PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939708

United States Automotive Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

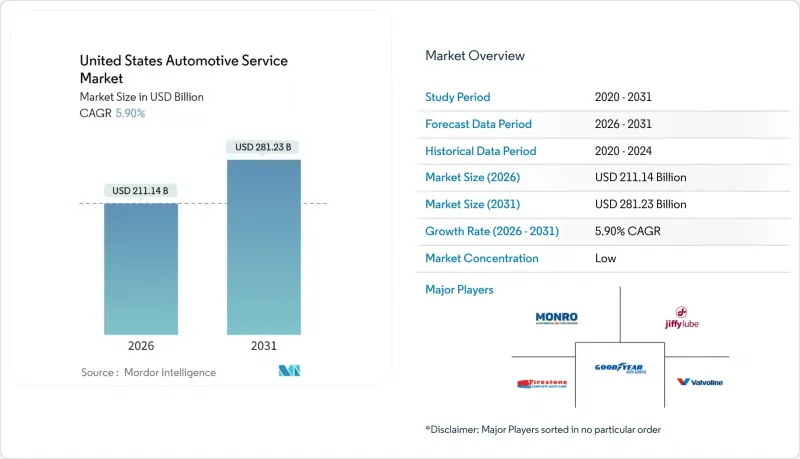

The United States automotive service market size in 2026 is estimated at USD 211.14 billion, growing from 2025 value of USD 199.38 billion with 2031 projections showing USD 281.23 billion, growing at 5.9% CAGR over 2026-2031.

Robust demand comes from an aging national vehicle fleet that averages 12.6 years, a rebound in vehicle miles traveled, and rising light commercial vehicle utilization that intensifies service requirements. Accelerating electrification lifts repair complexity and ticket values, even lowering routine maintenance frequency, prompting providers to invest in technician upskilling and high-voltage tooling. Digital booking platforms, subscription-based maintenance bundles, and right-to-repair legislation are reshaping competitive strategies, while mobile on-demand services gain traction among urban consumers. Collectively, these forces position the US automotive service market for sustained revenue growth and operational transformation

United States Automotive Service Market Trends and Insights

Aging Vehicle Parc Surpassing 12.6 Years

Average vehicle age reached 12.6 years in 2024, creating a structural tailwind as units between six and fourteen years now form the largest service cohort. High new-vehicle prices above USD 45,000 and constrained inventories have extended ownership cycles, pushing more owners toward essential maintenance rather than replacement. Hybrid registrations swelled 181% from 2021 to 2024, setting the stage for future battery replacement revenue. Independent repair specialists captured nearly 45% of incremental service spend during the 2021 rebound, evidencing the segment's appeal. High interest rates reinforce consumer emphasis on longevity, anchoring steady parts replacement demand even during economic slowdowns.

Post-COVID Rebound in Vehicle Miles Traveled

Federal Highway Administration data show national VMT climbing 1.4% year-over-year to 274.8 billion miles in February 2024, fully matching pre-pandemic baselines. Long-haul truck mileage is projected to expand 1.1% annually through 2050, while single-unit truck activity may grow 1.9% per year, reinforcing commercial fleet maintenance needs. Higher miles intensify wear across an aging vehicle mix, boosting brake, tire, and fluid service demand. As post-pandemic driving surges, weekly mileage trends emerge as a key indicator for workshop activity. Relatively stable gasoline at USD 2.85 per gallon supports sustained travel, and rising consumer credit balances continue to divert budgets from new-car purchases toward aftermarket services.

EV Adoption Lowers Routine Service Intensity

Electric vehicles require fewer mechanical fluids and belts, trimming routine visits, yet each repair averages almost 50% higher than on an internal-combustion model, mainly due to battery and electronic complexity. Powertrain-agnostic work, such as tires and wiper blades, remains resilient, but the conventional aftermarket could contract by 2035. Only some of technicians report substantial EV training, generating a skills gap that favors large chains and dealer groups capable of funding high-voltage safety infrastructure. Independent shops servicing BEVs claimed a significant share in 2024, yet over half lack dedicated marketing to showcase that capability.

Other drivers and restraints analyzed in the detailed report include:

- OEM-Branded After-Sales Program Expansion

- Digital Booking and CRM Platforms Proliferation

- OEM Telematics Locking Customers into Dealerships

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars accounted for 68.74% of the US automotive service market in 2025 as the segment's large installed base demanded consistent maintenance. The US automotive service market size linked to passenger cars is projected to grow steadily as the average age surpasses 12 years and hybrid penetration deepens. Light commercial vehicles, buoyed by e-commerce and last-mile delivery, are set to record the fastest 8.55% CAGR through 2031, reshaping shop capacity planning and parts inventory strategies.

Fleet operators now specify preventative maintenance contracts that minimize downtime, driving predictable parts ordering for brakes, tires, and suspension. Tesla opened seventy new service centers in 2024, many exceeding 100,000 square feet, to cater to rising EV volume across both passenger and commercial segments. Medium and heavy trucks, though smaller in count, remain lucrative due to stringent uptime requirements and federal safety regulations that drive specialized service demand.

Mechanical repair and maintenance retained a 42.67% revenue share in 2025, anchoring the US automotive service market. Electrical and electronics work is forecast to grow at a 9.02% CAGR as ADAS penetration rises by 2031.

Shops invest in scan tools, calibration frames, and static targets to capture this margin-rich business. Due to mixed-material body structures, exterior and structural repairs remain stable yet more complex. Quick-lube chains diversify into battery, tire, and light mechanical jobs to offset longer EV oil-change intervals, preserving customer frequency.

The United States Automotive Services Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Service Type (Mechanical Repair and Maintenance, and More), Equipment Type (Tires, Batteries, and More), Service Channel (OEM Dealerships, Independent General Repair Shops, and More), and by U. S. Census Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Firestone Complete Auto Care

- Jiffy Lube International Inc.

- Meineke Car Care Centers

- Midas International

- Monro Inc.

- Safelite Group

- Walmart Auto Care Centers

- Pep Boys

- Valvoline Instant Oil Change

- Goodyear Auto Service

- NTB - National Tire & Battery

- Christian Brothers Automotive

- Take 5 Oil Change

- Express Oil Change & Tire Engineers

- Caliber Collision

- Gerber Collision & Glass

- Service King Collision

- Tesla Service Centers

- CarMax Auto Care

- AAA Car Care Centers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Vehicle Parc Surpassing 12.6 Years

- 4.2.2 Post-COVID Rebound in Vehicle Miles Travelled

- 4.2.3 OEM-Branded After-Sales Program Expansion

- 4.2.4 Digital Booking and CRM Platforms Proliferation

- 4.2.5 Subscription-Based Maintenance Bundles

- 4.2.6 State-Level Right-To-Repair Legislation Momentum

- 4.3 Market Restraints

- 4.3.1 EV Adoption Lowers Routine Service Intensity

- 4.3.2 Acute Technician Shortage Inflates Labor Costs

- 4.3.3 Inflation-Driven Deferral of Discretionary Repairs

- 4.3.4 OEM Telematics Locking Customers into Dealerships

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium & Heavy Trucks

- 5.2 By Service Type

- 5.2.1 Mechanical Repair & Maintenance

- 5.2.2 Exterior & Structural (Body / Paint / Glass)

- 5.2.3 Electrical & Electronics

- 5.2.4 Quick Services (Oil, Fluids, Filters)

- 5.3 By Equipment Type

- 5.3.1 Tires

- 5.3.2 Batteries

- 5.3.3 Seats & Interiors

- 5.3.4 ADAS Sensors & Cameras

- 5.4 By Service Channel

- 5.4.1 OEM Dealerships

- 5.4.2 Independent General Repair Shops

- 5.4.3 Quick-Lube & Tire Chains

- 5.4.4 Mobile / On-Demand Services

- 5.5 By U.S. Census Region

- 5.5.1 Northeast

- 5.5.2 Midwest

- 5.5.3 South

- 5.5.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Firestone Complete Auto Care

- 6.4.2 Jiffy Lube International Inc.

- 6.4.3 Meineke Car Care Centers

- 6.4.4 Midas International

- 6.4.5 Monro Inc.

- 6.4.6 Safelite Group

- 6.4.7 Walmart Auto Care Centers

- 6.4.8 Pep Boys

- 6.4.9 Valvoline Instant Oil Change

- 6.4.10 Goodyear Auto Service

- 6.4.11 NTB - National Tire & Battery

- 6.4.12 Christian Brothers Automotive

- 6.4.13 Take 5 Oil Change

- 6.4.14 Express Oil Change & Tire Engineers

- 6.4.15 Caliber Collision

- 6.4.16 Gerber Collision & Glass

- 6.4.17 Service King Collision

- 6.4.18 Tesla Service Centers

- 6.4.19 CarMax Auto Care

- 6.4.20 AAA Car Care Centers

7 Market Opportunities & Future Outlook