PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939740

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939740

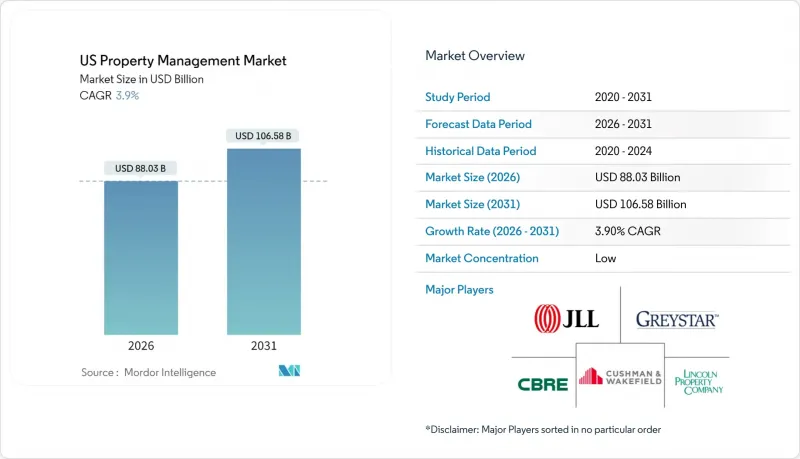

US Property Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The US Property Management Services Market was valued at USD 84.73 billion in 2025 and estimated to grow from USD 88.03 billion in 2026 to reach USD 106.58 billion by 2031, at a CAGR of 3.9% during the forecast period (2026-2031).

Growth rests on resilient rental demand, institutional ownership of both single-family and multifamily assets, and renewed leasing activity in premium office buildings. Federal Reserve surveys show 27% of U.S. adults rent their homes, underpinning a large tenant base that requires professional oversight. Institutional investors use scale to drive professional management, while environmental, social, and governance (ESG) regulations accelerate demand for compliance-oriented services. Technology adoption, especially artificial-intelligence tools that automate leasing, maintenance, and resident engagement, further supports efficiency and tenant retention. Competitive intensity is rising as national firms buy tech-enabled specialists to widen service breadth and geographic reach.

US Property Management Market Trends and Insights

Expansion of Single-Family Rental (SFR) Portfolios

Institutional ownership of single-family homes grew from bulk foreclosure purchases in the early 2010s to sophisticated build-for-rent programs by 2024. The GAO traced holdings of 170,000-300,000 homes by 2015, with larger footprints today as funds accelerate acquisitions. American Homes 4 Rent, for example, managed 61,336 homes and generated USD 1.729 billion rental revenue in 2024. Scale drives demand for standardized leasing, maintenance, and compliance processes that individual landlords rarely provide. Consequently, residential specialists and integrated REIT platforms gain pricing power and recurring revenue inside the US property management services market.

Rising Demand from Class-A Commercial Real Estate

Premium office assets are regaining tenant attention as employers seek high-amenity space to support hybrid work models. CBRE recorded 18% leasing revenue growth in 2024, including a 28% jump in office leasing in New York. Owners of trophy buildings deploy concierge teams, smart-building platforms, and curated tenant experiences to differentiate supply. These value-added services typically require large management budgets, allowing professional firms to command higher fees. Performance benchmarking and amenity upgrades also create cross-selling potential for energy management and workplace consulting. The result is durable revenue growth for managers focused on Class-A portfolios within the US property management services market.

Interest-Rate-Driven Transaction Slowdown

Elevated borrowing costs since late 2023 have caused a pause in property sales and ground-up development. CBRE noted that investment volume fell sharply even as existing portfolios remained relatively stable. Less trading means fewer property takeovers and new-build assignments for managers who earn onboarding and construction-management fees. Smaller firms that rely on deal flow face near-term revenue stress. Nonetheless, recurring management contracts cushion the impact, allowing the broader US property management services market to continue expanding, albeit at a slower clip until rates normalize.

Other drivers and restraints analyzed in the detailed report include:

- Aging U.S. Housing Stock Needs Professional Maintenance

- Growing Institutional Outsourcing by Pension/SWF Investors

- State & City Rent-Control Legislation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential properties accounted for 49.35% of 2025 revenue, making them the largest slice of the US property management services market share. Institutional single-family rentals and multifamily portfolios deliver predictable, recurring fees based on rent rolls, while amenity-rich communities drive ancillary income from parking, storage, and smart-home subscriptions. Commercial properties are projected to register a 4.82% CAGR and will narrow the gap as leasing rebounds in Class-A offices and experiential retail.

The residential segment benefits from concentrated holdings by REITs such as Invitation Homes, which invested USD 425.2 million in property upgrades in 2024. Scale improves vendor pricing, technology adoption, and response times, reinforcing professional management as table stakes for institutional owners. Commercial growth is fueled by corporate flight to quality and new flexible-workspace models integrated into traditional buildings. Industrial and logistics assets add further upside as e-commerce firms seek proximity to consumers and rely on specialized maintenance and security protocols. Together, these dynamics sustain balanced momentum in the US property management services market.

The US Property Management Services Market Report is Segmented by Property Type (Commercial, Residential, Industrial & Logistics, and More), by Service Type (Marketing & Leasing, Property Evaluation & Due Diligence, Tenant & Resident Services, Maintenance & Facility Management, and More), and by Geography (Northeast, Midwest, Southeast, West and Southwest). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Greystar Real Estate Partners

- CBRE Group, Inc.

- Lincoln Property Company

- Jones Lang LaSalle (JLL)

- Cushman & Wakefield plc

- Pinnacle Property Management Services

- Equity Residential

- AvalonBay Communities, Inc.

- Invitation Homes Inc.

- FPI Management

- RPM Living

- FirstService Residential

- UDR, Inc.

- Aimco

- WinnCompanies

- Brookfield Properties U.S.

- Colliers International U.S.

- CoStar Group, Inc.

- Cushman & Wakefield Asset Services

- Knightvest Capital Management

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from Class-A commercial real estate

- 4.2.2 Expansion of single-family rental (SFR) portfolios

- 4.2.3 Growing institutional outsourcing by pension/SWF investors

- 4.2.4 Adoption of AI-enabled leasing & service tech

- 4.2.5 Aging U.S. housing stock needs professional maintenance

- 4.2.6 ESG & green-lease compliance pressure

- 4.3 Market Restraints

- 4.3.1 Interest-rate-driven transaction slowdown

- 4.3.2 State & city rent-control legislation

- 4.3.3 Skilled trade-labor shortages raising OPEX

- 4.3.4 Owners' shift to DIY prop-tech platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (HUD, FHFA, State landlord-tenant laws)

- 4.6 Technological Outlook (IoT sensors, AI leasing bots, SaaS PM suites)

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Owners/Tenants

- 4.7.3 Bargaining Power of Suppliers/Sub-contractors

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts(Value, In USD Billion)

- 5.1 By Property Type

- 5.1.1 Commercial

- 5.1.2 Residential

- 5.1.3 Industrial & Logistics

- 5.1.4 Institutional & Mixed-Use

- 5.2 By Service Type

- 5.2.1 Marketing & Leasing

- 5.2.2 Property Evaluation & Due Diligence

- 5.2.3 Tenant & Resident Services (Renting, Leasing, etc.)

- 5.2.4 Maintenance, Repair & Facility Management

- 5.2.5 Lease Administration & Compliance

- 5.2.6 Other Services (Compliance, Legal Services, Renewals, etc.)

- 5.3 By Geography

- 5.3.1 Northeast

- 5.3.2 Midwest

- 5.3.3 Southeast

- 5.3.4 West

- 5.3.5 Southwest

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves & Funding Activities

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Greystar Real Estate Partners

- 6.4.2 CBRE Group, Inc.

- 6.4.3 Lincoln Property Company

- 6.4.4 Jones Lang LaSalle (JLL)

- 6.4.5 Cushman & Wakefield plc

- 6.4.6 Pinnacle Property Management Services

- 6.4.7 Equity Residential

- 6.4.8 AvalonBay Communities, Inc.

- 6.4.9 Invitation Homes Inc.

- 6.4.10 FPI Management

- 6.4.11 RPM Living

- 6.4.12 FirstService Residential

- 6.4.13 UDR, Inc.

- 6.4.14 Aimco

- 6.4.15 WinnCompanies

- 6.4.16 Brookfield Properties U.S.

- 6.4.17 Colliers International U.S.

- 6.4.18 CoStar Group, Inc.

- 6.4.19 Cushman & Wakefield Asset Services

- 6.4.20 Knightvest Capital Management

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment