PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940665

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940665

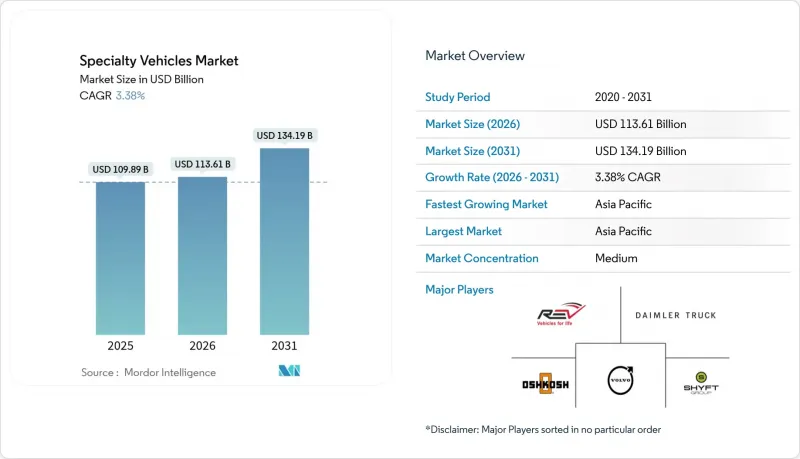

Specialty Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The specialty vehicles market was valued at USD 109.89 billion in 2025 and estimated to grow from USD 113.61 billion in 2026 to reach USD 134.19 billion by 2031, at a CAGR of 3.38% during the forecast period (2026-2031).

Demand resilience comes from non-discretionary spending across emergency medical services, public safety, and industrial support fleets. Expansion of urban infrastructure, aging populations that raise emergency response needs, and government incentives for zero-emission fleets collectively sustain global procurement activity. Competitive intensity is rising as electric-first entrants leverage modular designs and connected technologies to compress customization lead times and lower operating costs. Meanwhile, established manufacturers protect share by pairing certified platforms with nationwide after-sales networks.

Global Specialty Vehicles Market Trends and Insights

Rising Demand for Emergency Medical Response Vehicles

Growing elderly populations and tighter response-time mandates are prompting healthcare systems to enlarge ambulance fleets. The Centers for Medicare & Medicaid Services widened reimbursement for community paramedicine, boosting capital budgets for advanced life-support vehicles. Urban density further intensifies the need for well-equipped units capable of faster scene arrival. Community-based healthcare programs also favor mobile medical clinics that can supply diagnostics, immunizations, and chronic-care follow-ups. Collectively these factors underpin sustained procurement even when municipal operating budgets face pressure. Electric powertrains are increasingly specified for city duty cycles where zero-emission zones loom.

Growth in Construction and Mining Service Fleets

Infrastructure mega-projects and resource extraction ventures are extending the specialty vehicle market's reach into rugged environments. The U.S. Infrastructure Investment and Jobs Act earmarked USD 1.2 trillion over five fiscal years (2022-2026), underpinning demand for mobile fuel tankers, service bodies, and onsite command centers . China's Belt and Road Initiative similarly keeps specialty service fleets active across Asia-Pacific and Africa. Stricter safety rules now require vehicles outfitted with dust-suppression systems, real-time telematics, and emergency shelters. Remote mines adopt mobile environmental-monitoring labs to satisfy ESG commitments. Although construction cycles remain sensitive to macroeconomic swings, replacement of aging fleets ensures a baseline of annual demand.

High Acquisition and Lifecycle Costs

Specialty vehicles often cost 40-60% more than mainstream commercial platforms due to bespoke equipment, small-batch production, and rigorous compliance testing. Electric versions elevate sticker prices even further, though fuel and maintenance savings accrue over 7-10 years. Many municipalities defer fleet refreshes, extending service life beyond recommended cycles and heightening downtime risk. Insurance premiums trend higher because replacement parts and skilled repairs command premium rates. Smaller private operators feel pressure most acutely, sometimes opting for rental models to circumvent capital outlays. Persistently high input prices-from stainless steel tanks to medical electronics-could dampen adoption where budget elasticity is limited.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Mobile On-Site Industrial Services

- Government Incentives for Zero-Emission Specialty Fleets

- Complex Multi-Jurisdictional Regulatory Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ambulances generated the largest slice of the specialty vehicle market in 2025, capturing 31.05% revenue amid mandated replacement cycles and heightened community paramedicine deployment. The sub-segment is well-positioned to retain dominance given aging demographics and regulatory focus on faster response times. Mobile medical clinics, though smaller in absolute dollars, represent the breakout category with a 5.30% CAGR, reflecting healthcare's pivot to preventive outreach and pop-up vaccination hubs. Fire apparatus continues to post dependable public-sector orders, while command centers gain traction as disaster-management complexity increases.

Electrification is emerging fastest inside ambulance fleets operating in dense urban cores, where overnight depot charging aligns with duty patterns and zero-emission zones expand. Fire truck electrification lags due to high-draw pump requirements, yet hybrid assist systems are entering trials. Specialty tankers servicing industrial sites maintain diesel reliance because of range and payload needs. Manufacturers that standardize chassis and electrics while retaining modular interiors stand to capture a growing slice of this specialty vehicle market.

Medical and healthcare services accounted for 35.62% of overall 2025 demand, underpinned by hospital network modernization and expanded insurance reimbursements for ambulance transport. Telehealth growth stimulates procurement of connected mobile diagnostics units able to link rural patients to urban specialists. Recreational and hospitality vehicles, enveloping luxury motor coaches and mobile food units, form the fastest-expanding application cluster with a 3.96% CAGR as consumers favor experiential leisure activities.

Industrial utilities sustain significant orders for mobile substations, grid-repair trucks, and pipeline inspection rigs that mitigate downtime costs. Law enforcement agencies refresh fleets with next-generation tactical response vehicles featuring ballistic protection and AI-enabled situational awareness, although volumes trail medical orders. Event organizers increasingly lease mobile command suites and medical triage trailers to meet safety codes, reinforcing the sharing-economy effect across this specialty vehicle market. Compliance with NFPA ambulance standards and FDA medical device rules remains the chief hurdle in the healthcare slice, but reward comes via consistent budget allocations even in economic contractions.

The Specialty Vehicles Market Report is Segmented by Vehicle Type (Ambulances, Fire Trucks, and More), Application (Law Enforcement and Public Safety, Medical and Healthcare Services, and More), Propulsion/Powertrain (Diesel, Gasoline, and More), Ownership Model (Government and Municipal, Private Fleet Operators, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the specialty vehicle market with a 36.28% share in 2025 and is tracking a 3.83% CAGR through 2031. China's hospital expansion programs and continued Belt and Road construction corridors sustain high ambulance and tanker demand, while India's Smart Cities Mission finances command centers and firefighting apparatus. Southeast Asian nations add procurement momentum as tourism-driven hospitality vehicles and industrial service fleets grow. Japanese and South Korean OEMs contribute innovation in compact electric ambulances that suit dense city streets.

North America represents a mature but technology-forward slice of the specialty vehicle market. Replacement cycles keyed to NFPA guideline updates keep fire departments renewing fleets, and the Infrastructure Investment and Jobs Act funnels funds to utility and construction vehicles. Canada's resource economy sustains off-road service rigs, while Mexico's export-oriented manufacturing base orders mobile maintenance trucks to minimize line stoppage. Electrification gathers pace in New York, Los Angeles, and Toronto where zero-emission fleet mandates converge with broader climate goals.

Europe shows moderate CAGR but leads regulatory stringency. Urban zero-emission zones slated for 2030 guarantee demand for battery-electric ambulances and refuse trucks, and EU CO2 standards push hybrid fire apparatus prototypes into field pilots. Germany's engineering depth accelerates modular chassis adoption, and the United Kingdom's NHS fleet renewal propels procurements despite fiscal constraints. Nordic countries pioneer hydrogen fuel-cell rescue vehicles on account of abundant green hydrogen projects.

- REV Group

- Daimler Truck AG (Mercedes-Benz Special Trucks)

- Oshkosh Corporation

- Volvo Group

- Shyft Group

- LDV Inc.

- Matthews Specialty Vehicles

- Farber Specialty Vehicles

- Force Motors Limited

- Emergency One Group

- Rosenbauer International AG

- Wietmarscher Ambulanz- und Sonderfahrzeug GmbH

- XCMG Group (Special Purpose Division)

- Hyundai Everdigm

- Morita Holdings Corporation

- KME Fire Apparatus

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Emergency Medical Response Vehicles

- 4.2.2 Growth in Construction and Mining Service Fleets

- 4.2.3 Expansion of Mobile On-Site Industrial Services

- 4.2.4 Government Incentives for Zero-Emission Specialty Fleets

- 4.2.5 5G-Enabled Connected Platforms for Remote Operations

- 4.2.6 Modular Chassis Platforms That Cut Customization Lead-Time

- 4.3 Market Restraints

- 4.3.1 High Acquisition and Lifecycle Costs

- 4.3.2 Complex Multi-Jurisdictional Regulatory Approvals

- 4.3.3 Skilled Labor Shortages in Custom Up-Fitting

- 4.3.4 Long Lead-Times for Low-Volume Critical Components

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Ambulances

- 5.1.2 Fire Trucks

- 5.1.3 Mobile Fuel Tankers

- 5.1.4 Mobile Command and Control Centers

- 5.1.5 Mobile Medical Clinics

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Law Enforcement and Public Safety

- 5.2.2 Medical and Healthcare Services

- 5.2.3 Industrial and Utility Services

- 5.2.4 Recreational and Hospitality

- 5.2.5 Others

- 5.3 By Propulsion / Powertrain

- 5.3.1 Diesel

- 5.3.2 Gasoline

- 5.3.3 Hybrid

- 5.3.4 Electric

- 5.3.5 Alternative Fuels (CNG / LNG / H2)

- 5.4 By Ownership Model

- 5.4.1 Government and Municipal

- 5.4.2 Private Fleet Operators

- 5.4.3 Rental / Leasing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 REV Group

- 6.4.2 Daimler Truck AG (Mercedes-Benz Special Trucks)

- 6.4.3 Oshkosh Corporation

- 6.4.4 Volvo Group

- 6.4.5 Shyft Group

- 6.4.6 LDV Inc.

- 6.4.7 Matthews Specialty Vehicles

- 6.4.8 Farber Specialty Vehicles

- 6.4.9 Force Motors Limited

- 6.4.10 Emergency One Group

- 6.4.11 Rosenbauer International AG

- 6.4.12 Wietmarscher Ambulanz- und Sonderfahrzeug GmbH

- 6.4.13 XCMG Group (Special Purpose Division)

- 6.4.14 Hyundai Everdigm

- 6.4.15 Morita Holdings Corporation

- 6.4.16 KME Fire Apparatus

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment