PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940556

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940556

Automated Mining Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

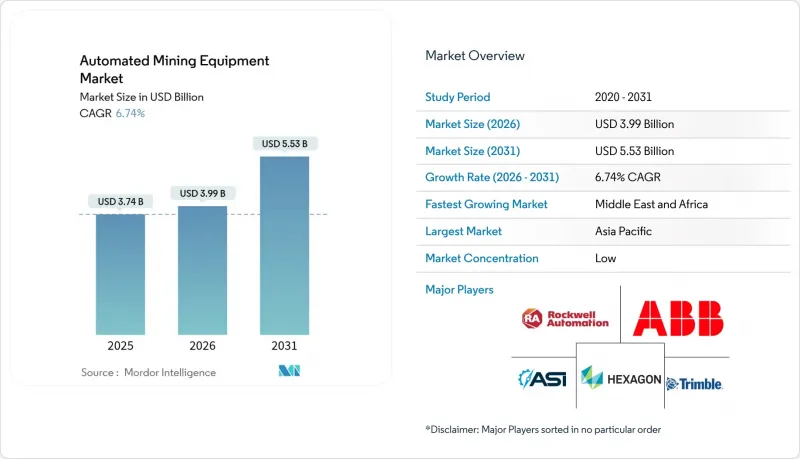

The Automated Mining Equipment Market was valued at USD 3.74 billion in 2025 and estimated to grow from USD 3.99 billion in 2026 to reach USD 5.53 billion by 2031, at a CAGR of 6.74% during the forecast period (2026-2031).

Persistent labor shortages, stringent safety mandates, and escalating cost-reduction pressures are accelerating autonomous adoption, while maturing sensor, software, and connectivity technologies continue to lower technical risk and boost return on investment. Hardware remains the largest revenue contributor thanks to the capital-intensive nature of autonomous trucks, drills, and loaders, yet software is outpacing all other components as mine operators unlock higher productivity through advanced fleet-management and analytics platforms. Surface operations still dominate deployment volumes, but recent breakthroughs in underground 5G and GPS-independent navigation are pushing subterranean automation onto a steeper growth trajectory. Asia-Pacific commands the largest regional foothold, anchored by Australia's 706 autonomous haul trucks, whereas Middle East and Africa shows the fastest growth as flagship projects in Saudi Arabia and South Africa demonstrate the viability of fully digital mines. Vendor competition is coalescing around interoperable ecosystems as miners demand open architectures that can knit together mixed fleets, spurring both consolidation among incumbents and a steady influx of software-centric challengers.

Global Automated Mining Equipment Market Trends and Insights

Growing Demand for Productivity and Worker Safety

Adoption accelerates when mines achieve simultaneous productivity gains and safety improvements. Northparkes' semi-automated LHDs lifted output 20% and eradicated loader injuries, illustrating the dual benefits that resonate with executives and regulators alike. Rio Tinto's autonomous trucks run 700 more hours per year and cut costs 15%, proving the systemic leverage of automation across haulage, maintenance, and dispatch. BHP reported an 80% accident reduction across a 367-truck fleet, reinforcing the social-license advantages of remote, zero-harm operations. ISO 23725:2024 establishes baseline safety and interoperability standards, further lowering perceived implementation risk and smoothing procurement cycles for fleet upgrades.

Rising Labor Shortages in Mature Mining Regions

More than 50% of the Western U.S. mining workforce will retire by 2029, and recruitment pipelines lag replacement needs. Australian contractors such as MACA are turning to driverless battery-electric vehicles to plug skills gaps and stabilize production. Remote operation centers let a shrinking pool of skilled operators run multiple sites, creating a redistribution of labor that is fundamentally technology-centric. Partnerships between miners and technical institutes are building automation-focused curricula, ensuring a future-ready workforce without inflating headcount costs.

High Upfront CAPEX and Complex Integration

Full-scale autonomy demands expensive equipment retrofits, site network upgrades, and workforce reskilling, all translating into lengthy payback periods that can stretch thin mid-tier balance sheets. Integration is notoriously cumbersome in mixed fleets where proprietary data protocols force bespoke middleware or costly lock-in to a single OEM. Emerging consumption-based models and third-party integration hubs are softening the blow, yet capital hurdles remain the largest friction to mass adoption.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Reduction Initiatives via Automation

- Advancements in Sensor and AI Integration for Autonomous Haulage

- Cyber-Security Vulnerabilities in Connected Fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 62.20% automated mining equipment market share in 2025 on the back of high-value trucks, drills, and loaders that form the backbone of autonomy programs. Excavators remain the largest sub-segment, and the automated mining equipment market size for excavators is expected to climb steadily as OEMs release autonomy-ready models tuned for lower emissions and quicker duty cycles. Load-haul-dump (LHD) machinery is transitioning fastest from manual to autonomous, with Sandvik's battery-electric LH518iB demonstrating cycle-time gains that accelerate payback periods.

Software and services together grow at 7.22% CAGR, reaching a proportionally larger slice of the revenue pie as mines view analytics and decision-automation as the key to enterprise-wide optimization. Wenco's open-standards fleet platform now allows "swarm" mining, where algorithms schedule multiple assets as a single resource pool, underscoring how data orchestration overtakes mechanical horsepower in value creation. Consulting and remote-management services add stickiness to vendor relationships, redirecting capital budgets into ongoing operating expenditure.

The Automated Mining Equipment Market Report is Segmented by Component (Hardware, Software, and Services), Mining Technique (Surface Mining, and Underground Mining), Application (Metal, Mineral, and Coal), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 37.60% revenue share in 2025 reflects entrenched autonomous truck fleets in Australia and accelerating unmanned projects in China. New South Wales operations posted multi-year accident-free records after shifting to driverless haulage, a proof point that resonates with regulators across the region. Japanese component suppliers feed innovation loops by exporting high-resolution LiDAR and ruggedized edge processors, undergirding the broader regional ecosystem.

Middle East and Africa, although smaller in absolute terms, is the fastest-growing geography with an 7.95% CAGR outlook. Saudi Arabia's Mansourah Massarah mine showcases a cradle-to-gate digital strategy, blending Hexagon's life-of-mine platform with Komatsu AHS trucks to leapfrog legacy development stages. South Africa's deep-level gold and PGM mines lean on autonomy to mitigate seismic risk and ventilation costs, pointing to a future where underground robotics compensates for extreme geotechnical conditions.

North America sits at the bleeding edge of R&D partnerships linking OEMs, telcos, and semiconductor firms. Nevada Gold Mines' 5G-enabled FrontRunner roll-out across 300-tonne trucks underscores how connectivity is now a gating factor for scale. Canada maintains policy incentives for tele-remote and battery-electric adoption, while Europe couples autonomy with carbon-pricing signals to accelerate the business case. Latin America's giant copper belts harness autonomy to offset high altitude labor constraints, yet patchy spectrum regulation slows network upgrades.

- Rockwell Automation Inc.

- ABB Ltd.

- Autonomous Solutions Inc. (ASI Mining)

- Hexagon AB

- Trimble Inc.

- Hitachi Ltd.

- Caterpillar Inc.

- Komatsu Ltd.

- Atlas Copco Inc.

- AB Volvo Inc.

- Sandvik AB

- Epiroc AB

- Liebherr Group

- Wenco International Mining Systems

- MICROMINE Inc.

- RPMGlobal Inc.

- Flanders Electric Inc. (Flanders)

- BelAZ Inc.

- Hitachi Construction Machinery Digital Solutions

- Rio Tinto Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for productivity and worker safety

- 4.2.2 Rising labor shortages in mature mining regions

- 4.2.3 Cost-reduction initiatives via automation

- 4.2.4 Advancements in sensor and AI integration for autonomous haulage

- 4.2.5 ESG-driven shift to remote zero-harm mines

- 4.2.6 Surge in autonomous underground LHD retrofits at mid-tier sites

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and complex integration

- 4.3.2 Cyber-security vulnerabilities in connected fleets

- 4.3.3 Legacy fleet heterogeneity hampers interoperability

- 4.3.4 Limited high-bandwidth connectivity in deep-underground mines

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Excavators

- 5.1.1.2 Load Haul Dump

- 5.1.1.3 Robotic truck

- 5.1.1.4 Drillers and Breakers

- 5.1.1.5 Other Equipments

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Mining Technique

- 5.2.1 Surface Mining

- 5.2.2 Underground Mining

- 5.3 By Application

- 5.3.1 Metal

- 5.3.2 Mineral

- 5.3.3 Coal

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Singapore

- 5.4.4.6 Australia

- 5.4.4.7 Malaysia

- 5.4.4.8 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Rockwell Automation Inc.

- 6.4.2 ABB Ltd.

- 6.4.3 Autonomous Solutions Inc. (ASI Mining)

- 6.4.4 Hexagon AB

- 6.4.5 Trimble Inc.

- 6.4.6 Hitachi Ltd.

- 6.4.7 Caterpillar Inc.

- 6.4.8 Komatsu Ltd.

- 6.4.9 Atlas Copco Inc.

- 6.4.10 AB Volvo Inc.

- 6.4.11 Sandvik AB

- 6.4.12 Epiroc AB

- 6.4.13 Liebherr Group

- 6.4.14 Wenco International Mining Systems

- 6.4.15 MICROMINE Inc.

- 6.4.16 RPMGlobal Inc.

- 6.4.17 Flanders Electric Inc. (Flanders)

- 6.4.18 BelAZ Inc.

- 6.4.19 Hitachi Construction Machinery Digital Solutions

- 6.4.20 Rio Tinto Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment