PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939156

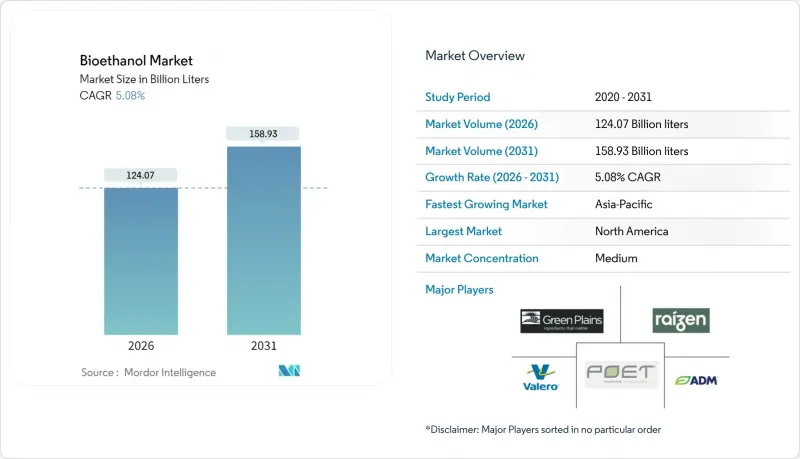

Bioethanol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Bioethanol Market was valued at 118.07 billion litres in 2025 and estimated to grow from 124.07 billion litres in 2026 to reach 158.93 billion litres by 2031, at a CAGR of 5.08% during the forecast period (2026-2031).

Continued policy backing for E10-E20 blends, growing interest in ethanol-to-jet fuel, and cost-advantaged feedstock supply underpin this trajectory even as light-duty vehicle electrification advances. North American corn-based capacity, Brazilian sugarcane flexibility, and fresh capital inflows from Middle Eastern investors reinforce supply security. Meanwhile, Asia-Pacific governments fast-track aggressive blending targets that deepen regional demand pools, and refiners pursue low-carbon ethanol to satisfy tightening ESG metrics. Together, these factors sustain the bioethanol market's resilience against competing transport decarbonization pathways.

Global Bioethanol Market Trends and Insights

Favourable Global E10-E20 Blending Mandates

Strengthened blending requirements are creating predictable baseload demand that insulates the bioethanol market from crude price swings while locking in capacity expansion. Japan's nationwide E10 roll-out and pilot E20 zones, Brazil's 27% ceiling flexibility, and India's accelerated 30% target together lift annual offtake volumes and encourage new plant investment. Regulatory agencies back compliance through fuel-quality standards, domestic content rules, and import controls, ensuring blend targets translate into physical deliveries rather than paper credits. These policies turn the bioethanol market into a structural element of national energy security strategies even as electrification gains momentum.

Carbon-Reduction and ESG Pressure on Refiners

Refiners facing investor scrutiny and stringent carbon standards now view low-intensity bioethanol as a strategic differentiator instead of a mere compliance component. California's 2024 Low Carbon Fuel Standard update tightened carbon benchmarks, rewarding supplies certified under schemes such as ISCC. The EU's revised Renewable Energy Directive likewise privileges traceable, sustainably sourced ethanol. In response, companies like BP vertically integrated upstream via the USD 1.4 billion acquisition of Bunge Bioenergia, securing feedstock and lifecycle emission control in one step. Premium demand emerges in markets where renewable-content uptake exceeds mandate floors, sustaining price spreads favorable to lower-carbon producers.

Rapid Electrification of Light-Duty Vehicles

Soaring EV adoption trims gasoline demand ceilings in core markets. Norway hit 94% EV penetration for 2024 new car sales, China surpassed 35%, and the IEA forecasts a 30% global light-vehicle share by 2030. As a result, refiners face shrinking blend pools, compelling bioethanol producers to pivot toward aviation, heavy-duty transport, and export-led strategies. Regional demand divergence persists because emerging economies lag in vehicle electrification, creating opportunities for geographic diversification within the bioethanol market.

Other drivers and restraints analyzed in the detailed report include:

- Feedstock Cost Advantage in U.S. Corn and Brazil Sugarcane

- Octane Demand Spurring Ethanol as Aromatic Substitute

- Food-vs-Fuel and Land-Use Controversy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corn-based output contributed 58.12% of the bioethanol market size in 2025, anchored by the U.S. Midwest, Brazil's Mato Grosso expansion, and well-established rail and barge logistics. Producers leverage enzyme advances and co-product valorization, notably distillers' grains for livestock feed and captured CO2 for beverages, to compress unit costs and improve carbon scores. Continuing investments in carbon capture and underground storage clusters across the Midcontinent further enhance lifecycle performance credentials.

Wheat ethanol is projected to record a 5.45% CAGR through 2031, the fastest growth among mainstream feedstocks. European players harness policy incentives for domestic grain diversification, while Australia's bumper wheat cycles offer export opportunities. Rising protein premiums make wheat distillers' grains attractive to livestock feeders, offsetting higher starch costs. Technology breakthroughs enabling high-gravity fermentation and fractional distillation improve plant utilization rates, strengthening wheat's competitiveness within the bioethanol market.

Other feedstocks, such as sugarcane, cassava, and emerging lignocellulosic sources, supply niche but strategic volumes that hedge against weather-induced crop swings. Brazilian sugarcane retains a structural cost edge via bagasse-fired cogeneration, while Indonesia's nipa palm and Mexico's agave pilots aim to unlock marginal-land production. Such diversification dampens price volatility and aligns with policymakers' pressure to minimize food-crop displacement.

The Bioethanol Market Report is Segmented by Feedstock Type (Sugarcane, Corn, Wheat, and Other Feedstock), Application (Automotive and Transportation, Food and Beverages, Pharmaceutical, Cosmetics and Personal Care, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

North America maintained 55.10% of global volume in 2025 thanks to entrenched corn infrastructure, stable Renewable Fuel Standard targets, and supportive state-level Low Carbon Fuel initiatives. Producers integrate carbon capture, direct air capture, and pipeline networks that compress the carbon intensity of corn ethanol, qualifying it for high-value credit markets. Canada leverages wheat and corn feedstock clusters, whereas Mexico's demand uptick absorbs U.S. exports, reinforcing continental trade flows that stabilize regional balance.

Asia-Pacific records the highest forecast CAGR at 5.74% through 2031 as India's 30% blend target and China's import appetite amplify consumption. Regional governments frame bioethanol expansion as rural income support and foreign-exchange savings, encouraging local investment in multi-feedstock biorefineries. Thailand, the Philippines, and Vietnam advance blend mandates aligned with agricultural modernization plans, while Indonesia pilots nipa-to-ethanol routes to sidestep food-crop constraints.

Europe emphasizes sustainability certification and favors residue-based ethanol that fulfills stringent greenhouse-gas savings thresholds. Quota systems in Germany and France anchor demand, and the United Kingdom's Renewable Transport Fuel Obligation prioritizes SAF, indirectly boosting ethanol-to-jet pathways. South America, dominated by Brazil, attracts foreign capital, notably the UAE's USD 13.5 billion commitment, to expand integrated assets that marry sugarcane, corn, and cogeneration. Middle East and Africa remain niche but rising, catalyzed by FAO programs for clean cooking solutions that position ethanol as a household energy alternative.

- Abengoa

- ADM

- Alto Ingredients Inc.

- Blue Biofuels Inc.

- BP p.l.c.

- Cenovus Energy

- Cristalco

- CropEnergies AG

- Ethanol Technologies

- GranBio Investimentos SA

- Green Plains Inc.

- Henan Tianguan Group Co. Ltd

- Jilin Fuel Ethanol Co. Ltd

- KWST

- Lantmannen

- POET LLC

- Raizen

- SEKAB

- SUNCOR Energy Inc.

- Tereos

- Valero

- VERBIO Vereinigte Bioenergie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favourable global E10-E20 blending mandates

- 4.2.2 Carbon-reduction and ESG pressure on refiners

- 4.2.3 Feedstock cost advantage in U.S. corn and Brazil sugarcane

- 4.2.4 Octane demand spurring ethanol as aromatic substitute

- 4.2.5 Airline demand for ethanol-to-jet SAF pathways

- 4.3 Market Restraints

- 4.3.1 Rapid electrification of light-duty vehicles

- 4.3.2 Food-vs-fuel and land-use controversy

- 4.3.3 Stricter ILUC-based carbon-intensity scoring

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Feedstock Type

- 5.1.1 Sugarcane

- 5.1.2 Corn

- 5.1.3 Wheat

- 5.1.4 Other Feedstock

- 5.2 By Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Food and Beverages

- 5.2.3 Pharmaceutical

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Other Applications (Fuel Cells, Power Generation)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Abengoa

- 6.4.2 ADM

- 6.4.3 Alto Ingredients Inc.

- 6.4.4 Blue Biofuels Inc.

- 6.4.5 BP p.l.c.

- 6.4.6 Cenovus Energy

- 6.4.7 Cristalco

- 6.4.8 CropEnergies AG

- 6.4.9 Ethanol Technologies

- 6.4.10 GranBio Investimentos SA

- 6.4.11 Green Plains Inc.

- 6.4.12 Henan Tianguan Group Co. Ltd

- 6.4.13 Jilin Fuel Ethanol Co. Ltd

- 6.4.14 KWST

- 6.4.15 Lantmannen

- 6.4.16 POET LLC

- 6.4.17 Raizen

- 6.4.18 SEKAB

- 6.4.19 SUNCOR Energy Inc.

- 6.4.20 Tereos

- 6.4.21 Valero

- 6.4.22 VERBIO Vereinigte Bioenergie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment