensity, strong dealer networks, and widespread digital agronomy platforms make North America a launchpad for advanced inoculant technologies within the biofertilizers market.

Asia-Pacific stands out as the fastest-growing territory, advancing at a projected 9.74% CAGR to 2031. India anchors growth through its INR 41 billion subsidy scheme, distributing microbial inputs to 45 million farmers each year. China, representing USD 438.5 million in 2025, pursues a 20% synthetic-fertilizer cut, supported by regional demonstration plots. Japan and Australia invest in high-precision delivery systems, while Vietnam and Indonesia deploy biofertilizers across rice and palm plantations. Upgrades in rural cold storage and state-run extension clinics reduce adoption hurdles, enhancing regional contribution to the global biofertilizers market size.

Europe ranks second by value, buoyed by the European Union (EU) Farm to Fork target and Common Agricultural Policy eco-payments. Germany leads at 23% of regional revenue, followed by France and Italy. Post-Brexit, the United Kingdom channels Environmental Land Management payments into biological input adoption. Eastern European modernization programs are adding demand at double-digit rates. South America, chiefly Brazil and Argentina, leverages large-scale soybean rotations to integrate nitrogen-fixing inoculants, widening the geographic spread of the biofertilizers market.

- Gujarat State Fertilizers & Chemicals Ltd

- IPL Biologicals Limited

- Koppert Biological Systems Inc.

- Novonesis Group

- Rizobacter Argentina S.A. (Bioceres Crop Solutions)

- Symborg Inc. (Corteva Agriscience)

- Andermatt Group AG

- T. Stanes and Company Limited

- Atlantica Agricola

- Biostadt India Limited

- Kiwa Bio-Tech

- Lallemand Inc.

- Certis Biologicals (Mitsui & Co.)

- Indian Farmers Fertiliser Cooperative Limited

- Indogulf Company

- Bionema Ltd

- Binzhou Jingyang Biological Fertilizer Co. Ltd

- Sustane Natural Fertilizer Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 EXECUTIVE SUMMARY AND KEY FINDINGS

3 REPORT OFFERS

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 Egypt

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Iran

- 4.3.12 Italy

- 4.3.13 Japan

- 4.3.14 Mexico

- 4.3.15 Netherlands

- 4.3.16 Nigeria

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Turkey

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Consumer Shift Toward Organic Food Drives Premium Market Expansion

- 4.5.2 Government Subsidies Create Favorable Adoption Economics

- 4.5.3 Environmental Regulations Accelerate Synthetic Input Substitution

- 4.5.4 Certified Organic Acreage Expansion Sustains Demand

- 4.5.5 Carbon-Credit Monetization for Biofertilizer Use

- 4.5.6 Adoption of Microbial Consortia for Drought/Salinity Tolerance

- 4.6 Market Restraints

- 4.6.1 Cold-Chain Infrastructure Limitations Constrain Market Access

- 4.6.2 Performance Inconsistency Across Agricultural Systems

- 4.6.3 Rising Competition from Biostimulants and Nano-fertilizers

- 4.6.4 Patentability Hurdles for Novel Microbial Strains

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Form

- 5.1.1 Azospirillum

- 5.1.2 Azotobacter

- 5.1.3 Mycorrhiza

- 5.1.4 Phosphate Solubilizing Bacteria

- 5.1.5 Rhizobium

- 5.1.6 Other Biofertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Geography

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Nigeria

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest of Africa

- 5.3.1.1 By Country

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 Thailand

- 5.3.2.1.8 Vietnam

- 5.3.2.1.9 Rest of Asia-Pacific

- 5.3.2.1 By Country

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.3.1 By Country

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest of Middle East

- 5.3.4.1 By Country

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest of North America

- 5.3.5.1 By Country

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest of South America

- 5.3.6.1 By Country

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Gujarat State Fertilizers & Chemicals Ltd

- 6.4.2 IPL Biologicals Limited

- 6.4.3 Koppert Biological Systems Inc.

- 6.4.4 Novonesis Group

- 6.4.5 Rizobacter Argentina S.A. (Bioceres Crop Solutions)

- 6.4.6 Symborg Inc. (Corteva Agriscience)

- 6.4.7 Andermatt Group AG

- 6.4.8 T. Stanes and Company Limited

- 6.4.9 Atlantica Agricola

- 6.4.10 Biostadt India Limited

- 6.4.11 Kiwa Bio-Tech

- 6.4.12 Lallemand Inc.

- 6.4.13 Certis Biologicals (Mitsui & Co.)

- 6.4.14 Indian Farmers Fertiliser Cooperative Limited

- 6.4.15 Indogulf Company

- 6.4.16 Bionema Ltd

- 6.4.17 Binzhou Jingyang Biological Fertilizer Co. Ltd

- 6.4.18 Sustane Natural Fertilizer Inc.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS