PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940654

Virtual Reality In Education - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

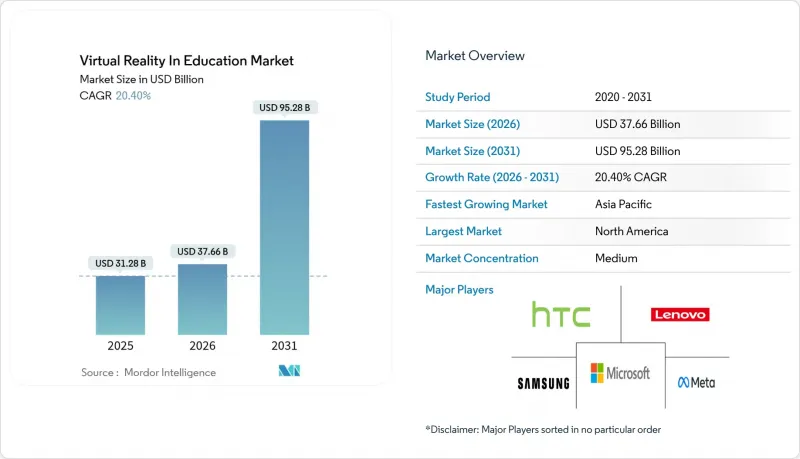

The Virtual Reality In Education Market was valued at USD 31.28 billion in 2025 and estimated to grow from USD 37.66 billion in 2026 to reach USD 95.28 billion by 2031, at a CAGR of 20.4% during the forecast period (2026-2031).

Lower headset prices, sizable government grants, and measurable improvements in learner performance continue to propel the virtual reality in education market, especially as corporations adopt immersive training programs that reduce seat time by up to 75% while quadrupling knowledge retention. Hardware still supplies most revenue, but service-oriented subscription packages are expanding fastest as institutions seek turnkey content and analytics. North America leads the adoption due to the Biden-Harris Administration's USD 277 million innovation fund, whereas the Asia Pacific accelerates on the back of Chinese and Japanese infrastructure programs. Competitive rivalry is moderate, as large platforms such as Meta and Microsoft contend with specialists like zSpace and Labster, which pair curriculum-aligned content with cost-effective deployment models.

Global Virtual Reality In Education Market Trends and Insights

Rising Demand for Interactive and Personalized Learning

Institutions increasingly value immersive lessons that adapt to diverse learning styles, with studies showing VR learners achieve 275% higher confidence and complete courses four times faster than classroom cohorts. Universities highlight gaps in design-thinking skills within current VR curricula, opening opportunities for providers that combine technical rigor with pedagogy. AI-driven engines tailor content to each learner; zSpace's Career Coach AI, for instance, matches local labor-market data to personalized study pathways Controlled virtual environments also reduce anxiety for students with emotional impairments while boosting retention. As learner-centric models move mainstream, the virtual reality in education market becomes core infrastructure for institutions seeking improved outcomes.

Greater Stakeholder Acceptance from Higher Engagement

Quantified gains are persuading administrators, parents, and corporate L&D heads alike. Nursing programs see 95% participation when scenarios run in VR versus 15% in traditional labs. Manufacturing firms report 43% drops in workplace injuries after VR safety drills. Classroom engagement spikes in mathematics when students manipulate 3-D objects that clarify abstract concepts. Meta's program with 13 universities demonstrates institutional confidence, creating reference sites that spur peer adoption. These outcomes generate a virtuous cycle of investment and acceptance for the virtual reality in education market.

Scarcity of Quality Curriculum-Aligned VR Content

Many applications prioritize entertainment over pedagogy, leaving educators short of materials that match learning standards, especially outside English-speaking markets. Teachers struggle to locate VR modules that embed assessment tools and constructivist methods, hampering adoption despite hardware availability. Specialized domains such as medicine need regulatory compliance, yet the pipeline of validated scenarios remains thin. Partnerships like Pearson-XR Bootcamp illustrate early progress but are insufficient to satisfy global demand. Until content libraries scale, growth of the virtual reality in education market will trail underlying hardware capability.

Other drivers and restraints analyzed in the detailed report include:

- Falling Prices and Ubiquity of Standalone VR Headsets

- Government/Institutional EdTech Funding Post-Pandemic

- Teacher Training Gaps and Pedagogical Resistance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 60.72% of the virtual reality in education market share in 2025 on the strength of device rollouts across schools and training centers. However, the services segment is on pace for 22.2% CAGR as institutions favor subscription bundles that bundle content, device management, and analytics. The virtual reality in education market size tied to services is poised to overtake software revenue approaching 2031. Standalone headset affordability keeps hardware relevant, yet platform vendors are already bundling perpetual updates, reducing replacement cycles.

Subscription models also mitigate capital-expenditure barriers for districts with limited budgets. ArborXR's shift into learning analytics and zSpace's AI-powered guidance tools illustrate how vendors convert hardware footholds into recurring-revenue ecosystems. Training and consulting services that improve instructional design now factor prominently in RFPs. These patterns signal a pivot toward outcomes-based procurement, reinforcing recurrent income streams across the virtual reality industry.

Academic institutions still own 64.62% of the virtual reality in education, reflecting early grant-funded pilots across K-12 and universities. Yet corporate training advances at 22.9% CAGR, propelled by measurable ROI in safety, compliance, and customer-service scenarios. The virtual reality in education market size attributable to enterprises is projected to approach parity with academia by 2031. Corporations in healthcare and mining have logged 40%-plus error reductions after immersive programs, shortening payback periods.

Enterprises champion soft-skills and product-knowledge modules, fueling demand for rapid-authoring tools and analytics integrations. Academic growth continues but faces budget cycles and curriculum-approval processes. For vendors, diversified portfolios that address both segments offer resilience against economic swings within the virtual reality industry.

Virtual Reality in Education Market is Segmented by Component (Hardware, Software, and Services), End User (Academic Institutions, and Corporate Training), Device Type (Standalone Headsets, Tethered PC-VR Headsets, and More), Application Area (STEM and Technical Education, Medical and Healthcare Training, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.95% of 2025 revenue thanks to robust grant programs and a mature EdTech ecosystem. The Administration's USD 277 million innovation grants earmark immersive algebra tools, while the National Science Foundation commits USD 25 million to R&D, seeding university partnerships. Corporate uptake spans healthcare, retail, and skilled trades as companies such as Interplay Learning scale VR modules for talent shortages. These forces keep the virtual reality market in education expanding at a healthy clip, though growth moderates as penetration rises.

Asia Pacific is set to log the fastest regional CAGR of 21.5% through 2031. China's provinces issued tenders exceeding USD 15 million for vocational VR labs in 2025 alone, while Japan's DX High School scheme funds up to JPY 10 million per campus for digital upgrades. South Korean institutions deploy VR to cut equipment costs in technical training, an approach highlighted by World Bank researchers. These coordinated policies accelerate classroom integration, positioning Asia Pacific to narrow its gap with North America in the virtual reality in education market.

Europe benefits from the Digital Europe Programme's EUR 1.3 billion allocation and EUR 108 million for specialist academies that include virtual-worlds curricula. Scotland's council-wide ClassVR rollout shows regional bodies embracing systemic procurement. Emerging markets in South America and the Middle East follow as hardware prices dip below USD 300, though infrastructure constraints still curb immediate uptake. Overall, policy alignment and funding density remain the primary predictors of regional traction for the virtual reality in education market.

- Meta Platforms, Inc.

- HTC Corporation

- Lenovo Group Limited

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- Sony Group Corporation

- Alphabet Inc.

- Pico Technology Co., Ltd.

- Valve Corporation

- Unity Technologies SF

- Epic Games, Inc.

- zSpace, Inc.

- EON Reality, Inc.

- Avantis Systems Ltd.

- Veative Labs Pvt. Ltd.

- Virtalis Holdings Limited

- Nearpod, Inc.

- Labster ApS

- Immerse VR Ltd.

- VictoryXR, Inc.

- Dreamscape Immersive, Inc.

- Alchemy Immersive Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for interactive and personalized learning

- 4.2.2 Greater stakeholder acceptance from higher engagement

- 4.2.3 Falling prices and ubiquity of standalone VR headsets

- 4.2.4 Government/Institutional EdTech funding post-COVID

- 4.2.5 Integration of eye-tracking analytics for adaptive VR

- 4.2.6 WebXR standards lowering total cost of ownership

- 4.3 Market Restraints

- 4.3.1 Scarcity of quality curriculum-aligned VR content

- 4.3.2 High upfront and maintenance costs for institutions

- 4.3.3 Biometric data-privacy concerns in classrooms

- 4.3.4 Teacher training gaps and pedagogical resistance

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Industry Value Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis - VR App Distribution and Pricing Models

- 4.9 Key Use-Cases and Implementation Case Studies

- 4.9.1 China's classroom roll-out programmes

- 4.9.2 Corporate VR training for service standardisation

- 4.9.3 Virtual field trips (e.g., Google Expeditions)

- 4.10 Assessment of Macroeconomic Factors on the Market

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End User

- 5.2.1 Academic Institutions

- 5.2.1.1 K-12 Learning

- 5.2.1.2 Higher Education

- 5.2.2 Corporate Training

- 5.2.2.1 IT and Telecom

- 5.2.2.2 Healthcare

- 5.2.2.3 Retail and E-commerce

- 5.2.2.4 Other Corporate Users

- 5.2.1 Academic Institutions

- 5.3 By Device Type

- 5.3.1 Standalone Headsets

- 5.3.2 Tethered PC-VR Headsets

- 5.3.3 Smartphone-Enabled VR

- 5.3.4 Mixed-Reality Head-Mounted Displays

- 5.4 By Application Area

- 5.4.1 STEM and Technical Education

- 5.4.2 Medical and Healthcare Training

- 5.4.3 Language and Arts Learning

- 5.4.4 Vocational and Technical Skills

- 5.4.5 Soft-Skills and Team Collaboration

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Meta Platforms, Inc.

- 6.4.2 HTC Corporation

- 6.4.3 Lenovo Group Limited

- 6.4.4 Samsung Electronics Co., Ltd.

- 6.4.5 Microsoft Corporation

- 6.4.6 Sony Group Corporation

- 6.4.7 Alphabet Inc.

- 6.4.8 Pico Technology Co., Ltd.

- 6.4.9 Valve Corporation

- 6.4.10 Unity Technologies SF

- 6.4.11 Epic Games, Inc.

- 6.4.12 zSpace, Inc.

- 6.4.13 EON Reality, Inc.

- 6.4.14 Avantis Systems Ltd.

- 6.4.15 Veative Labs Pvt. Ltd.

- 6.4.16 Virtalis Holdings Limited

- 6.4.17 Nearpod, Inc.

- 6.4.18 Labster ApS

- 6.4.19 Immerse VR Ltd.

- 6.4.20 VictoryXR, Inc.

- 6.4.21 Dreamscape Immersive, Inc.

- 6.4.22 Alchemy Immersive Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment