PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940676

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940676

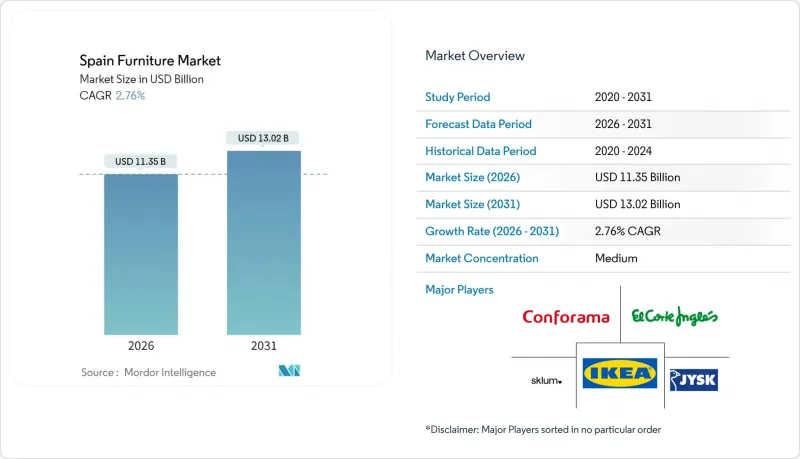

Spain Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Spain Furniture market was valued at USD 11.05 billion in 2025 and estimated to grow from USD 11.35 billion in 2026 to reach USD 13.02 billion by 2031, at a CAGR of 2.76% during the forecast period (2026-2031).

Momentum stems from a rebound in residential renovations, a sharp resurgence in tourism-led hospitality refurbishments, and rising acceptance of omnichannel shopping models that blend in-store engagement with e-commerce convenience. Demand is also supported by EU-funded energy-efficiency retrofits that incentivize home upgrades, while value-oriented Scandinavian-design chains enlarge their Spanish footprints to capture price-sensitive consumers. Meanwhile, urban downsizing and sustainability preferences steer households toward modular, recycled, and circular-economy offerings, prompting manufacturers to recalibrate material choices and packaging formats. Supply-side conditions remain mixed: input-cost swings in wood, metal, and logistics squeeze margins for small workshops, yet scale-driven retailers negotiate global contracts that buffer volatility and sustain competitive pricing.

Spain Furniture Market Trends and Insights

Residential Construction Rebound & Renovation Boom

Building permits exceeded 127,000 units in 2024, outpacing sector capacity and signalling strong refurbishment pipelines that will translate into furniture purchases through 2027. Spain logged 1.85 million scheduled home renovations for 2025 after years of under-building, redirecting demand from new housing to interior upgrades. Construction costs climbed 4.20% in 2024, making retrofits more cost-effective than new builds and spurring appetite for modular cabinets, wardrobes, and space-saving seating. The Spain Furniture market benefits because renovations prompt whole-room refurnishing rather than piecemeal replacement. EU Recovery funds earmarked for energy-efficient retrofits further enlarge budgets for quality furnishings that complement thermal upgrades. Manufacturers with rapid-fit, customizable lines are best positioned to monetize the renovation wave.

Tourism-Led Hospitality Refurbishment Cycle

International arrivals rebounded to 93.8 million in 2024, restoring the cash flow hotels need for property upgrades. Tourism services generated a 4.20% of GDP surplus, enabling chains such as RIU and Radisson to accelerate multi-million-euro refurbishments that soak up contract-grade furniture. Islands heavy on short-term rentals, Balearic and Canary, present concentrated demand where replacement cycles run every 3-4 years, far quicker than residential averages. Suppliers secure higher margins on hospitality orders because buyers prioritize durability and uniform aesthetics. Logistic advantages arise when manufacturers cluster deliveries to tourism zones, trimming transport costs. The Spain Furniture market therefore, captures elevated per-unit spending in coastal hospitality corridors.

Input-Cost Volatility in Wood & Logistics

Raw material price inflation poses significant margin pressure on Spanish furniture manufacturers, with wood prices experiencing potential increases up to 30% by year-end 2025 according to European manufacturing surveys, while steel could rise 25% and plastics at least 20%. Although pine timber prices have fallen EUR 4-10 (USD 4.28-10.70) per tonne since March 2023, the underlying volatility creates planning difficulties for manufacturers who must balance inventory costs against supply security. Logistics costs compound these pressures, with land prices for logistics facilities rising 1.70% in 2024 and rental rates increasing 3.70%, directly impacting furniture distribution networks that rely on large-format warehousing. The combination of material and logistics inflation disproportionately affects smaller, fragmented Spanish manufacturers who lack the purchasing power and vertical integration of multinational competitors.

Other drivers and restraints analyzed in the detailed report include:

- Omnichannel & E-Commerce Penetration Surge

- Value-Oriented Scandinavian-Design Retail Expansion

- Demographic Drag from Ageing & Low Household Formation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Home Furniture dominated the Spain Furniture market with a 72.45% revenue stake in 2025, reflecting Spanish households' deep cultural investment in living-space aesthetics. That leadership is forecast to expand at only 3.38% CAGR as replacement cycles lengthen, but it still anchors overall growth because renovation spending converts into whole-room re-furnishing orders. Sofas, dining sets, and modular storage remain staples, although urban apartments spur demand for collapsible tables and wall-mounted shelving. Hospitality Furniture trails in absolute size yet races ahead at a projected 3.96% CAGR, as hotel groups, short-term rentals, and boutique hostels refresh interiors to meet global guest expectations. Spain's Furniture market size for hospitality is expected to edge up each year as the Canary and Balearic Islands upgrade aging room inventories. Suppliers seeking stability hedge by serving both residential and contract pipelines, smoothing seasonal tourism swings.

The applications portfolio is diversifying into office, educational, and healthcare categories as hybrid work, school modernization, and hospital expansions progress. Office purchases skew toward ergonomic chairs and height-adjustable desks that accommodate flexible working styles, although volumes remain small compared to household needs. Educational furniture captures public-sector tenders focused on collaborative classroom layouts, while healthcare demand centers on antimicrobial surfaces and mobility aids. Even within niche segments, Spain Furniture market share gains accrue to brands offering rapid customization, strict certification, and clear sustainability credentials.

Wood retained a 60.20% share in 2025, underpinned by Valencia's centuries-old carpentry cluster and consumer affinity for natural finishes. Spain Furniture market size for wooden pieces is expected to inch forward, but relinquish a few points as recycled plastics gain acceptance. Polymer furniture, growing at a brisk 4.37% CAGR, benefits from lower cost, weather resistance, and design flexibility, making it popular for outdoor terraces and budget apartments. Manufacturers like Actiu showcase chairs moulded from recycled fruit crates, reinforcing circular-economy storytelling.

Metal retains a niche in office frames and hospitality fixtures where durability trumps weight concerns. Composite panels and engineered woods widen in cabinetry, blending resource efficiency with strength. EU eco-design directives accelerate the pivot toward FSC-certified timber and traceable recycled content, reshaping supply chains. Compliance introduces documentation costs but also differentiates brands that validate sustainable sourcing. Consequently, Spain's Furniture market share is likely to tilt toward material innovators capable of meeting strict environmental benchmarks without eroding affordability.

The Spain Furniture Market Report is Segmented by Application (Home Furniture, Office Furniture, Hospitality Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Other Materials), Price Range (Economy, Mid-Range, Premium), Distribution Channel (B2C/Retail, B2B/Project), and Geography (Catalonia, Andalusia, Community of Madrid, Valencian Community, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IKEA Iberica

- Conforama Espana

- JYSK Spain

- El Corte Ingles (Home & Decor)

- Sklum

- Actiu

- Andreu World

- Fama Sofas

- Franco Furniture

- Kave Home

- Hannun

- Rapimueble

- Merkamueble

- Muebles Boom

- Maxcolchon

- Punt Mobles

- Mobliberica

- Vondom

- Mobalpa Spain

- Maisons du Monde Spain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Residential?construction rebound & renovation boom

- 4.2.2 Tourism-led hospitality refurbishment cycle

- 4.2.3 Omnichannel & e-commerce penetration surge

- 4.2.4 Value-oriented Scandinavian-design retail expansion

- 4.2.5 EU-funded energy-efficiency retrofits

- 4.2.6 Second-hand & circular-economy trade-in platforms

- 4.3 Market Restraints

- 4.3.1 Input-cost volatility in wood & logistics

- 4.3.2 Import-price pressure on fragmented local makers

- 4.3.3 Demographic drag from ageing & low household formation

- 4.3.4 Tightened fire-safety & eco-design compliance costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for the Furniture Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Application

- 5.1.1 Home Furniture

- 5.1.1.1 Chairs

- 5.1.1.2 Tables (side, coffee, dressing, etc.)

- 5.1.1.3 Beds

- 5.1.1.4 Wardrobe

- 5.1.1.5 Sofas

- 5.1.1.6 Dining Tables/Sets

- 5.1.1.7 Kitchen Cabinets

- 5.1.1.8 Other Home Furniture

- 5.1.2 Office Furniture

- 5.1.2.1 Chairs

- 5.1.2.2 Tables

- 5.1.2.3 Storage Cabinets

- 5.1.2.4 Desks

- 5.1.2.5 Sofas & Soft Seating

- 5.1.2.6 Other Office Furniture

- 5.1.3 Hospitality Furniture

- 5.1.4 Educational Furniture

- 5.1.5 Healthcare Furniture

- 5.1.6 Other Applications

- 5.1.1 Home Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Furniture Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Retail Channels

- 5.4.2 B2B/Project

- 5.4.1 B2C/Retail

- 5.5 By Region

- 5.5.1 Catalonia

- 5.5.2 Andalusia

- 5.5.3 Community of Madrid

- 5.5.4 Valencian Community

- 5.5.5 Balearic & Canary Islands

- 5.5.6 Remaining Autonomous Communitie

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 IKEA Iberica

- 6.4.2 Conforama Espana

- 6.4.3 JYSK Spain

- 6.4.4 El Corte Ingles (Home & Decor)

- 6.4.5 Sklum

- 6.4.6 Actiu

- 6.4.7 Andreu World

- 6.4.8 Fama Sofas

- 6.4.9 Franco Furniture

- 6.4.10 Kave Home

- 6.4.11 Hannun

- 6.4.12 Rapimueble

- 6.4.13 Merkamueble

- 6.4.14 Muebles Boom

- 6.4.15 Maxcolchon

- 6.4.16 Punt Mobles

- 6.4.17 Mobliberica

- 6.4.18 Vondom

- 6.4.19 Mobalpa Spain

- 6.4.20 Maisons du Monde Spain

7 Market Opportunities & Future Outlook

- 7.1 Spanish Contemporary & Mediterranean Aesthetics Expand Global Export Appeal

- 7.2 Rising Popularity of Modular & Multifunctional Furniture for Urban Apartment