PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939636

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939636

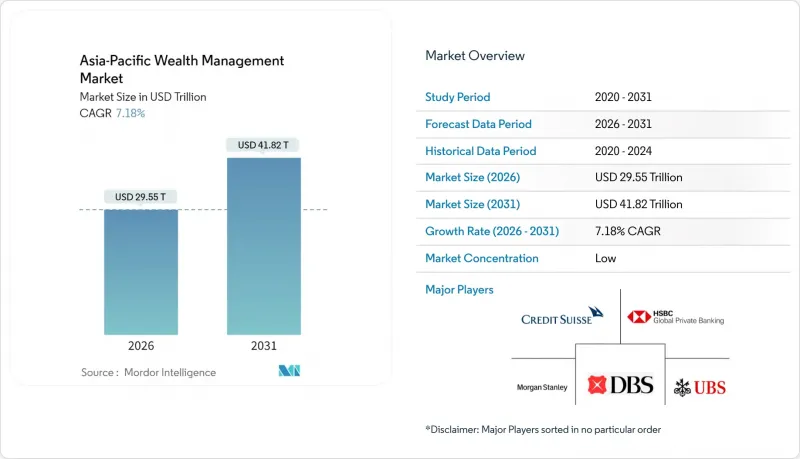

Asia-Pacific Wealth Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific wealth management market was valued at USD 27.57 trillion in 2025 and estimated to grow from USD 29.55 trillion in 2026 to reach USD 41.82 trillion by 2031, at a CAGR of 7.18% during the forecast period (2026-2031).

Sustained urbanization, expanding middle-class affluence, and a widening embrace of low-cost robo-advisory models are the primary forces propelling revenue expansion, while ongoing regulatory liberalization under schemes such as RCEP widens cross-border product access and fundraising channels. China's sheer scale anchors regional growth, yet India's double-digit momentum signals a clear diffusion of new wealth creation across technology-centric economies. At the same time, environmental, social, and governance (ESG) imperatives shape allocation decisions as APAC investors pivot toward sustainable instruments ranging from green bonds to social-impact private equity. The competitive landscape is intensifying as private banks focus on preserving their relationship-driven business models, while fintech specialists leverage fee reductions to attract younger, digitally-native customer segments.

Asia-Pacific Wealth Management Market Trends and Insights

Rising Digital-First Advisory & Robo-Advisory Adoption

In 2024, the assets under management for robo-advisory services in Singapore experienced substantial growth, while digital platforms in Hong Kong attracted billions in new assets. These trends highlight a pronounced consumer transition toward algorithm-based portfolio management solutions. The competitive landscape is intensifying as private banks focus on preserving their relationship-driven business models, while fintech specialists leverage fee reductions to attract younger, digitally-native customer segments. Japan's major banks implemented AI-driven portfolio engines, enhancing customer engagement and achieving operational cost efficiencies within the same period. Regulators now provide clear guardrails. Australia's ASIC sandbox issued 23 fresh robo licenses in 2024, signaling a sustained runway for digital advice penetration.

Rapid Expansion of Affluent Middle Class & HNWI Base

In 2024, the Asia-Pacific region recorded an 8.8% annual growth in High-Net-Worth Individuals (HNWIs), outperforming the global average. This growth was primarily attributed to the expansion of technology-driven entrepreneurship and the positive impact of equity-market performance. The chaebol ecosystem in South Korea experienced an expansion in ultra-wealthy families, driven by increased chip and battery exports that significantly boosted share valuations. Wealth concentration remains prominent across Southeast Asia, driven by Indonesia's resource industry leaders, Malaysia's digital entrepreneurs, and Thailand's real estate investors, who have collectively contributed to the growth of investable wealth. The development of Asia-focused single-family offices continues to advance, with 2024 witnessing the establishment of new entities, primarily registered in Singapore, Hong Kong, and mainland China.

Heightened Market Volatility & Macro-Economic Uncertainty

Geopolitical tensions and divergent monetary policies drove APAC equity-index volatility above historical averages in 2024. The regional VIX, a key measure of market volatility, reached elevated levels due to trade-related disruptions. Speculation regarding capital controls and corrections in China's property market resulted in significant portfolio outflows from emerging APAC exchanges during the first half of the year. Currency fluctuations intensified risks, with the Korean won experiencing a sharp decline against the USD, while the Thai baht and Malaysian ringgit also recorded substantial depreciations. These movements complicated hedging strategies for cross-border portfolios. In response to heightened uncertainty, wealth managers increased average cash allocations to levels not observed in four years, reducing exposure to alternative and illiquid investments. Additionally, the uncertain environment delayed a considerable proportion of planned family-office launches, as indicated by multiple industry surveys conducted across the region's primary exchanges.

Other drivers and restraints analyzed in the detailed report include:

- Ongoing Regulatory Liberalization Across APAC Hubs

- Growing Appetite for ESG & Sustainable Investing

- Rising AML/KYC Compliance Costs & Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The HNWI segment owns 42.74% of the Asia-Pacific wealth management market, while the retail investors are anticipated to expand their assets at a CAGR of 8.41% by 2031. This growth highlights a democratization trend that is transforming the Asia-Pacific wealth management market. By 2024, robo-advisors and hybrid digital-human models will have significantly expanded their presence in the retail sector, accumulating notable assets under management. The average account size has declined, representing a fraction of the historical thresholds set by private banks. However, high-net-worth individuals remain a critical revenue driver by utilizing bundled lending, succession planning, and access to alternative investments, which justify the prevailing fee structures. The Asia-Pacific wealth management market linked to the retail segment is anticipated to grow as consumer-grade platforms increasingly integrate features such as fractional private credit, REITs, and thematic ETFs. Conversely, the market share for high-net-worth individuals in the Asia-Pacific region may experience a slight decline, as younger mass-affluent segments are projected to achieve faster growth from a smaller base.

Institutional mandates, particularly from pension and sovereign funds, continue to provide stable inflows while extending beyond traditional advisory services into areas such as liability-driven investing. Singapore's Central Provident Fund and Australia's superannuation sector collectively manage substantial assets, offering specialist managers a revenue stream that remains insulated from fee compression due to regulatory support. Meanwhile, the convergence of expectations is reshaping the market landscape. Retail clients increasingly demand institutional-grade analytics, while pension trustees seek mobile interfaces that align with the user experience standards of retail banking.

The Asia Pacific Wealth Management Market Report Segments the Industry Into by Client Type (HNWI, Retail/Individuals, Other Client Types (Pension Funds, Insurance Cos., Etc. )), by Provider (Private Banks, Family Offices, Other Providers (Independent/External Asset Managers)), and by Geography (India, Japan, China, Singapore, Indonesia, Malaysia, Vietnam, Hong Kong, and Other).

List of Companies Covered in this Report:

- UBS Group AG

- HSBC Holdings plc

- Morgan Stanley

- Credit Suisse

- DBS Group

- Julius Bar Group

- Standard Chartered plc

- Citigroup Inc.

- Bank of China

- China Merchants Bank

- Bank of Singapore

- OCBC

- ANZ Banking Group

- Mitsubishi UFJ Financial Group

- Nomura Holdings

- Samsung Securities

- Mirae Asset

- Kotak Mahindra Bank

- ICICI Bank

- Ping An Bank

- LGT Group

- EFG International

- Eastspring Investments

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising digital?first advisory & robo-advisory adoption

- 4.2.2 Rapid expansion of affluent middle class & HNWI base

- 4.2.3 Ongoing regulatory liberalisation across APAC hubs

- 4.2.4 Growing appetite for ESG & sustainable investing

- 4.2.5 Emergence of tokenised assets & digital custody platforms

- 4.2.6 RCEP-driven cross-border wealth programmes

- 4.3 Market Restraints

- 4.3.1 Heightened market volatility & macro-economic uncertainty

- 4.3.2 Rising AML / KYC compliance costs & complexity

- 4.3.3 Acute talent crunch in senior relationship & ESG specialists

- 4.3.4 Data-localisation rules hindering regional digital platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Client Type

- 5.1.1 HNWI

- 5.1.2 Retail / Individuals

- 5.1.3 Other Client Types (Pension Funds, Insurance Cos., etc.)

- 5.2 By Provider

- 5.2.1 Private Banks

- 5.2.2 Family Offices

- 5.2.3 Others (Independent/External Asset Managers)

- 5.3 By Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.3.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 UBS Group AG

- 6.4.2 HSBC Holdings plc

- 6.4.3 Morgan Stanley

- 6.4.4 Credit Suisse

- 6.4.5 DBS Group

- 6.4.6 Julius Bar Group

- 6.4.7 Standard Chartered plc

- 6.4.8 Citigroup Inc.

- 6.4.9 Bank of China

- 6.4.10 China Merchants Bank

- 6.4.11 Bank of Singapore

- 6.4.12 OCBC

- 6.4.13 ANZ Banking Group

- 6.4.14 Mitsubishi UFJ Financial Group

- 6.4.15 Nomura Holdings

- 6.4.16 Samsung Securities

- 6.4.17 Mirae Asset

- 6.4.18 Kotak Mahindra Bank

- 6.4.19 ICICI Bank

- 6.4.20 Ping An Bank

- 6.4.21 LGT Group

- 6.4.22 EFG International

- 6.4.23 Eastspring Investments

7 Market Opportunities & Future Outlook

- 7.1 On-shore family-office boom in mainland China

- 7.2 Shariah-compliant wealth products in South-East Asia