PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939570

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939570

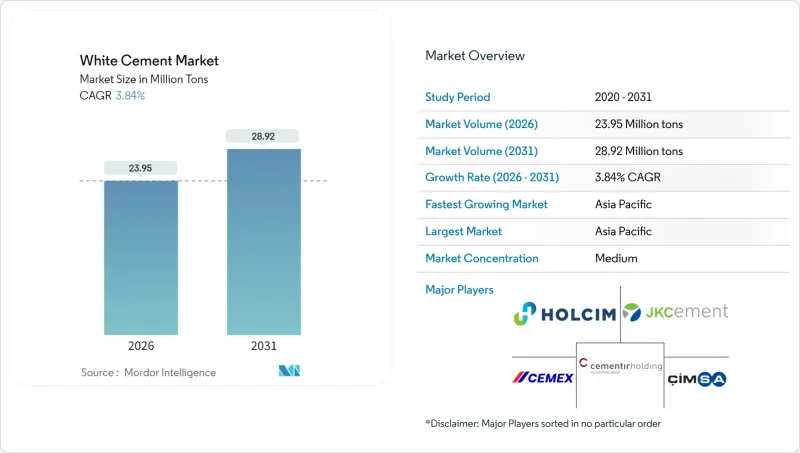

White Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The White Cement market is expected to grow from 23.06 million tons in 2025 to 23.95 million tons in 2026 and is forecast to reach 28.92 million tons by 2031 at 3.84% CAGR over 2026-2031.

Demand acceleration flows from premium architectural finishes, heat-reflective roofing systems, and a steady pipeline of infrastructure mega-projects across Asia-Pacific and the Middle East. High urbanization rates, rising disposable incomes, and stricter green-building codes collectively reinforce the growth path of the white cement market. Producers with dedicated white cement kilns enjoy pricing power because the product requires low-iron raw materials and operates under energy-intensive conditions that restrict supply. Competitive differentiation centers on capacity optimization, supply-chain control of suitable limestone, and formulation innovation aimed at meeting heritage-restoration and high-performance structural requirements.

Global White Cement Market Trends and Insights

Decorative and Architectural Construction Surge

Architects specify white cement to create uniform, light-toned facades that differentiate high-rise residential towers and experiential retail complexes in densely populated cities. Rising urban land prices intensify the need for visually distinctive buildings, pushing contractors toward exposed white concrete that eliminates cladding costs. Decorative interior elements such as terrazzo floors and GRC panels further magnify volume uptake, as homeowners pursue premium materials that elevate property value. JK Cement recorded a jump in decorative-grade sales in 2024, fueled by metropolitan India's luxury housing projects. Municipal regulations that promote higher solar-reflectance surfaces dovetail with private-sector aesthetic goals, making decorative usage a resilient demand pillar for the white cement market.

Infrastructure Mega-Projects in Asia-Pacific and Middle East

Flagship undertakings such as Saudi Arabia's NEOM city, India's Smart Cities Mission, and Belt and Road showcase projects specify white cement for stations, terminals, bridges, and cultural landmarks. Design guidelines emphasize glare reduction, thermal comfort, and enduring color stability-attributes amplified in white cement formulations. The UAE allocated USD 15.2 billion to public-sector infrastructure in 2024, channeling a sizable share toward airport concourses and metro systems that require bright, stain-resistant finishes. Contractors favor long-term supply agreements with regional producers to mitigate import bottlenecks, extending the visibility of the white cement market pipeline well beyond typical building cycles. These mega-projects also set quality benchmarks that govern subsequent provincial and municipal developments, multiplying forward demand.

High Production and Energy Costs Compared with Grey Cement

Specialized kilns for white cement maintain higher firing temperatures and reject cost-saving alternative fuels that might contaminate color. Cementir Group disclosed that energy accounted for 35% of its white cement production expenditure in 2024, compared to 28% for grey cement. Carbon-pricing schemes compound the disadvantage in Europe, pushing operating margins downward during periods of electricity inflation. Public procurement for large-scale infrastructure often awards contracts to the lowest bidder, limiting the adoption of white cement unless thermal or visual criteria require it. Short-term profitability, therefore, hinges on hedging energy exposure and optimizing waste-heat recovery systems.

Other drivers and restraints analyzed in the detailed report include:

- Heat-Reflective Roofing Demand in Hot Climates

- Heritage Restoration Premiumization

- Scarcity of Low-Iron Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Type I generated 51.63% of 2025 output and is forecast to accelerate at a 3.96% CAGR, underscoring its role as the baseline grade across ornamental facades, terrazzo, and architectural precast elements. High workability and balanced compressive-strength trajectories simplify contractor logistics, allowing a single inventory item to span structural columns, wall panels, and interior plasters. Upgrading mixes with polymeric additives has expanded their applicability to medium-load bridge decks, encroaching on the territory once held by Type II. Manufacturers such as JK Cement introduced a new Type I blend in 2024, demonstrating higher early strength without sacrificing flow properties, marking an iterative progression that maintains market leadership. Continuous performance gains reinforce specifier confidence and discourage substitution, cementing Type I's franchise in the white cement market.

Type II addresses aggressive environments where sulfate resistance, chloride permeability, or elevated compressive strength surpass Type I thresholds. Though representing a smaller slice of the white cement market, Type II secures premium pricing from coastal industrial plants, petrochemical docks, and desalination infrastructure. Pipeline documents for Saudi Arabia's NEOM include tailored Type II mixes for power-block foundations, indicating niche but sticky demand. The "Others" category, encompassing restoration-grade, ultra-high-performance, and 3D-printing formulations, logged the fastest percentage growth in 2024. Nevertheless, patent activity surged 25% year-over-year, suggesting a long runway for specialized applications that could incrementally reshape type segmentation over the next decade.

The White Cement Market Report is Segmented by Type (Type I, Type II, and Others), End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

The Asia-Pacific region anchors nearly half of the global volume, reflecting a 47.55% share in 2025 and delivering the top regional CAGR of 4.33% through 2031. China's consumption is driven by continuous high-rise construction and provincial mandates on cool roofing. India trails but grows faster due to smart city investments and federal housing programs; Southeast Asian markets, such as Vietnam and Thailand, ride the upcycle in hospitality and retail capital expenditures, aided by favorable logistics costs for intra-ASEAN cement flows.

North America contributes steady, if less spectacular, gains, concentrated in renovation and heritage-preservation activities. U.S. building codes referencing cool-roof standards bolster demand for white cement in southern states, while Canadian commercial developers adopt light-colored facades for energy code compliance. Mexico taps cross-border supply chains to fuel industrial parks near the U.S. Sun Belt, ensuring stable inflows despite currency volatility.

Europe emphasizes conservation and premium architectural veneers. Energy costs and carbon trading pinch margins, yet policy incentives for recyclable, high-albedo materials provide partial offsets. The Middle East and Africa, though smaller in absolute tonnage, display robust momentum linked to flagship projects such as NEOM, Riyadh metro extensions, and South African warehouse hubs. Extreme climate amplifies thermal-reflectance advantages, nudging government specifications toward white cement for public-domain assets. South America remains nascent but promising, especially in Brazil where sustainability criteria in real-estate financing encourage the adoption of high-reflectance facades. Argentina's commercial-office refurbishments also integrate white cement cladding to modernize 1970s-era buildings, highlighting a continental shift toward premium materials even amid macroeconomic flux.

- Buzzi Unicem S.p.A.

- Cementir Holding N.V.

- Cementos Portland Valderrivas

- CEMEX S.A.B. de C.V.

- Cimsa Cimento

- Federal White Cement

- HOLCIM

- Jiangxi Yinshan White Cement Co., Ltd.

- JK Cement Ltd.

- OYAK Cimento

- Riyadh Cement Co.

- Royal White Cement, Inc.

- Saudi White Cement Co.

- SCG Cement-Building Materials

- UltraTech Cement Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Decorative and architectural construction surge

- 4.2.2 Infrastructure mega-projects in the Asia-Pacific and the Middle East, and African countries

- 4.2.3 Heat-reflective roofing demand in hot climates

- 4.2.4 Heritage restoration premiumization

- 4.2.5 Low-carbon white PLC adoption

- 4.2.6 E-commerce penetration in DIY segment

- 4.3 Market Restraints

- 4.3.1 High production and energy costs compared to grey cement

- 4.3.2 Scarcity of low-iron raw materials

- 4.3.3 Colour constraints on alternative fuels and SCMs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Type I

- 5.1.2 Type II

- 5.1.3 Others

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Indonesia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 United Kingdom

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Buzzi Unicem S.p.A.

- 6.4.2 Cementir Holding N.V.

- 6.4.3 Cementos Portland Valderrivas

- 6.4.4 CEMEX S.A.B. de C.V.

- 6.4.5 Cimsa Cimento

- 6.4.6 Federal White Cement

- 6.4.7 HOLCIM

- 6.4.8 Jiangxi Yinshan White Cement Co., Ltd.

- 6.4.9 JK Cement Ltd.

- 6.4.10 OYAK Cimento

- 6.4.11 Riyadh Cement Co.

- 6.4.12 Royal White Cement, Inc.

- 6.4.13 Saudi White Cement Co.

- 6.4.14 SCG Cement-Building Materials

- 6.4.15 UltraTech Cement Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for Cement CEOs