PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940569

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940569

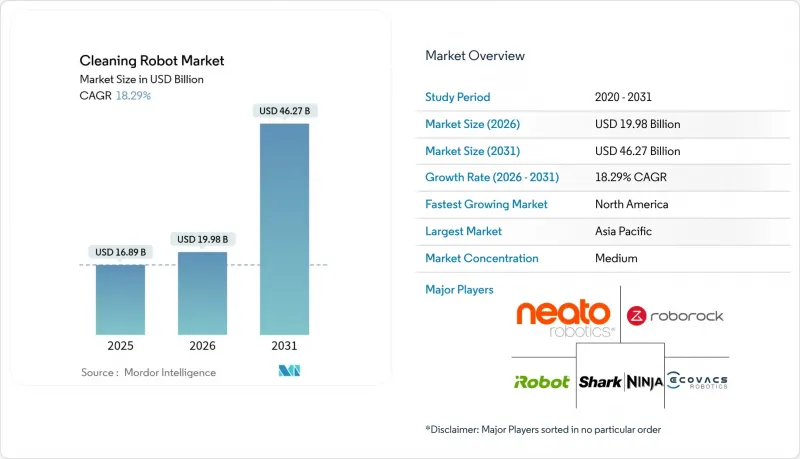

Cleaning Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The cleaning robot market is expected to grow from USD 16.89 billion in 2025 to USD 19.98 billion in 2026 and is forecast to reach USD 46.27 billion by 2031 at 18.29% CAGR over 2026-2031.

Strong demand for touch-free hygiene solutions, rapid smart-home adoption, and sharp declines in sensor bills of material continue to propel the cleaning robot market. Commercial property managers increasingly view autonomous cleaning as mission-critical for labor optimization, while residential buyers benefit from lower LiDAR prices and easy e-commerce access. Supply-side economies of scale in solid-state LiDAR, coupled with robots-as-a-service subscriptions, further expand the cleaning robot market by lowering ownership barriers. Intensifying competition from vertically integrated Asian manufacturers is compressing margins, yet it also accelerates product variety and regional availability.

Global Cleaning Robot Market Trends and Insights

Rising Post-Pandemic Hygiene Standards in Commercial Spaces

Most public and private facilities have institutionalized COVID-19-era cleaning protocols, sustaining demand for autonomous floor-care and UV-C disinfection robots. Airports that run robots overnight report measurable labor savings and better passenger confidence. Singapore's public-sector tenders for large fleets of autonomous cleaners underscore the government's endorsement of continuous hygiene programs. Healthcare operators also lean on ISO 13482-certified models to mitigate infection risks without adding staff. Sustained regulatory attention and user expectations together keep the cleaning robot market on a high-growth path.

Rapid Smart-Home Penetration and Disposable-Income Growth

Smart-home hubs now synchronize scheduling, voice control, and remote diagnostics for floor-care bots, elevating them from gadgets to integral home-automation nodes. Matter-certified devices from leading vendors remove interoperability friction and broaden the addressable base. In China, India, and Southeast Asia, rising middle-class income fuels premium purchases that bundle AI-based obstacle recognition and hybrid navigation. These dynamics continue to funnel new users into the cleaning robot market.

High Upfront Cost vs Conventional Equipment

Small businesses still hesitate to replace USD 50-200 manual tools with bots priced from USD 300 to USD 3,000. Even at Heathrow, where robots saved GBP 124,175 (USD 155,219) in annual labor, board-level approval required proof of sub-two-year payback. Robots-as-a-service mitigates sticker shock by converting capex into opex, but vendors must manage battery depreciation and redeployment risk to keep contracts attractive.

Other drivers and restraints analyzed in the detailed report include:

- Falling LiDAR and Sensor ASPs Reduce Bill of Materials

- E-Commerce Channel Scaling Accelerates Global Reach

- Data-Privacy Concerns Over Camera/VSLAM Mapping

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Domestic units, notably floor-vacuum robots, held a commanding 71.32% share of the cleaning robot market size in 2025. Consistent price erosion and frequent model refreshes keep household demand buoyant, while niche segments, such as pool and window cleaners, remain smaller yet stable. In contrast, professional robots are expected to book an 18.42% CAGR, driven by measurable ROI and rising labor costs in facility maintenance. Disinfection models are outpacing all others, thanks in part to hospital mandates for ultraviolet or plasma sterilization. Commercial buyers also value ruggedized chassis, replaceable batteries, and certified ingress protection for wet environments. Vendor differentiation is increasingly centered on fleet-management dashboards and predictive-maintenance data analytics that reduce unplanned downtime. Extended service contracts further improve the total cost of ownership, solidifying professional adoption pathways. Despite higher acquisition prices, payback periods are shrinking, tilting procurement toward autonomous solutions across various industries, including rail stations, shopping malls, and government buildings.

The domestic sphere continues to benefit from feature spillovers originally developed for professional fleets, such as multi-floor mapping and adaptive suction. Hybrids capable of wet and dry cleaning broaden household appeal, while subscription consumable deliveries lock customers into branded ecosystems. Regulatory attention is minimal in residential contexts, accelerating time-to-market for new features. Overall, both domains reinforce each other: the consumer scale reduces hardware costs, while commercial ASPs finance advanced R&D, sustaining a virtuous cycle for the cleaning robot market.

Residential users accounted for 57.41% of 2025 revenue, reflecting the widespread adoption of smart-home integration and word-of-mouth advocacy. Yet hospitals, clinics, and elder-care centers are the fastest movers with an 18.55% CAGR. Infection-prevention budgets justify premium pricing for UV-C or hydrogen-peroxide disinfection robots that operate after visiting hours. Facility managers cite consistent pathogen load reduction and enhanced staff safety as prime purchase triggers. Retail chains, hotels, and restaurants now deploy smaller fleets to maintain service ambiance amid staffing shortages. Airports leverage 24-hour robot operation to match passenger peaks without overtime premiums. Offices experimenting with flexible occupancy adopt on-demand cleaning triggered by IoT occupancy sensors.

Industrial plants and warehouses seek ATEX-certified units that safely handle dust and volatile chemicals, a niche yet high-margin segment of the cleaning robot market. As end-users diversify, vendors must tailor payload capacity, navigation algorithms, and antimicrobial material choices to distinct use cases, reinforcing segmentation complexity.

The Cleaning Robot Market is Segmented by Type (Domestic/Household Robots, Professional Robots), End-User (Residential, Commercial, Industrial), Navigation Technology (LiDAR SLAM, Visual SLAM, Hybrid, Random/Infrared, AI Sensor-Fusion), Sales Channel (Online, Offline), and Geography (North America, South America, Europe, Asia Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 39.45% revenue share in 2025, led by the United States government's procurement of autonomous floor cleaners for airports, transit hubs, and schools. Hospitals in California and New York accelerated rollouts after quantifying reductions in hospital-acquired infections. Canada's regulatory alignment and proximity to U.S. vendors smooth cross-border expansion, while Mexico's maquiladora clusters attract assembly investments that hedge tariff exposure. Growth here now stems less from first-time purchases and more from refresh cycles and service contracts, signaling a maturing yet lucrative segment of the cleaning robot market.

The Asia-Pacific region is the fastest climber, with a 18.76% CAGR outlook to 2031. China blends massive domestic demand with vertically integrated supply chains, slashing delivery lead times. Government subsidies under the "Made in China 2025" initiative encourage domestic brands to export across Southeast Asia and the Middle East, thereby increasing competitive pressure elsewhere. Singapore's multi-agency tenders validate the credibility of robotics in public settings, while Japan's aging demographics elevate demand for caregiver adjuncts that relieve nursing staff. Australia and South Korea remain early adopters of premium models, whereas India is entering the market through value-oriented SKUs targeting urban middle-class households.

Europe demonstrates steady but regulation-heavy growth. Germany and France champion industrial and hospitality applications, leveraging stringent hygiene norms. The United Kingdom's service-sector dominance drives airport and retail deployments, even amid tariff uncertainties. Compliance with the EU Machinery Directive 2006/42/EC and the EN 60335 family of safety standards adds certification overhead, favoring established brands with deep testing budgets. Energy costs and tight labor pools continue to motivate automation investment, maintaining double-digit growth in the region's slice of the cleaning robot market.

- iRobot Corporation

- Ecovacs Robotics Co., Ltd.

- Roborock Technology Co., Ltd.

- Neato Robotics Inc.

- Dreame Technology (Suzhou) Co., Ltd.

- Narwal Robotics Inc.

- SharkNinja Operating LLC

- ILIFE Innovation Ltd.

- Cecotec Innovaciones S.L.

- bObsweep Inc.

- Proscenic Technology Co., Ltd.

- Anker Innovations Ltd. (Eufy)

- SoftBank Robotics Corp.

- Tennant Company

- Alfred Karcher SE and Co. KG

- Nilfisk A/S

- Avidbots Corp.

- Gaussian Robotics Co., Ltd. (Gausium)

- Midea Group Co., Ltd. (Eureka)

- Tineco Intelligent Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDCSAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising post-pandemic hygiene standards in commercial spaces

- 4.2.2 Rapid smart-home penetration and disposable-income growth

- 4.2.3 Falling LiDAR and sensor?suite ASPs reduce BOM cost

- 4.2.4 E-commerce channel scaling accelerates global reach

- 4.2.5 Facility-management contracts shifting to robots-as-a-service

- 4.2.6 Government procurement of UV-disinfection bots for public infrastructure

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional equipment

- 4.3.2 Data-privacy concerns over camera/VSLAM mapping

- 4.3.3 Supply-chain fragility for solid-state LiDAR components

- 4.3.4 Emerging trade tariffs on Chinese robot exports

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Domestic / Household Robots

- 5.1.1.1 Vacuum Floor Cleaner

- 5.1.1.2 Pool Cleaning

- 5.1.1.3 Window Cleaning

- 5.1.1.4 Lawn Cleaning

- 5.1.1.5 Other Domestic/Household Cleaning

- 5.1.2 Professional Robots

- 5.1.2.1 Floor Cleaning

- 5.1.2.2 Tank / Tube / Pipe Cleaning

- 5.1.2.3 Disinfection Robots

- 5.1.2.4 Other Professional Cleaning

- 5.1.1 Domestic / Household Robots

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.2.1 Hospitality

- 5.2.2.2 Retail and Shopping Centres

- 5.2.2.3 Healthcare Facilities

- 5.2.2.4 Airports and Transportation Hubs

- 5.2.2.5 Office and Corporate Facilities

- 5.2.2.6 Other Commercial Facilities

- 5.2.3 Industrial (Manufacturing and Warehousing)

- 5.3 By Navigation Technology

- 5.3.1 LiDAR SLAM

- 5.3.2 Visual SLAM (vSLAM)

- 5.3.3 Hybrid (LiDAR + Vision)

- 5.3.4 Random / Infra-red Based

- 5.3.5 AI Sensor-Fusion Suites

- 5.3.6 Other Navigation Technologies

- 5.4 By Sales Channel

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Singapore

- 5.5.4.5 South korea

- 5.5.4.6 Australia

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 iRobot Corporation

- 6.4.2 Ecovacs Robotics Co., Ltd.

- 6.4.3 Roborock Technology Co., Ltd.

- 6.4.4 Neato Robotics Inc.

- 6.4.5 Dreame Technology (Suzhou) Co., Ltd.

- 6.4.6 Narwal Robotics Inc.

- 6.4.7 SharkNinja Operating LLC

- 6.4.8 ILIFE Innovation Ltd.

- 6.4.9 Cecotec Innovaciones S.L.

- 6.4.10 bObsweep Inc.

- 6.4.11 Proscenic Technology Co., Ltd.

- 6.4.12 Anker Innovations Ltd. (Eufy)

- 6.4.13 SoftBank Robotics Corp.

- 6.4.14 Tennant Company

- 6.4.15 Alfred Karcher SE and Co. KG

- 6.4.16 Nilfisk A/S

- 6.4.17 Avidbots Corp.

- 6.4.18 Gaussian Robotics Co., Ltd. (Gausium)

- 6.4.19 Midea Group Co., Ltd. (Eureka)

- 6.4.20 Tineco Intelligent Technology Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment