PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940573

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940573

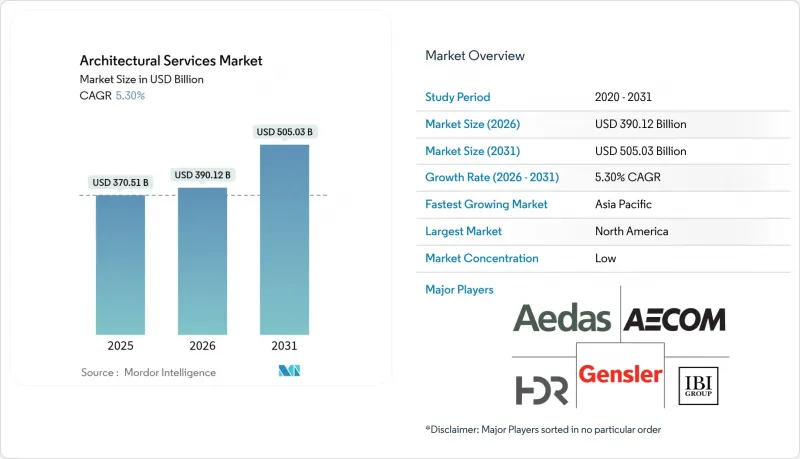

Architectural Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The architectural services market was valued at USD 370.51 billion in 2025 and estimated to grow from USD 390.12 billion in 2026 to reach USD 505.03 billion by 2031, at a CAGR of 5.30% during the forecast period (2026-2031).

Post-pandemic infrastructure outlays, a surge in smart-city programs, and growing sustainability mandates anchor this expansion, while artificial intelligence (AI) and digital-twin platforms improve project speed and accuracy. North America keeps its revenue lead through federally funded transport, power, and water upgrades, yet Asia Pacific produces the steepest growth curve as governments commit large-scale capital to meet urban housing and mobility gaps. Across all regions, heightened client focus on carbon neutrality and operational resilience pushes firms toward low-embodied-carbon materials, net-zero design targets, and climate-risk scoring. Competitive intensity rises as global firms acquire niche specialists to secure multidisciplinary talent and to widen local regulatory expertise. Meanwhile, rising wages and volatile input costs pressure margins, prompting broader use of automation for repetitive documentation and early-stage massing studies.

Global Architectural Services Market Trends and Insights

Increasing demand for green buildings drives market transformation

Mandatory sustainability codes such as California's CALGreen and the International Green Construction Code enforce energy-, water-, and carbon-performance thresholds that now shape baseline client expectations. Global corporations link facility strategies to environmental, social, and governance (ESG) targets, rewarding firms that present costed net-zero pathways and cradle-to-cradle material schedules. As LEED v4 remains the dominant global certification, architects build internal capability in daylight simulation, whole-building life-cycle analysis, and renewable-energy integration. Fee premiums for verified green design offset rising labor and software costs, and project pipelines advance in healthcare, education, and logistics where net-zero metrics unlock cheaper finance.

Growing adoption of Building Information Modelling transforms project delivery

Singapore's 90% BIM utilization demonstrates how coordinated 3D environments and design-for-manufacture principles shorten construction cycles and limit rework. Global market value for BIM software is projected to reach USD 22.1 billion by 2030 under a 16.3% CAGR, with advanced Level 3+ environments attracting the highest momentum. Natural-language Text2BIM agents streamline object creation and parameter tagging, curbing authoring time and lowering entry barriers for small studios. Set against this potential, firms cite acute shortages of mid-career BIM managers, intensifying recruitment costs and delaying complex multidisciplinary projects. Governments answer with mandatory BIM documentation on public buildings, accelerating demand despite transitional skill gaps.

Shortage of BIM-proficient architects constrains market growth

Industry surveys show that 96% of design firms experience skills shortages, especially at intermediate BIM levels, forcing 51% of companies to decline new work. U.S. architecture services lost 1,300 jobs in November 2024, even as the wider construction sector must add 439,000 workers by 2025 to meet demand. Salaries for BIM coordinators have climbed faster than inflation, eroding profit margins. Companies fund internal academies and partner with universities, yet training cycles lag behind project timetables. AI-assisted modeling automates repetitive layout tasks but cannot replace human code interpretation, client liaison, or context-specific detailing, keeping skilled labor pivotal.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of modular and prefabricated construction reshapes design practices

- Generative-AI-driven concept design workflows enhance speed and creativity

- Regulatory fragmentation across municipalities creates compliance challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Design and Documentation held 40.92% revenue in 2025, underlining their place as the indispensable core of every capital project. This dominance safeguards predictable fee flows because regulatory submittals mandate sealed drawings and specifications. The architectural services market size for Urban Planning and Master-planning is predicted to grow at a 6.28% CAGR, driven by new-town developments in India and rail-corridor rejuvenations in the United States. Municipalities demand advanced scenario modeling that blends land-use analytics, mobility forecasts, and green-infrastructure overlays, encouraging firms to expand GIS and socio-economic research teams. Interior and Space Planning keeps steady volume as hybrid workplaces and data-center suites require reconfigurable layouts that support well-being standards. Restoration and Conservation, although niche, rises on incentives for embodied-carbon retention and cultural-tourism value. Across every service, AI-assisted parametric templates speed code-compliant detailing, with pilot studies showing 31% document-production savings by 2030.

Project-management add-ons grow as owners favor single-contract design-build packaging to reduce risk. Stantec's 2025 acquisition of Page exemplifies how multidisciplinary scope wins market share in advanced manufacturing and healthcare, sectors that prize integrated design-construction oversight. Firms also integrate digital-twin maintenance dashboards, transforming one-off contracts into recurring facilities-support subscriptions.

Residential schemes yielded 34.21% of 2025 billings as national housing deficits persist, ranging between 1.5 million and 7.3 million units in the United States alone. Yet tighter lending terms, higher mortgage rates, and land scarcity in core metros push architects toward middle-income multifamily, senior living, and build-to-rent platforms that promise predictable occupancy. Conversely, industrial and manufacturing inquiries surge at 6.12% CAGR through 2031 on reshoring of semiconductor fabs, battery plants, and cloud-computing data centers. These programs demand clean-room design, thermal-load balancing, and resilience audits against power interruptions, placing premium fees on specialist consultants.

Office pipelines remain subdued following hybrid-work adoption; however, adaptive reuse of under-occupied towers into life-science labs or residential lofts unlocks new revenue. Healthcare and education remain counter-cyclical mainstays; demographic aging sustains clinic and long-term-care expansion, while universities modernize research wings to compete for grants. Public-sector infrastructure, funded by multiyear appropriations, offers stable volume in transit, courthouse, and water-treatment segments, especially for firms versed in Davis-Bacon wage and Buy-America sourcing rules.

The Architectural Services Report is Segmented by Service Type (Design and Documentation, Construction and Project Management, and More), End User (Residential, Corporate/Commercial Offices, and More), Project Type (New Construction, Renovation and Retrofit, and More), BIM Adoption Level (Non-BIM/2D-CAD, BIM Level 1, BIM Level 2, and BIM Level 3+), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained 39.14% of global billings in 2025, buoyed by USD 1.2 trillion in federal infrastructure allocations that translate into sustained design spending across highways, rail, and flood-control systems. Mandatory BIM on federal buildings, stringent energy codes, and voluntary WELL and LEED commitments encourage high-fee technical consulting. Nevertheless, the Architecture Billings Index fell to 45.6 in January 2025, showing softness in private commercial work as higher interest rates defer speculative office and retail starts. Mergers such as Stantec-Page shore up geographic coverage and deepen advanced manufacturing competencies to capture reshoring demand.

Asia Pacific delivers the fastest regional CAGR at 6.07% through 2031 on back of USD 1.7 trillion average annual infrastructure needs.Southeast Asian economies attract industrial plant designs due to competitive labor and export-zone incentives, while India's smart-city program accelerates metro-station and affordable-housing tenders. Singapore's 90% BIM penetration sets a regional benchmark, with governments in Malaysia and Indonesia launching similar mandates. In the Gulf, sovereign wealth-funded giga-projects spur modular high-rise adoption and data-center clusters, opening opportunities for mission-critical designers.

Europe posts steady gains under rigorous decarbonization policies. The European Union's Renovation Wave strategy seeds pipeline certainty for deep-energy retrofits, while cultural preservation funding supports restoration specialists. Diverse code bases complicate cross-border delivery, yet pan-EU digital-twin research consortia promote standardization. South America and Africa remain smaller contributors but grow off low bases as urbanization and private-equity investment in logistics and renewable energy schemes widen design scope.

- AECOM

- Aedas Ltd.

- Arcadis NV

- Arup Group Ltd.

- BDP Holdings Ltd.

- CallisonRTKL Inc.

- CannonDesign Inc.

- DP Architects Pte. Ltd.

- Foster + Partners LLP

- Gensler Design and Planning Inc.

- HDR Architecture Inc.

- HKS Inc.

- IBI Group Inc.

- Jacobs Solutions Inc.

- NBBJ LP

- Perkins and Will International LLC

- Skidmore, Owings and Merrill LLP

- Stantec Inc.

- Sweco AB

- Woods Bagot Pty Ltd

- Zaha Hadid Architects Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for green buildings

- 4.2.2 Growing adoption of Building Information Modelling (BIM)

- 4.2.3 Expansion of modular and prefabricated construction

- 4.2.4 Urban infrastructure spending rebound post-COVID-19

- 4.2.5 Generative-AI-driven concept design workflows

- 4.2.6 Design-build-operate digital-twin subscription models

- 4.3 Market Restraints

- 4.3.1 Shortage of BIM-proficient architects

- 4.3.2 Volatile construction-material prices

- 4.3.3 Regulatory fragmentation across municipalities

- 4.3.4 Cyber-security risk in connected-building design files

- 4.4 Technological Outlook

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Design and Documentation

- 5.1.2 Construction and Project Management

- 5.1.3 Interior and Space Planning

- 5.1.4 Urban Planning and Master-planning

- 5.1.5 Restoration and Conservation

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Corporate / Commercial Offices

- 5.2.3 Retail and Hospitality

- 5.2.4 Healthcare

- 5.2.5 Educational and Cultural

- 5.2.6 Industrial and Manufacturing

- 5.2.7 Public Infrastructure and Government

- 5.2.8 Other End Users

- 5.3 By Project Type

- 5.3.1 New Construction

- 5.3.2 Renovation and Retrofit

- 5.3.3 Adaptive Re-use

- 5.3.4 Heritage Restoration

- 5.4 By BIM Adoption Level

- 5.4.1 Non-BIM / 2D-CAD

- 5.4.2 BIM Level 1 (3D Modelling)

- 5.4.3 BIM Level 2 (Collaboration)

- 5.4.4 BIM Level 3+ (Integrated Data Environment)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AECOM

- 6.4.2 Aedas Ltd.

- 6.4.3 Arcadis NV

- 6.4.4 Arup Group Ltd.

- 6.4.5 BDP Holdings Ltd.

- 6.4.6 CallisonRTKL Inc.

- 6.4.7 CannonDesign Inc.

- 6.4.8 DP Architects Pte. Ltd.

- 6.4.9 Foster + Partners LLP

- 6.4.10 Gensler Design and Planning Inc.

- 6.4.11 HDR Architecture Inc.

- 6.4.12 HKS Inc.

- 6.4.13 IBI Group Inc.

- 6.4.14 Jacobs Solutions Inc.

- 6.4.15 NBBJ LP

- 6.4.16 Perkins and Will International LLC

- 6.4.17 Skidmore, Owings and Merrill LLP

- 6.4.18 Stantec Inc.

- 6.4.19 Sweco AB

- 6.4.20 Woods Bagot Pty Ltd

- 6.4.21 Zaha Hadid Architects Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment